Lunch Wrap: Oil stocks drag down ASX, but KalGold triples after ripper gold find

Kalgoorlie triples after gold find. Picture via Getty Images

- ASX slips after yesterday’s rally, eyes on US jobs report

- Amazon drops amid weak forecast, but AI still trending

- Kalgoorlie triples after gold find

The ASX200 retreated by 0.1% on Friday morning, though the index is still close to its record high after yesterday’s 1% rally.

Investors seem to be in wait-and-see mode, looking to the upcoming US jobs report (due later today US time) to get a sense of whether the Federal Reserve might ease interest rates further.

Overnight, Wall Street had a mixed session. The Dow Jones slipped 0.3%, while the S&P 500 edged up by more than 0.4% and the Nasdaq gained 0.5%.

Amazon dropped 4% after it posted a disappointing Q1 forecast, adding to concerns over cloud tech sales as Microsoft and Google also missed expectations for their cloud business.

Nevertheless, artificial intelligence (AI) is still a very hot topic in earnings calls, with a record 50% of S&P 500 companies mentioning it during these calls.

“This [Amazon] isn’t an amazing result for investors, but it’s important not to be too short-sighted and instead look ahead,” said Josh Gilbert at eToro.

“As AI capacity grows, so will revenue and profit. That may not happen overnight, but some patience may be needed for investments to bear fruit.”

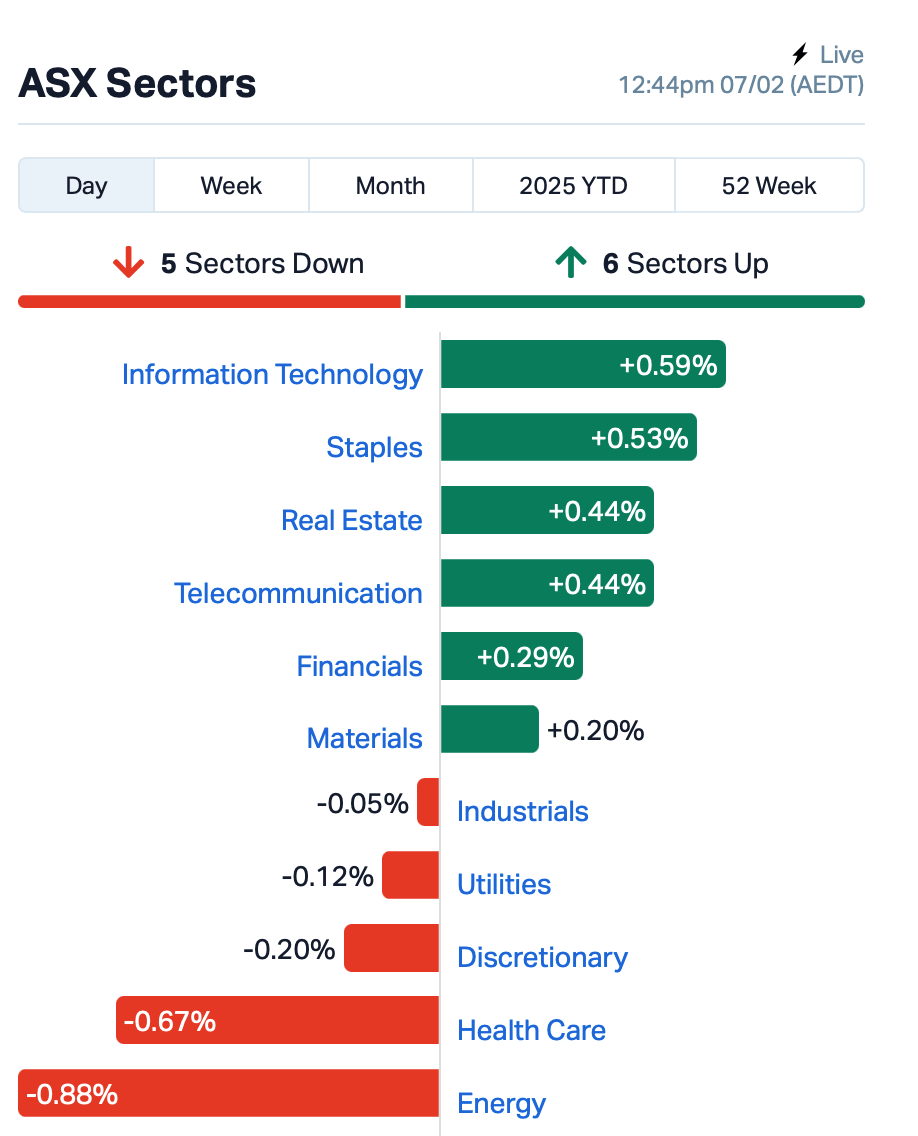

Back on the ASX, six out of the 11 sectors opened in the green, but like yesterday, energy once again took the biggest hit.

Energy-related stocks got hammered after a wild ride in oil prices overnight. Brent crude slipped almost 1%, landing at US$74 a barrel.

Oil had a volatile session after US President Trump pushed for more oil production in the US, while also pushing for tighter sanctions on Iran.

This is where things stood at about lunch time, AEDT:

In large caps news, Domino’s Pizza Enterprises (ASX:DMP) surged by 21% after announcing the closure of 205 loss-making stores, mostly in Japan.

The rise in Domino’s shares also boosted Collins Foods (ASX:CKF) (which operates KFC and Taco Bell in Australia) by 12.5%.

Nick Scali’s (ASX:NCK) shares also jumped 13% after reporting a net profit of $36 million for the half-year, smashing expectations.

And Sigma Healthcare (ASX:SIG) was up 5% after it upgraded its full-year guidance, partly thanks to the Chemist Warehouse supply contract. The merger between Sigma and Chemist Warehouse is expected to complete later this month.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 7 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| KAL | Kalgoorliegoldmining | 0.076 | 230% | 41,013,754 | $6,281,493 |

| PKD | Parkd Ltd | 0.074 | 72% | 2,822,003 | $4,472,597 |

| PRS | Prospech Limited | 0.032 | 60% | 4,998,414 | $6,576,518 |

| SVG | Savannah Goldfields | 0.026 | 37% | 352,507 | $5,340,613 |

| ABE | Ausbondexchange | 0.028 | 33% | 20,289 | $2,366,030 |

| E79 | E79Goldmineslimited | 0.024 | 26% | 2,017,711 | $1,941,090 |

| CDT | Castle Minerals | 0.003 | 25% | 5,965 | $3,793,628 |

| MPR | Mpower Group Limited | 0.010 | 25% | 20,761 | $2,749,626 |

| POS | Poseidon Nick Ltd | 0.005 | 25% | 32,156,073 | $16,815,567 |

| AON | Apollo Minerals Ltd | 0.023 | 24% | 14,557,660 | $14,530,687 |

| M2M | Mtmalcolmminesnl | 0.016 | 23% | 115,000 | $2,944,183 |

| DMP | Domino Pizza Enterpr | 35.670 | 20% | 1,173,101 | $2,739,754,920 |

| SRL | Sunrise | 0.270 | 20% | 16,541 | $20,301,187 |

| GES | Genesis Resources | 0.006 | 20% | 35,000 | $3,914,206 |

| MRD | Mount Ridley Mines | 0.003 | 20% | 2,000 | $1,946,223 |

| TEM | Tempest Minerals | 0.006 | 20% | 5,837,799 | $3,172,649 |

| TMK | TMK Energy Limited | 0.003 | 20% | 1,219,542 | $23,313,913 |

| WNR | Wingara Ag Ltd | 0.006 | 20% | 150,000 | $877,713 |

| IKE | Ikegps Group Ltd | 0.660 | 18% | 108,781 | $90,019,853 |

| RNX | Renegade Exploration | 0.007 | 17% | 1,235,566 | $7,704,021 |

Kalgoorlie Gold Mining’s (ASX:KAL) shares more than tripled after the company made a ripper gold discovery at Lighthorse, located at its Pinjin site in the Eastern Goldfields. KalGold hit some impressive high-grade gold, with one drill hole showing 17m at 4.81g/t of gold, including 8m at 9.21g/t. The mineralisation is open along strike and down dip, meaning it could extend further. This find is smack-bang in the middle of a solid 600m strike, and the company said it’s clear this gold system has got some size to it.

What makes this discovery even more exciting is the location. Lighthorse is just 1km from KalGold’s Kirgella Gift deposit and surrounded by some big players like Hawthorn Resources’ Anglo Saxon Gold Mine and Ramelius Resources’ Rebecca Gold Project. KalGold said it’s keen to push ahead with further drilling, and the area’s definitely turning into a hot spot for gold exploration.

Parkd (ASX:PKD) has locked in a five-year exclusive licensing deal with Fielders (part of BlueScope Steel) for its metal decking support bracket (MDSB) and system (MDSS) for the construction industry. This agreement allows Fielders to manufacture, market, and sell the MDSB in Australia, while also giving them first dibs on international markets like the US, NZ, and others. No immediate revenue is guaranteed, PKD said.

Prospech (ASX:PRS) has reported some top-notch assay results from its Korsnäs Rare Earths Project, and it’s looking like a winner. The new results are extending the resource estimate, showing off some seriously high-grade mineralisation. Assays have hit impressive numbers like 21.5m at 25,827 ppm TREO and 17.5m at 13,737 ppm TREO, plus significant heavy rare earth elements (HREEs), including up to 58 ppm Terbium and 206 ppm Dysprosium.

Meanwhile, Neuren Pharmaceuticals (ASX:NEU) revealed it was in talks with the US FDA to start the next stage of clinical trials for a drug to treat multiple neurodevelopmental disorders.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 7 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EEL | Enrg Elements Ltd | 0.001 | -50% | 1,050,000 | $6,507,557 |

| CVR | Cavalierresources | 0.072 | -28% | 861,218 | $5,784,222 |

| MMR | Mec Resources | 0.003 | -25% | 1,200,185 | $7,399,063 |

| BIT | Biotron Limited | 0.010 | -23% | 10,776,996 | $11,730,976 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 1,300,006 | $13,474,426 |

| TEG | Triangle Energy Ltd | 0.004 | -20% | 145,200 | $10,446,170 |

| ASV | Assetvisonco | 0.024 | -17% | 147,753 | $21,441,485 |

| ERA | Energy Resources | 0.003 | -17% | 810,489 | $1,216,188,722 |

| TKM | Trek Metals Ltd | 0.023 | -15% | 228,004 | $14,043,317 |

| ADN | Andromeda Metals Ltd | 0.006 | -14% | 661,001 | $24,001,094 |

| BCB | Bowen Coal Limited | 0.006 | -14% | 483,239 | $75,429,481 |

| HLX | Helix Resources | 0.003 | -14% | 206,670 | $11,774,678 |

| LNR | Lanthanein Resources | 0.003 | -14% | 3,960,352 | $8,552,726 |

| AMN | Agrimin Ltd | 0.125 | -14% | 247,315 | $49,707,852 |

| HRE | Heavy Rare Earths | 0.026 | -13% | 38,000 | $6,241,016 |

| GRE | Greentechmetals | 0.061 | -13% | 83,571 | $7,849,973 |

| PER | Percheron | 0.007 | -13% | 26,985,288 | $8,699,501 |

| FUL | Fulcrum Lithium | 0.140 | -13% | 12,000 | $12,080,000 |

| HTG | Harvest Tech Grp Ltd | 0.016 | -11% | 525,367 | $15,948,881 |

| MVL | Marvel Gold Limited | 0.008 | -11% | 121,620 | $7,774,116 |

| VKA | Viking Mines Ltd | 0.008 | -11% | 1,085,000 | $11,953,326 |

| HPG | Hipages Group | 1.245 | -11% | 28,373 | $187,663,526 |

IN CASE YOU MISSED IT

Lanthanein Resources (ASX:LNR) has completed the first stage of diamond drilling at its Lady Grey project at Mt Holland in WA’s Yilgarn, testing the modelled conductor plate under MLEM Survey Line #6. Lady Grey sits adjacent to the historic Bounty gold mine, which produced ~1.3Moz. First assays are expected this quarter.

At Stockhead, we tell it like it is. While Lanthanein Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.