Lunch Wrap: ASX lifts and miners bounce back after tariff de-escalation

ASX edges higher as tariff de-escalation pushes miners higher. Pic: Getty Images

- ASX edges higher as tariff de-escalation pushes miners higher

- Oil wobbles on OPEC supply ramp-up talk

- Gold stocks bounce back

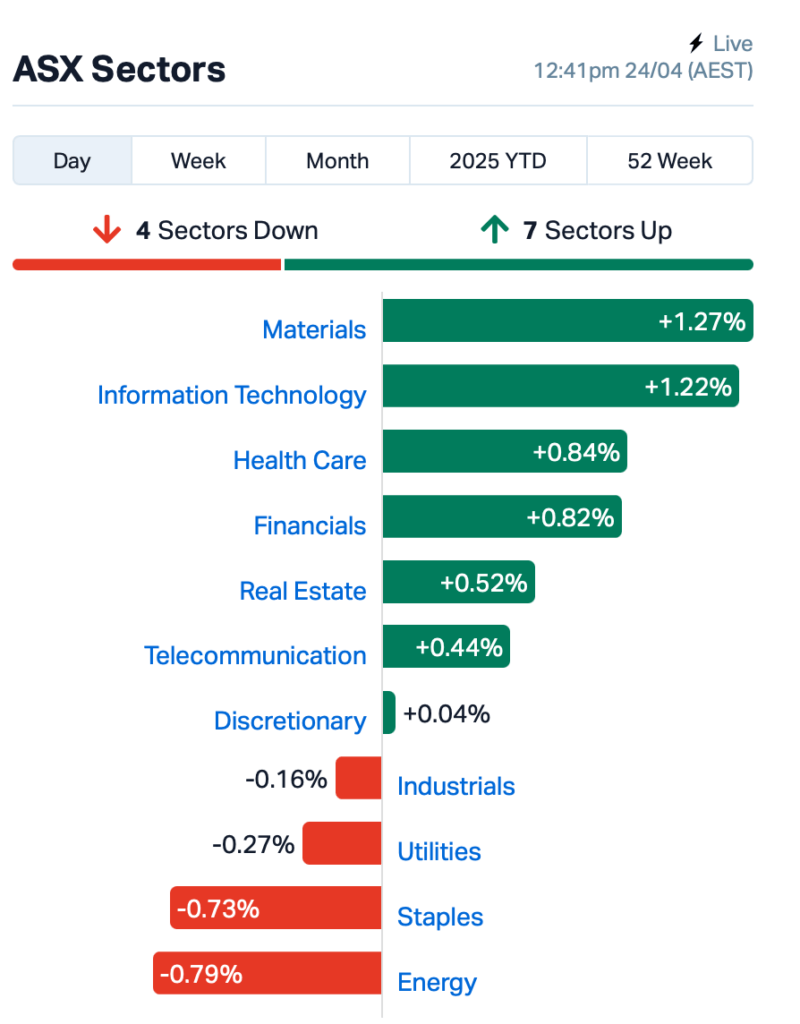

The ASX lifted again on Thursday morning, with the ASX 200 climbing 0.5% by lunchtime, AEST.

Not a thumping rally, but enough to keep the mood upbeat.

Investors seemed to breathe a little easier as whispers emerged from Washington that President Trump might be looking to ease those monster 145% tariffs on China.

Word is, they could be dialled back to somewhere between 50% and 65%. Nothing official, but it was enough to give Wall Street a jolt overnight.

The S&P 500 hit a two-week high, Nasdaq surged 2.5%, while the Dow had a crack at a 400-point gain.

Tesla jumped nearly 6% after Elon Musk promised to actually spend more time running the company, instead of moonlighting at DOGE.

Intel, meanwhile, is swinging the axe, with plans to cut over 20% of its headcount as it tries to get back to its engineering roots.

The chip giant’s been wobbling a bit lately, and the new boss, Lip-Bu Tan, reckons it’s time for a clean-out and he’s not mucking around.

In other markets, Brent is hovering around a two-week low as rumours grow that OPEC+ might open the taps further.

Concerns also still remain for the oil market that this whole tit-for-tat tariff drama could dent energy demand, especially if it drags on.

Back home, most of the big lift came from the miners this morning.

Gold stocks, which faced a bloodbath on Wednesday, bounced back strongly. Emerald Resources (ASX:EMR) and Newmont Corporation (ASX:NEM) clawed back 4%.

Iron ore names like BHP (ASX:BHP) and Fortescue (ASX:FMG) also rallied, helped by the iron ore price popping back above US$100 a tonne.

In large caps news, Kathleen Valley lithium mine operator Liontown Resources (ASX:LTR) gained 3% after reporting a solid 17% lift in March quarter revenue.

Resolute Mining (ASX:RSG) said its gold production and sales dipped during the March quarter, down to 75,497 ounces and 64,322 ounces respectively, though it insists it’s still on track to hit its full-year guidance.

And, Generation Development Group (ASX:GDG), headed by former Olympics champ Grant Hackett, crashed 17% despite growing its asset base in the March quarter. Looks like the market expected more from its first quarter as an ASX 200 club member.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 24 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| M2R | Miramar | 0.004 | 100% | 14,698,944 | $1,993,647 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 1,500,000 | $3,253,779 |

| RAN | Range International | 0.003 | 50% | 333,334 | $1,878,581 |

| PPY | Papyrus Australia | 0.011 | 38% | 13,750 | $4,565,454 |

| ACS | Accent Resources NL | 0.008 | 33% | 60,000 | $2,838,764 |

| BNL | Blue Star Helium Ltd | 0.008 | 33% | 1,473,566 | $16,169,312 |

| RDS | Redstone Resources | 0.004 | 33% | 2,618,087 | $2,776,135 |

| CUS | Coppersearchlimited | 0.022 | 29% | 180,006 | $2,017,456 |

| RFA | Rare Foods Australia | 0.009 | 29% | 485,766 | $1,903,883 |

| GCM | Green Critical Min | 0.012 | 28% | 29,194,954 | $17,655,105 |

| KNI | Kunikolimited | 0.175 | 25% | 135,330 | $12,169,398 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 1,905,216 | $12,314,111 |

| TAR | Taruga Minerals | 0.011 | 22% | 1,330,000 | $6,354,241 |

| PDN | Paladin Energy Ltd | 4.850 | 22% | 5,257,867 | $1,587,861,950 |

| BMG | BMG Resources Ltd | 0.012 | 20% | 1,298,293 | $8,383,972 |

| JLL | Jindalee Lithium Ltd | 0.285 | 19% | 295,832 | $17,662,044 |

| ABE | Ausbondexchange | 0.039 | 18% | 218,181 | $3,718,048 |

| AGE | Alligator Energy | 0.028 | 17% | 14,454,597 | $92,966,384 |

| AKN | Auking Mining Ltd | 0.007 | 17% | 429,095 | $3,448,673 |

| SPX | Spenda Limited | 0.007 | 17% | 175,201 | $27,691,293 |

| TEG | Triangle Energy Ltd | 0.004 | 17% | 5,600,699 | $6,267,702 |

| TOE | Toro Energy Limited | 0.225 | 15% | 1,033,453 | $23,454,960 |

| AEE | Aura Energy | 0.115 | 15% | 781,040 | $89,074,814 |

| CU6 | Clarity Pharma | 2.055 | 14% | 1,448,202 | $580,039,660 |

Gold Mountain (ASX:GMN) has been poking around its Ararenda Project in northeast Brazil, and reckons it’s onto something big. Early test results from stream sediment samples show some chunky copper-gold anomalies stretching across 20 kilometres, which line up with a known mineralised zone nearby. It’s sniffing out signs of a large IOCG-style system and with more results on the way, the company said it’s keen to drill.

Pursuit Minerals (ASX:PUR) released its quarterlies today. The company said during the quarter, it’s been busy at its Rio Grande Sur lithium project over in Argentina, which is starting to hit some solid milestones. The company fired up its lithium carbonate pilot plant in Salta and produced its first batch from synthetic brine. Pursuit is also rolling out a staged production plan aiming for over 15,000 tonnes a year, and the numbers from its recent resource upgrade are feeding straight into the feasibility study due out in the first half of 2025.

Forbidden Foods (ASX:FFF) is finding its groove after snapping up Oat Milk Goodness, with March racking up its best sales month since the new crew took over. Net sales hit $1.1 million for the quarter, more than double what it was this time last year, and online orders are still climbing. Costco’s placed another chunky order – its biggest yet – and the company is building up stock to keep pace with demand.

Sabre Resources (ASX:SBR) is offloading its Ninghan Gold Project to Capricorn Metals in a deal worth $1.6 million, with most of the payment coming in Capricorn shares. It’s pocketed a $100k deposit and could score up to $1.75 million more down the track if Capricorn kicks off drilling, confirms a decent gold resource, and gives the green light to mine. Sabre’s also keeping a small royalty on any gold dug up.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 24 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.001 | -33% | 6,981,035 | $43,400,718 |

| FTC | Fintech Chain Ltd | 0.004 | -33% | 583,050 | $3,904,618 |

| T3D | 333D Limited | 0.006 | -25% | 22,222 | $1,409,468 |

| NGX | Ngxlimited | 0.100 | -20% | 73,985 | $11,326,480 |

| CTN | Catalina Resources | 0.002 | -20% | 776,798 | $4,159,399 |

| FAU | First Au Ltd | 0.002 | -20% | 58,227 | $5,179,983 |

| LML | Lincoln Minerals | 0.004 | -20% | 2,665 | $10,512,849 |

| VFX | Visionflex Group Ltd | 0.002 | -20% | 5,000,000 | $8,419,651 |

| TRP | Tissue Repair | 0.205 | -18% | 628,015 | $15,116,211 |

| CTT | Cettire | 0.540 | -18% | 5,388,646 | $249,711,034 |

| KPO | Kalina Power Limited | 0.005 | -17% | 5,315,165 | $17,365,318 |

| SHP | South Harz Potash | 0.005 | -17% | 72,000 | $6,495,472 |

| REE | Rarex Limited | 0.032 | -16% | 14,943,330 | $30,432,142 |

| 8CO | 8Common Limited | 0.017 | -15% | 6,695 | $4,481,898 |

| IR1 | Irismetals | 0.135 | -14% | 300,698 | $26,926,103 |

| AAU | Antilles Gold Ltd | 0.003 | -14% | 100,000 | $7,442,287 |

| CLA | Celsius Resource Ltd | 0.006 | -14% | 1,907,211 | $20,352,998 |

| FFF | Forbidden Foods | 0.006 | -14% | 5,514,266 | $4,984,714 |

| HHR | Hartshead Resources | 0.006 | -14% | 3,226,541 | $19,660,775 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 6,993 | $11,196,728 |

| W2V | Way2Vatltd | 0.006 | -14% | 350,000 | $6,538,001 |

| OBM | Ora Banda Mining Ltd | 1.030 | -14% | 5,855,173 | $2,250,645,829 |

| C1X | Cosmosexploration | 0.074 | -13% | 13,378 | $8,794,661 |

| AGD | Austral Gold | 0.061 | -13% | 95,141 | $42,861,795 |

Motor-sports cooling system specialist, PWR (ASX:PWH), took a 5% hit after announcing that founder and CEO Kees Weel is stepping back temporarily to focus on his health. While Weel will still be involved in steering the company’s direction, day-to-day operations are now in the hands of the executive leadership team, with Matthew Bryson stepping in as acting CEO.

IN CASE YOU MISSED IT

Hillgrove Resources (ASX:HGO) has mobilised contractors, equipment, and labour to fast-track development of the Nugent decline at its Kanmantoo site, with first ore on track for processing in the December 2025 quarter. This milestone marks the start of Stage 1 in the company’s 12-month production ramp-up strategy.

EU-funded geophysical exploration has kicked off at Latitude 66 (ASX:LAT) flagship KSB Project in Finland’s Kuusamo Schist Belt, as part of the €5 million UNDERCOVER initiative led by the Geological Survey of Finland (GTK). Backed by Horizon Europe, the three-year project aims to advance deep exploration for critical raw materials using innovative and environmentally friendly techniques.

At Stockhead, we tell it like it is. While Hillgrove Resources and Latitude 66 are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.