Selfwealth names top ASX gainers for August; UBS says sell them in September

Via Getty

For me, earnings without guidance is a bit like pizza without cheese – little more than cooked tomato paste on flatbread. And I don’t buy it.

Macquarie Bank analysts who know more and are paid better for it, said – in their end of season ASX-autopsy – that the ASX Discretionary Sector produced the most positive surprises in an earnings seasons of notable downgrades, but with the rider that the absolute vacuum of expectations on discretionary and most other stocks may’ve played a significant role in those beats.

On the flipside, it was a few of the more reliable defensive names which in turn delivered the most decisive disappointment.

On Macquarie’s numbers, the 2022-23 fiscal year saw Earnings Per Share (EPS) contract -0.8% across the board.

The bank also offered a chunky forecast too – a -3.8% slide ahead in the 2023-’24 fiscal year.

Both of which compare unhappily with the pandemic-inspired cash-flush circa 22% bounce in the over fiscal ’21-22.

The millionaire’s factory floor was likewise annoyed at the feeble season of forward guidance we’ve just endured.

“Guidance continues to disappoint and – coupled with a more volatile market – these factors appear to have driven 2023-24 earnings per share (EPS) downgrades.”

Hot August Neuren

For a clear-eyed take of what just happened on the ASX through a turbulent August, the monthly data from the ASX-listed trading platform SelfWealth (ASX:SWF) makes for good reading too.

So, speaking of Macquarie, for example, shares in MQG enjoyed a significant bump in August inflows – MQG was the 7th most traded stock by value, up around 43% compared with July, which followed a pull-back in the bank’s share price towards its lowest level since the start of the year.

While the weaker lead from the US posed a challenge for investors, SelfWealth’s Robert Marfell says that aside from the Consumer Discretionary sector which was a notable exception, Utilities, Consumer Staples and Healthcare stocks led the ASX sectors in the red last month.

The most traded stock on the platform was boring old moneybags CBA, which dropped its results early and made even more billions of dollars than expected.

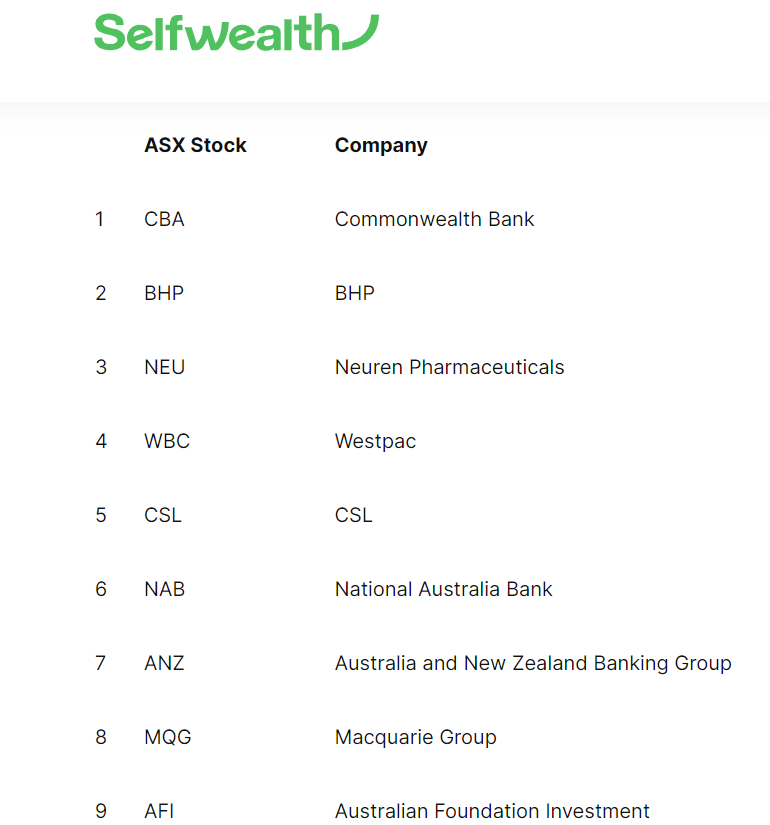

MOST POPULAR STOCKS

“There were no surprises at the top, with Commonwealth Bank’s (ASX:CBA) record full-year profit attracting a lot of scrutiny, but also cementing its position as the most popular ASX-listed stock, according to Marfell.

He says the investors on the Selfwealth platform “overlooked moderation in the lender’s net interest margins in favour of its large dividend and plans for a $1 billion share buyback”.

Selfwealth community holdings in CBA grew 2.8%, despite the stock posting a monthly decline of 3.3%.

“Elsewhere, BHP (ASX:BHP) and Neuren Pharmaceuticals (ASX:NEU) swapped positions in second and third.

“Both saw a notable decrease in the collective value of their holdings, down 5.7% and 9.4% respectively.”

Unlike CBA, both of those figures were worse than the underlying performances of the head shares, suggesting Selfwealth members’ views towards these two names soured more than that of the broader market.

Neuren’s been the 2023 darling of the ASX biotech sector, health sciences expert Scott Power told Nadine last week.

Thje NEU share price is up circa 40% YTD after large pharma partner Acadia (Nasdaq:ACAD) announced in March that the US Food and Drug Administration (FDA) had approved trofinetide for the treatment of Rett syndrome.

Now dubbed DAYBUE, the drug is the first approved treatment for Rett syndrome with its official launch in the US by Acadia in April.

Acadia recently provided encouraging early insights into the US launch of DAYBUE, expecting net sales of US$21-23 million in Q2 2023 and US$45-55 million in Q3 2023.

Furthermore, NEU has also had received the upfront payment of US$100 million that was earned following the recent expansion of its partnership with Acadia for trofinetide to a worldwide exclusive licence.

However, in a sign the market was not even taking in good news well this week the NEU share price is down more than 10% in the past five days.

“It’s a real head scratcher to us and we thought it would rally,” Power admitted.

“Fundamentally nothing is going wrong and getting into the ASX 200 is a positive and when we get this improved environment toward the end of the year we’d expect it well above $15.”

But the price action on Selfwealth suggests a simple reason for NEU’s last run of outs, which has seen the share price fall away by double-digits – buyers are cashing in on some sound profit.

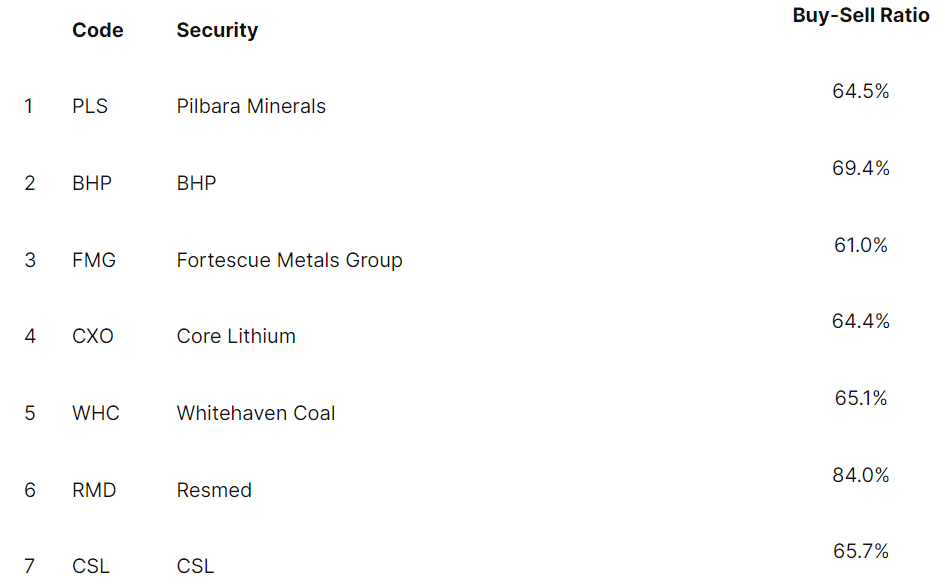

In terms of trading activity, August saw a number of beaten-down names attract above-average trading activity, with the first of these being Whitehaven Coal (ASX:WHC), which ranked fifth for all trades.

Marfell added: “Shares in the coal exporter fell 12% last month amid a weaker-than-expected coal output forecast for fiscal 2024. A significant increase in capital spending requirements also concerned the broader market, but Selfwealth members largely looked past the news, with buyers accounting for around two-thirds of all trades.

“In sixth position, ResMed (ASX:RMD) made a rare appearance among the most traded stocks on the Selfwealth platform. While the company’s results, particularly gross margins, were partly to blame for a 24.2% share price slump, it was heightened fear about competition that had the most effect.

“Investors have increasingly grown concerned about the role that diabetes drugs could play in weight loss treatment, and in turn, reducing sleep apnea and the demand for Resmed’s medical devices,” Marfell says.

RMD stock is down calamitously – close to 30% after posting dull numbers and an unimpressive outlook.

Te margins are depressing and the shadow of Danish giant Novo Nordisk and its game-changing twin weight loss drugs Wegovy and Ozempic have been directly correlated to fears for RMD’s addressable but possibly dwindling sleep apnea market.

That seems a fairly long string. You’d reckon there’s nothing so rotten in the state of Resmed to justify those kind of falls.

RMD has a fine track record and sleep apnea is its own problem, which RMD has been providing solutions for over a long period.

After its horror August, the stock is back where it was before the pandemic – trading at 2020 prices, or about 20x forward price to earnings ratio (damn that’s decent) and yet, the earnings report which triggered the group-sell shows RMD is pulling in almost double what it was the last time the P/E was so sweet.

The other Healthcare Sector contender for worst-on-field, best-on-price last month goes to regenerative medtech Mesoblast (ASX:MSB), where, Marfell says, shareholders “were left licking their wounds” after a disastrous month.

“Shares in MSB plummeted 55.7% last month in light of the US Food and Drug Administration’s decision to reject Mesoblast’s Remstemcel-L cell therapy, designed to treat a type of complication that may occur following a stem cell or bone marrow transplant.”

In its complete response, the FDA said it requires more data to support marketing approval and to obtain this data, Mesoblast has to conduct “a targeted, controlled study in adult patients”, specifically those in the highest-risk category with the greatest mortality.

While it’s a big setback for Mesoblast, the company said the adult study is in line with its overall commercial strategy in the first place since adults comprise 80% of the SR-aGVHD market.

“We remain steadfast in making remestemcel-L available to both children and adults suffering from this devastating disease, and have received substantial clarity in how to bring this much-needed product to these patients,” Mesoblast CEO Silviu Itescu said.

For the most part, buyers bought Silviu’s take above the FDA and consequently bought the dip; almost 70% of all Selfwealth’s recorded MSB trades last month were for buy orders.

On a similar theme, the supermarket giant Coles Group (ASX:COL) was the 11th most traded stock in August after its share price touched a 52-week low.

“The company joined a long list of names to fall victim to cost overruns, with the construction of its automated customer fulfilment centres in New South Wales and Victoria behind schedule and also set to run beyond budget.

“Higher wages and stock loss weighed on the market’s view but over 80% of SelfWealth trades in Coles shares were buy orders,” Marfell notes.

As is often the case with the supermarket-duopolists, if one goes good, then the other cops the stick.

Last month Coles shares fell -7% after its flat earnings drop, while over the road, Woolies shares pumped by the same degree after delivering decent numbers, led by a headline circa 13% growth in FY profits.

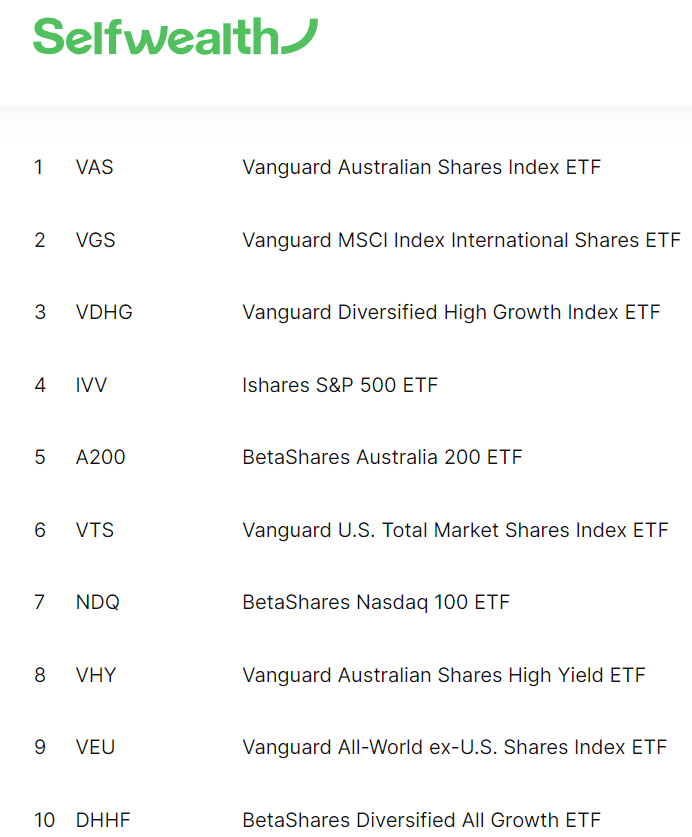

ETF as BFF

On the whole, August saw a higher level of buying activity in ETFs compared with the month prior.

MOST POPULAR ETFs

While all of the ETFs featuring among the most actively traded names last month were carried over from July, there was a notable performer courtesy of the BetaShares Diversified All Growth ETF (ASX: DHHF). This fund yielded the largest monthly increase in value compared with the month prior, with the collective value of all holdings rising 4.6%, far outpacing an underlying gain of 0.4%.

Back in July, the buy-to-sell volume for the most traded ETF on the platform, the Vanguard Australian Shares Index ETF (ASX:VAS), was 79.7%.

That figure increased by almost 5 percentage points last month.

TOP STOCKS BY TRADE

UBS on ASX consumer stocks: Go make some money

For its just released Q3 investor survey, the investment bank UBS somehow found and quizzed 1,000 living Australian adults over a fortnight last month.

The bank says the results show that 12 months of intense rate rises, and the little conclusive impact it’s had on sticky inflation, continue to thwart consumer sentiment.

Groceries, energy, insurance, health and rent, are areas consumers are resigned to ongoing spend.

The bank says we need to contemplate “a new consumer which has little appetite for debt”, a sharp ‘no thank you’ on intentions to go buy a new car and less willingness to pay up for ESG investor aware options.

“Consequently, consumers appear on the cusp of dialling back expenditure on entertainment, recreation, eating out, takeaway food, furniture, and household appliances,” the bank noted.

Some of the best-performing stocks outside Consumer Discretionary have emerged from companies involved in the Building Material sectors.

The largely downbeat findings suggest that the recent outperformance by these domestic consumer/household and housing linked sectors is likely to prove short-lived.

As a result, UBS says pretty directly to go cash in your chips:

“(We) advocate investors use the recent rally as an opportunity to take profits.”

Nice. Direct.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.