The Ethical Investor: ESG funds are quietly buying oil and gas stocks to chase return

Ethical Investor : ESG funds are quietly buying up oil stocks. Picture Getty

- ESG funds are warming up to fossil fuel stocks

- Major global oil companies are now dominating ESG Meter list, BofA’s list of environmentally responsible companies

- Evergreen Consultants publishes Responsible Investment Grading (ERIG) Index

Next time you receive your ESG-themed fund statement, take a closer look at the stocks in your portfolio.

Word is that after years of demonising the fossil fuel sector, some “environmentally responsible” themed fund managers are now warming up to it.

Recent analysis shows that ESG fundies are moving their funds to the oil and gas sector, an unimaginable thing to do just a couple of years ago.

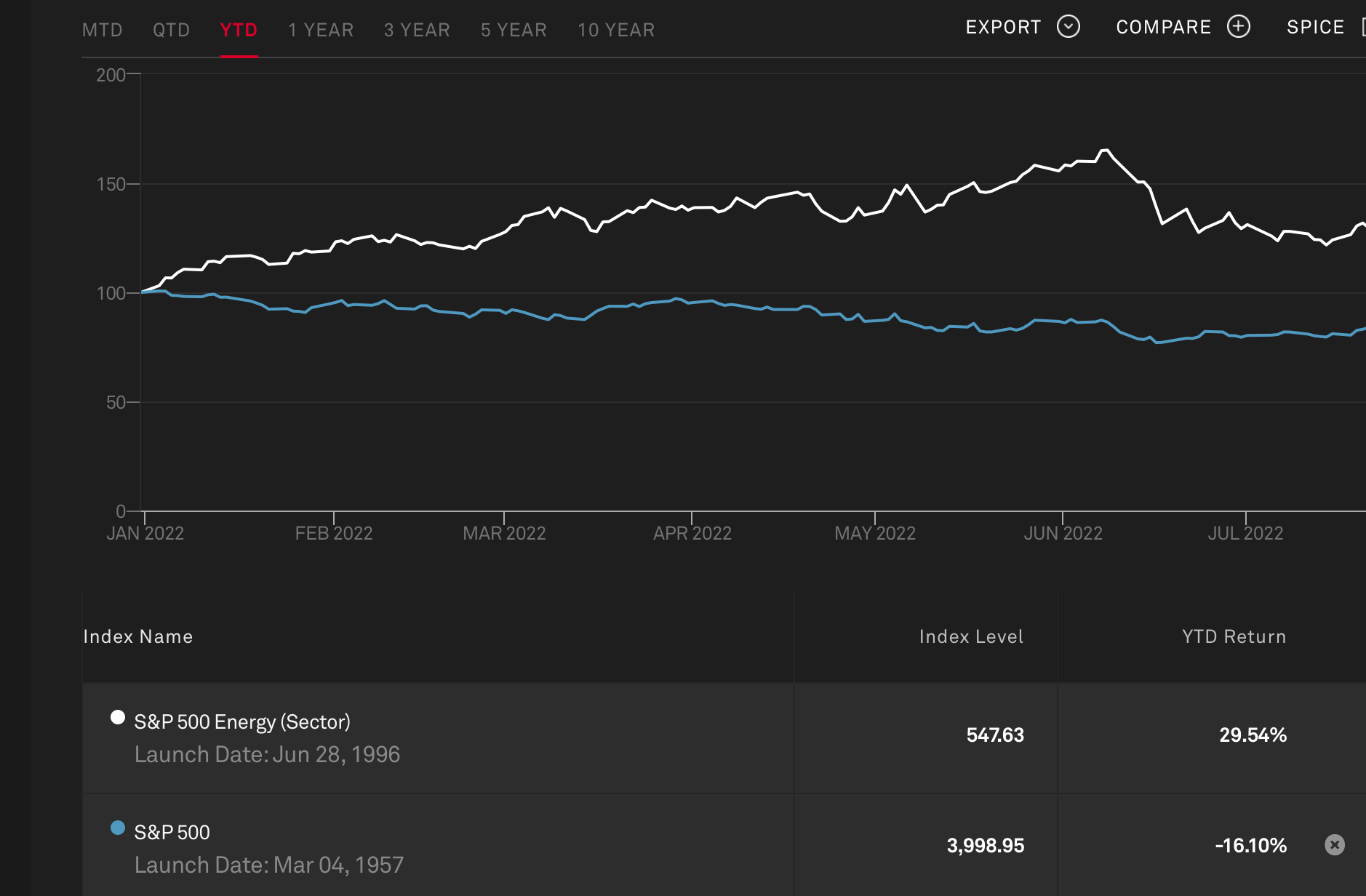

It’s an opportunistic yet astute move because due to the recent turmoil, the energy sector is the only sector to have made gains in the S&P 500 index this year.

It’s a rapid about-face which is spreading throughout the industry.

A recent research note out of Bank America (BofA) for instance, has put giant oil companies at the top of its ESG Meter – a list of stocks the Bank deems as top environmental performers.

The BofA ESG Meter’s top 10 is now pretty much dominated by giant oil companies (see below in alphabetical order):

Chevron

ConocoPhillips

Devon Energy

ExxonMobil

Halliburton (oil field services)

Hess

Marathon Petroleum

Source:Oilprice.com, FT.com

Well justified

The move into fossil fuel stocks is more pronounced in Europe, where some 6% of European ESG funds now own Shell.

According to Bank of America, there were no European ESG funds invested in Shell in 2021.

“We believe some ESG funds are revisiting the cost of exclusion of energy companies given their underperformance in the first half of 2022,” says Menka Bajaj, an ESG strategist at BofA.

Some experts believe however that buying into oil stocks is well justified for ESG funds, as investment decisions don’t necessarily have the same impacts as consumption decisions.

“While switching to an electric vehicle or a plant-based diet has measurable environmental impacts, selling oil shares does not. That’s because selling stocks does not change the demand for oil and gas,” said ESG expert, Dustyn Lanz of Investment Executive.

Lanz also said that from an environmental perspective, it might actually be useful for an ESG fundie to be part of the decision making of an oil company.

“There is a higher probability of generating positive environmental impacts by taking a stake in a leading energy company and engaging with its management to reduce emissions and improve its environmental practices more broadly,” he said.

Not on target

Other experts agree, saying the oil majors will in fact be critical in successfully reducing carbon emissions and accelerating a sustainable transition by providing a viable substitute product.

“Oil exposure in a portfolio is an attractive investment in the current environment,” said Citywire analyst, Martin Walker.

“Firstly, because responsible oil and gas companies have a critical role to play in being part of the solution to environmental problems,” he said.

But it’s still difficult to digest how that role could be effective in today’s world, given that those industry majors alone contributed to 40% of new oil and gas discoveries last year.

Far from divesting, these majors have instead expanded to ever new regions and far flung places like Namibia and Ivory Coast, for example.

“As more oil and gas discoveries come to light, the impacts of companies’ net zero pledges on production levels are rather unlikely in the medium time horizon,” said a note from ESG consultant, Engagement International.

“Considering the forward-looking projections, it appears that major oil and gas companies’ targets deviate from a net zero trajectory in the 2030-time horizon,” it said.

Impact on Australian ESG funds

So how does all this affect the return on Australian ESG funds?

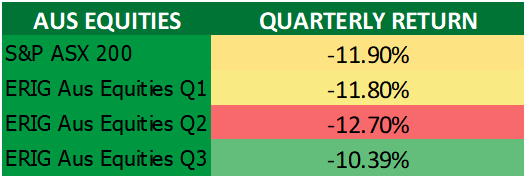

According to new data from Sydney-based Evergreen Consultants, most Aussie ESG funds have underperformed their benchmarks this year.

The top quartile Australian equity managers in the Evergreen Responsible Investment Grading (ERIG) Index just scraped in ahead of the ASX 200 index, returning negative 11.8% in the June quarter vs 11.9% for the ASX 200.

Evergreen Consultants Director Michael Ohlsson says these results have been driven by a rotation out of tech stocks and into energy stocks.

“Fund managers with a responsible investment or ESG tilt tend to favour tech stocks, and avoid materials and energy stocks,” Ohlsson said.

However he said that if you leave aside the big swing back to energy this year, funds with high responsible investment scores have performed in line with the ASX 200 index over the past three years.

“Despite short-term performance issues, we are starting to see evidence that over the long term, responsible investing does not cost you performance,” he said.

Ohlsson believes that an important issue underlying recent performance is that ESG investing in Australia is still relatively new, and there is a lack of depth in the stocks available to fund managers.

“We do expect some volatility in terms of performance, compared with the index. In the short term there will be some growing pains for the sector,” he said.

Other ESG news on the ASX this week

As reported by Stockhead’s green expert, Jessica Cummins:

Battery materials company, EMN has joined the Global Battery Alliance – a partnership of leading organisations from across the battery value chain.

Euro Manganese is the first high-purity manganese company to join the GBA with intensions to participate in discussions around battery materials transparency and traceability, particularly as the GBA moves towards the development of the Battery Passport.

Contact, which operates entirely in New Zealand but maintains a listing on the ASX, has demonstrated just how much firepower a renewable energy generator can bring to bear.

Of course the company benefits from New Zealand being blessed with ample geothermal and hydro power to begin with, but it is hard to argue with the numbers.

Contracted wholesale electricity sales, including that sold to the customer business totalled 751GWh while electricity and steam net revenue reached $126/MWh – meaning CEN reeled in a whopping $94.6m in revenue for the month of June.

Electricity generated (or acquired) by the company recorded 763GWh compared to 2021 figures of 880GWh.

EVOLUTION ENERGY MINERALS (ASX:EV1)

Sustainable graphite player, EV1, has received electrochemical test work results, indicating that Chilalo spherical graphite can be produced into the super-premium class of active anode materials for lithium-ion batteries.

This class of active anode materials sells for around US$18,000 to US$22,000 per tonne.

EV1 says the results ‘exceed specifications’ of the major EV manufacturers and means that lithium-ion batteries using Chilalo coated spherical graphite will have exceptional cycle life, and very high recharge efficiency compared to competing products.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.