The Ethical Investor: Biodiversity loss and what it means for ESG investing with Martin Currie’s David Sheasby

Stockhead’s Ethical Investor. Picture: Getty Image.Reef.

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX. This week’s special guest is David Sheasby, Head of Stewardship and ESG at Martin Currie Investment Management, part of the Franklin Templeton Group.

Biodiversity loss is an emerging ESG issue, and Australian investors are increasingly seeking to understand how it ties to the companies they invest in.

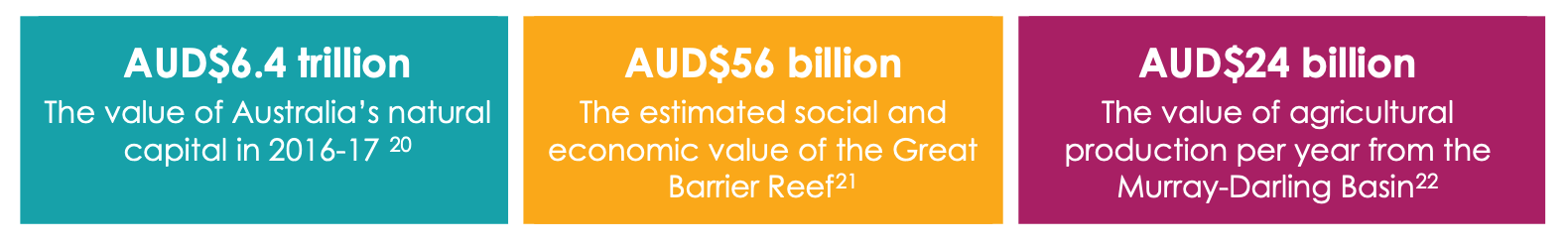

A recent report conducted by Ersnt & Young (EY) and sponsored by the Australian Council of Superannuation Investors (ACSI) concluded that biodiversity has a significant economic, social and cultural value – which is being rapidly eroded.

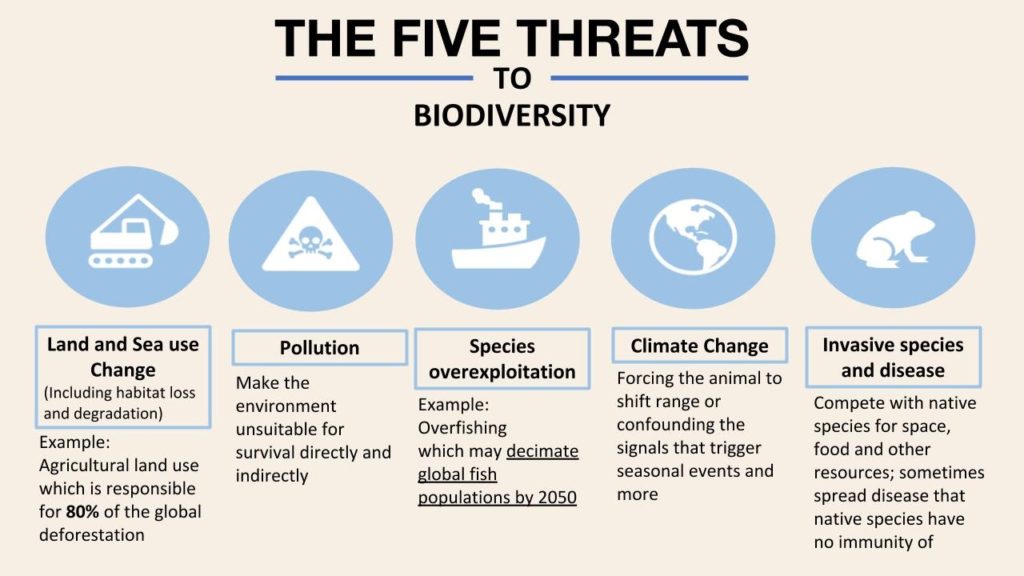

Biodiversity loss is primarily human-induced, and in Australia the major drivers include deforestation and land-clearing, climate change-induced drought, ocean warming, as well as invasive species.

To that extent, our unique biodiversity is unfortunately in a fragile state, having been depleted more than that of any other developed nation in the past 200 years.

This is especially concerning as between 7% and 10% of all species globally are found in Australia, with many of them only found Down Under.

Our most precious treasure, the Great Barrier Reef, has lost over half its corals since 1995 but while the government insists the “reef is not fine”, it says it’s “not dead” either.

Globally, more than half the world’s total GDP is dependent on nature, yet investors have a poor understanding of biodiversity as a core component of economic capital.

The significant value provided by biodiversity has remained widely unrecognised and undervalued, and in many cases, is even excluded from market prices altogether.

This could be due to many factors – one of which is a lack of education and two, a lack of a universal metric to measure biodiversity loss (such as CO2-e in the case of climate change).

So what can be done to educate investors?

The World Economic Forum has listed biodiversity loss and ecosystem collapse as one of the top five risks for the next 10 years, presenting both risks and opportunities to investors.

Australian investors are particularly exposed to both domestic and global biodiversity risks through the value chains of their portfolios.

A report by the World Wildlife Fund found the Australian economy could lose US$20 billion every year by 2050 because of nature loss, and identified Australia as the fifth worst-affected country based on potential GDP loss.

The EY report has recommended critical actions that Aussie companies can take now to begin to understand and manage their biodiversity risks and opportunities.

One of these includes developing a clear plan for managing biodiversity by building the capability and competence of the organisation, including aligning the company to the TNFD (Taskforce on Nature-related Financial Disclosures) framework.

EY also recommends identifying and assessing material financial risks and opportunities associated with biodiversity. This could be done by undertaking a portfolio-level assessment to identify risk and opportunity across asset classes and consider appropriate investment actions.

Finally, monitoring the company’s performance, and tracking and disclosing its own performance against targets relating to biodiversity is crucial in understanding the risks to biodiversity.

To understand this further and discuss ESG investing in general, Stockhead reached out to David Sheasby, Head of Stewardship and ESG at Martin Currie Investment Management, part of the Franklin Templeton Group, a global company with more than $2.1 trillion in assets under management.

Interview with David Sheasby

What has been done in moving to a more comprehensive network to tackle biodiversity loss?

“While the main focus over the course of the last few years has been on climate change, there is a growing realisation of the interconnection between climate change and biodiversity loss.

“The second stage of the COP15 on biodiversity (the equivalent of the COP focused on climate) is due to take place in April and May 2022. Out of this we should see the final version of the Convention on Biological Diversity and the Post-2020 Biodiversity Framework, which will set out key priorities for the next decade.

“The current lack of consensus around how to consistently evaluate and manage exposure to the financial risks and opportunities resulting from biodiversity is hindering its application within the investment world.

“The first version of the TNFD reporting framework is set to be published early next year, building on the widely accepted Task Force on Climate-Related Financial Disclosures (TCFD). This will hopefully create a consistent and comprehensive framework for organisations to report on nature-related risks within mainstream corporate reporting.”

The year 2021 was no doubt the breakout year for ESG investing. But given the volatility in the market, would ESG funds drop significantly this year?

“Putting COVID-19 aside, a key feature of the last year has been the continued substantial flows into ESG and sustainable funds, with European regulation in the form of SFDR being particularly supportive.

“We believe this momentum will continue in 2022 with the support of the upcoming UK Sustainability Disclosure Regime (SDR), and change of tone in ESG regulation in the US.”

How do investors assess the extent to which a company is aligned to net zero?

“We have seen many companies stating their ambition to be aligned with net zero in the run up to COP26. Assessing the validity of these claims however presents a challenge.

“Aspects that need to be considered include the boundaries of what is included, the different emission scopes, the use of offsets and the short-, medium- and long-term targets.

“There are some useful frameworks that can help with this analysis – for example the Science-Based Target initiative (SBTi) or the Transition Pathway Initiative (TPI), but even these are not perfect.

“The key is to engage with management and understand how and the extent to which these ambitions are truly embedded into strategy, capital allocation decisions and operational ambitions.”

What reporting standards are needed to move the ESG investing world forward?

“One of the current challenges facing an investor interested in ESG is the lack of consistency and standardisation in reporting of ESG related data.

“This is clearly on the radar of investors but also of regulators and standard setters and we are really encouraged to see the establishment of the International Sustainability Standards Board (ISSB) which is set to develop a corporate disclosure standard.

“We’re also encouraged by the coalescing that we are seeing around frameworks such as the TCFD, which aim to provide decision useful information to the providers of capital, central to which are investors.

“Both of these will be supportive in moving the works of ESG investing forward.”

ESG news on the ASX this week

As reported by Stockhead’s green expert Jessica Cummins:

The largest of 16 remaining coal power plants in Australia, Origin’s Eraring in NSW’s Hunter Valley will close seven years ahead of schedule, following “rapidly changing conditions” that are not well suited to “traditional base-load power stations”.

Origin said although plans had been made to close the Eraring Power Station in 2032, the company’s newly proposed exist from coal in August 2025 highlights the rapid transition of the NEM as Australia moves towards cleaner sources of energy.

The US Department of Energy has awarded $2.2m in funding to a Rio Tinto-led team to explore carbon storage potential at the Tamarack Nickel joint venture in Minnesota.

Tamarack is a nickel, copper and cobalt project located in central Minnesota that is currently progressing towards feasibility studies.

The project is managed by Rio Tinto’s joint venture partner Talon Metals, which holds a 51 per cent share and has a right to earn-in to acquire up to 60%.

Locality Planning Energy Holdings (ASX:LPE)

Queensland electric services company, LPE, has raised $7.5m by way of a placement to fund its participation in a BioHub project in Bundaberg.

The staged development will unleash the power of biogas, hydrogen, and solar to fuel industry and support networks with a targeted completion date set for 12 months, LPE said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.