The EV plays set to shine at the New World Metals conference – while the EU watches

Pic: Getty Images

Up-and-coming commodity plays in an up-and-coming space – it’s an investor’s dream, and one brought together at Ritz Carlton Perth this Wednesday for Vertical Events’ New World Metals conference.

You only need to look at the significant recent newsflow around technology, battery storage and emission-free power transmission to recognise the importance of tech-linked materials.

Just last week, the announcement by the Western Australian government of an Electric Vehicle Strategy and a $21 million investment in charging infrastructure represented a big green light for the ASX’s emerging battery metal plays.

Lithium’s seeming emergence from a two-year bear market has created buzz around the commodity in more ways than one, and the conversation around rare earths – cobalt and tungsten in particular – was boosted by the release of the Federal Government’s Australian Critical Minerals Prospectus 2020 in late October.

That report didn’t really delve in the base metals key technological development, like copper and nickel. But make no mistake, both are positioned to benefit.

These developments are a local reflection on global trends. In November, a report by green policy think tank Transport & Environment suggested European electric vehicle sales would triple over the next year on the back of more stringent EU emission standards.

Perhaps a reflection of this, New World Metals is supported by the West Australian European Business Association and the European Union Delegation to Australia.

Speaking with Stockhead in the lead-up to the conference this week, EU Ambassador to Australia Dr Michael Pulch said the EU Commission foresaw a need to diversify its supply of raw critical minerals and energy sources.

“Many of the EU industries rely on these resources, such as the automotive industry, the ICT sector, aerospace, communications, medical technology – just to name a few,” he said.

“Our support for the New World Metals Conference stems from our trade engagement with Western Australia and our desire to keep important stakeholders appraised of the critical raw materials situation in the EU, with trade and investment opportunities in mind.”

Dr Pulch, who will speak at the conference, said WA was ideally placed to contribute to the global materials mix the EU was working towards.

“The EU’s objective is to support the development of a balanced, diverse, well developed global resources sector that will supply these critical industries into the future in an as environmentally sustainable manner as possible,” he said.

“Ultimately, the entrepreneurial and professional endeavours of explorers and producers, as well as the investors themselves that invest in these industries, both in WA and in EU, are the main actors to achieve this result.

“We believe there is tremendous scope for cooperation in WA in this sector and other energy sectors additionally.”

The delegation of the EU in Australia will take part in a trade visit to WA in March next year.

With all this going on, the timing is perfect for the New World Metals conference – an event which will shine a light on companies working in spaces such as lithium, graphite, vanadium, cobalt, manganese, magnesium, zinc, nickel, helium, hydrogen rare earths, and more.

Plays to watch

There are a number of companies whose presentations will make for interesting listening at New World Metals this year. Below are some highlights from the event’s stacked program.

A market darling in the second half of 2020 following a massive hit at its flagship Carr Boyd nickel-copper project in October, the Estrella story is one many will be paying close attention to.

ESR’s share price rocketed massive nickel-copper-PGE sulphides 300m south of its original T5 discovery zone at Carr Boyd that month, and the company has since set about expanding the exploration in the area to good effect.

Further significant intersections were reported in November, when the company said it was gearing up for expanded drilling efforts on site.

Managing director and CEO Chris Daws will speak on the morning of New World Metals.

While focused on the Cummins Range rare earths project in WA, which has a significant JORC 2012 inferred resource of 13 million tonnes at 1.13% total rare earth oxides, REE is simultaneously exploring its exciting Weld North anomaly 84km north of Lynas Corporation’s (ASX:LYC) world-class Mt Weld rare earth mine.

Here, REE has detected a large, circular magnetic anomaly it believes may represent a carbonatite intrusive complex similar to those of Mt Weld and Cummins Range.

At Cummins Range, REE is carrying out extensional and infill drilling with the goal of upgrading the current inferred resource, and defining a high-grade component.

With so much going on, RareX’s presentation will be one to tune into.

One at the forefront of the resurgent graphite space and already a leading producer of mineral sands, Mineral Commodities has in recent times looked to branch into anode production – a space surprisingly lacking in the European EV arena.

This year, MRC outlined its plans to transition into downstream anode production using the graphite concentrate materials from its Skaland operations in Norway.

The company plans to expand its operation, with a view to processing graphite concentrate from its Muglinup operations in Australia.

It’s a proposition worth watching.

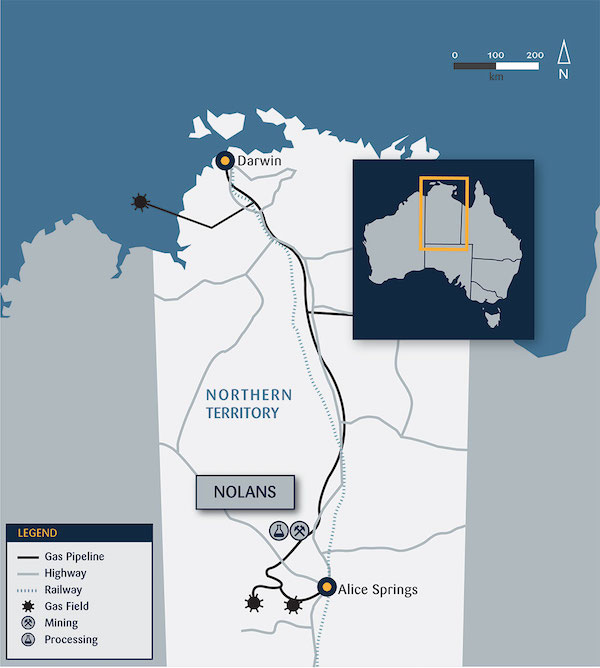

Arafura is the 100% owner of the Nolans neodymium-praseodymium (NdPr) project near Alice Springs – regarded as one of the most advanced rare earths projects owned by an ASX-listed entity.

It recently completed a feasibility study on Nolans, along with Northern Territory and federal environmental approvals; reached an agreement over Native Title with traditional owners; and has been granted mining tenure by the NT government.

The company was among those plugged by the Federal Government in the Critical Minerals Prospectus, and Nolans has national Major Project Status.

With a portfolio of projects spanning lithium, vanadium, titanium and nickel at different stages of the commodity lifecycle, Neometals is among the more diverse companies on the New World Metals roster.

The company’s core projects span the globe and include a lithium battery recycling project, a vanadium recovery project, a lithium refinery project processing material from the Mt Marion mine in WA, and the Barrambie titanium/vanadium project in WA.

All are funded through to final investment decisions, and all are in line with the company’s core philosophy of developing opportunities in minerals and advanced materials essential for a sustainable future.

Neometals is also exploring for nickel sulphides at the Mt Edwards project in WA.

These are just some among the many prospective and current producers well placed to tap the new world of metals. Event details and the full conference program can be found here.

At Stockhead, we tell it like it is. While RareX, Mineral Commodities and Arafura Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.