There’s one ASX auto stock racing ahead of the rest… and it’s in New Zealand

Turners is the biggest used car dealership networkn in NZ. Picture Getty

- Automotive stocks have been under pressure as cost of living soars

- Turners Auto is a NZ used-car dealership that’s been delivering record profits

- Stockhead reached out to Turners’ CEO, Todd Hunter

The ASX automotive sector tumbled to near lows when the pandemic first hit in March 2020, but then surged dramatically to reach record levels by the end of 2021.

It was easy to see why. Concerns over crowded public transportation and the need for social distancing prompted many people to shift to private vehicles.

Used car prices skyrocketed on that demand, and also because people weren’t able to get their hands on new cars amid production slowdowns and chip shortages.

ASX-listed car dealership groups, including Eagers Automotive (ASX:APE), Peter Warren Automotive (ASX:PWR) and Autosports Group (ASX:ASG), generated substantial profits from used vehicle sales during that period.

But things have changed since then.

Supply chains and chip shortages are starting to normalise, new vehicles production have ramped up, and people are starting to pile back onto trains and buses.

Auto stock prices are now pulling back to pre-pandemic levels as used car prices in Australia have fallen by around 12% from a year ago, and could fall 10% more this year (according to Moody’s Analytics).

Analysts believe the auto industry will remain vulnerable to global headwinds in 2023 – including the energy crisis, and higher cost of living caused by spiralling inflation and interest rates.

Turners Auto has been gaining market share in NZ

But it’s not all doom and gloom for the used car space, as New Zealand’s largest used car dealer network, Turners Automotive (ASX:TRA), has shown.

Turners is NZ’s largest used vehicle network and operates across three key areas: used cars, used trucks & machinery, and damaged vehicles. The company has 30 branches nationwide and has been in business for over 50 years.

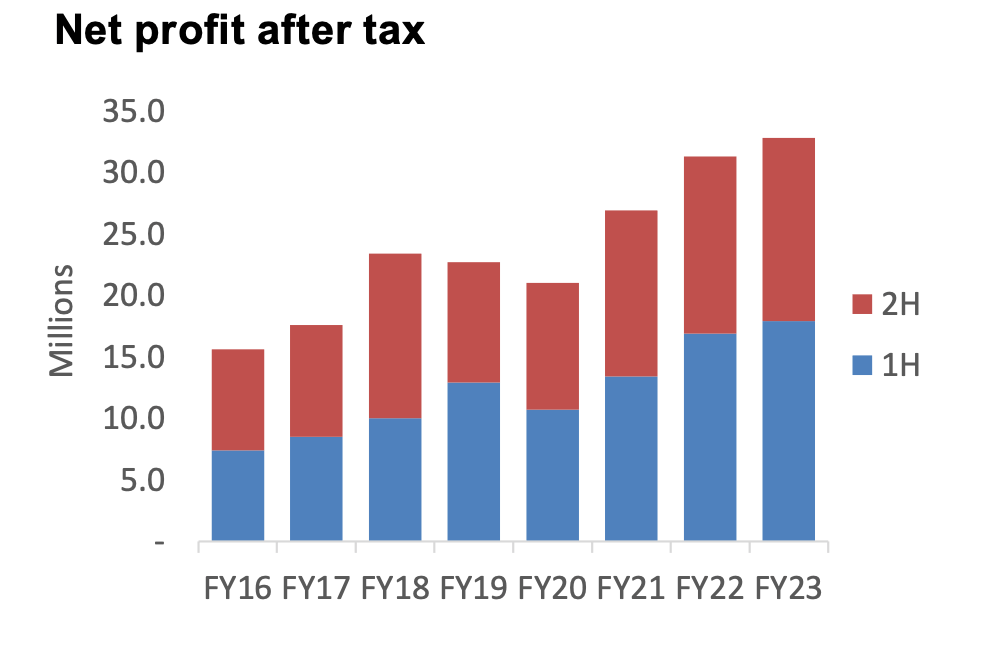

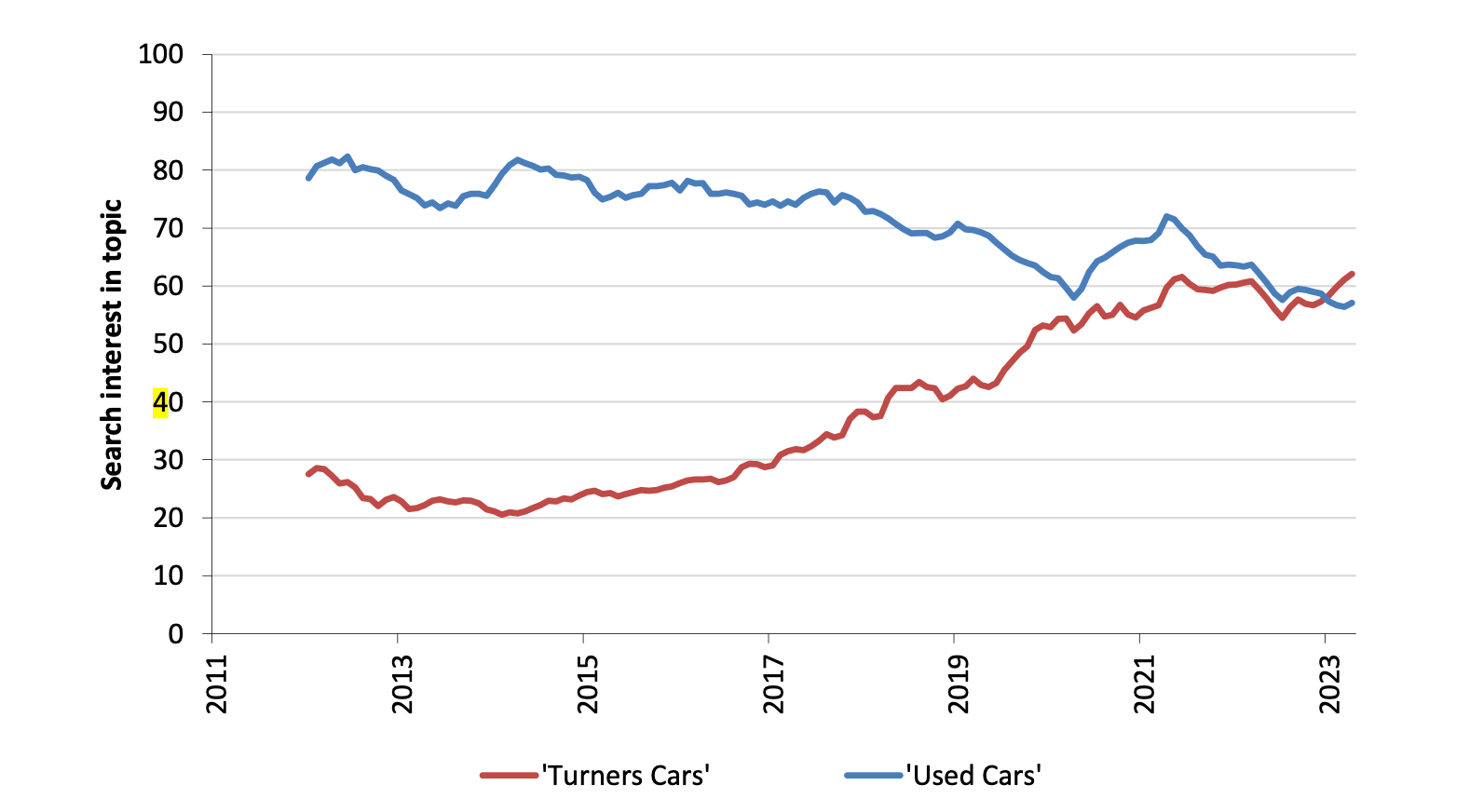

The Turners brand is becoming synonymous with used car sales in NZ, and the company has delivered record profits over the last three financial years.

But Turners CEO, Todd Hunter, is under no illusions and acknowledged the auto industry is facing tough times ahead.

“It’s all to do with cost of living pressures, and we’ve been operating in a declining market, not a rising market,” Hunter told Stockhead.

There are however other aspects such as regulation that have created tailwinds for the company.

For example, Hunter explained that used car imports to NZ have been declining due to a government regulation that only allows cars with certain emission standards to be imported.

As a result, sales have declined, but that meant Turners’ market share has been growing in a market that’s going backwards.

Hunter also said that a lot of the smaller undercapitalised players have left the market because it’s getting harder to import cars due to the stricter regulations.

“So as used car outlets across New Zealand continues to contract, we see further opportunity to consolidate our position.”

Interest rates is the key

Hunter said the company’s ability to generate record profits came down to volume and scale.

“It’s all about growing our branch network, expanding and opening new branches in our retail division,” Hunter said.

The company owns all 30 branches throughout the country, which is a mixture of mostly cars but also trucks and machinery too. It also sells written-off cars for the insurance sector.

“Around 50 odd per cent of our used cars are sourced locally from people who want to sell their cars. We also import a bunch of used cars directly from Japan, and the balance we get on consignment,” he explained.

Hunter says the central bank’s monetary policy will have a big impact on the company’s performance over the next 12 months.

Last week, the RBNZ raised its OCR (overnight cash rate) by 25 basis points to the highest in more than 14 years at 5.5%, but said it would put any further rate hikes on hold until mid 2024.

Asked if TRA still had growth potential, Hunter said:

“We spend a bit of time focusing on our NZ$50 million profit target by FY25, so if you’re taking a medium term view, we’re still very confident we can grow our auto retail finance, insurance and credit management businesses further in the next couple of years.”

Automotive and adjacent stocks on the ASX

| Code | Name | Price | % Mth Change | % 6-Mth Change | % 12-Mth Change | MarketCap |

|---|---|---|---|---|---|---|

| GUD | G.U.D. Holdings | 8.70 | -8.90 | 6.75 | -24.48 | $1,228,601,749 |

| CAR | Carsales.Com Ltd. | 23.45 | -1.30 | 3.40 | 18.83 | $8,872,047,573 |

| ARB | ARB Corporation. | 28.69 | -10.20 | 1.34 | -10.96 | $2,339,009,029 |

| APE | Eagers Automotive | 12.35 | -12.72 | 0.73 | 11.36 | $3,174,113,601 |

| ABV | Adv Braking Tech Ltd | 0.04 | -9.52 | 0.00 | 22.58 | $14,419,744 |

| TRA | Turners Automotive | 3.30 | 0.00 | -1.20 | 1.54 | $286,110,815 |

| SFC | Schaffer Corp. Ltd. | 17.40 | -2.08 | -2.25 | -6.55 | $236,320,693 |

| SIX | Sprintex Ltd | 0.03 | -32.43 | -10.71 | -53.70 | $6,358,858 |

| PWR | Peter Warren | 2.53 | -1.56 | -12.76 | -0.78 | $452,151,141 |

| AHL | Adrad Hldings | 0.96 | -9.00 | -17.95 | -38.00 | $77,427,346 |

| PWH | Pwr Holdings Limited | 8.75 | -12.85 | -25.28 | 10.20 | $888,366,009 |

| CBR | Carbon Revolution | 0.14 | -6.67 | -26.32 | -70.53 | $30,727,678 |

| VMT | Vmoto Limited | 0.27 | -22.86 | -29.87 | -28.95 | $79,706,636 |

| RPM | RPM Automotive | 0.11 | 14.13 | -44.74 | -66.13 | $19,362,735 |

| DDT | DataDot Technology | 0.00 | 0.00 | -50.00 | -62.50 | $3,632,858 |

Peter Warren Automotive (ASX:PWR)

Peter Warren’s auto dealership has been operating in Australia for over 60 years.

The company operates 80+ franchise operations, and represents more than 25 OEMs across the volume, prestige and luxury segments.

Peter Warren operates under various banners including Peter Warren Automotive, Frizelle Sunshine Automotive, Sydney North Shore Automotive, Mercedes‐Benz North Shore, Macarthur Automotive, Penfold Motor Group, and Euro Collision Centre across the Eastern seaboard.

Carbon Revolution has successfully commercialised the advanced manufacture of carbon fibre wheels for the global automotive industry.

The company has progressed from single prototypes, to designing and manufacturing lightweight wheels for cars and SUVs in the high performance, premium and luxury segments.

Its premium end of the market clients include Ford, Ferrari, General Motors and Renault.

CBR has has recently secured US$60m of debt to fund further Mega-line automation and capacity expansion.

Sprintex is a clean air compressor engineering and manufacturing company which designs electric and mechanically driven clean air compressors for use in a wide variety of applications.

The company’s products include combustion engines where it sells the Sprintex twin screw superchargers in the automotive aftermarket and OEM market in Australia, Asia, Africa, the Middle East and the US.

Most recently, Sprintex participated in the European €14m sHyPs hydrogen powered cruise liner decarbonisation programme.

Based in Perth with a manufacturing facility in Nanjing, China, Vmoto is a designer, manufacturer and distributor of high quality electric two-wheel vehicles and related EV business solutions.

It specialises in electric powered two-wheel vehicles and a range of electric scooters.

Vmoto has three brands: Vmoto, aimed at the value market in Asia, E-Max, targeting international B2B markets, and Super Soco, a third party brand Vmoto markets into international B2C markets.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.