The White House: Forget The Fed, it’s time for Lockdown 2.0

Via Getty

In this series, global equities portfolio manager James White ditches micro and macro and embraces “The Meta” perspective. A place where James can obsess over the detritus of where economies crash into equities.

Whitey’s house is Lessep IM, a Sydney-based global equities investment manager.

He looks a lot like this:

There’s a recession in the wind. Possibly a global one at that.

With sudden and painful rate hikes around the world, it looks like the only play left in the book for central banks is whack-a-mole on resurgent price rises.

The US Federal Reserve announced on Wednesday its largest interest rate increase since 1994. It’s considered by some to be the most aggressive decision aimed at controlling bumptious inflation that hit 8.6 per cent in May, the highest in 40 years.

Asset markets continue to be hugely concerned by inflation and the long looming night of policy tightening by global central banks. Inflation is such a problem that only a sustained period of weaker demand, created by higher interest rates, can resolve entrenched price increases.

But is that the only solution? (long, dramatic pause…)

Enter: Lockdown 2.0

An extreme, but likely solution to the problem would be a self-imposed return to lockdown. Just as the first lockdown saw an immediate dramatic decline in prices, a second, voluntary lockdown would lead to lower prices and a resumption of higher economic growth in the future. It’d totally add to the strength in household savings, not to mention easing the strain on cost of living and on Covid-flu hit hospital beds and surgery wait times.

But crucially, the economy would go back to its mini cryo-status. As would we.

And this is exactly the solution that markets are clearly driving for.

By increasing prices on the global economy, markets are forcing a rapid decline in economic activity. As economic activity declines, a period of time when supply can begin to catch up will become available. This will help prices normalise in the medium term.

For instance, of the 35,000 flights scheduled for Sunday June 19th in the US, 916 were cancelled. It was over 1400 on Friday. As random as this may seem, cancelling 4% of flights leads to better dynamics in the stretched jet fuel market.

In a similar vein, in a NSFW rant, a truck driver in the US shows packed truck stops, full of trucks unable to get diesel. Activity stops, it doesn’t continue at higher prices.

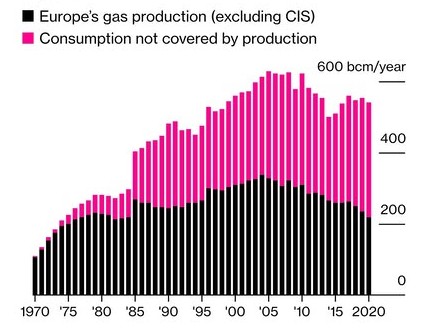

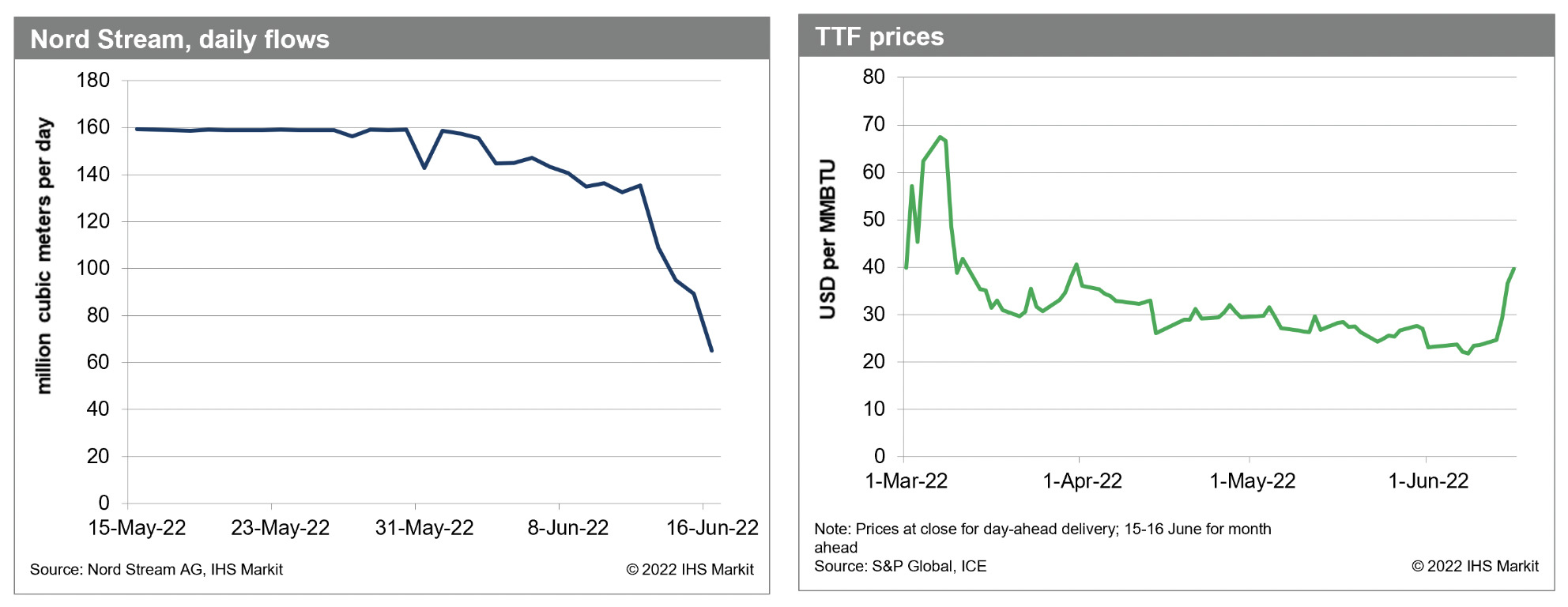

As discussed last week, the sharp increase in European energy prices, particularly natural gas (71% in a week), will lead to shutdowns of economic activity.

Manufacturing businesses cannot be profitable at these prices.

And on the continent, early summer holidays are on the menu.

It may not be entirely coincidental, in this context of higher prices, that France banned outdoor events as a consequence of the heatwave. It forces lower economic activity.

Meanwhile, rolling out a list of technical probs, safety issues, and Western imposed sanctions, Russia’s slashed its Nord Stream pipeline capacity by 60% late last week.

That’s whacked deliveries of Russian gas into Europe by about 35% to very, very, very low levels.

Germany’s put upon climate minister Robert Habeck accused Russia of seeking to drive up prices and destabilise the gas market, which if I was a tyrant-in-a-corner I’d probably do it too.

Remember Freddie Mac?

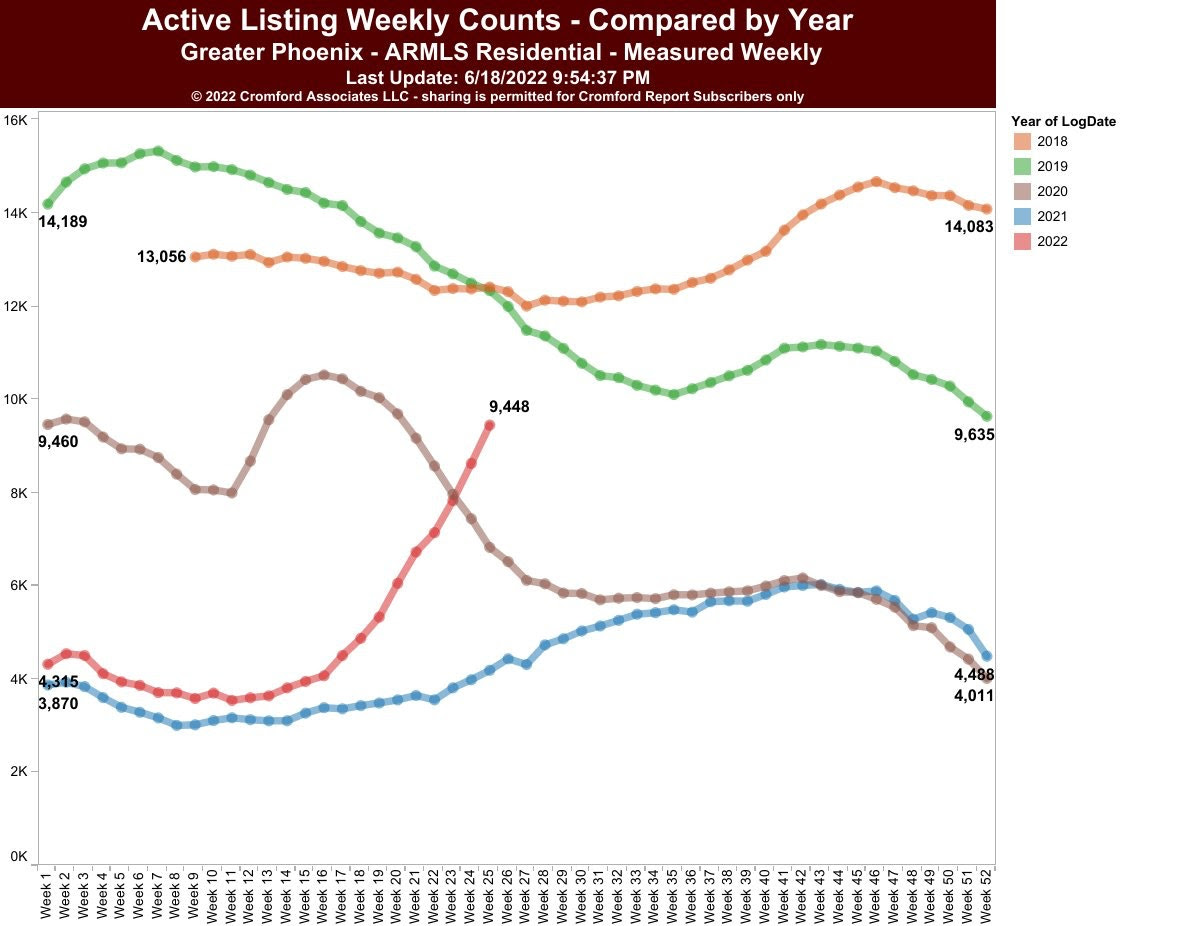

The US housing market is at the beginning stages of the most significant contraction in activity since 2006.

It hasn’t shown up in many data series yet, but mortgage applications are pointing to a large decline over summer.

Purchase apps down 40% from seasonally adjusted peak pic.twitter.com/s4Wl712MZZ

— Len Kiefer (@lenkiefer) June 9, 2022

Last week FMCC’s deputy chief economist Len Kiefer: – “I don’t think that home sales are going to grind to a complete halt. They’ll just slow. People will still be able to sell homes, but it may take you just a little bit longer than what it’s been.”

Purchases and refinance applications are in fact down to the lowest level in 22 years.

The uppity market has created a rise in 30-year mortgage interest rates leading to a near-complete collapse in US housing activity.

The chart below shows home listings in the Greater Phoenix area have doubled from mid-April 2022. At these mortgage rates, economic activity is unlikely to occur. This in turn, will put downward pressure on housing costs and inflation, until such time as it can resume more sustainably.

Finally, emerging market mobility data shows that across countries like Indonesia, India, Brazil, and Argentina transport activity growth has stalled, or even begun to decline.

Prices are too high for these consumers to maintain previous levels of activity growth.

Wang Dan, the China chief economist at Hang Seng Bank, is just as worried about the knock-on impact on emerging markets already grappling with rising post-COVID poverty levels.

“The emerging market is borrowing very heavily in the international markets, and most of those debts are in dollar terms,” Wang says. “By increasing the rates in the US it (has) actually increased the cost of borrowing in dollar(s), immediately.”

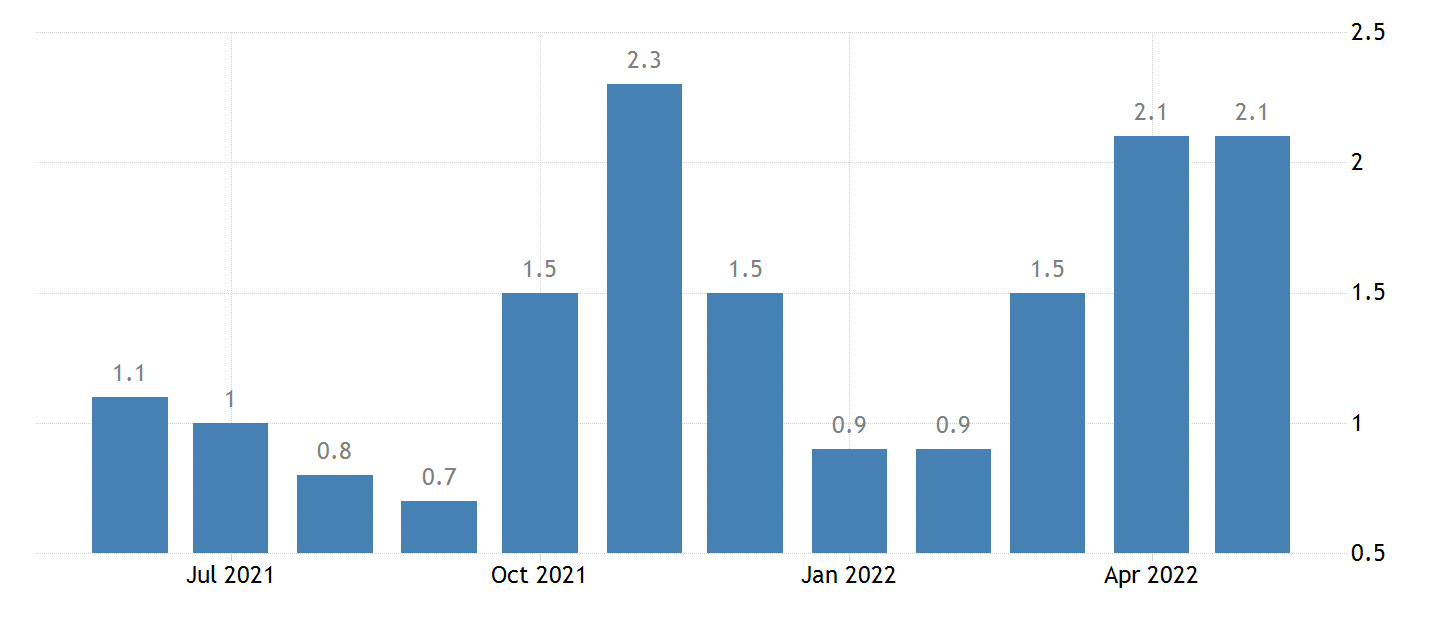

Whereas the world’s second largest economy is quite different, notably the low inflation rate.

Monthly China CPI

China’s CPI rose only 2.1 per cent in May, which is much lower compared to the 8.6 per cent in the US and 8.1 per cent in the eurozone.

Will this be sufficient?

It’s likely that markets continue to push prices to the point where activity stops. At such price levels, demand will disappear, and allow supply a period of time in which it can catch up. The sharper the prices rises are, the faster this period can occur, and then pass.

There should be no doubt that prices will reach levels that inhibit economic activity. A sustained decline in the oil price would indicate this point has been reached.

It’s likely to come to pass at a considerably faster rate than if the economy were to wait for monetary policy, as the Fed seemed to indicate last week.

The Federal Reserve

Last week the Federal Reserve raised interest rates by 75bps in an effort to slow inflation from its fastest pace since 1984. The expectation of markets is for another, similar sized move, to occur in July. The Federal Reserve, through its “dot plot” chart, indicates that, in addition to the July move, rates will rise a further one percentage point in 2022, and 40bps in 2023, taking the Fed Funds Rate to 3.8% in 2023.

The Federal Reserve aims to have inflation under control by 2023. It currently forecasts inflation, using its favoured measure personal consumption expenditures (PCE), at 5.15% in 2022 and falling to 2.70% in 2023. Interestingly, to reach its 2022 forecast, the Fed expects inflation to re-accelerate from the current 4.9% in April.

There are a number of points to make about the Fed’s policy position.

First, it is forecasting a re-acceleration in inflation, so as to justify aggressive policy action. If inflation peaked two months ago, as the chart currently suggests, aggressive action may not be as necessary, now. It would have, however, helped a year ago. To be fair, it wants its forecast (of high inflation) to be wrong.

Second, Jerome Powell, the Fed Chair, is clear that a large part of the problem is beyond the control of the Fed:

“… supply constraints have been larger and longer lasting than anticipated, and price pressures have spread to a broad range of goods and services. The surge in prices of crude oil and other commodities that resulted from Russia’s invasion of Ukraine is boosting prices for gasoline and food and is creating additional upward pressure on inflation.”

Inflation has remained at levels well above the Federal Reserve’s inflation goal of 2% for over a year.

Separating the underlying data from the PCE price index into supply-versus-demand-driven categories reveals that supply factors explain about half of the run-up in current inflation levels. Demand factors are responsible for about one-third, with the remainder resulting from ambiguous factors.

While supply disruptions are widely expected to ease this year, this outcome is highly uncertain, says the Reserve Bank of San Fran.

Monetary policy cannot resolve these problems. As has been discussed above, the market likely achieves the Federal Reserve’s goals first.

On the basis of this analysis, the Fed Funds rate peaks this year, and with a six-month horizon, the market begins to price this in.

Or we can let common sense prevail, and retreat back into our little domiciles and wait this all out.

At Stockhead we tell it like it is. While we’re big admirers of the Reserve Bank of San Francisco, they did not sponsor this article.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.