The Ethical Investor: ‘Stranded assets’ and what it means for ESG investing, with JP Equity’s Nic Brownbill

Picture: Getty Image

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX. This week’s special guest is Nic Brownbill, a Director of investment advisory firm, JP Equity Partners.

The energy sector was rocked this week following the attempted takeover of AGL Energy (ASX:AGL) by billionaire Atlassian co-founder Mike Cannon-Brookes, led by Canadian asset manager Brookfield.

The $8 billion, $7.50 a share offer was summarily rejected by the AGL board but had it been successful, Cannon-Brookes said he would have shut down AGL’s coal plants within the decade to bring forward AGL’s total exit from coal-fired power.

The economics works out too he said, calling decarbonisation “the greatest economic opportunity facing Australia”, while adding that an end to coal-fired power could lower electricity bills for consumers.

The AGL offer came shortly after fellow ASX-listed Origin Energy (ASX:ORG) announced it would shut down the Eraring coal plant in Lake Macquarie by 2025, seven years earlier than planned.

Stranded assets

These new developments have brought renewed focus on the lingering issue of “stranded assets”, or assets that are unexpectedly or prematurely written down.

It’s a concept that’s important when considering ESG investing.

As we’re seeing now, ESG pressures can cause assets that are no longer socially or environmentally viable to decline in value for their owners.

According to eInvest’s Jodi Pettersen who spoke to Stockhead for this article, the shutting down of assets like the Eraring power station earlier than expected could impact valuations in two ways.

Firstly, the value of future cashflows of coal power generated from Eraring will obviously be reduced.

But also secondly, neighbouring renewable power stations, especially those with batteries, can now expect increased demand.

“I know which side of that investment I would be on,” Pettersen told Stockhead.

“This is why many energy retailers are considering splitting their coal power assets from their other assets. And if the energy businesses are thinking this way, are you?” she said.

ESG investors don’t actually want ‘green’ companies

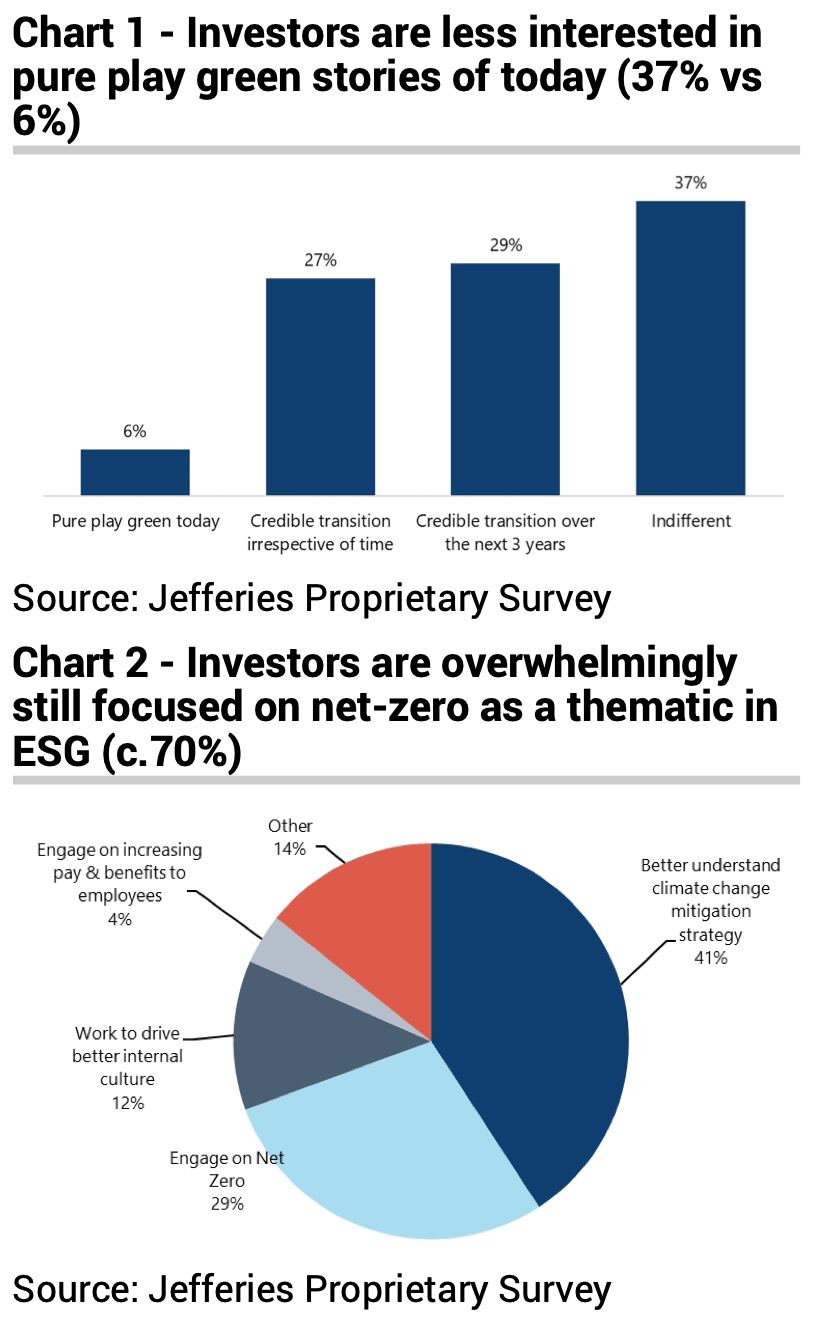

A recent survey however revealed that ESG investors were more focused on the transitioning to clean energy, instead of on pure play green companies.

The result of the survey, conducted by Jefferies LLC, revealed that while 56% of investors were interested in stories about firms with large carbon footprints shifting over to renewable energy, only 6% said they were interested in pure play green stories.

“With the expansion in the multiples of many equities considered dark green in previous years, investors are increasingly interested in transition stories, instead of pure play green stories of today,” said Aniket Shah, global head of ESG research at Jefferies LLC.

This suggests that more capital may be going into “greening” companies — such as fossil fuel, mining, steel, and other carbon-intensive sectors — as opposed to pure play “green” companies.

Having said that, climate remains the number one focus of ESG investors globally, according to survey respondents.

To put all this into perspective, Stockhead has reached out to expert Nic Brownbill, a Director at JP Equity Partners.

Interview with Nic Brownbill

Why are energy retailers keen to split off their coal power assets?

“Energy retailers are essentially being forced by the winds of change, to adapt their company structures thanks to a new age of responsible investing and ESG investment,” Brownbill says.

“Companies like AGL and Origin that have green or ESG assets alongside the existing hydrocarbon electricity generation assets, have previously not only sent a mixed messages to shareholders and investors in what they are at their core, but also have blocked access to capital on both sides of the coin.

“By splitting assets, this opens avenues towards ESG investment as well as continued targeted investment by those looking for hydrocarbon electricity providers. This also achieves a focussed message for customer retailing and shareholder investment.”

Should ESG investors start looking at these companies in a favourable light?

“I believe so yes, companies like AGL have for years seen the writing on the wall when it comes to coal powered electricity generation, and they have made significant progress towards the company’s clean energy future,” Brownbill says.

“Just because they retain these core assets in the meantime while the inevitable switch continues, should not exclude them from ESG investment.

“AGL for example are Australia’s leading private investor in renewable energy, and are now focussed on leading the business of transition to a low emissions, affordable and smart energy future in line with the goals of the company’s Climate Statement.”

Mike Cannon-Brookes said retiring coal plants early would reduce electricity prices. Do you agree?

“Unfortunately, renewables and coal generated electricity are not a 1-for-1 replacement,” Brownbill says.

“The intermittency of renewable electricity generation due to irregular weather patterns and the sun obviously not shining at night means that for every GW of power from coal we would need 2.5 – 3 GW of renewables to replace it.

“Although renewables are already naturally replacing coal generated electricity by reducing coal’s profits, prematurely retiring coal plants could put unwanted instability on the power grid, and create unwelcome higher prices when renewables cannot provide the required base load.

“Other less harmful base load power like gas, hydro, and the optimal nuclear power, in combination with large battery storage options are better suited to cope with the intermittency of renewables, without suffering the same profit losses that coal is experiencing.”

What’s your focus at JP Equity right now with regards to ESG investments?

“We are of the view that climate change represents the ‘biggest investment opportunity since the evolution of the internet’,” Brownbill says.

“The investment required to decarbonise the planet is estimated to be more than $US30 trillion ($41 trillion), presenting people with a rare opportunity to invest in companies that will be involved in the race to net zero.

“JP Equity Partners continue to focus on ESG investments where ‘the future is now’ for investment.

“Carbon prices have boomed in the last year. The carbon market connects a company that has too many emissions with another that has a carbon surplus. The large emitter can then buy carbon credits to offset its emissions from the low carbon emitting company.

“In Australia and internationally, we have carbon markets where companies can buy Carbon Credit Units to offset their emissions and reduce their carbon footprint. If you want to demonstrate your credentials in this space and you’ve got a net zero commitment, you need to buy offsets/carbon credits in some cases to be able to meet that.

“A first-mover on the ASX in the carbon space is carbon credit development and sustainable land management company Fertoz Ltd (ASX:FTZ).

“Fertoz is perfectly positioned to take advantage of this inevitable market shift towards companies offsetting their emissions, with the company now focusing on developing and managing carbon projects and facilitating carbon trading for agricultural producers, retailers and manufacturers.

“We are also of the view, the upcoming $2 billion IPO on the ASX of the world’s largest carbon offset exchange, Xpansiv, will be the start of an avalanche of investment and interest into the sector in Australia.”

Fertoz share price today:

ESG news on the ASX this week

As reported by Stockhead’s green expert Jessica Cummins:

Battery and advanced materials company Talga has produced Europe’s first battery anode (Talnode®-C) as part of kiln commissioning, signalling promise for greener batteries to be produced for the major shift to electrification.

Talga’s electric vehicle anode (EVA) facility, where the lithium-ion battery anode was produced, is understood to be Europe’s first Li-ion battery anode plant.

Earlier this week the Tasmanian Government and Rio Tinto signed a memorandum of understanding (MoU) to jointly investigate if the Bell Bay Aluminium smelter in the Tamar Valley has the capability to support the development of renewable energy supply.

The MOU was signed at Bell Bay by Tasmanian Premier Peter Gutwein and Rio Tinto chief executive Jakob Stausholm and seeks to support the Tasmanian Government’s target of doubling renewable electricity generation by 2040.

Montem is planning for the transition of its Tent Mountain Mine to a renewable energy complex in Alberta, Canada following separate independent expert studies in 2019 and 2021.

These studies demonstrated the project’s strong viability to host a renewable energy complex comprising 320 MW of pumped hydro energy storage, 100 MW green hydrogen electrolyser, and a 100 MW wind farm (offsite).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.