The Ethical Investor: Which ASX stocks made ESG moves this week?

ESG investing is growing massively globally. Picture Getty Images

Environmental, Social and Governance (ESG) investing has been around as far back as the early 2000s, but it’s had an explosion only in the past couple of years.

ESG investments are now estimated to be worth $35.3 trillion, equivalent to around a third of assets under management globally.

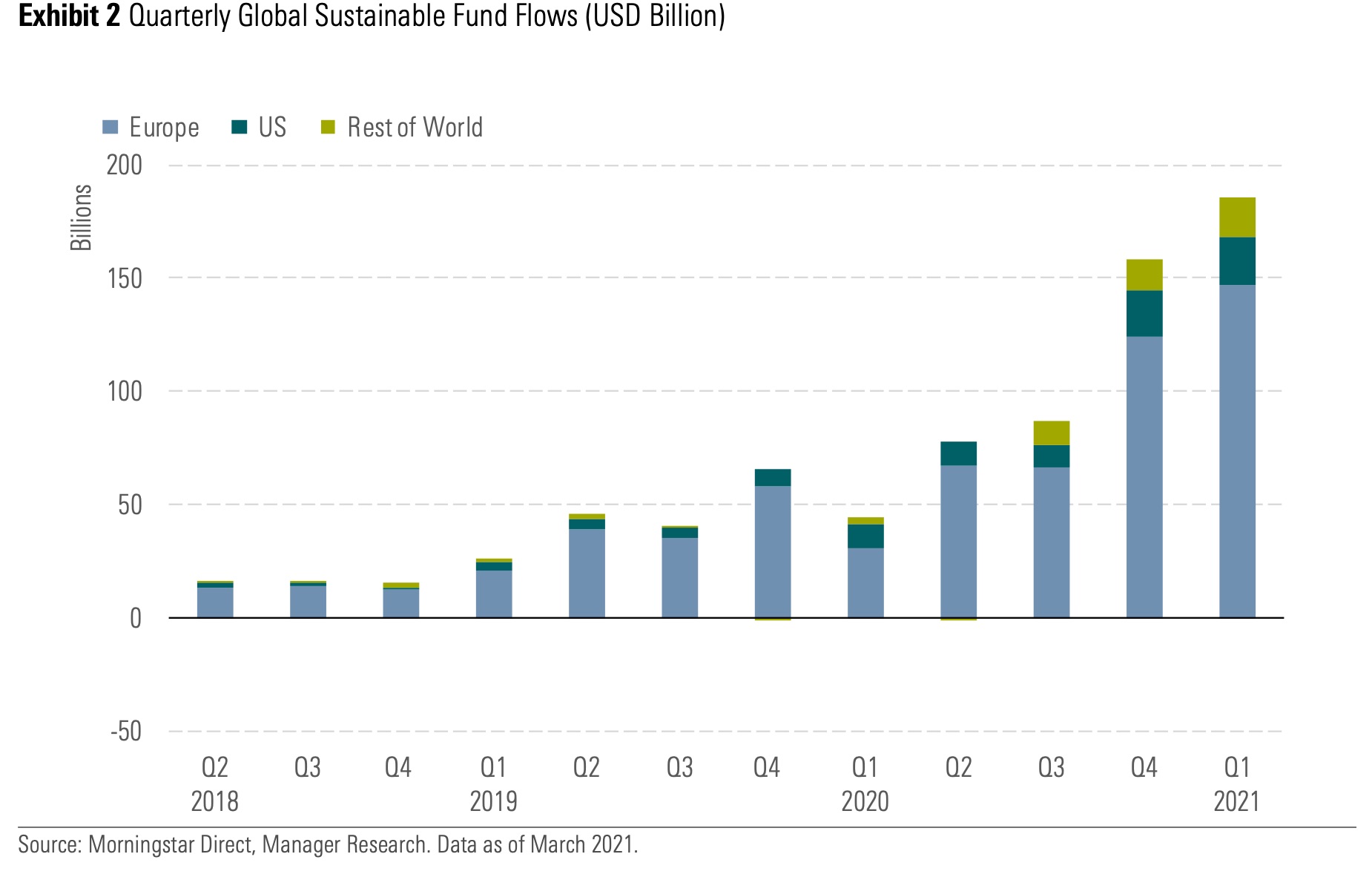

The explosion happened right when the pandemic first started (Q1 of 2020), with Europe currently the epicentre of ESG action.

Snowball effect

There’s so much happening in the ESG space globally at any given point in time. Before we start, here’s a good guide to what ESG investing actually is.

In July, 457 fundies managing more than US$41 trillion in assets wrote a co-ordinated message to G7 leaders, urging them to raise climate ambition and implement robust policies.

The co-ordinated letter set out five actions governments need to urgently undertake, or face being shunned by investors.

The message, in part read: “Strengthen nationally determined contributions for 2030 in line with limiting warming to 1.5°C”. It was the strongest call yet from ESG money managers to tackle climate change.

And the World Gold Council has just launched a paper detailing its contribution to the UN’s Sustainable Development Goals (SDG).

The report says gold miners are contributing to world health, as gold metals are being used as components in diagnostic devices for COVID-19 and other diseases such as malaria.

Meannwhile, the world’s first and only vegan ETF, the NYSE Arca-listed Vegan Climate ETF (ticker: VEGN) has outperformed the S&P 500 Index since its inception two years ago.

Since September 2019, VEGN has returned 67.91% vs 57.07% for the S&P 500 Index.

What’s happening in Australia

Back home, things are also getting serious, as corporate regulator ASIC announced that it was reviewing the threat of “greenwashing”.

Greenwashing refers to the potential for funds to overrepresent the extent to which their practices are environmentally friendly, sustainable or ethical. ASIC says it wants to make sure their investment strategy is as ESG-focused as what they claim to be.

ESG-themed investments have indeed been very profitable for Aussie investors.

Over the last five years, shares in ESG fund Australian Ethical Investment (ASX: AEF) have gained 1,100%, or 12 times.

Prices in renewable energy stocks like lithium mining and batteries have also skyrocketed in this time period.

Lithium battery producer Novonix (ASX: NVX) for example, increased by 1,000% in five years, and 200% in the past year alone. As a result, the company has recently been included in the ASX 300 index.

Notable ESG-related ASX announcements during the week

Australia’s largest regional vet network Apiam Animal Health says that it’s determined to do its part in putting an end to the mental health and suicide crisis gripping the sector.

Studies show that vets are four times more likely to die of suicide than the general population, and two times more likely than any other healthcare profession.

“We’ve tried to make access to counselling services as convenient as possible through not just the traditional face-to-face sessions but also by phone or online,” says Apiam general manager, people, Renee Waters.

Apiam also has an additional paid-leave reward day to support mental wellbeing and has joined forces with Smiling Mind, a not-for-profit web and app-based program developed by psychologists and educators to help promote mindfulness.

The rare earths explorer said this week it has established an ESG framework which it adopted from the World Economic Forum (WEF) guidelines.

REE says this new framework will help to ensure that it can develop its flagship Cummins Range project in WA in a responsible and balanced manner – with due regard for safety, corporate governance, and the environment.

It will also make sure that it maintains indigenous relationships, community and stakeholder engagement and other critical elements of the ESG matrix.

The company has signed a Memorandum of Understanding (MOU) with the Arctic University of Norway to form a collaboration concerning the fields of ore geology, which includes training and indigenous studies of the Sami culture.

The Samis are indigenous people that traditionally occupied the Sapmi region in the northernmost parts of Scandinavia and Russia.

The diversified technology design company announced a major new contract win during the week, after being selected as a key designer of choice for the $11bn Metro Tunnel Project (MTP).

The MTP adds to Synertec’s diversified suite of ESG-focused technologies and tier-one engineering and consulting projects, including an MoU with oil & gas major Santos to build a renewable power energy system for its Myalla coal-seam-gas development in Roma, Queensland.

Taken in aggregate, Synertec’s work pipeline places it at the leading edge of the ESG transition, where its in-house intellectual property and knowledge base gives it a competitive advantage in the market.

The renewable energy company signed a deal with Enosi, an Australian firm that has developed Powertrace – a 24/7 renewable energy trading and tracing software solution.

Tracing carbon free energy is rapidly becoming the next global sustainability benchmark to achieving ambitions for round-the-clock 100% renewable energy.

ReNu Energy CEO Greg Watson said: “The proposed investment in Enosi is a part of advancing the company’s renewable and clean energy incubator and accelerator strategy.”

The company will issue its inaugural EUR550 million (approximately A$880 million) Sustainability Linked Bonds.

The notes are linked directly to the group’s sustainability goals of achieving emissions target of a 63% reduction from 2015 levels by 2030.

The notes were priced at a margin of 0.60% over the Euro base rate, and has been rated as “stable outlook” by both Moody’s (Baa2) and S&P (BBB).

After divesting its fossil fuel business to focus on green metals, the mining giant is expected to release its annual economic contribution report next week.

Share prices today:

At Stockhead we tell it like it is. While Apiam Animal Health and Synertec are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.