Semi-conducting yourself when the Nvidia chips are down

Just add vinegar. Via Getty

Now that Wall Street appears to have confirmed – en-masse – that US inflation is beat and the Federal Reserve will cut rates in the coming months, the name of the new game is rotation.

A sweetly slow consumer price inflation (CPI) read for June was the inspiration (Thursday last week) for Wall Street’s momentous two-step out of the market’s megatech growth stocks like the US chipmaking juggernaut Nvidia (NVDA), into the smaller, cheaper and in some cases more global stocks.

But the head scratcher for traders is – are we watching an overdue correction for the easy money of backing Big Tech and artificial intelligence stocks, or is this the real deal?

Does it mean au revoir to the simple, happy solution of parking your money in AI-related stocks, the Magnificent Seven and one or two of whatever Warren Buffett is buying?

And is it hello to the vast veldt of previously under-loved, under-performing and under-valued corners of the global equity market?

Certainly Wall Street’s Magnificent Seven stocks have love to spare.

Collectively they’re up about 57% over the past year. Easily double the 25% return of the entire S&P 500. And it hasn’t been entirely unified growth, either – until this month Tesla was bleeding market cap in 2024.

While over at Jensen Huang’s Nvidia (NVDA), the share price alone has tripled in that time.

The rise and fall of the GPU empire

Compared to those numbers, since hitting another all-time high in late June, shares in NVDA are in a relative death spiral. NVDA hasn’t gained anything at all in the last few weeks, in fact it’s slipped an almost unheard of 9%.

And the omens portend further headwinds for the global semiconductor sector.

According to S&P Global Market Intelligence, the global machinery feeding AI with that sweet semiconductor goodness is finally overheating.

The elaborate supply chains which were choked off during COVID-19, and which eventually resupplied the headline demand for AI applications are faltering again, S&P says.

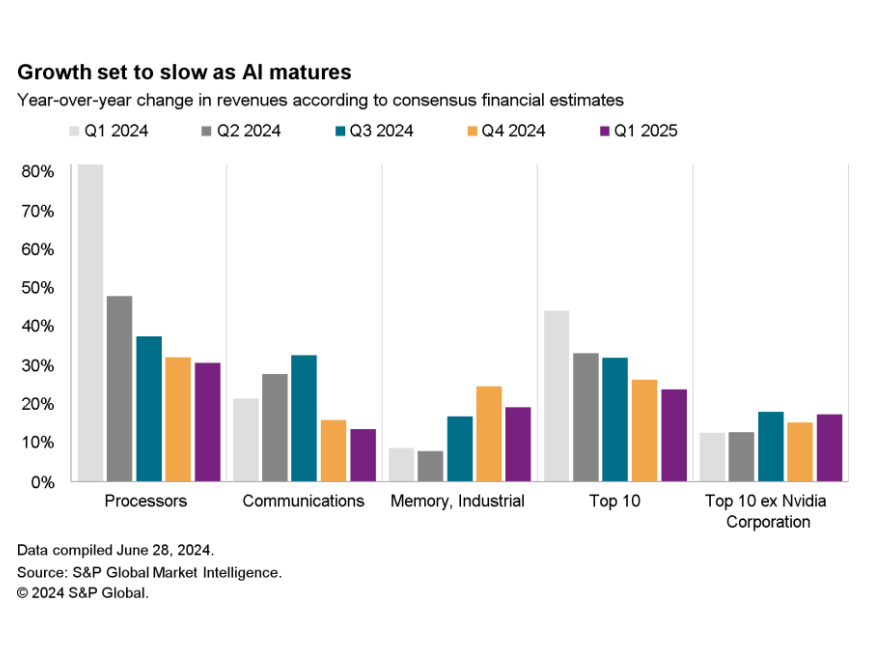

Sector revenue growth is expected to crash to 24% in the first quarter of 2025, down 20% on the same period of 2024.

“Consumer devices have mixed prospects, with pent-up demand driving smartphone growth and AI pushing a new PC upgrade cycle, while industrial and automotive chip demand lags due to high interest rates and geopolitical uncertainties,” S&P Global reports.

The news follows reports that DNB Asset Management, the Nordic fund giant with circa $90 billion Funds Under Management (FUM) just offloaded a big chunk of its Nvidia stake in the wake of a rally that pushed its market valuation above $3 trillion.

According to regulatory filings, DNB culled its smashing NVDA stake by some 9% in the second quarter to about 9.3 million shares, leaving its piece of the chip giant down to some US$1.1bn, as per the US Securities and Exchange Commission (SEC).

It’s not the greatest rotation in funds management history – NVDA remains DNB’s third-biggest holding at the end of June.

And don’t get out the hankies for CEO Jensen Huang’s undisputed king of AI, NVDA stock and its must-have graphics processing units (GPU) and generative AI tech is still ahead circa 160% this year, as per CNBC.

Still, the rally in Nvidia has recently shown signs of exhaustion as 2024’s bull run broadened out to the unloved pockets of the market. Shares of the chipmaker have dipped about 9% from their all-time high reached on June 20.

Meanwhile, S&P notes that global trade volumes for chips are on the up. Up significantly – with Q2 growth of 11% year on year (the three months to May 31).

That’s being driven by ongoing demand for memory chips, with those producers driving the growth rate thanks to the relentless fascination for AI applications.

For example, despite the weak export numbers out of Taiwan, local and regional giants like TSMC, Samsung and Micron are all expanding.

The sector is also due a handy tailwind as the billions of dollars unlocked from the US CHIPS and Science Act continue to flow chip-wards.

Thursday’s near-record swing from megatech to mini cap shows just how overflowing the cup is in Magnificent Sevenland.

The gains have been fab, but this iteration of Wall Street is mighty unbalanced.

The last few years US stocks have been monstered by a handful of businesses.

The top 10 companies on the US benchmark S&P 500 accounted for 27% of the index at the end of 2023, nearly double the 14% share a decade earlier, according to Morgan Stanley analysis.

That intense concentration has just kept blowing out in 2024.

According to FactSet, as of June 24, the top 10 now accounts for 37% of the entire market cap of the benchmark.

In other words, for every 100 US dollarbucks invested, about $37 goes directly into 10 companies, up from the $14 a decade ago.

Today our mates at the Magnificent Seven, Messrs: Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla — represent 31% of the index.

But more importantly, according to Morgan Stanley, the Magnificent Seven alone drove more than half the S&P 500’s gain last year.

Over the past three quarters their hold on returns solidified further, making up just shy of 60% of the S&P 500’s total return.

Are semi-conductors set to slide?

Here are 10 takeaways from S&P Global Market Intelligence:

- The semiconductor sector is experiencing varied recovery rates across different segments, with AI applications and Nvidia Corp driving the fastest growth.

- Supply chain challenges persist, especially for new AI-related products, complicating the steady rollout of upgrades in both the chip and server segments. Sector revenue growth is expected to slow from 44% in the first quarter of 2024 to 24% in the same period of 2025.

- The prospects for consumer devices are mixed.

- The global smartphone market is seeing a temporary growth in shipments due to pent-up demand, but long-term trends indicate a decline due to market saturation. Personal computer shipments are entering a new upgrade cycle, driven by AI-enabled machines. Connected devices like streaming media and video game consoles are experiencing slower growth due to market maturity and lack of new product launches.

- The industrial equipment and automotive sectors are lagging in chip demand, despite a recent uptick in manufacturing new orders.

- Industrial chipmakers remain cautious due to high interest rates and inventory challenges, with firms downgrading revenue forecasts amid weak demand and geopolitical uncertainties.

- International trade volumes of chips are increasing, with growth of 11.0% year over year in the three months to May 31, 2024, while memory chipmakers lead growth due to the requirements of AI applications.

- Despite weak export data for Taiwan, TSMC and other firms like Samsung and Micron are expanding. The sector will also be aided by the funds recently provided from the US CHIPS and Science Act.

- The hurdle to recovery comes from export controls related to national security, particularly by the US and EU, which impact semiconductor supply chains connected to mainland China who are advancing their domestic chip production capabilities.

- The widening trade restrictions on computer chips and manufacturing technology may affect chipmakers’ revenues significantly, as 30% of their sales come from mainland China.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.