Too much of a gold thing? Prices remain under pressure as central banks buy bullion in record volumes

Via Getty

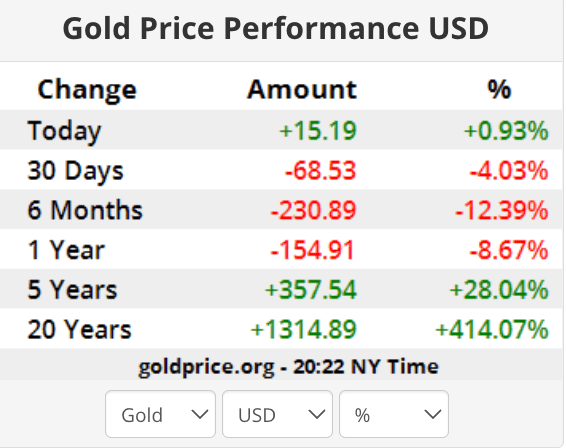

Gold prices were up nearly 1% during the sleepy times here in Sydney, nudging over US$1,650 an ounce.

The ‘roid rallying USD hit pause and bond yields fell, as positions began to settle ahead of another wildly-anticipated Fed rates decision decision due tomorrow.

The most malleable and ductile of the elements is mostly traded on the OTC London market, the US futures market (COMEX) and the Shanghai Gold Exchange (SGE). And of late the go to safe haven in times of need has been pressured by the USD and by unmoored Treasury yields caught in the intensifying crossfire between global inflation and the efforts of global central banks, keeping Team Fed on course to hike rates by another 75 basis points this week.

Despite the welcome gains, gold is yet under some pressure, and has been seen hanging out on the lower end of town, not that far from from pre-pandemic days before April 2020, as the rising cost of money lifts the opportunity cost of holding non-yielding bullion.

In other words, gold is back to its re-pandemic growth.

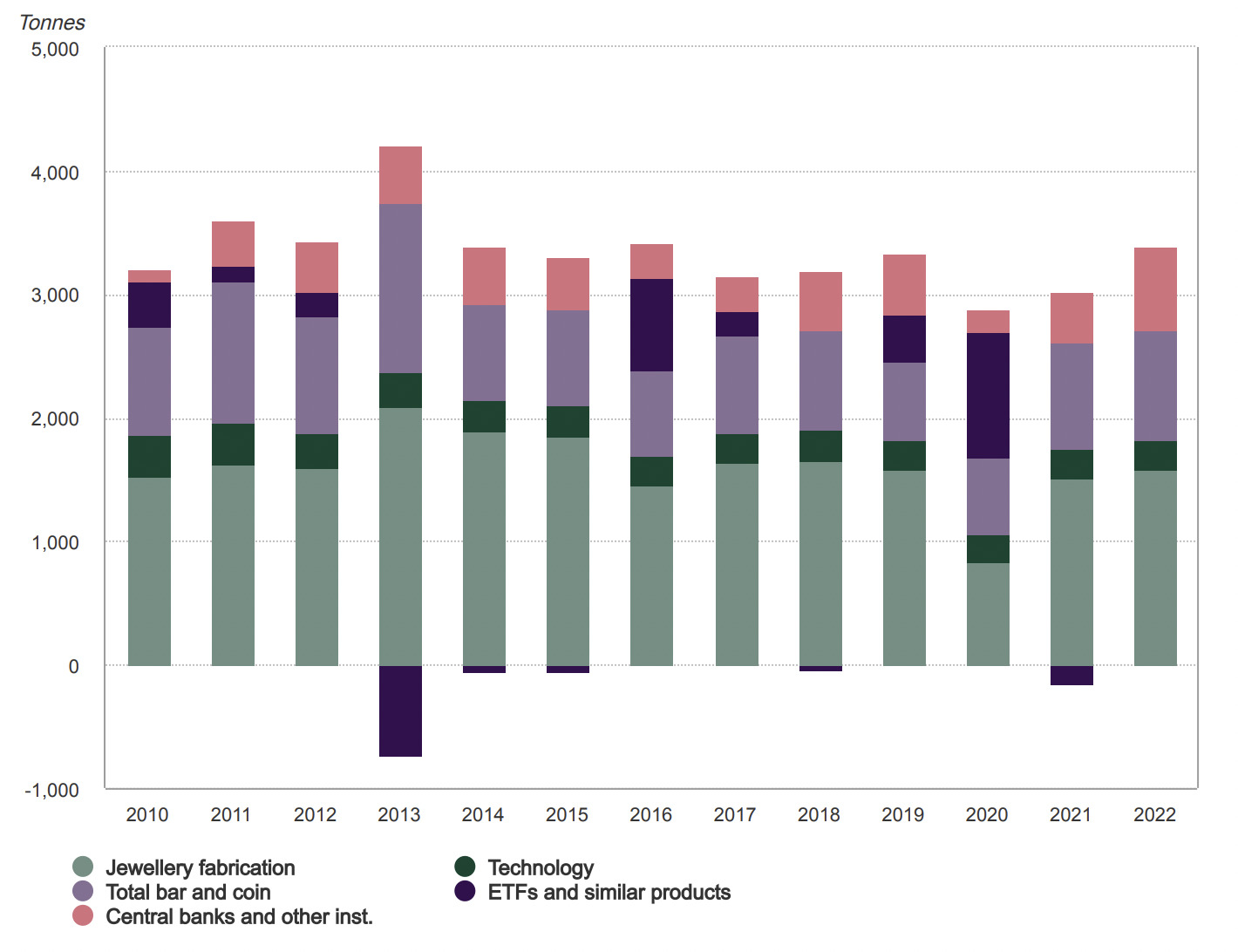

By a broad stroke definition, around half global gold demand is in jewelery, 40% investments, and 10% industry.

The biggest producers are us, China the US, South Africa, Russia and Indonesia.

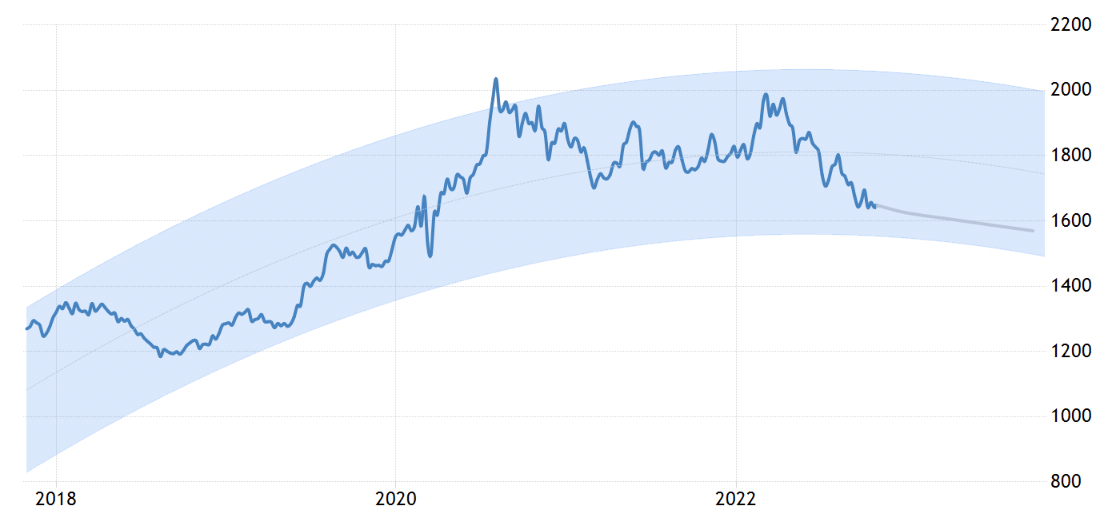

This is the current forecast for near-term prices:

Central Bank bonanza

Global central banks bought a record amount of goldin the September quarter, according to the latest work out of the World Gold Council (WGC).

Reserve banks have sought to diversify their foreign-currency reserves, with a large chunk of the latest bullion purchases coming from as-yet unknown buyers.

And despite a notable contraction in investment demand, keen attention from both consumers and central banks ensured demand for the precious metal (excluding OTC) around the world in Q3 topped 1,180 tonnes, up 28% year-on-year, to its pre-COVID levels.

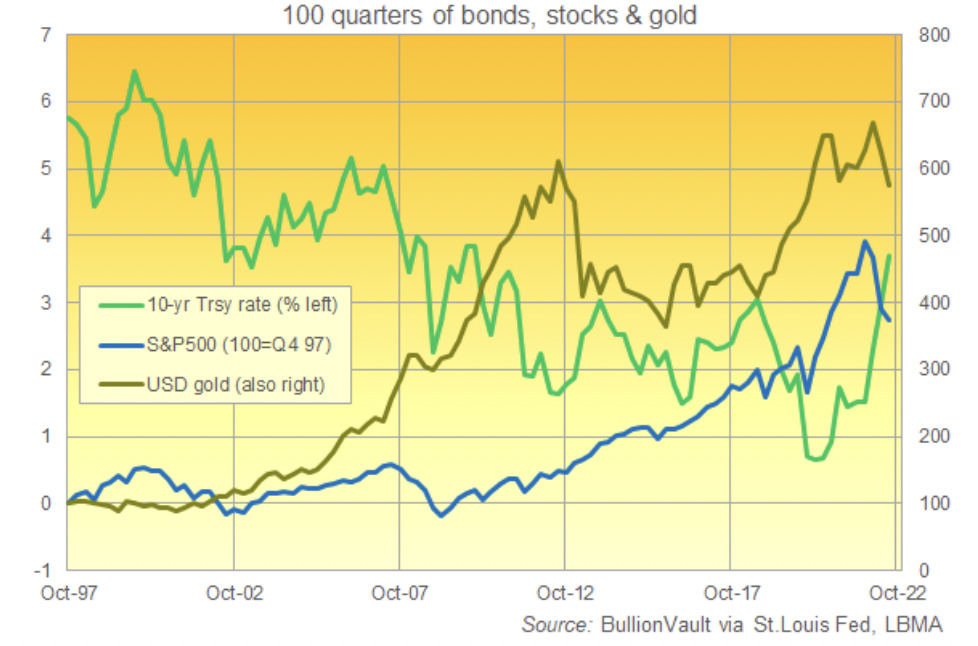

By a quick comparison, the S&P500 has now fallen for 3 calendar quarters straight, its worst trot since the GFC back in 2007 – 2009.

Losing almost 25% from a near Christmas ’21 record high while the price of gold is short some down 8% since the start of January, the S&P meanwhile is no hair match with EU equities – outperforming the EuroStoxx 600 index, the largest European equities now down 32.6% .

The WGC reports almost 400ts have been snapped up up by central banks in Q3, more than 4 x the amount of gold bought up a year earlier.

That takes the total so far this year to the highest since 1967, when the dollar was still backed by the metal.

Bullion prices have been pressured this year by aggressive US interest-rate hikes as the Federal Reserve tackles soaring inflation, which have prompted exchange-traded fund investors to sell the non-yielding asset. But support has come from other areas, such as retail buyers in Asia and central banks.

Central banks including Turkey and Qatar were among recent buyers, as well as unreported purchases from institutions — which the WGC said that although isn’t uncommon, amounted to a “substantial” estimate.

And not everyone is in the business of reporting their gold dealings, enter China and Russia.

but, just as consumer gold demand firmed, central bank buyers came through on earlier signals that they might come knocking, armed for a buying spree.

In fact, buying picked up so intensely over the three months to September that the WGC estimates the banks delivered a record 400t of volume across the third quarter.

1 in 4 central banks had previously said they intended to increase their gold reserves in the next 12 months.

At home

Interestingly, Aussie demand has jumped 17% on last year, from 6.1t in the third quarter of ’21 to 7.1t in Q3 22.

“The higher demand was mainly supported by a 71% year-on-year increase in jewellery demand from 1.4t in Q3 2021 to 2.3t Q3 2022. There was also a 1% year-on-year increase in bar and coin demand from 4.7t in Q3 2021 to 4.8t in Q3 2022,” Andrew Naylor, Regional CEO, APAC (ex-China) at the World Gold Council said

Mr Naylor says the 71% y-o-y increase in gold consumption is a reflection of how the COVID situation in Australia has rapidly changed over the last twelve months.

“Q3 last year was a time when quite severe COVID restrictions were still in place, the y-t-d increase of 27% suggests the jewellery market in Australia remains robust, despite the backdrop of economic uncertainty.”

Gold uninvesting

Globally, gold investment was down 47% year-on-year, as ETF investors paled before a combination of fast rising interest rates and a fulsomely empowered US dollar. ETF outflows totalled 277t.

These movements, alongside weakness in OTC demand and negative sentiment in futures markets, hampered gold’s price performance – contributing to an 8% quarter-on-quarter price falls across Q3.

Despite these headwinds, gold continued to hold favour with retail investors who take their market cues from different places and have turned to gold for its status as a store of value amidst rampant inflation and geopolitical uncertainty.

Investors sought to hedge inflation with bar and coin investment, driving total retail demand up 36% y-o-y.

Around the grounds

The twin engines of retail buying came viaTurkey (up more than 5 x on last year) and in Germany (up 25% y-o-y at 42t).

Retail gold prices in fevered fanboy and top consumer – India have defied a seasonal trend over the festive months through October to December by extending falls across the traditionally bullish time for bullion.

Jewellery consumption on the other hand – spearheaded by India’s urban consumers – continued to rebound and is now back to pre-pandemic fever pitch, reaching 523t – 10% higher compared to the same time last year.

Similarly impressive growth was also seen in much of the Middle East, led by jewelers in the House of Saud where jewellery consumption is up 20% on Q3 2021, and over in the UAE it’s up 30%.

Chinese jewellery demand also saw a modest 5% increase y-o-y driven by improved consumer confidence, a dip in the local gold price in July and the release of some insanely pent-up demand.

Turning to supply, mine production (net of hedging) was up 2% versus Q3 2021, with gold mining seeing its sixth consecutive quarter of growth.

By contrast, recycling was 6% lower y-o-y in Q3, as consumers held onto their gold in the face of surging inflation and an uncertain economic outlook.

Coming up

“Looking ahead,” WGC senior markets analyst Louise Street says, “we anticipate central bank buying and retail investment to remain strong and that could help offset potential declines in OTC and ETF investment that may prevail if the dollar strength persists.”

“We also expect to see jewellery demand continue to perform strongly in some regions such as India and Southeast Asia, while the technology sector will likely witness further decline in the face of economic deceleration.”

In the short-term markets will be looking for guidance on the Fed’s next move, as a dovish light touch might put a breeze under bullion prices.

While gold is playing its part as a hedge against inflation and economic uncertainties, higher interest rates raise the opportunity cost of holding non-yielding bullion, denting its most malleable appeal.

And these central banks?

We see significantly stronger than expected y-t-d, net purchases will likely continue in Q4, says the WGC.

“Consistent reported purchases are expected to continue but perhaps at a lower pace in Q4. We can’t rule out further unreported buying so have revised our forecast higher for FY 2022,” Louise added.

Market Matters

Gold is driven by a mixture of factors including interest rates, the $US, inflation and global uncertainty.

Market Matters says that until further notice we believe for gold to bounce / rally a pullback is required by both bond yields and the $US, we can see this unfolding into Christmas but these are calls against a well established and strong trend hence caution is warranted.

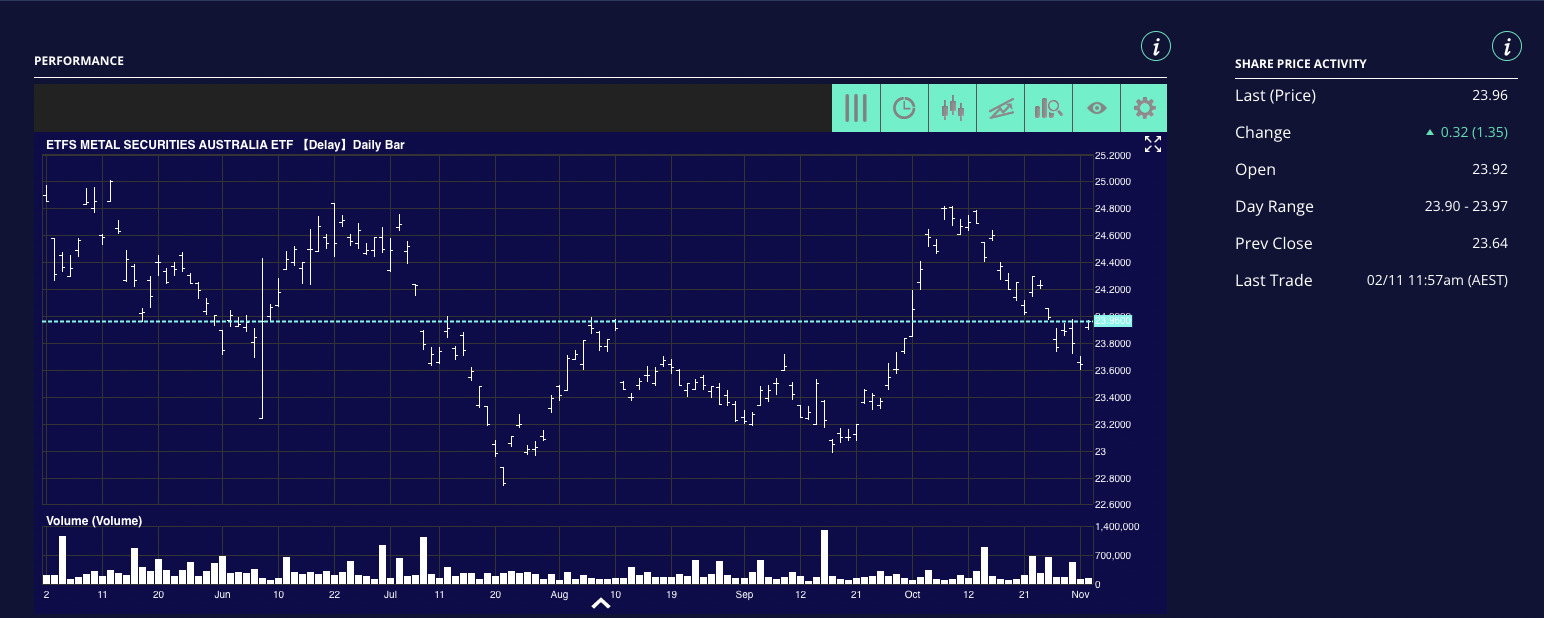

ETFS Metal Securities Australia Ltd

ETFS Physical Gold is an open-ended Exchange Traded Commodity, incorporated in Australia .

It is designed to track the Gold price less fees allowing investors to invest in the precious metals market. It is backed by physical allocated metal bullion which has no credit risk.

The security only holds LBMA Good Delivery bars.

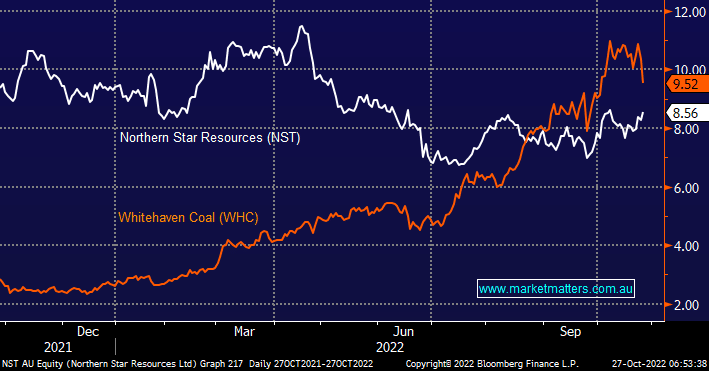

Gold vs Coal at Christmas

Through 2022 the markets delivered plenty of false dawns that investors should consider switching from coal to gold, all of which have withered and died, but if other markets are about to finally reverse some major trends of this volatile year why not this one?

- Local coal heavyweight Whitehaven (WHC) may be up +264% year-to-date but it’s corrected 21%,16%, and 14% along its way.

- Conversely major Australian gold play Northern Star Resources (NST) has fallen -9% so far this year but it bounced 40% in February and 29% in July.

The RBA and BOC are slowly adopting a less hawkish stance on interest rates leaving primarily the Fed to ease off before trends can reverse but of course, once they utter such conciliatory words, whether in November or into 2023, a significant portion of the stock and sector reversion is likely to be in the rear-view mirror i.e. markets usually lead the news.

- We believe the pieces of the jigsaw are falling into place for lower bond yields into Christmas, certainly a tailwind for the gold names.

MM believes NST will outperform WHC into Christmas

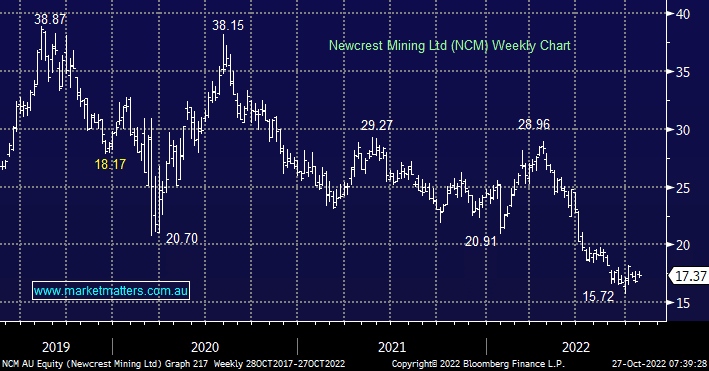

Newcrest Mining (NCM) $17.37

NCM has fallen -29% in 2022, significantly underperforming NST in the process.

The stock looks poised to test the $20 region but it hasn’t demonstrated the strength to compel us to increase our holding in the Flagship Growth Portfolio.

- We believe NCM is set to rally towards the $20 area but MM is likely to reduce our position if such a move unfolds.

The MM Bottom Line

We do believe that gold stocks will outperform coal into Christmas which raises one question and plan moving forward:

- MM remains long NCM but we are questioning whether NST provides better exposure for a recovery in the gold names.

- We continue to like coal stocks but believe they can slip another 10-15% which would deliver excellent risk/reward in our opinion.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.