Small Caps Lunch Wrap: ASX down, Commodities depressed, Gregor has Covid… The only thing doing good is inflation

She's going to stick around. Via Getty

Firstly… “some b’stard” has apparently infected Our Gregor with Covid this morning.

After much discussion we have concluded it’s either Stockhead Editor Peter The Pandemic Farquhar or Noxious Roaming Resources Reporter Robert The Super Spreader Badman.

I can here avow to all of our hardcore regular readers that both these two very unAmerican Australians – and the guilty parties – will be dealt with as per Stockhead’s long-standing Zero-PESTILENTIAL policy and walled up alive, as per the instructions of gothic master Edgar Allen Poe.

One thing we don’t abide by here at Stockhead is a toxic workplace where we can’t mete out our own revolutionary ideas around tribal justice.

However, as good as this knee-jerk retribution might make us feel, sadly, Gregor is out and it’s me now guiding you through the ASX adventures at lunch – sans any genuine Gregor-genre gags.

Meh. I just don’t find the mornings as funny as Mnsr Stronach does.

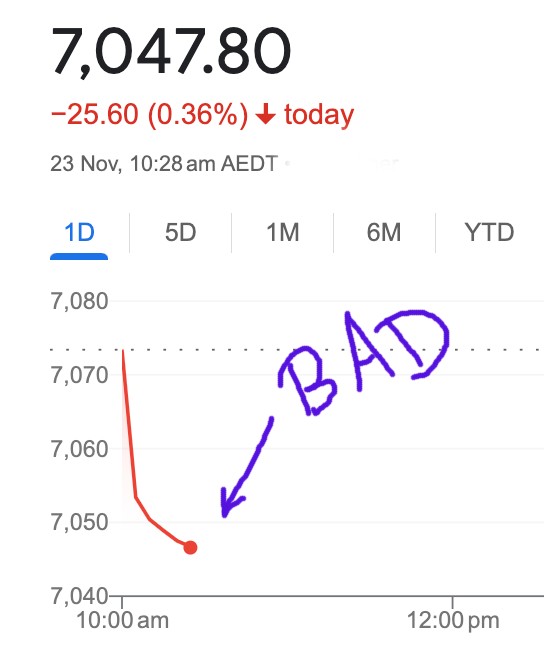

This doesn’t help, mind you:

Yeah. That was the way the benchmark ASX200 began Thursday. A display even more pitiful and full of pathos when held up to the hectic gains made on Wall Street overnight.

At lunchtime in Sydney on Thursday Nov. 23, the S&P/ASX 200 index was down -0.48% to 7039.5 points:

American indices rose in unison on Wednesday in New York, after US Treasury yields went and retraced all the heights they’ve hit in the last few months, briefly dropping to 10-week lows. That and possibly the prospect of an imminent Thanksgiving holiday provided some outsized optimism across all three major US averages.

The Dow Jones jumped almost 200 points, or +0.55%. The S&P 500 found +0.4%, and the tech heavy Nasdaq Composite walked in a +0.45% gain to top 14,266.

Even US small and mid caps outperformed, rising +0.7% and +0.6%, respectively.

More than half of the stocks trading in New York were in the green last night, a good measure of what a broad-based market rally looks like. This was no pre-vacation rally on light-volumes either – the Nasdaq saw high levels of participation, while almost 63% of the entire tech heavy index closed higher.

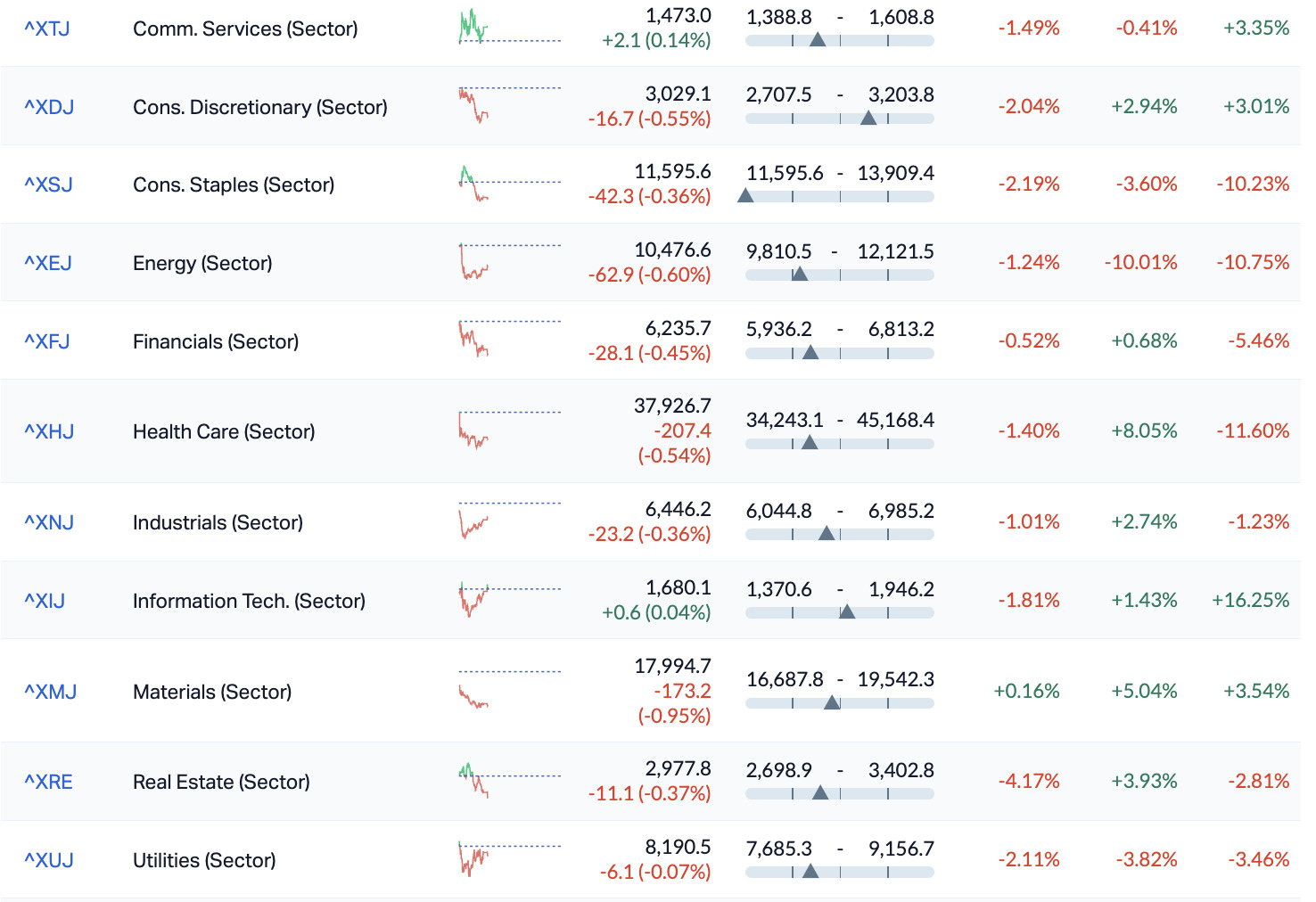

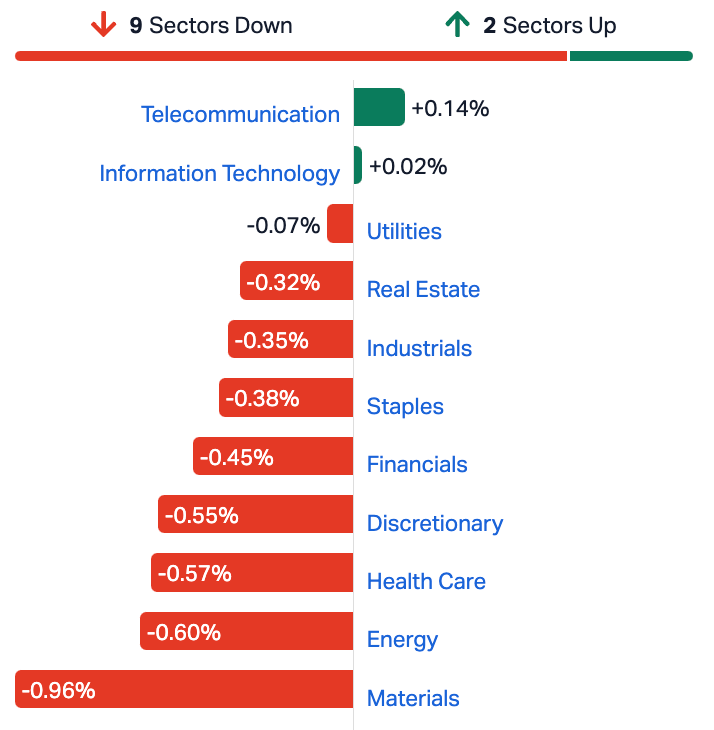

At home by contrast, the benchmark is struggling all across the bourse, weighed down in particular by sharp losses in the Materials, Health and Energy Sectors.

ASX Losses: Broad based enuf for ya?

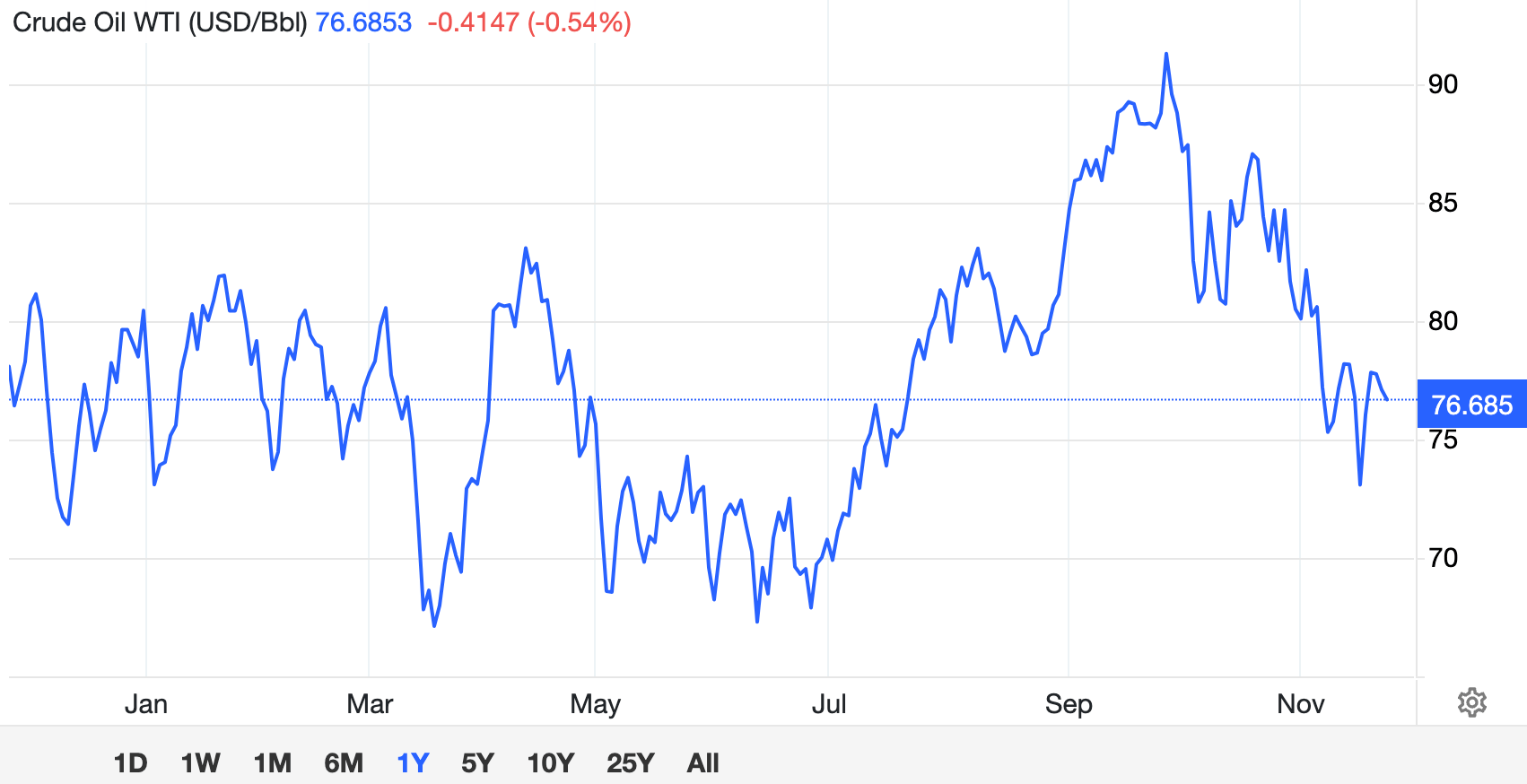

Oil prices got ambushed last night. But it is already on the recovery table, (WTI down only 0.55%) after US government data showed that America’s crude inventories rose more than expected last week.

That was actually in standing with the Tuesday report dropped by the US Gov’s Energy of Information Administration (EIA) which clearly indicated a superlative 8.701 million-barrel increase in US crude inventories, smashing forecasts of a 3.592 million build.

But why would traders pay attention to those guys (whose entire existence is to administer information on energy), when just freaking out is so much easier?

Before that, the US benchmark dropped a precipitous circa 5% at one stage, before trimming the losses.

The initial shock of a fews hours peace in Gaza was quickly compounded by Saudi Arabia saying it’s rather unhappy over the production levels of other OPEC+ oil-producing members – who it would like to stop pulling their weight.

Next week it’ll be thrill a minute when OPEC member states are likely to get down to brass tacks on production quotas. Meanwhile, government data showed that US crude inventories rose more than expected last week, aligning with industry data reported on Tuesday. The latest EIA report indicated an 8.701 million-barrel increase in US crude inventories last week, surpassing forecasts for a 3.592 million build.

Here’s a chart:

So they’re lining up for the stick this morning in Sydney.

After signing off Wednesday with a bif spiel about how the materials sector is back, baby. Losses at lunch are being led by materials.

Namely the mining and energy stocks, which are at least in some terrific comapny.

Weak-ass commodity prices, another monthly contraction in local manufacturing and services PMIs serving only to underline the major culprit for the curdling of local sentiment – an overnight address by the RBA Governor M. Bullock, who scared the pants off homeowners, rich people, rich people with children, homeowners with or without children. Poor people. Their children. And their children’s children.

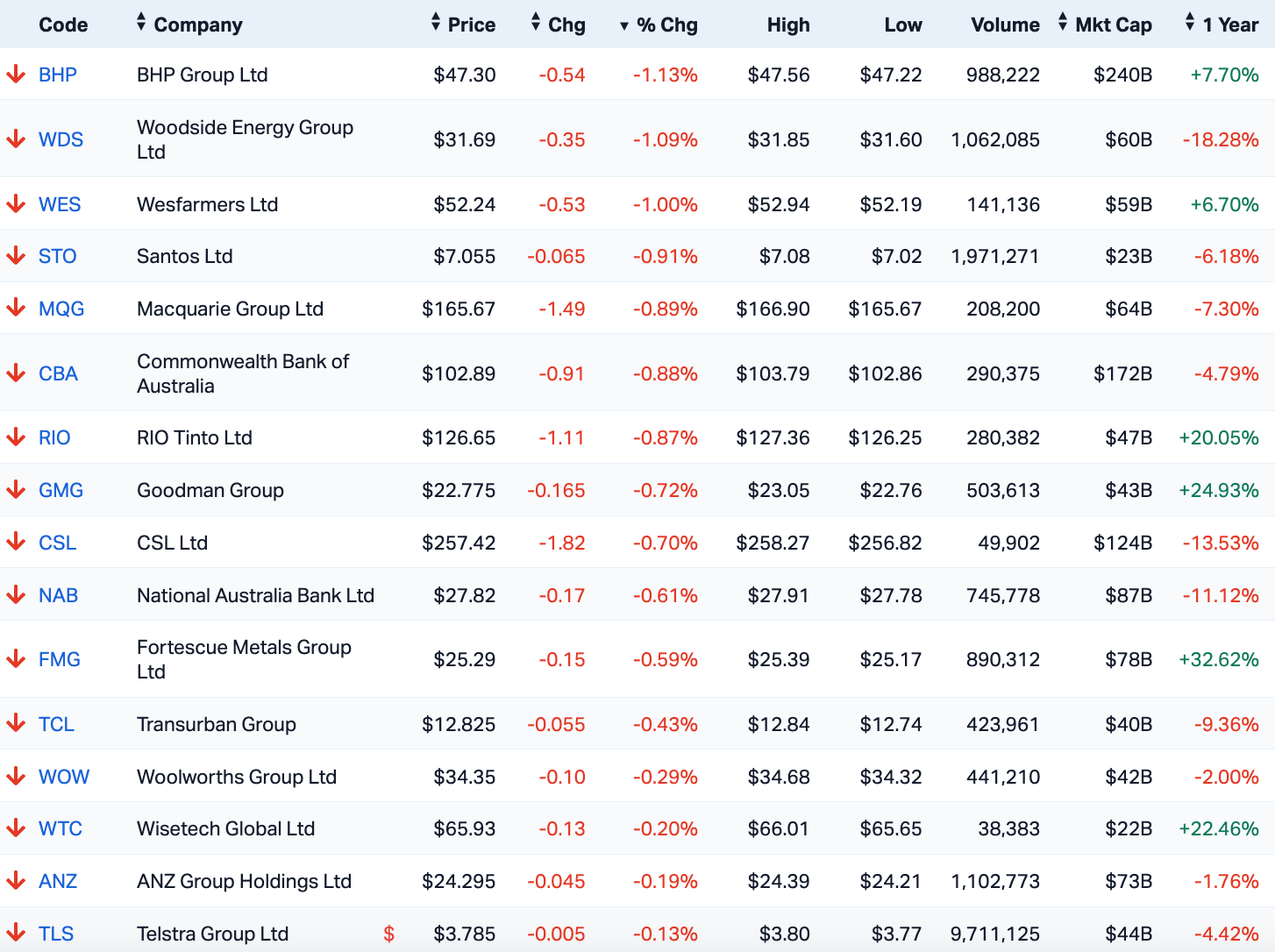

The blue chip names are leading losses. The major iron ore producers BHP (ASX:BHP) (-1.6%) and Rio Tinto (ASX:RIO) (-0.9%), Fortescue Metals Group (ASX:FMG) (-0.6%).

The major oil producers South32 (ASX:S32), Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) also lower.

Other disreputable big cap moneymakers getting smacked about include …

Eh. You know what? We don’t have much to do with The S&P/ASX 20 (XTL) – our narrowest of narrow Aussie indices which is the home of the ASX top 20 stocks by float-adjusted market cap, but…

The index is highly liquid and accounts for ~49% (September 2023) of our entire equity market.

Here’s another chart: 17 of the top 20 biggest stocks are (also) depressed on Thursday

And here, by god, is a table: ASX Sectors at Lunch

Meanwhile…

And the OpenAI saga continues…

I know everything about this, BTW. I was up late and sat through about four (seemingly) endless podcasts by massive Silicon Valley insiders from the Times, The Economist and the WaPo. It was weird to hear how excited they were, when the whole shebang shows how much level heads are not prevailing around AI.

The main takeaway isn’t that this kid Sam is back in the big chair, that’s but a deck chair on the Titanic.

No, the moral here is that we’re all going to briefly get rich before everything you saw in every The Terminator movie happens, except the cool bits like the Guns n Roses motorbike chase.

That, frankly, would almost make it all okay. Go home. Hug and/or sell your children.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 23 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap VPR Volt Power Group 0.0015 50% 47,375 $10,716,208 SIT Site Group Int Ltd 0.0035 40% 10,840,846 $6,506,226 AI1 Adisyn Ltd 0.026 37% 69,769 $2,655,960 AHN Athena Resources 0.004 33% 1,852,051 $3,211,403 SIH Sihayo Gold Limited 0.002 33% 20,000 $18,306,384 SCT Scout Security Ltd 0.02 33% 173,994 $3,486,411 AMM Armada Metals 0.053 33% 1,676,997 $6,902,723 MKL Mighty Kingdom Ltd 0.018 29% 5,555 $5,885,174 FFG Fatfish Group 0.014 27% 3,816,061 $13,092,637 OLI Oliver'S Real Food 0.024 26% 286,650 $8,373,906 GTG Genetic Technologies 0.0025 25% 9,960,621 $23,083,316 PKO Peako Limited 0.005 25% 1,195,762 $2,108,339 RML Resolution Minerals 0.005 25% 130,000 $5,029,167 CHM Chimeric Therapeutic 0.0355 22% 44,648,488 $15,996,234 PPK PPK Group Limited 1.15 21% 36,417 $84,824,828 ASP Aspermont Limited 0.012 20% 4,179,864 $24,387,637 LVT Livetiles Limited 0.006 20% 33,667 $5,885,553 MOH Moho Resources 0.012 20% 8,357,498 $5,100,666 NGY Nuenergy Gas Ltd 0.024 20% 1,061,541 $29,619,110 TAS Tasman Resources Ltd 0.006 20% 1,350,084 $3,563,346 AMO Ambertech Limited 0.25 19% 231,881 $19,990,509 POD Podium Minerals 0.044 19% 72,249 $13,480,454 NWF Newfield Resources 0.13 18% 100,000 $97,025,197 IDT IDT Australia Ltd 0.093 16% 226,858 $28,118,358 C1X Cosmos Exploration 0.145 16% 38,500 $5,934,375

I’m no financial expert. Nor indeed do I know much about mining, Brazil, or lithium.

But it’s fair to say combining all three is a good idea right now.

Armada Metals (ASX:AMM) is up about 40% on Thursday morning, having pulled off the trifecta.

The local prospective explorer says it’s scored a deal with Brazilian counterpart Antares Minerais Estratégicos to acquire ‘legal ownership and title over certain Exploration Permits and Applications for Exploration covering an area of 16,750ha in the eastern portion of Minas Gerais State, Brazil.’

Apparently they’re the new owners of some 14 mineral permits divvied up into four blocks. You don’t need to know their names.

ALL are accessible via Brazil’s terrific paved roads and by a few ‘well-maintained farm’ roads. They’ve got a tonne of high voltage power lines, a nearby railway which goes directly to the Tubarão Port at Vitoria, (the capital city of Espirito Santos State), and there’s an airport (of sorts… well there’s airport infrastructure, which is as good as) at nearby Governador Valadares.

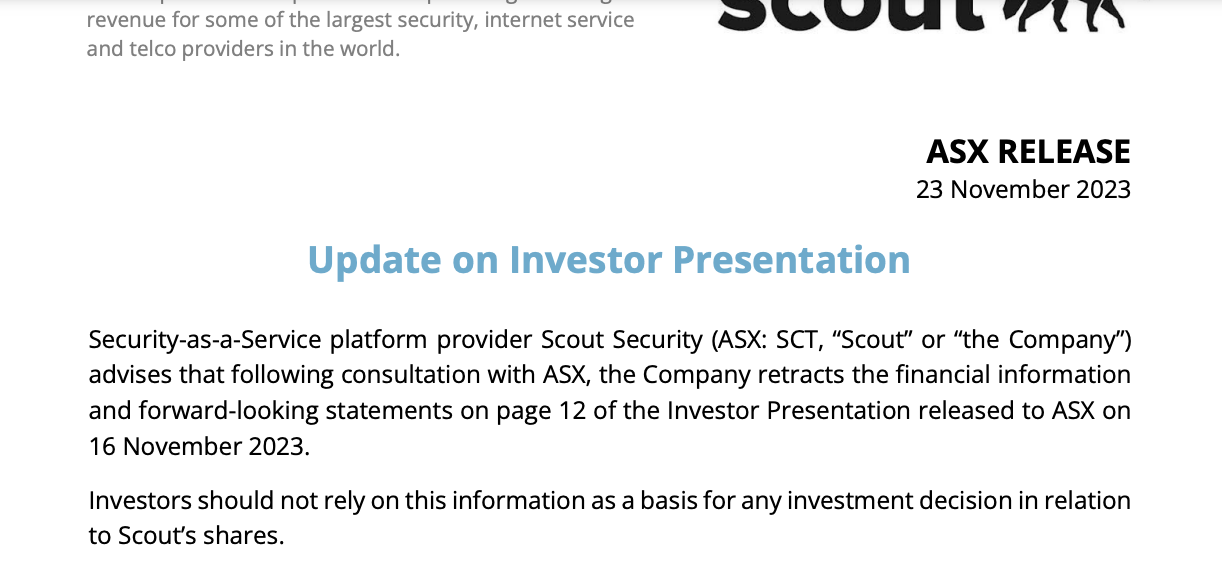

The other standout on a glum day is security-as-a-service platform Scout Security (ASX:SCT) which is in the business of providing ‘affordable DIY solutions to some of the largest security, internet service and telecommunications providers in the world’.

SCT recently dropped an investor presso and this morning has advised people to ignore the most meaningful bits of the presso:

Pancreatic cancer is a hard sell, but an easy buy on Thursday, following some very positive preclinical data for cell therapy player Chimeric Therapeutics (ASX:CHM) and its lead CHM 1301 therapy.

The local mini-pharma reports that its next gen, off the shelf CLTX CAR NK cell therapy “demonstrates the synergies of assets in the Chimeric portfolio, as it combines the recently announced efficacy of CHM 1101, Chimeric’s CLTX CAR T cell therapy, with the efficacy and off-the-shelf convenience of CHM 02012, Chimeric’s NK cell platform, to create a next generation CLTX CAR NK cell therapy.”

I know. But this is not a marketing company.

Apparently we’re talking up to 300% ‘enhanced cell killing demonstrated compared to first generation NK cells,’ as well as some decent evidence of the drug marching ‘into two new solid tumours – pancreatic cancer and ovarian cancer.’

A very pleased Jennifer Chow, CEO and MD, says the CHM 1301 program is set to advance to the next stage of preclinical development under academic research collaboration.

“We are very pleased with the rapid success being shown with our next generation CHM 1301 platform… We believe this work is highly impactful as it demonstrates the synergy of the assets that currently exist in Chimeric’s portfolio, the ability for Chimeric to expand into new disease areas and the potential for enhanced efficacy with an off the shelf version of our CHM 1101 CAR.”

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 23 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ACM Australian Critical Mineral 0.185 -49% 4,683,856 $10,703,250 ADR Adherium Ltd 0.002 -33% 83,258 $15,004,781 AYM Australia United Mining 0.002 -33% 6,033 $5,527,732 ME1 Melodiol Global Health 0.002 -33% 3,326,595 $12,654,126 APX Appen Limited 0.625 -28% 7,335,819 $135,584,185 ENT Enterprise Metals 0.003 -25% 300 $3,197,884 KNB Koonenberry Gold 0.028 -22% 3,650 $4,310,967 OAU Ora Gold Limited 0.0055 -21% 62,456,558 $39,355,173 KPO Kalina Power Limited 0.004 -20% 626,981 $7,575,979 LSR Lodestar Minerals 0.004 -20% 44,937 $10,116,987 ODE Odessa Minerals Ltd 0.008 -20% 1,122,407 $9,471,118 TTI Traffic Technologies 0.009 -18% 350,439 $8,334,372 AX8 Accelerate Resources 0.048 -16% 4,656,013 $26,904,125 BMO Bastion Minerals 0.016 -16% 35,000 $3,973,950 PSQ Pacific Smiles Grp 0.925 -14% 2,697,378 $172,348,493 VRC Volt Resources Ltd 0.006 -14% 1,129,179 $28,910,747 NMT Neometals Ltd 0.21 -14% 1,348,744 $134,633,654 IMI Infinity Mining 0.13 -13% 62,534 $11,678,958 CUF Cufe Ltd 0.013 -13% 1,349,312 $17,191,685 M2R Miramar 0.02 -13% 10,000 $3,424,000 AYT Austin Metals Ltd 0.007 -13% 440,000 $8,126,997 MGT Magnetite Mines 0.315 -13% 862,779 $27,635,418 PRM Prominence Energy 0.015 -12% 1,009 $2,615,899 RNE Renu Energy Ltd 0.0135 -12% 654,068 $6,831,368 BCB Bowen Coal Limited 0.115 -12% 2,304,186 $336,483,248

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.