TESLA: Is Australia’s favourite overseas stock a buy in 2023?

Experts

US electric car maker Tesla (Nasdaq:TSLA) is one of Australia’s most popular international stocks.

Investing app Pearler co-founder Nick Nicolaides said ~90% of its investors would own Tesla through a diversified ETF but it is also its most popular standalone stocks.

He said Pearler investors favour global ETFs (to the tune of 80%+) and Tesla sits in five of its top 10 holdings (across all ETFs).

“We also offer direct US stocks on the Pearler platform and the Telsa factor is real, even for our younger investors, who are opting for passive investing,” he said.

“It’s been the number one direct stock holding since we launched and generally by 25%+ on our number two holding, which is Apple.”

But while Tesla may be popular, it is also highly polarising, with those who believe in its future growth potential and others who aren’t so sure.

Thrown into the equation is Tesla’s high profile billionaire CEO Elon Musk, who has been highly controversial for years but seemed to take it to another level in 2022 with a drawn out saga to buy Twitter.

Investors seemed concerned Musk had taken on too much with Twitter, now running the social media giant along with Tesla, SpaceX and other companies.

Furthermore he sold down large amounts of his Tesla holdings to fund the $44 million buy of Twitter, which by all reports is facing increasing financial woes.

To continue Musk’s not so good start to 2023, he has been facing a US court to testify in a class action lawsuit filed by Tesla investors alleging he misled them with a tweet five years ago.

And as Stockhead’s Josh Chiat reported he’s “got tongues wagging for a comment that verges on the absurd” regarding copper and lithium using his Twitter megaphone.

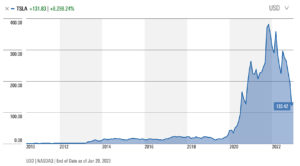

The Tesla share price itself has been on a wild ride and after a strong run in 2020 and 2021 had what can only be described as a disappointing 2022 for investors.

Tesla’s shares started 2022 at ~US$400/share, but ended the year at ~US$120/share, equating to around a 70% drop. Shares in Tesla reached a high of US$410 in November 2021.

But while the share price took a tumble last year, it has tended to reward investors over the years since it first went public. Tesla’s IPO was on June 29, 2010 and priced at $17/share.

Economic headwinds including inflation haven’t helped the car maker. Growth in new vehicle deliveries slowed to 40% last year from 87% the year before and below the 50% annual rate Musk had set as the benchmark.

So to get the rundown on Tesla we woke up early to speak with Morningstar US equity strategist Seth Goldstein.

He said with a high growth stock like Tesla the market has to try to extrapolate what the long term growth will be and whether that is closer to 50% a year – which is management’s annual delivery growth goals – and does revenue grow accordingly.

“Or does Tesla shift into a lower growth mode that likely means 10 to 20% growth a year?” he said.

Goldstein said when growth was above the 50% goal management set was when the price soared but when it shifted to a lower growth the market became overly bearish and assumed a much lower long-term growth rate.

“We thought the market was too optimistic thinking 50% a year was the correct long-term growth rate but now we think the market has gone a little too pessimistic on the name,” he said.

“Just as we viewed it as massively overvalued a year to 18 months ago now we see it as undervalued. Even despite what has been around a 40% rally from the 52-week low we think the market is still a little too pessimistic on Tesla’s long term growth rate.”

Morningstar’s fair value estimate for Tesla is currently at US$220/share, which Goldstein said assumes a five-year revenue growth rate of ~28% and over a 10-year time period 20% revenue growth.

He said Morningstar’s model is largely driven by Telsa’s automotive business, growing from 1.3 million vehicle deliveries last year to over 5 million by the end of the decade.

While Musk is much the face of Tesla, it was founded by Martin Eberhard and Marc Tarpenning in 2003. Musk became its biggest shareholder in 2004 and has been CEO since 2008.

So what about Tesla away from its controversial CEO? How is it holding up?

“It’s still very connected to Elon Musk and I think much of the sell-off is due to Musk and his involvement with Twitter leaving the market concerned he may lose focus on Tesla and the company’s goals may not be reached as a result,” Goldstein said.

“There is also the risk that Musk may need to sell more shares to help Twitter secure permanent financing as a lot of the debt he took out to close the Twitter is likely not a sustainable financing source in the long run.”

However, Goldstein said Tesla has shown it is a large conglomerate that can sell its vehicles.

“The company seems to be very well organised where all the division heads can certainly manage the business if Musk was to step away or transition to something like a managing director on the board,” he said.

“If that happens I think Tesla will be just fine as they are opening up new factories with lowering production costs while increasing production,” he said.

Goldstein said Tesla is regrowing demand for its vehicles, its self-driving software is progressing, the insurance business continues to expand, more chargers are being built while interest in electric vehicles and renewal energy also grows.

“When you look at all the long-term goals Musk has set for Tesla the company is still making progress,” he said.

“I don’t think he needs to be as involved day to day as perhaps he once did say like in 2018 when the Model 3 was launching.”

Goldstein said he’s confident Tesla will continue to grow in 2023 and beyond, even under challenging economic conditions.

“In 2023 even on the backdrop of a global economic slowdown and potential recession I still forecast Tesla to grow to over 1.6 million deliveries which is would be a mid 20% growth rate year over year,” Goldstein said.

“They will continue to make progress on full self driving, expand insurance to more states, roll out more energy regeneration and storage capacity so I’m expecting Tesla to still have a solid 2023 and forecasting about 22% revenue growth.”

He said Tesla management’s lack of financial guidance hasn’t helped with investor sentiment.

“Tesla stated they want to grow vehicle delivery by an average of 50% a year over a multi year period but unfortunately that’s all management said. And they keep repeating this but don’t say is it 50% a year from 2020 or 2021, or does it reset every year even if they grow more than 50%,” he said.

“They give no other financial guidance so when management doesn’t want to give as much near term guidance on how they view the business or how they’re forecasting it, then that leaves the market to try and interpret what management is guiding to.

“I think the market assumes 50% every year and revenue and profits will grow in line with that. Then when it didn’t happen, the market re-shifted its growth expectations and without guidance there seemed to be a much larger reset in growth expectations than if management had have provided more clarity.”

So does Goldstein think Tesla investors are likely to see a return to the US$400 share price anytime soon?

“We still see upside to the current price but if anyone is expecting the $400 share range, which was the 52-week high, then that is a little optimistic and the market may not be making as much optimistic assumptions in the near term,” he said.

The author held shares in Tesla at the time of writing this article.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.