Tesla’s record Q4 is a tale of two Elons: It was the best of times, it was the worst of times…

Elon. A prodigy at war with himself? Via Getty

So we all know by now that Tesla parked another record quarterly profit this week.

Just when you think things can’t get any worse, they get better than ever before.

In short, Q4 2022 profits are up a smidge off 60% on the same time a year-ago and revenues jumped 37% to US$24.3 billion.

Goldman Sachs didn’t mind at all. The investment bank reiterated Tesla (TSLA) a Buy Rating, with a (1 year) Target Price of a exactly US$200.

That means Goldman sees at least circa 40% upside from the pop the share price received after the numbers dropped on Thursday’s close.

AllianceBernstein’s Toni Sacconaghi meanwhile stuck to the guns of his Underperform Rating, according to CNBC, saying he remains “torn” on the American automaker.

While the strong orders are promising, the analyst maintains the auto gross margins were “too weak to overlook”.

“Despite raising our energy storage forecast materially, our FY EPS declines from $3.80 to $3.54 amid lower margins. Moreover, while no one (including Tesla) knows what demand elasticity is, we believe it is uncertain whether surging demand will be sustained, particularly in China, where we believe more price cuts will likely be needed before year end,” Sacconaghi wrote.

“We particularly worry about what happens in ’24, when Tesla will target selling 2.5-3M cars with the same lineup, a much more saturated customer base, and relatively modest contribution from Cybertruck. New low-priced offerings can’t come soon enough, but we wouldn’t count on any prior to 2025,” he added.

Pleasure and pain

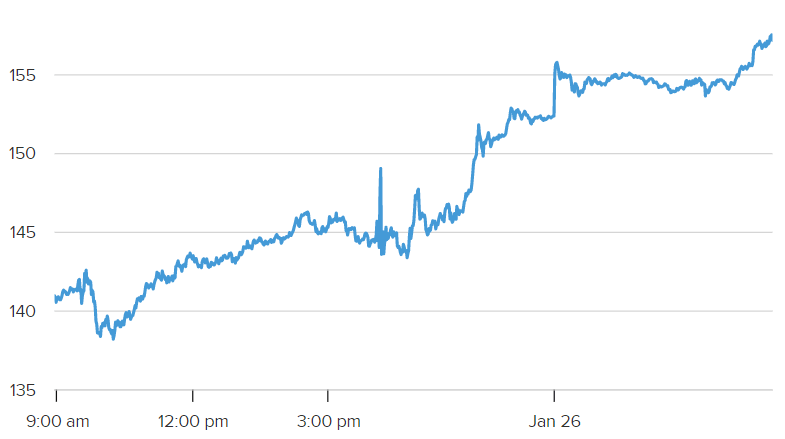

At the time of writing, (Friday morning US time), Tesla closed out the previous session at US$160.27, swinging with familiar excess by US$15.84 or some 11%.

Looking back, over the first four weeks of 2023, it’s been a decent year-to-date. This company has a share price happy to skirt the highs and lows of life on the Nasdaq composite.

Tesla has gained 46.9% since New Year.

And over the last 12 months, its share price remains 42% the worse for wear.

Not as billionaire-ish as last year but more billionaire-ish now than a week ago, the electric vehicle (EV) maker’s controversial CEO Elon Musk must’ve taken some pleasure in reconfirming Tesla’s long-term growth outlook regardless of the gathering macroeconomic headwinds, the Chinese production problems and the incoming competition which all suddenly seem a mile away. If always closing in.

Certainly shareholder and punter complaints that Musk’s new $US44 billion plaything Twitter was too much of a distraction for the unpredictable business savant carry a lot less weight when this is what happens…

Tesla Q4 2022 financial results: what was expected

Tesla’s Q4 2022 profits of US$3.7 billion are up just a smidge off 60% on Q4 last year and while revenues jumped 37% to US$24.3 billion, the take of the tape will show the company just managed to beat earnings (with US$1.19 per share) and missed on revenue by US$300 million. Which in this sport really is pocket change.

The results were fuelled by the 31% increase in the all-important vehicle deliveries measurement when compared with Q4 last year.

In a note Goldman noted Tesla commentary that since it slashed prices during the quarter it’s enjoyed the best orders year-to-date in its brief and colourful history.

In Q4 orders ran at about two times production.

“While we believe this rate of orders may not be sustained in light of the weak macroeconomic environment, it would suggest the company is tracking well to our 1.8mn delivery estimate,” Goldman’s Man on Tesla, Mark Delaney said.

The company also managed to increase its cash position by just over US$1 billion during the quarter. And here we have a growth name sitting on a gold bullion $22 billion mountain of playdough.

Tesla’s latest trick

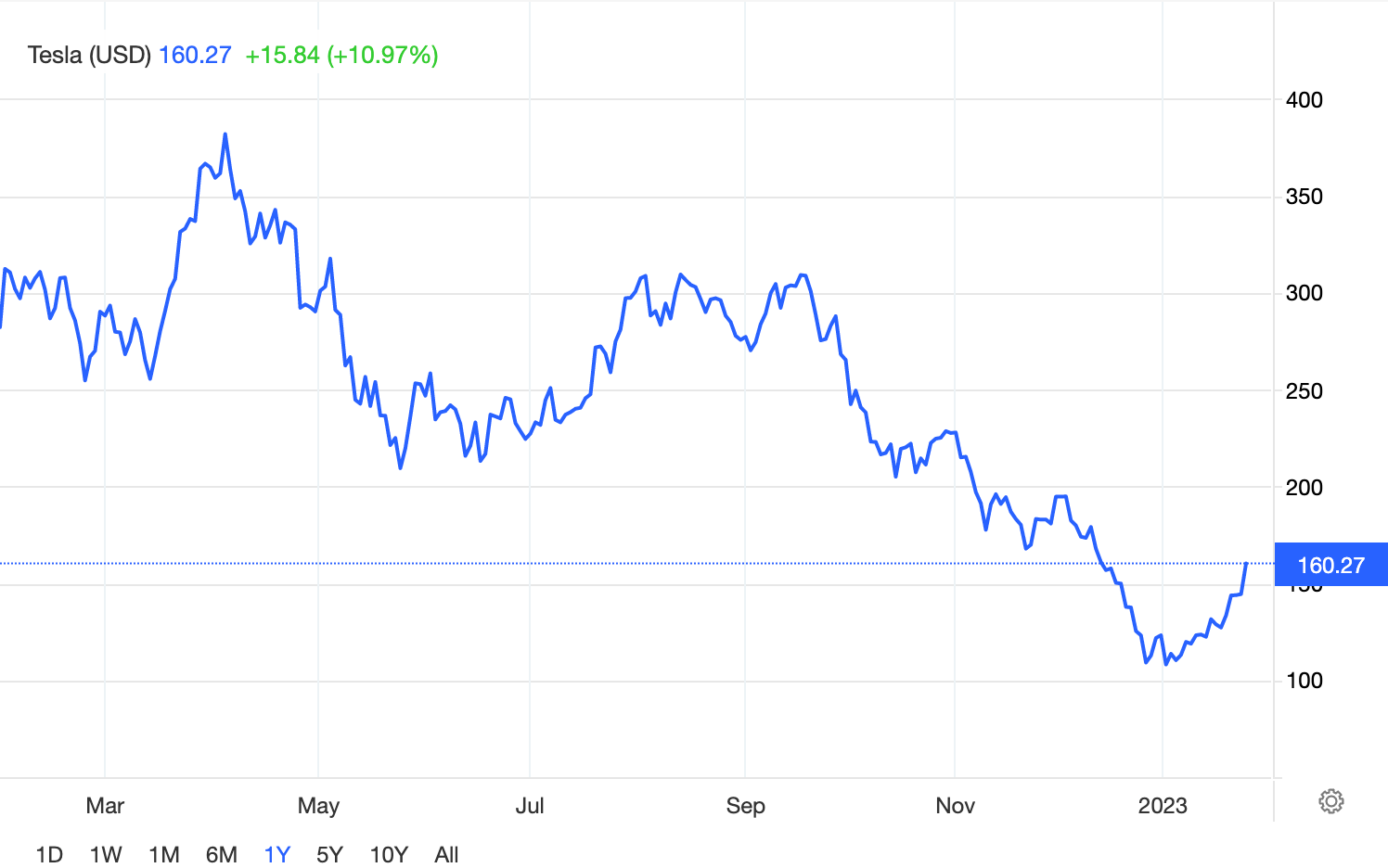

After a decade of stunning gains, the Tesla share price fell 65% during the course of 2022, effectively erasing $850 billion in stakeholder value, so what do we make of the most important Q4 in the company’s brief history?

Last year Tesla finally hit a wall, a hit that sucked US$850 billion of shareholder air, hopes and value from the electric vehicle groundbreaker, but behind the savage repricing was an almost inevitable, if not quite perfect storm.

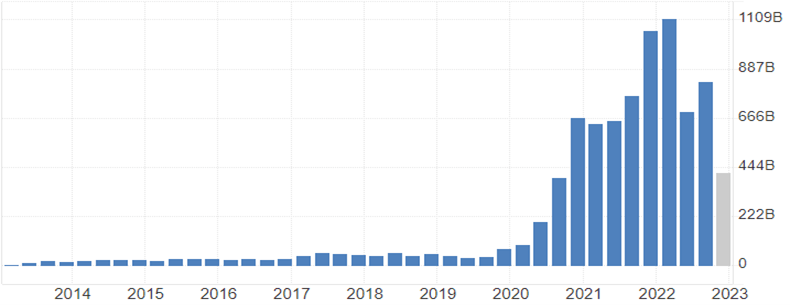

Tesla market cap chart

Via IG. Source: TradingEconomics

But in announcing Tesla’s new record quarterlies, the ever effervescent Musk also slipped in warning of further delays in the rollout of the Cybertruck saying something like ‘volume production’, whatever that is, won’t start until sometime in 2024.

Instead of the usual glorious 50% a year stuff, he said Tesla’s volume growth guidance for 2023 would only be 38%.

Whatevs. The Tesla stock (TSLA) was up more than 10% a few hours later.

Tesla’s Year of being a BNPL

The garage Elon Musk built – like many other growth/tech stocks last year – took the heat of a hawkish Federal Reserve.

As the US Federal Reserve raised rates by a record 425bp in a bid to contain inflation, the tech-heavy Nasdaq Composite, of which Tesla is a boisterous component, finished the year down a skittle off 33%. A full third, I like to say, knowing but a few of my convertible fractions.

Tony Sycamore from IG says rising input costs and supply chain disruptions also contributed to the pain.

“Making matters worse, Elon Musk’s clumsy takeover of Twitter required Musk to sell some $40 billion worth of Tesla shares to fund his latest and controversial acquisition.

“After the acquisition was complete, Musk’s focus on Twitter caused many investors to question where his attention was, including billionaire entrepreneur and long-time Musk supporter Leo KoGuan who tweeted that the Tesla “board is missing in action (MIA)!””

Adding further lithium to the fire, Tesla missed three consecutive quarters of delivery targets.

The most recent delivery miss was reported in early January 2023 when the carmaker delivered 405,278 vehicles for the quarter, below analyst estimates of 420,760.

While this meant that Tesla still delivered a record 1.3 million vehicles in 2022 – a 40% increase from the 936,222 units shipped in 2021 – it fell short of Tesla’s (wholly-American style boasts, rather than, say, ‘forward guidance’) stated aim to grow deliveries by around 50% each year which has underpinned the carmaker’s lofty valuation.

Consensus calls for 1.9 million vehicles to be sold in 2023, then taking another two years to approach 3 million, an average growth rate of 29% and heaps under the 38% he mentioned Wednesday.

“Tesla’s market share in the US peaked at 86% in Q3 2018 and has since slipped to 63% as traditional manufacturers ramp up their own EV production,” Tony says.

“And then finally,” he adds, “there’s the response to the global economic slowdown and in an effort to boost sales and ward off competitors.”

“Tesla cut prices on its vehicles in China in October. Since then, it has cut prices by up to 20% in other key markets, including the US, the UK and Europe, which will weigh on margins while boosting sales revenue.”

“It’s not been a pretty 12 months for a business which is used to being called a glamour.”

“But this is a company with a track record of achieving the unexpected, and discounting the history behind it is probably a mistake.”

2012 – 2022: Tesla’s decade of dominion

Tesla sales revenue: 2013 – 2022

Down the road: Tony’s Tesla technical analysis

IG market analyst Tony Sycamore says the share price of Tesla ended the year at US$123.18, which is “a far cry from the US$402.67 high it struck on the 3rd of January”.

“And 71% below its bull market high of November 2022 of US$414.50.”

“While this represents a significant loss of value for shareholders that bought near the bull market highs, shareholders that bought before the start of 2020 are still up over 380% on the purchase price at the current price of $128.78.

Tesla weekly chart

“Turning to the daily chart, Tesla’s decline from the double high of August/September at $314 is impulsive, and the bounce from this year’s $101.81 low appears to be corrective…. So, presuming the share price holds support at $102.00/00, for those tempted into buying Tesla ahead of the psychologically important $100 level, there are some key levels of resistance to keep in mind,” Sycamore said.

“The first is the 200-week moving average which currently sits at $166.00 and which coincides with the late November $166.19 low. Above here, there is a cluster of resistance around $200/10 coming from the December 1 $198.92 high and May 2022 $206.86 low.

“If the Tesla share price were to see a sustained break above $200/10 and then above the 200-day moving average currently at $240, it would allow a more positive technical picture to emerge.

“On the downside, a sustained break below the year-to-date low at $102/00 would suggest that the corrective bounce is complete and that the downtrend has resumed. In this case, the decline could extend to the pre-Covid $64.60 high of February 2020,” Tony adds.

Tesla daily chart

Via IG Source: TradingView

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.