The most expensive of all: Aussie homes at new record highs

News

Aussie homes have never cost more, just as there’s been a fresh surge in houses coming onto the market, according to new data from PropTrack.

The latest quarterly PropTrack Home Price Index shows the national median home price hit a record high last month – recouping all last year’s losses.

That means Australia’s most calamitous price declines in recent history have been gobbled up just as the spring selling season rises with PropTrack data suggesting national prices climbed 0.35% month-on-month to peak levels.

Prices are now up 4.31% so far this year.

The market has kicked back into life on both sides of the till, according to senior economist Eleanor Creagh, with buyer and seller confidence strong just as choice is improving across major capitals.

September marked the ninth straight month of national home price growth, leading your typical Aussie home to clock its highest ever level a few months out from Xmas.

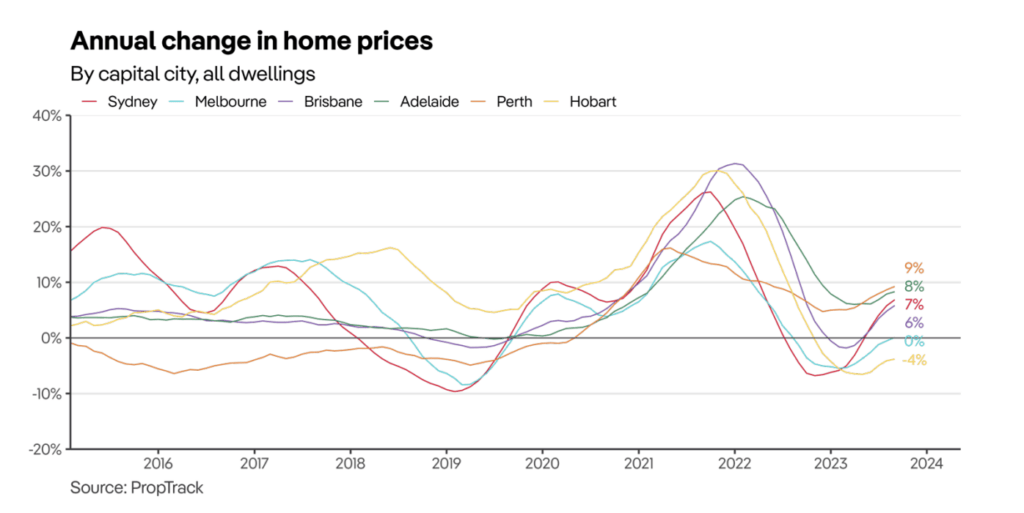

Rising cash rates sucked the oxygen and the fun out of property as prices fell 4.10% between March 2022 to December 2022, according to PropTrack.

National prices are now up 4.31% from the low point recorded in December and 3.75% higher than a year ago.

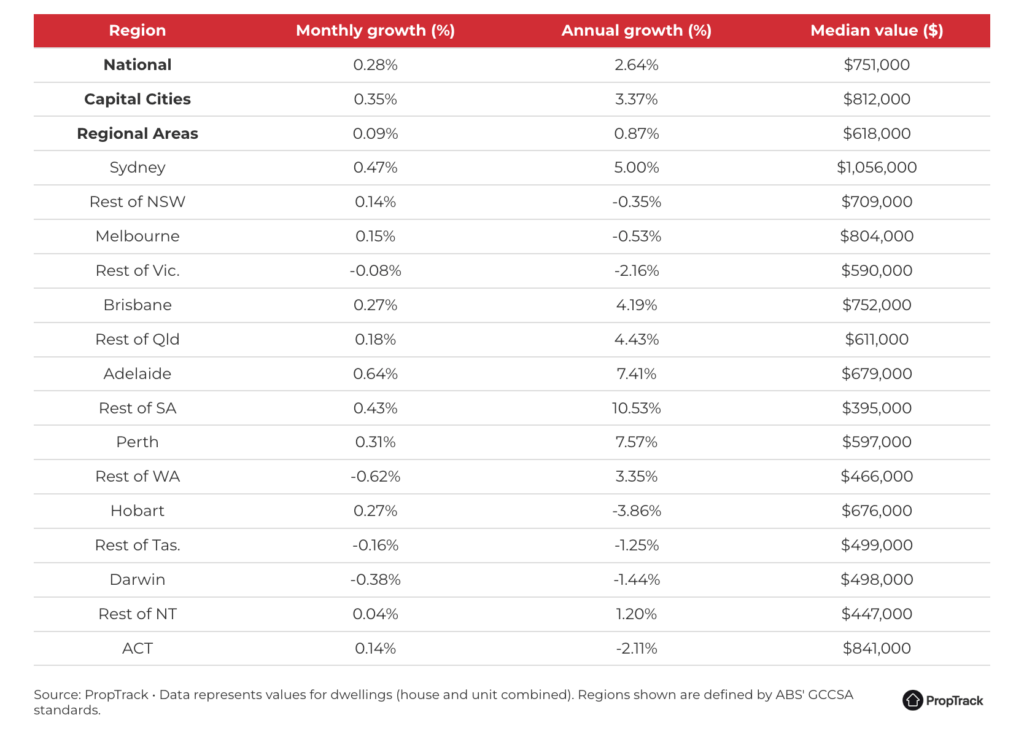

Australia’s median home price rose 0.35% in September and the capital city median increased 0.41%, even though buyers had more properties to choose from last month.

Perth, Adelaide and Brisbane are now at record highs, while Sydney prices are just below the peak recorded in February 2022.

The swift acceleration in price growth has been driven by a perfect storm of record high net immigration, tight rental markets and a housing shortage, says Creagh.

“Despite the uplift in the number of properties coming to market, national home prices have moved higher again, regaining 2022’s rapid price falls in entirety to reach a record high in September.”

Prices grew fastest in Perth (0.71%), Sydney (0.48%), Adelaide (0.48%) and Brisbane (0.39%) in September, building on strong gains last month.

“The smaller capital city markets continue to record a stronger pace of growth.”

The big increase in properties listed for sale in Australia’s two biggest markets hasn’t slowed price growth, Creagh says.

“While a sharp increase in the number of properties hitting the market in Sydney and Melbourne has been improving choice for buyers, strong demand has seen prices continue to lift.”

Prices declined in regional Victoria and the Northern Territory, and fell very slightly in Darwin and regional Tasmania.

The regional median price rose 0.18% in September and is now sitting 0.78% below the previous record, but prices in regional South Australia and Queensland are at record highs.

Pressure from booming population growth and a shortage of new housing stock is likely to cause prices to rise further, Creagh said.

“Looking ahead, interest rates have likely peaked and population growth is rebounding strongly,” she said.

“As we head further into spring, more markets are likely to reclaim 2022’s fast falls to set new peaks.”

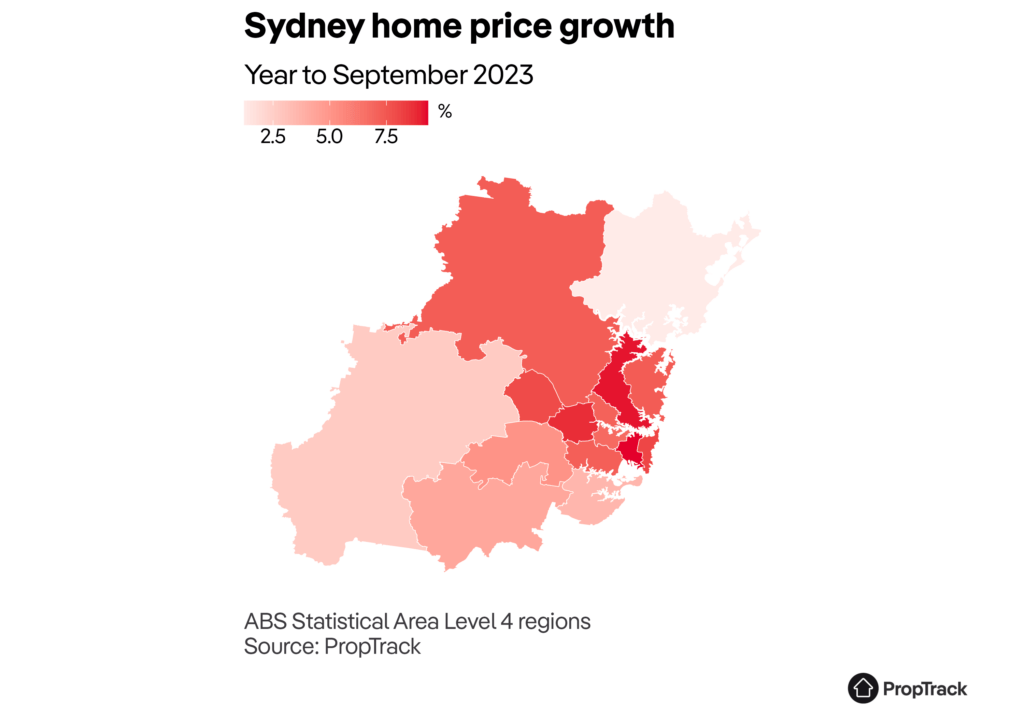

Prices in Sydney have rebounded significantly since bottoming out in November 2022, with the median value rising 7.43% after 10 consecutive months of growth.

Sydney’s median home value is now $1.057m – just 0.03% below its previous peak.

“Sydney has led Australia’s home price recovery after leading the downturn in 2022,” Creagh said. “Prices in Sydney have now regained most of the decline in values recorded in 2022.”

The fastest growth was recorded in the City and Inner South, North Sydney and Hornsby, and Parramatta SA4 regions, with annual price growth of about 9% in each of these areas.

Sydney’s northern suburbs and the inner city were the regions where home prices grew the fastest over the past year.

Belle Property Lane Cove principal James Bennett said increased buyer confidence amid low stock levels had pushed up prices over the year, but the surge in new listings was giving buyers more choice.

“There’s still plenty of buyers out there and we can get more properties sold, but they’re a lot more price sensitive,” he said.

More buyers were upgrading to larger properties, which was driving strong results for more valuable homes, Bennett said.

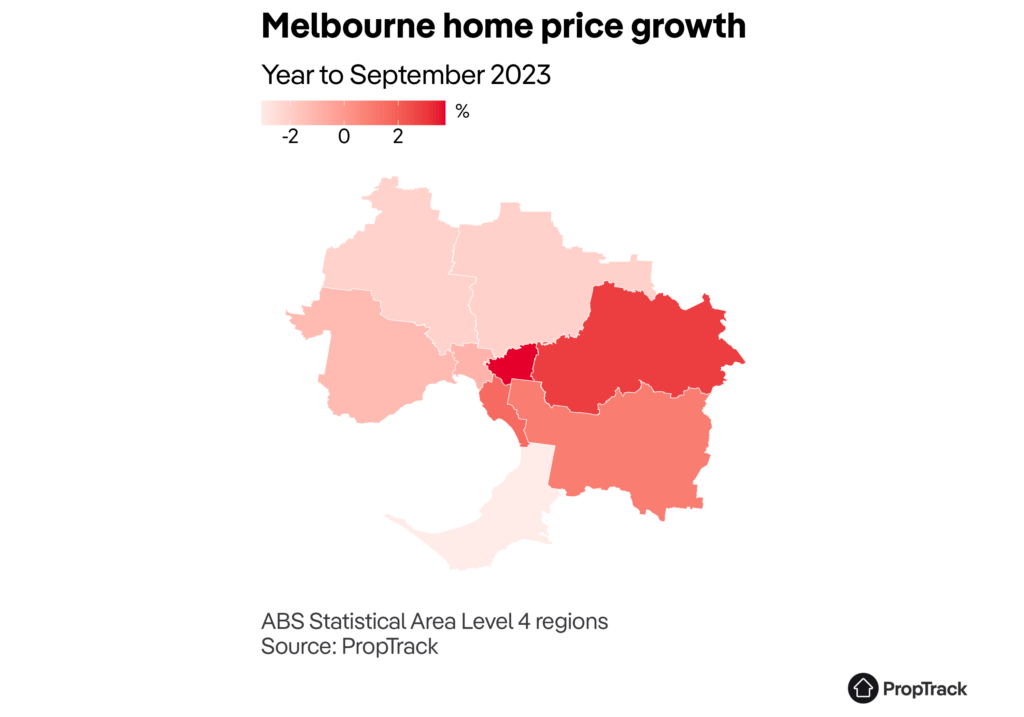

Although prices in Melbourne are still more than 4% below the peak of March 2022, the city has recorded positive annual price growth for the first time since 2022.

“Melbourne home price growth accelerated in September, with prices climbing 0.25% month-on-month,” Creagh said.

“Home prices are up 1.66% from their low point recorded in January 2023, meaning the price recovery in Melbourne is lagging Sydney and Brisbane, but remains ahead of the recovery seen in Hobart and Canberra.”

Melbourne’s median price is now 0.07% higher than a year ago, but pricier regions have outperformed the wider city and led the recovery.

Values rose about 4% in the Inner East, 3% in the Outer East and 2% in the Inner South over the past year.

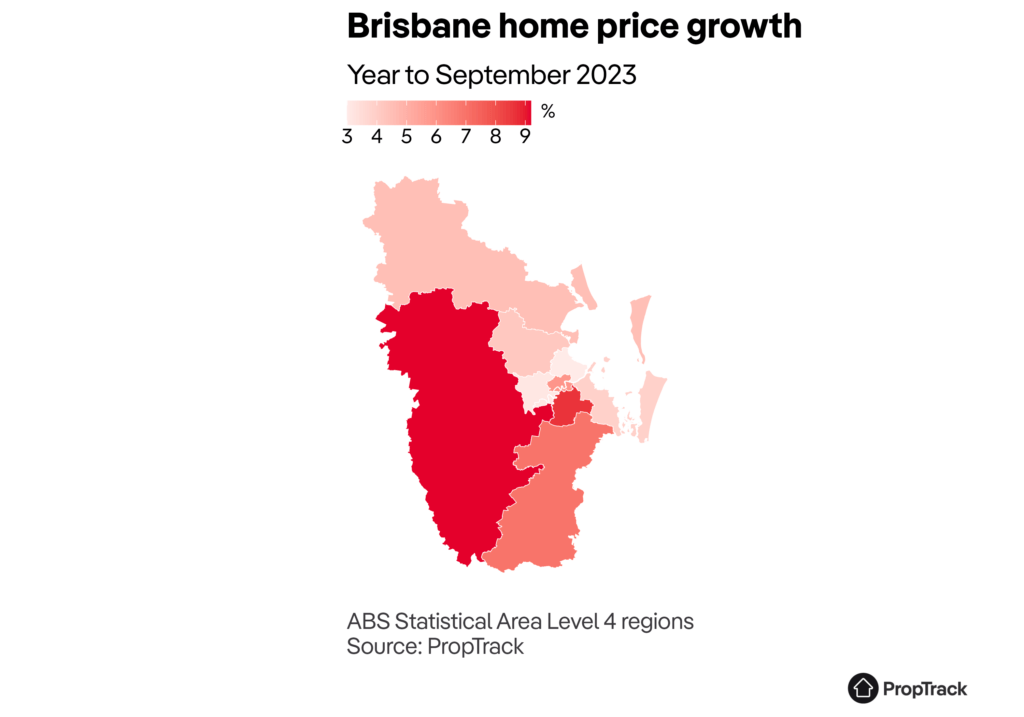

The median home value in Brisbane is now $762,000, the highest value ever recorded.

“Home prices in Brisbane have already regained 2022’s price falls and are rising at a fast pace, jumping 0.39% in September to hit a new price peak,” Creagh said.

Brisbane’s median prices has risen 5.82% in the past year, but the city’s more affordable southern and western regions have recorded stronger growth. Stock levels remain low in Brisbane, with the total number of properties for sale about 14% lower compared to a year ago.

Over the year, prices grew 9% in the Brisbane – South and Ipswich regions, and 7% in Logan and Beaudesert.

Strong demand from buyers with few properties to choose from has pushed prices higher, particularly in outer suburbs, Torres Property director Will Torres said.

“There’s still interstate migration coming in and they’re mainly focused on the inner city market,” he said.

“That’s pushing the local buyers out further. They’re finding themselves having to compromise and go out that extra one or two kilometres to find a home in their budget.”

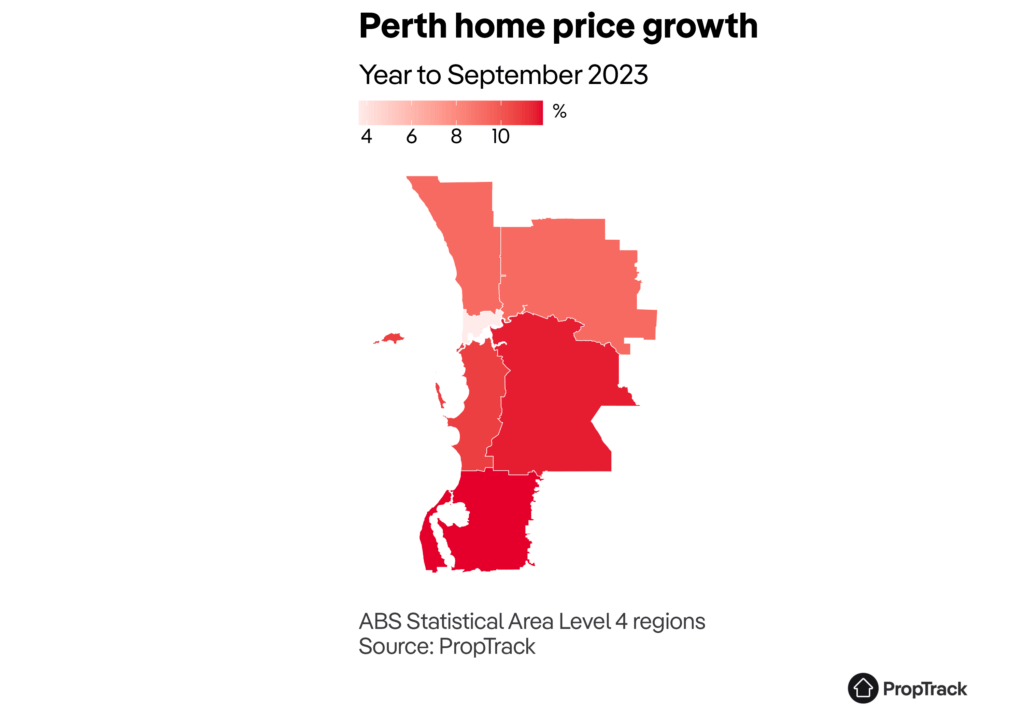

The property market is booming in Australia’s strongest performing capital city, with Perth’s median value jumping 0.78% in September to $597,000 – a new record high.

Home prices in Perth are up 9.24% from their level a year ago, and a whopping 53.5% since March 2020 – making Perth the strongest performing capital city market over the past year.

The relative affordability of the city’s homes and limited choice for buyers are seeing prices climb at a fast pace.

Even so, Western Australia is the most affordable state for home buyers, according to the PropTrack Housing Affordability Report, and that bargain hunting is the flavour of the current market, driving strong demand from buyers, Creagh said.

“Population growth, a shortage of housing and very tight rental markets are also supporting values,” she said.

Perth’s South East and Mandurah regions outperformed the rest of the city, rising 12% over the past year. By contrast, the pricier inner suburbs rose 4%.

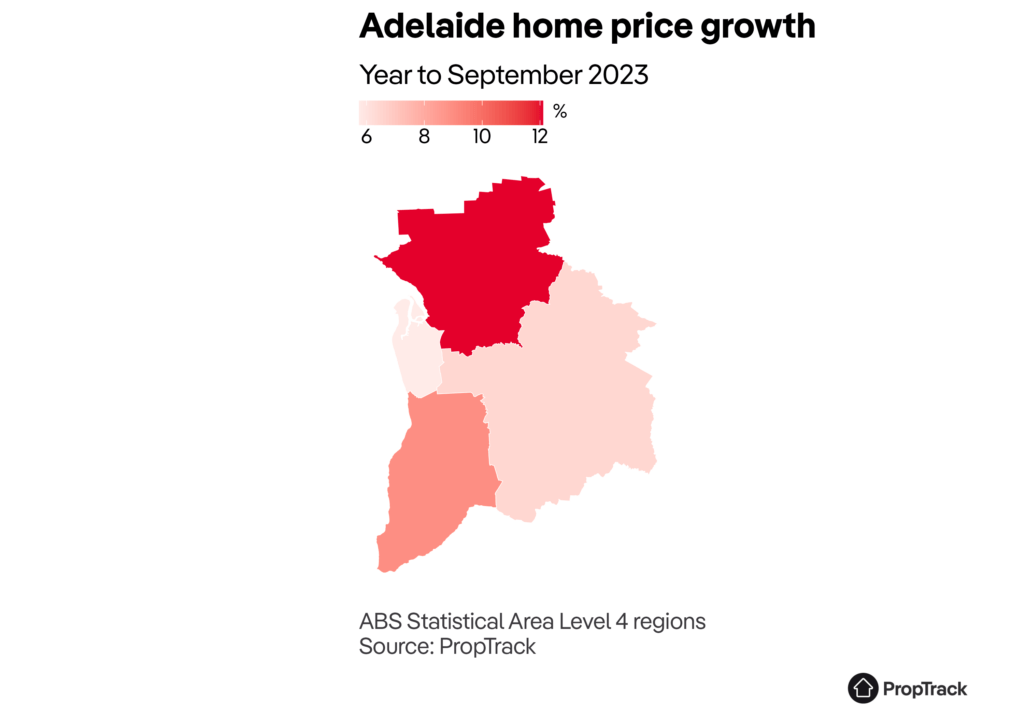

Adelaide home prices grew another 0.48% in September, taking the median to $689,000.

Prices rose 8.31% over the past year – faster growth than any other capital apart from Perth.

Adelaide’s north was the standout performer, with prices rising 12% in the past year.

The affordability of Adelaide relative to other cities has lessened the effect of rising interest rates and supported growth, Ms Creagh said.

Adelaide home prices rose 0.48% month-on-month in September to a new peak and are now up 6.90% year-to-date. Adelaide continues to be one of the country’s top performing markets.

Low stock levels are also intensifying competition and home prices in Adelaide are rising at a fast pace but although more properties have come to market in recent months, the total number of properties on the market remains lower than a year ago.

Canberra Median: $842,000

Home prices in Canberra crept up again in September, rising 0.30% over the month to a median value of $842,000.

Canberra’s home price recovery has been slower than other capitals, with prices still 5.18% below the peak in March 2022.

Despite lagging behind the other capitals, prices are still up more than 36% since the start of the pandemic.

Hobart Median: $677,000

Prices in Hobart edged a little higher in September, rising 0.09%.

Hobart prices are yet to recover from the falls during the most recent downturn, and buyers are spoilt for choice, with 32% more properties on the market than this time last year.

The median price is down 3.83% over the past year and 6.6% since the peak, but this comes after strong growth prior to and during the pandemic.

Prices are still up 38.4% since March 2020, and Adelaide, Perth and Brisbane are the only capitals that grew at a faster rate since then.

Darwin Median: $495,000

Prices in Darwin remained flat, falling by only 0.01% in September.

The slight decrease in the median price meant Darwin was the only capital where values retreated in September.

Prices in Darwin are down 1.64% over the past year and 2.43% since the peak in May 2022.

“Darwin has not seen a recovery in prices in 2023, but it also did not see as large a downturn in 2022,” Creagh says.