Small Caps Lunch Wrap: Markets are down but who cares when these ASX penny stocks have gone quite mad

Small cap madness is so precious. Via Getty

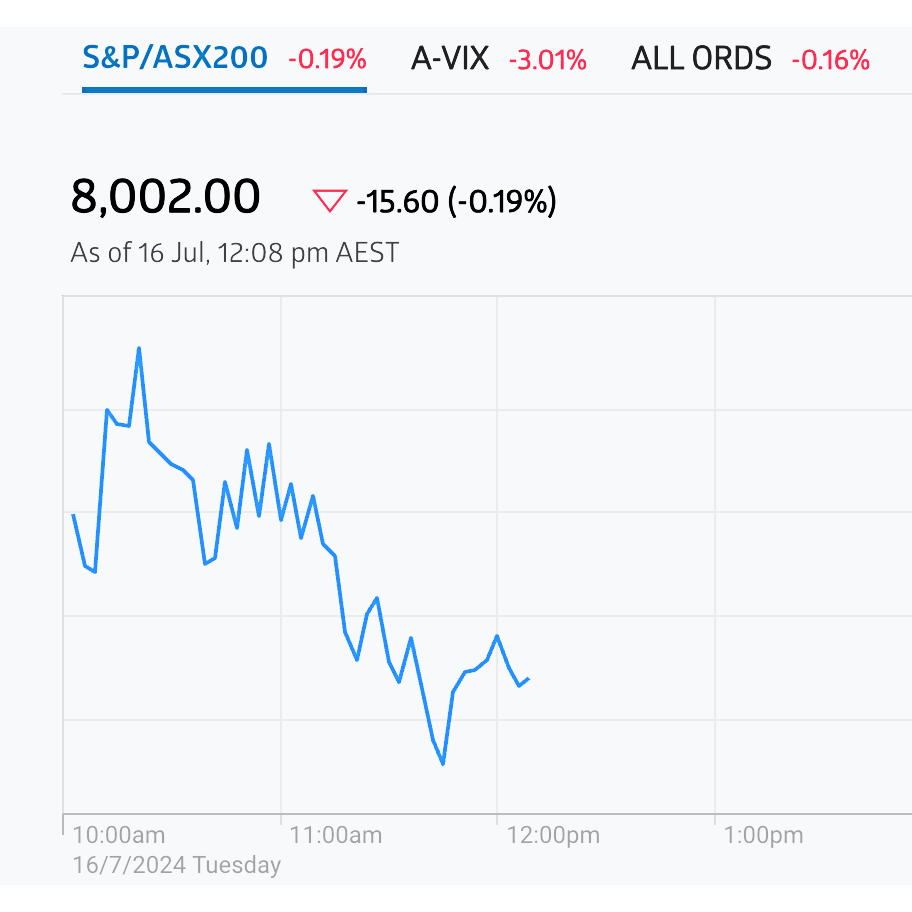

A bright good morning from Bridge Street in Sydney where post record highs on Monday have left Australian markets a tad glum on Tuesday with the declining price of iron ore in Singapore not helping anyones joie de vivre.

The S&P/ASX200 is lower today, dropping 15.60 points or 0.19% to 8,002.00.

After setting a new high to start the week, there was money on the table to be taken and so far traders have taken and run.

Overnight, US stocks marched onwards and ever upwards. This time it was the 40 stock Dow Jones Industrial Average hitting its strides as well as fresh new records.

Now that the smoke has cleared in Pennsylvania, the feeling on Wall Street appears to be that the extraordinary attempt on ex-president Donald Trump’s life over the weekend has in fact added more clarity to the chances of a Republican return to the White House in November.

By the close of business, The Dow added more than 0.5%, the tech-heavy Nasdaq Comp found 0.4% and the S&P 500 clocked casual new intraday highs, but trimmed gains to close at 0.3% the better.

While Wall Street ponders a third possible rate cut before Christmas, we’ve been left watching the Singapore Drift, where iron ore futures are down almost 2% and steel-making ingredient is now worth $US107 per tonne for the August contract.

On the plus side, the local Telecom sector has been having a bit of a blinder this past week. On Tuesday at lunch it’s again the best performing sector on the pitch.

It’s up about +0.35% today, and almost 3.8% over the past five sessions.

This is where we are on Tuesday at lunch for the ASX Telco (XTJ) index in blue vs the ASX Materials (XMJ) index in yellow.

And this is the same comparison, pulling out about one week.

The numbers aren’t quite right, with Comms Services actually ahead by 3.8%, but it’s a rare run and a decent reflection of how iffy the usually dominant ASX Materials sector has been going about its trade of late.

Let’s get down to brass tacks here.

Losers on Tuesday. Men in Skinny jeans, Metcash (ASX:MTS), (owns the IGA supermarkets), Star Entertainment Group (ASX:SGR) (not really entertaining) and Bellevue Gold (ASX:BGL) (lots of gold) which is the worst of the benchmark big caps, with a 3.5% slide.

Meanwhile, the complex joys of owning the three iron ore giants is beginning to perplex the average investor (pretty much anyone that owns a stock in this country) after prices again retreated in Singapore on Tuesday. The US markets can rally all they want. But if the iron ore triumvirate are in retreat to the tune of 2% each then it’s pack up the pennies Gladys, we’re going to Bingo at the CWA.

On the positive front, there’s always Healthcare and IT. Both sectors have been making a similarly strong run of the last few sessions, post-US June CPI which has been sympathetic to rate sensitive companies.

In the former, both PolyNovo (ASX:PNV) and Neuren Pharmaceuticals (ASX:NEU) were more than 4% stronger. In the latter, Block Inc (ASX:SQ2) and Pexa (ASX:PXA) are 3% the better.

And there’s the banks. Financial stocks were mostly ahead at lunch. Minus the Commonwealth Bank (ASX:CBA) , the big other 4 were between 0.5 and 1.0% higher.

National Australia Bank (ASX:NAB) the leader in that race.

After the ABC whacked it with a tell-all on telly (which wasn’t very flattering) the land leasing Lifestyle Communities (ASX:LIC) has begun the long climb back to parity with a 4% gain. There’s still a way to go after Monday where LIC dropped more than 20% by mid morning culling about $200mn off its market cap.

By midday the local sectors were a very mixed bag, with just six of the 11 ASX sectors higher.

The ASX Small Ordinaries (XSO) index is dead flat, while the ASX Emerging Companies (XEC) index is slightly higher.

Not the ASX

In the States, traders drank deep the words of US Federal Reserve chairman J.Powell who came right out and said there’s growing confidence inside the US central bank that inflation is easing.

Even more exciting: Powell suggested The Fed won’t just sit on its hands and wait for inflation to hit the magic 2% target before getting out the knives. The Fed’s next policy meeting is at the end of July.

Two quarter-point rate reductions are fully priced in now. Factset data has a possible third cut this year pricing close to 60%.

By the close of business, The Dow added more than 0.5%, the The tech heavy Nasdaq Comp found 0.4 % and the S&P 500 clocked casual new intraday highs, but trimmed gains to close at 0.3% the better.

In corporate news, the winners overnight included Apple and Goldman Sachs which rose in the wake of strong second quarter results.

Look out, Bitcoin is marching back toward $65,000 , which is surely some kind of key psychological level.

The rise is being put partly at the feet of the indestructible US presidential candidate Donald J. Trump. But also, BlackRock boss Larry Fink’s been heard spruiking it again, too. Wait… wait… Jim Cramer’s on board as well. Uh-oh…)

Overnight Trump’s choice of running mate in Ohio Senator J.D. Vance has apparently ticked some kind of crypto-friendly box, because he’s stowed away a crypto treasure chest worth circa $100k.

Vance has also been all over the US SEC’s regulatory whip cracking on the crypto industry. BTC is up 10% since Friday.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 16 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap MSG MCS Services 0.004 300% 16,337,068 $198,100 DGR DGR Global Ltd 0.029 222% 18,159,712 $9,393,241 MCT Metalicity Limited 0.003 50% 1,088,318 $8,971,705 SLB Stelar Metals 0.099 38% 4,977,817 $4,576,171 NAE New Age Exploration 0.004 33% 1,365,000 $5,381,697 OSX Osteopore Limited 0.073 30% 21,504,022 $6,435,537 AI1 Adisyn Ltd 0.042 27% 1,444,858 $6,109,356 ZLD Zelira Therapeutics 1 25% 17,101 $9,077,724 FEG Far East Gold 0.175 25% 455,884 $36,062,157 EMT Emetals Limited 0.005 25% 597,926 $3,400,000 TSL Titanium Sands Ltd 0.005 25% 20,000 $8,846,989 TTT Titomic Limited 0.1475 23% 5,287,633 $121,317,374 CXU Cauldron Energy Ltd 0.033 22% 1,629,722 $33,116,327 SPX Spenda Limited 0.0085 21% 3,248,077 $30,271,205 RML Resolution Minerals 0.003 20% 415,000 $4,025,055 AVC Auctus Invest Grp 0.635 18% 50,938 $43,364,740 SEN Senetas Corporation 0.014 17% 1,061,340 $18,855,400 T3D 333D Limited 0.007 17% 111,111 $716,670 EVG Evion Group NL 0.022 16% 161,112 $6,592,301 PVT Pivotal Metals Ltd 0.022 16% 90,909 $13,378,247 C29 C29 Metals 0.11 16% 569,018 $13,269,713 CSX Cleanspace Holdings 0.3 15% 38,506 $20,113,533 ADC ACDC Metals 0.06 15% 330,481 $2,580,370 1AE Aurora Energy Metals 0.091 15% 707,872 $14,146,035 AAU Antilles Gold Ltd 0.004 14% 1,003,000 $3,487,872

Here we go. It’s a resources company creator, and on Tuesday this niche Aussie stock is about 250% higher.

DGR Global (ASX:DGR) is the name and the reason it’s jumped so far, so quickly today is because of SolGold’s monster US$750m cash injection for the development of its mega Cascabel copper-gold project in Ecuador. DGR has a 6.8% stake in the once Aussie but now London/Canada-listed miner.

Also going nuts at lunch is MCS Services (ASX:MSG), which had added some 300% by 11am.

MSG provides uniformed security and traffic management services in Western Australia and elsewhere and Robert Badman has the mic:

“This thing is an absolute minnow, so it doesn’t take much to move the needle. Judging by its last announcement of import, however, the company recently advised “settlement of of the sale of its 100% share interest in the MCS Security Group Pty Ltd subsidiary to Vibrant Services Limited”. Make of that what you will.”

In the business of clinically validated cannabis therapies and meds is Zelira Therapeutics (ASX:ZLD) which this morning confirmed it’s secured patents for HOPE 1 and HOPE 2 formulations from the Ausssie Government’s Commission of Patents and the US Patent and Trademark Office (USPTO).

These are never easy and ZLD says the patents cover drugs that are designed to treat cluster symptoms associated with Autism Spectrum Disorder (ASD).

“The broad patents fortify Zelira’s competitive edge in the central nervous system (CNS) therapeutic space and significantly enhance its patent portfolio.”

Voila. Zelira says it’s expecting additional patent grants later this calendar year.

Now. Up a lazy 25% is Far East Gold (ASX:FEG) which just installed a totes Aussie legend Justin Werner as its chairman… and also announcing the acquisition of a potentially multi-million-ounce gold project in Indonesia.

Justin Werner knows Indo like the back of his hand having been involved in the country’s mining industry for more than two decades.

He’s been a non-executive director with FEG since its inception, and has been the MD of global top-10 nickel producer, Nickel Industries (ASX:NIC) since March 2008.

Meanwhile, FEG just signed a binding agreement with PT Iriana Mutiara Idenburg for exclusive rights to explore, develop, and operate the Idenburg Gold Project in Indonesia’s Papua Province.

The Idenburg project covers 95,280 hectares (952.8km2) and is known for high-grade lode gold occurrences characteristic of orogenic gold systems – similar to areas such as the 60Moz-plus Kalgoorlie Goldfields and the Mother Lode district of California.

It’s a region when combined with Papua New Guinea that hosts several multi-million-ounce gold and copper deposits including the world class Grasberg (+70Moz Au), where Werner once worked as a turnaround consultant, Porgera (+7Moz Au), Frieda River (20Moz Au) and Ok Tedi (20Moz Au).

And Titomic (ASX:TTT) is up over 20% as well after announcing the excellently titled Dr Patricia Dare, (a seasoned executive in the US Defence industry) to lead Titomic’s US Defence and Aerospace sales efforts.

Titomic says the engagement of Dr Dare – a former Boeing, and Lockheed exec -, represents a further push by Titomic into the US Defence sector following recent advances including Triton Systems (first TKF System sale to US Defence sector, A$1.2 million), OMIC R&D (Oregon based commercial R&D sale, A$1.2 million) and various confidential defence sector engagements (totalling A$0.48 million).

Finally, there’s more momentum left in Adisyn (ASX:AI1) it seems, which on Monday revealed it’d scored a binding agreement with 2D Generaton Ltd – a global semiconductor IP business incorporated in Israel with close ties to – among others – Nvidia.

AI1 reports the partnership aims to “generate transformational opportunities in the AI space”. And there’s Nvidia, nearby.

“Leveraging Adisyn’s expertise in data centre management, managed IT services, and cybersecurity, alongside 2D Generation’s industry-leading

capabilities in developing next-generation AI semiconductor solutions.”

Nvidiaaaa.

ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks for 16 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap MSG MCS Services 0.004 300% 16,337,068 $198,100 DGR DGR Global Ltd 0.029 222% 18,159,712 $9,393,241 MCT Metalicity Limited 0.003 50% 1,088,318 $8,971,705 SLB Stelar Metals 0.099 38% 4,977,817 $4,576,171 NAE New Age Exploration 0.004 33% 1,365,000 $5,381,697 OSX Osteopore Limited 0.073 30% 21,504,022 $6,435,537 AI1 Adisyn Ltd 0.042 27% 1,444,858 $6,109,356 ZLD Zelira Therapeutics 1 25% 17,101 $9,077,724 FEG Far East Gold 0.175 25% 455,884 $36,062,157 EMT Emetals Limited 0.005 25% 597,926 $3,400,000 TSL Titanium Sands Ltd 0.005 25% 20,000 $8,846,989 TTT Titomic Limited 0.1475 23% 5,287,633 $121,317,374 CXU Cauldron Energy Ltd 0.033 22% 1,629,722 $33,116,327 SPX Spenda Limited 0.0085 21% 3,248,077 $30,271,205 RML Resolution Minerals 0.003 20% 415,000 $4,025,055 AVC Auctus Invest Grp 0.635 18% 50,938 $43,364,740 SEN Senetas Corporation 0.014 17% 1,061,340 $18,855,400 T3D 333D Limited 0.007 17% 111,111 $716,670 EVG Evion Group NL 0.022 16% 161,112 $6,592,301 PVT Pivotal Metals Ltd 0.022 16% 90,909 $13,378,247 C29 C29 Metals 0.11 16% 569,018 $13,269,713 CSX Cleanspace Holdings 0.3 15% 38,506 $20,113,533 ADC ACDC Metals 0.06 15% 330,481 $2,580,370 1AE Aurora Energy Metals 0.091 15% 707,872 $14,146,035 AAU Antilles Gold Ltd 0.004 14% 1,003,000 $3,487,872

IN CASE YOU MISSED IT – AM EDITION

Aura Energy (ASX:AEE) 91Mlb Tiris uranium project in Mauritania is now fully permitted for development after securing the final approval required to begin construction and mining. It comes amidst numerous activities that the company is carrying out to improve project economics.

Greenvale Energy (ASX:GRV) has bolstered its cash position to >$2.85m after selling its investment in Astute Metals (ASX:ASE) for $1.53m.

It retains a 2% net smelter royalty over ASE’s Georgina IOCG project and is also entitled to a further milestone payment of 5 million ASE shares subject to ASE achieving certain milestones.

The company added that the 2023 R&D grant of ~$830,000 is currently awaiting finalisation. This is subject to processing by the Australian Taxation Office, which is expected to be completed soon.

Lanthanein Resources (ASX:LNR) has completed a comprehensive review of open file geophysical data and acquisition of additional multi-client data over its Lady Grey project in WA.

Additional data closing gaps in the tenement coverage will be acquired by drone magnetics within the next few weeks while a geophysical team on-ground this week will conduct moving loop electromagnetic survey over priority gold and copper targets highlighted by both geophysical and geochemical data.

Most of this work is focused on the >2km long gold anomaly coincident with structural flexure plus copper and nickel targets.

Norwest Minerals (ASX:NWM) has raised $2.52m through a placement of 97 million shares priced at 2.6c each to fund drilling at the large Malibu, Duck and Tamba prospects within its 1500km2 ground package in WA’s West Arunta province.

Malibu is a 5km fold system hosting high-gravity & variable magnetics crosscut by major fault structures that are coincident to several IOCG geochemical anomalies while Duck is a 5km east-west trending belt of high gravity and variable magnetics that is intersected by niobium, lithium, and IOCG geochemical anomalies.

Meanwhile, the 3km by 1.5km Tamba copper-gold-in-soils anomaly is located at the eastern extent of the company’s acreage.

Proceeds from the placement will also be used to advance the company’s Bulgera gold and Bali copper projects.

Peregrine Gold (ASX:PGD) is carrying out the latest phase of drilling at the Tin Can prospect to follow-up on high-grade hits such as 4m at 11.35g/t gold from 28m and 4m at 10.82g/t gold from 32m from the last campaign in May 2024.

Drilling will follow up and extend the greenfield discovery of bedrock hosted gold with technical director George Merhi saying that this latest work will give the company a much better understanding of the mineralised system at Tin Can.

The company is also carrying out regional reconnaissance programme on recently acquired tenements, which will be analysed, and will soon update on mapping and sampling at the neighbouring Epithermal prospect.

PharmAust (ASX:PAA) has achieved a major milestone after its lead investigational drug, monepantel, was selected for inclusion in the prestigious HEALEY ALS Platform Trial in the US under a Clinical Research Support Agreement with Massachusetts General Hospital.

Venture Minerals (ASX:VMS) has completed the sale of Venture Iron, the holder of the Riley iron ore mine, to Goldvalley Brown Stone for $3m.

Proceeds from the sale will be used to advance the company’s Jupiter clay-hosted rare earths project west of Mt Magnet, WA, towards a maiden resource estimate in Q4 this year.

Assays from the recent 22,000m drill program have consistently returned record-breaking results with broad widths of high-grade REE mineralisation.

At Stockhead, we tell it like it is. While Aura Energy, Greenvale Energy, Lanthanein Resources, Peregrine Gold, PharmAust and Venture Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.