Stonkhead: Will weed stocks end the year on a high note?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Stockhead’s biggest market (t)memes of the week.

After the long (cold) cannabis winter of 2019-2020, investors are finally responding positively to a convergence of regulatory tailwinds.

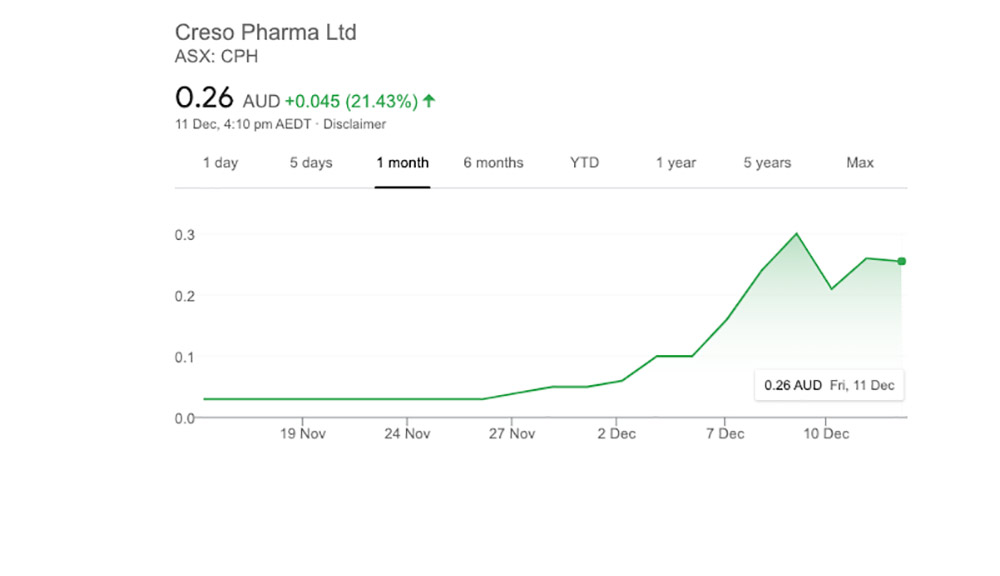

The standout local performer was Creso Pharma (ASX:CPH), which posted torrid gains over the past week on average daily trading volumes of more than 200 million (October average: ~30m).

This punter, and many others, wonder what could have been.

Here’s how much money you could have made if you bought CPH 11 days ago. from r/ASX_Bets

On the other hand, if you bought some of the 914k shares that traded at 47c (on Wednesday), you could’ve lost more than 1/3 of your investment by COB, says u/ mepat1111.

Like this guy.

Over on Wall Street, Airbnb soared 115% at the open in its trading debut on Thursday, giving the home sharing service a market valuation of more than $US100 billion.

That makes Airbnb more valuable than the seven largest US hotel chains combined, including Marriot, Hilton, and Hyatt.

The IPO frenzy of 2020 hasn’t been limited to just Airbnb.

On Wednesday, DoorDash and C3.ai posted substantial gains of 86% and 174% respectively.

And in September, Snowflake completed the largest software technology IPO in history and has been on a tear since its debut.

Is this ‘Dotcom Bubble 2.0’?

Wall Street just brought to IPO 2 companies with a combined revenue of $5.8B and investors are paying a combined market valuation of $169B.$DASH$ABNB

Just tweeting this for future reference in case someone later claims nobody could’ve seen this coming.

— Sven Henrich (@NorthmanTrader) December 10, 2020

Airbnb has a market cap of over $100 billion whereas Goldman Sachs has a market cap of $84bn. This makes sense because Goldman Sachs is just a global investment bank whereas Airbnb is a global accommodation service for cheapskates.

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) December 10, 2020

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.