Charted: Why fund managers have their eye on these ASX small caps

Pic: DKosig / iStock / Getty Images Plus via Getty Images

- M1 growth creating ‘huge amount of speculative activity’ in ASX small caps

- Investor cash flowing to gold and BNPL

- Microcaps have outperformed ASX small caps by 20 per cent

Like the Netflix series Stranger Things, ASX small caps are in the “upside down”. But unlike for the characters in the show, the “upside down” hasn’t been as terrifying.

(For those who have no idea what we’re on about, the “upside down” in Stranger Things is a much darker mirror image of the real world with a big scary resident “Demogorgon” that eats everyone.)

Spheria Asset Management portfolio manager Marcus Burns said earlier this week there have been some major distortions operating in the ASX small caps space that have turned the space upside down.

The two key distortions in the market right now are “stimulus distortion” (massive inflow of monetary stimulus by central banks) and “interest rate distortion” (low or negative interest rates).

Burns said at the recent Pinnacle Virtual Summit that M1 supply – the amount of cash in the economy – in Australia over the last 20 years has grown at a compound rate of 10-10.5 per cent, which was “pretty high”.

“The US is growing around 8-8.5 [per cent],” he explained. “So we’re materially higher than the US.

“But we’ve grown our money base by almost 40 per cent … 38.7 per cent to be exact. There’s been a massive increase in liquidity provided by the central bank in Australia.”

Australia’s M1 has grown by $350bn year on year.

Meanwhile, long-term interest rates are averaging between 0.5 and 0.8 per cent globally whereas typically they would be much higher.

“In a few cases in Europe, for example, they’re actually negative on a 10-year basis,” Burns said.

“This is creating a huge amount of speculative activity in the small cap space, particularly in the microcap area, and you’ve seen people, particularly retail investors, jump on board and really chase momentum and themes, which is creating a massive distortion.

“The gold sector has been a big beneficiary of that, as well as a bit of an inflation hedge.”

The buy now, pay later (BNPL) — or the “buy now, profit later” space as Burns calls it — is another sector that has benefited strongly from the market distortions.

ASX small caps with massive valuations

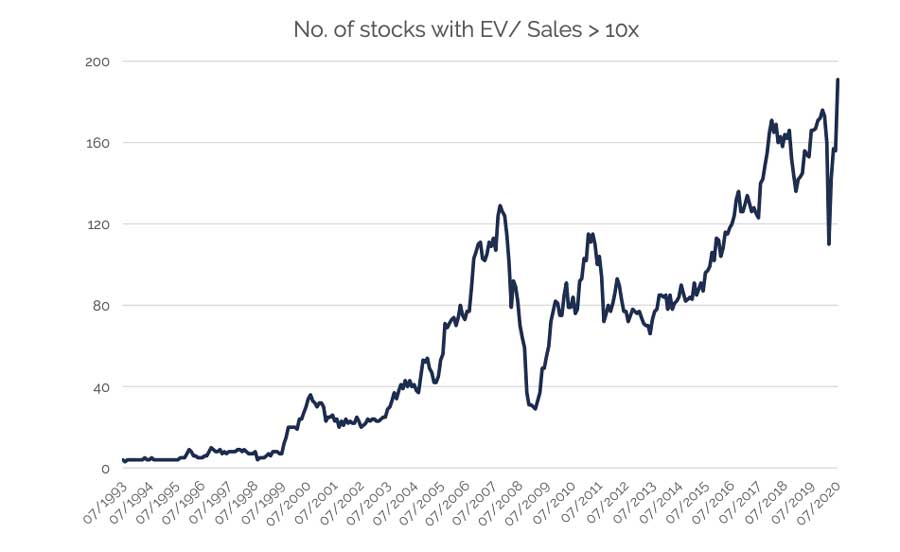

These distortions, according to Burns, have led to a massive increase in the number of small caps trading on an enterprise value (EV) to sales ratio multiple of over 10 times.

A company’s EV is worked out by adding together the market cap and debt and then subtracting cash on hand.

“The number of stocks currently trading in Australia with an EV to sales multiple over 10 is almost 200 shares,” Burns said.

“To put that in context, that’s about 10 per cent of the number of shares listed in the Australian stock market, so it’s a really massive multiple.”

“In normal investing parlance, an EV to sales ratio of say five or six is actually considered pretty fully priced and an EV to sales ratio of 10 or above is considered really rarefied, and it would be reserved for stocks with incredibly high growth rates, incredibly big margins, and really not something you’d see that commonly,” Burns said.

This has given rise to a phenomenon where “the less you earn, the more you are worth”. So the stocks that have negative operating cash flow have outperformed those with positive operating cash flow.

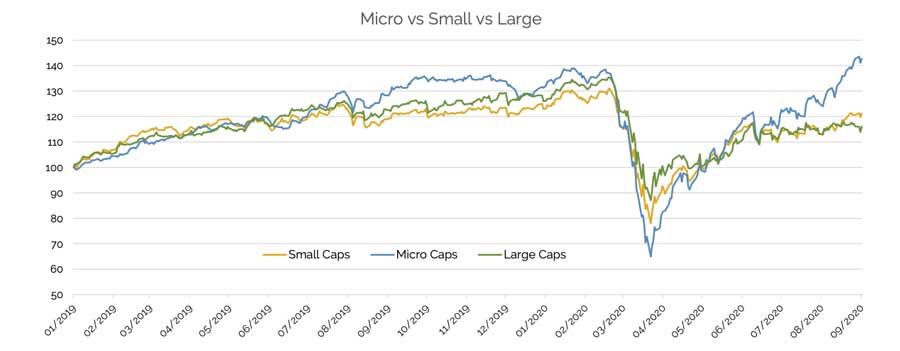

This in turn has seen microcaps and small caps outperform their much larger counterparts since the start of 2019.

“On the one hand, and the red line there (above), are stocks that actually lose money at the operating cash flow level, and on average over the last 12 months, they’ve returned a whopping 110 per cent, which is an astronomical number in anyone’s book,” Burns noted.

“Positive operating stocks are those on the blue line and their average return over the last 12 months has been 20 per cent, which is nothing to sneeze at. But you can see that, very bizarrely, the money-losing stocks have actually materially outperformed.”

In particular there has been a “dramatic outperformance” by the microcaps, according to Burns.

Microcaps have outperformed small caps by 20 per cent since early May this year.

Firetail Investments portfolio manager Matthew Fist says the opportunity in small caps is “immense and it’s now”.

“Small caps are beneficiaries of change and COVID has created material tailwinds for small companies, in many cases accelerating structural shifts that were already underway,” he told the Pinnacle Virtual Summit.

“The first one is really obvious, and we see it every day in our lives — that is the shift to cloud and cloud computing.

“COVID has pulled forward two years of digital transformation into the space of just three months. Companies who were resisting the move to digital, and there were many of them, were forced to either adapt or die.”

Furniture retailer Nick Scali (ASX:NCK) was one small cap that demonstrated strong resistance to the move to online sales.

“Twelve months ago, in our meetings with the Nick Scali management team, we discussed the proposition of moving to an online model,” Fist said.

“They said it was fraught with danger and weren’t interested. Just last month it’s well and truly on the cards and indeed a major strategic focus for them.”

This has led to an increased focus from fund managers on stocks in the retail space that are rapidly embracing ecommerce.

On Longwave Capital’s list of picks is plus-size women’s fashion retailer City Chic Collective (ASX:CCX), homewares retailer Adairs (ASX:ADH), Nick Scali and Baby Bunting (ASX:BBN).

“Now we understand that this example is fraught with all of the noise that’s going on in the market at the moment,” Longwave Capital founding partner David Wanis told the Summit.

“We have the lockdowns, JobKeeper, JobSeeker stimulus payments, we’re in a recession. But when we’re thinking about investing in a business, we’re thinking about three to five years.

“So when we’re looking at these retailers, we’re looking at what we think is likely to happen over the medium term, and what we can see … is that online sales from these retailers, the increased online sales, is not just a COVID sort of lockdown symptom.

“It’s actually been going on for some time. It’s been a stated goal of many of these companies to lift their online sales.”

The other ASX small caps fund managers have their eye on

One interesting stock in Spheria’s portfolio is A2B Australia (ASX:A2B), the stock formerly known as Cabcharge.

Despite the rise of ride-sharing apps like Uber, Ola and Didi, taxis are still making their fair share of dollars.

Spheria assesses a company’s cash flow conversion to determine how good a business model it has.

“Really, what we’re doing there is looking at the accounting earnings, the EBIT of a company and comparing it to the operating cash flow of the business to see really how they marry up over time,” Burns explained.

“And a really good business typically has good earnings, a good cash flow in our minds, or good reason not to have cash.

“Like it might be investing very heavily in capex for a short period of time, or if it’s growing very quickly it might be putting money into working capital. But there’s a good reason why cash flow doesn’t marry. If there’s not a good reason, then it’s a pretty poor business.”

Burns says A2B’s long-term cash flow conversion is 84 per cent, which is a good conversion rate.

“I think many people think that Cabcharge has been disrupted by ridesharing apps like Didi and Uber,” he said.

“There’s been disruption going on, but it hasn’t actually affected the amount of rides in the marketplace. So cabs have really seen rides flat and all the growth has been taken by the new riding apps.

“Fundamentally it’s a great business, great cash flows, and if you look at the balance sheet of the company it’s got net cash of about $24m and trades on EV of about three to four times.

“So it’s a very cheap business, good cash flow, hasn’t really been disrupted by new apps and has become more of a technology stock and we think that will really show in the long term.”

A2B Australia (ASX:A2B) share price chart

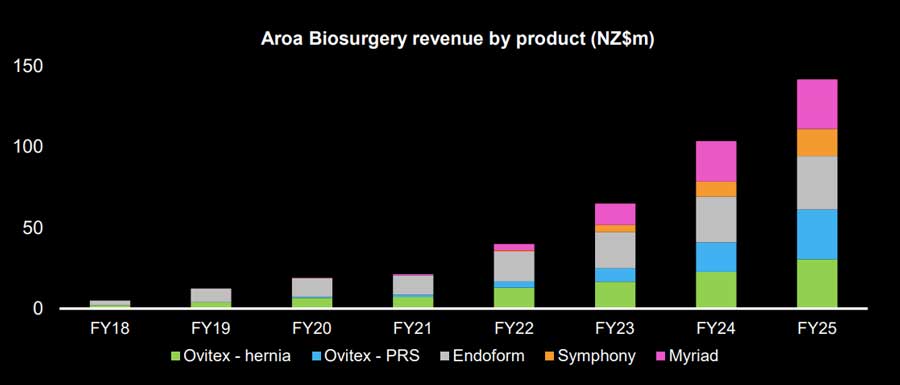

“For those who haven’t spent the last six months locked down in Melbourne learning about soft tissue regeneration, it is the patching up of skin or even an organ using some foreign material that the human body can work with in order to heal,” Fist explained.

“Think of it effectively like a big Band-Aid.

“Aroa was a pre-IPO investment for us. We purchased more stock on listing and we continue to be strong supporters as the largest institutional shareholders.”

Aroa’s product is manufactured from the fourth stomach of a sheep.

“The digestion system of any animal that has four stomachs is unique, and consequently products derived from them are too,” Fist said.

“In short, if you’re in the unfortunate situation and you need to be patched up, this is the stuff you want your surgeon to be using. Our conversations with surgeons and a review of the scientific evidence confirm the superior technology of the Aroa products.”

Aroa’s product, according to Fist, results in lower recurrence rates and lower complications compared to the alternatives.

“Despite all these benefits Aroa offers their products at comparatively lower prices to peers, and generates gross margins in excess of 75 per cent,” he said.

“Aroa may appear expensive to some investors based on current year earnings, however we do have a high conviction in the science and the medium-term potential of the company.”

Aroa Biosurgery (ASX:ARX) share price chart

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.