Traders’ Diary: Everything you need to get ready for the week ahead

Via Getty

The Economic Week that Was

With all that emotionally draining US debt ceiling nonsense done and dusted for a few years, the scent of fresh blood and the sweet risks of drinking it hot from the jugular (we’ll call that positive sentiment) reemerged pretty good last week.

In the states, the Nasdaq Composite eased off the accelerator last week, with a 0.15% gain. The US S&P500 was up again over the week, rising by 0.3% (and is up by 13.5% since January) while the tech-heavy NASDAQ was 0.5% lower but this follows a massive rally over recent weeks (with the NASDAQ up by 28% since the beginning of the year) so it’s not surprising to see tech shares take a breather. The Dow Jones Industrial Average found 0.34%, while the S&P 500 snaffled a further 0.3%, and is up by 13.5% since January.

And that, ladies and gents, puts the 500 back among the bulls, ending what’d been the very longest bear run for the index which tracks America’s biggest 500 companies since around 1940.

Obviously WW2 was a pretty dire time too, but really, that generation knew nothing about the travails of life in the digital age – like the siren song of Super Size Cola, no-one even caring you have sex with, widely accessible Fentanyl (for God’s sake they only got opioids after getting shot!) and – hand me the fentanyl – not very fast download speeds.

Locally, the benchmark ended slightly higher, although the All Ords didn’t. Commodity prices were mixed, with iron ore up on the stank of Chinese stimmy, oil fell back to just over US$70/barrel despite word of OPEC+ production cuts from Saudi Arabia, metal prices like copper, gold and silver were up.

AMP Capital’s senior economist Diana Mousina said agricultural prices – soybeans, sugar and wheat et al – rose on supply concerns after a very big dam in Ukraine got absolutely blown to smithereens.

Among the local winners, familiar diggers of Aussie commodities like:

New Hope Corp (ASX:NHC) +12.7%, Whitehaven Coal (ASX:WHC) +8.7%, Pilbara Minerals (ASX:PLS) +6.3%, Fortescue Metals (ASX:FMG) +5.6%, RIO Tinto (ASX:RIO) +4%, IGO (ASX:IGO) and BHP Group (BHP) +3.4%.

There’s also a discernible theme among the weekly bleeders:

SEEK (ASX:SEK) -8.4%, Lovisa Holdings (ASX:LOV) -7.3%, Stockland Group (ASX:SGP) -6.6%, Corporate Travel (ASX:CTD) -5.4%, Harvey Norman (ASX:HVN) -4.5%, REA Group (REA) -4.5%, Technology One (ASX: TNE) -4.1%.

We’ll get into that in a bit. (or scroll down… the other bits are pretty interesting too).

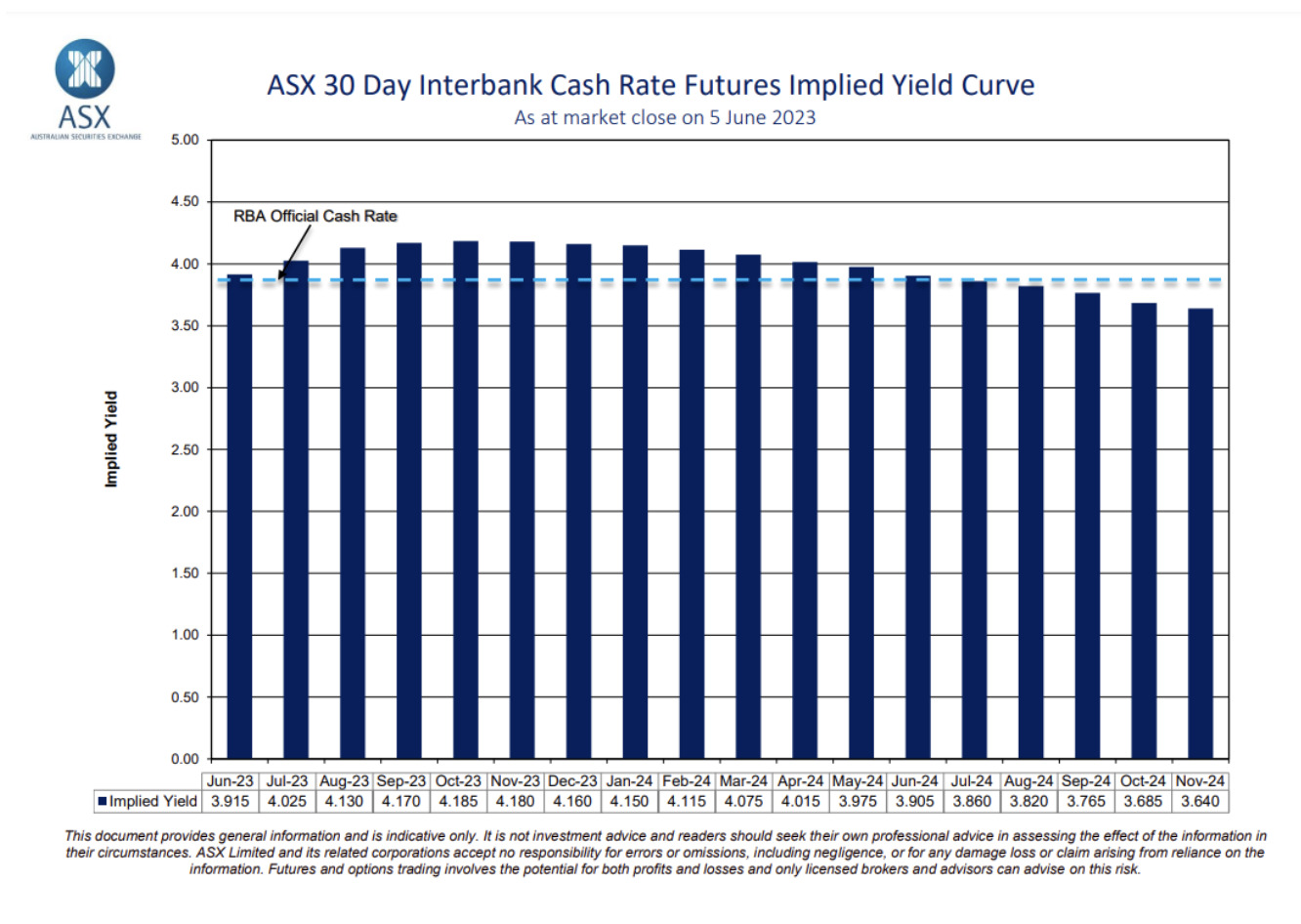

Hmmm. More rates pain

With summer dwindling in Martin Place, the Reserve Bank of Australia (RBA) made the silly cry of ‘once more unto the breach, dear friends’ and lifting the official cash rate (OCR) to 4.1% on Tuesday – just piling on the pain for households and the people trying to own them or just paying them off. RBA Guv’nah Dr P. Lowe was pretty fulsome in his allusions that further rate hikes may be ahead.

That’ll probably do a right number on consumer and/or business confidence – the true extent of which we’ll find out later this week.

On the RBA’s OCR, CBA said OMG…

In our view, the economic data flow preceding the Board meeting did not warrant a hike, but the Fair Work Commission’s decision to increase the award and minimum wage by 5.75% was seemingly an upside surprise to what the RBA was expecting. Also contributing to the hike was rising home prices as well as the RBA’s read on the monthly CPI indicator.

We had previously flagged that wages remained a key risk to the outlook and although the official measure of wages inflation remains consistent with inflation returning to target, the RBA is becoming increasingly concerned about nominal wages growth, lack of productivity and consequently, rising unit labour costs.

In this regard, Guv’nuh Josh Gilbert, relentless Cornish market analyst at eToro in Sydney, reckons it may not be good news when Westpac’s Australian Consumer Confidence reading drops this week.

“It may not move markets, but it could arouse a general empathy for Aussie consumers,” he told Stockhead.

Josh now also believes the path to Australia avoiding a recession is getting tighter than a group house of Theatre majors in Newtown as stubborn inflation and a 12-straight compilation of rate hikes weigh – or will eventually – weigh on growth.

The RBA’s blue pillars of implied agony

The Commonwealth Bank (ASX:CBA) economic team have an incoming recession priced at 50% on the office tote. As they’ve been telling anyone willing to listen, the delayed nature of 12 interest rate rises will eventually bite and it will likely leave a mark.

CBA’s also cut the forecast for our great nation’s ungreat GDP growth (Q4) to an not entirely lusty 0.7%.

“It’s clear that consumers are already tightening their belts and feeling the pressure,” Josh said, pointing to flat retail sales data for April.

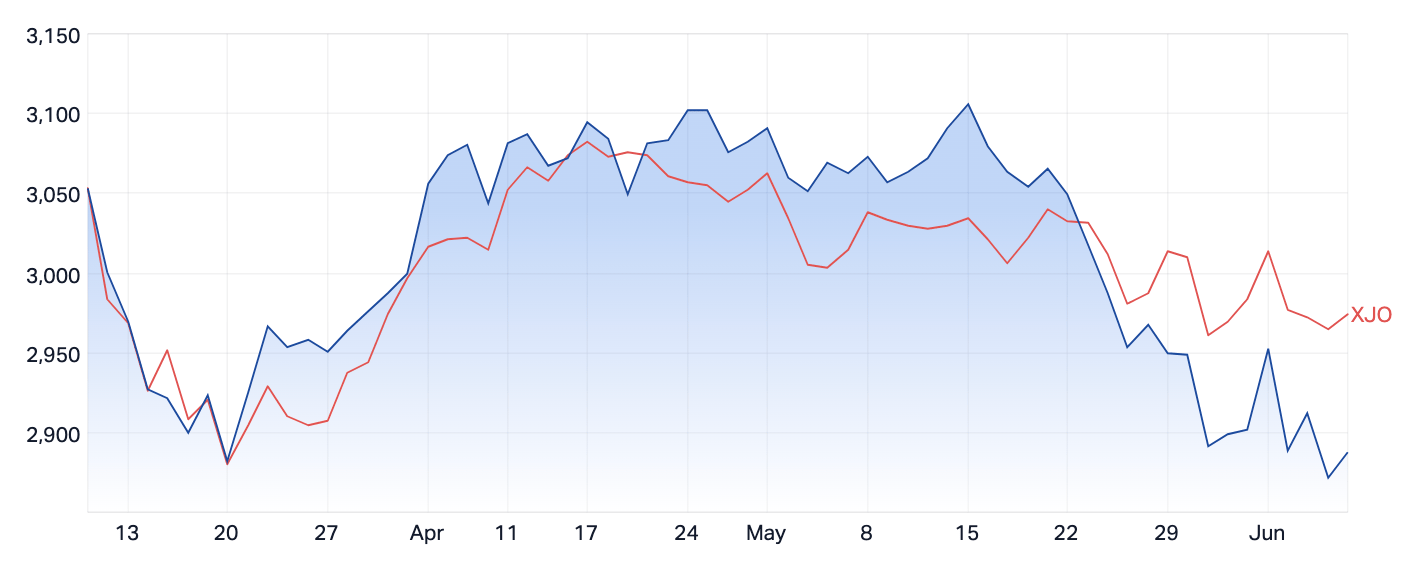

“With interest rates now at 4.1% and consumers bracing for further monetary tightening, spending could see a sharp decline. This is already being felt by consumer-sensitive stocks on the ASX, with the consumer discretionary sector (ASX: XDJ) falling by 0.3% this week and over 6% month-to-date.

“This will lead and already has led to retail companies such as Baby Bunting (ASX:BBN) to take the axe to full-year profit guidance as BBN did last week.”

The XDJ has now lost more than 6% over the last month of trade.

ASX XDJ (blue) down 6.1% MTD & Vs ASX200 (red) over QTD

The eccentric relationship: Wall Street – ASX

According to the central, inverse-square law force, when considering a two-body system consisting of a central body of mass (Wall Street, say) and a much smaller, orbiting body of mass (Like say, the ASX), i f the two bodies interact via a central, inverse-square law force (such as gravitation), then according to Newton and math etc – in the orbit equation can be written as:

And that’s where we are this week, although our orbit around Wall St is perhaps more eccentric.

US markets have been typically ebullient in the wake of (sorry, but it’s fake) good news regarding the US gov’t debt ceiling resolution. Traders also got excited about dovish central bankers and some decent job losses across the country.

Last week revealed in full the two-speed economic/sentiment tension between US markets and what’s happening at home.

The ASX200 had two cracks at its 200-day moving average despite a sad week of local data.

But rather than fall in a heap, the benchmark is being dragged into near reluctant gains by the gravitational strength of happy US markets, led by the Nasdaq.

With the US Treasury’s plastic unlocked, Ms Yellen’s crew have gone on a trillion US dollar borrowing binge. That will help yields rise.

The American jobless claims climbed to their highest level since October 2021.

The Economic Week Ahead

S&P’s brains trust – their Global Market Intelligence unit – say that the central bank meets in the States, EU, Japan, Taiwan and Hong Kong SAR will be the highlights. Giving traders a chance to hear central bankers’ views on WTF is happening with recent economic indicators.

“Further insights into economic conditions will nevertheless be drawn from various data releases including US consumer price index (CPI), as well as retail sales and industrial production figures from both the US and mainland China.”

The UK will also publish official labor market and growth figures while the EU drops revised inflation numbers.

The Fed Rate Decision

The final piece in the Fed’s puzzle, US inflation, is released just a day before the board meeting to decide their next policy move.

For now, it seems that the market consensus is for the Federal Reserve to pause its very special hiking cycle, and so far, market pricing hasn’t been wrong.

However, given how starry-eyed Wall Street is right now, another hike would be like a stake to the heart for US markets.

Blood, screams, equities under enormous pressure and a sudden arterial hardening of the US Dollar.

Josh: It’s worse that, he’s dead Jim

“What’s key for investors to understand is that a pause doesn’t mean the end. Uh-uh.

“Expectations are rising for the Federal Reserve to hike in July, but the bigger risk is if the door is left open for not just one but two hikes this year, which would then smother the run away Wall Street hopes of some rate cutting.

“Nevertheless, a pause from the Federal Reserve next week will likely be met with a rally from US markets, led by tech.”

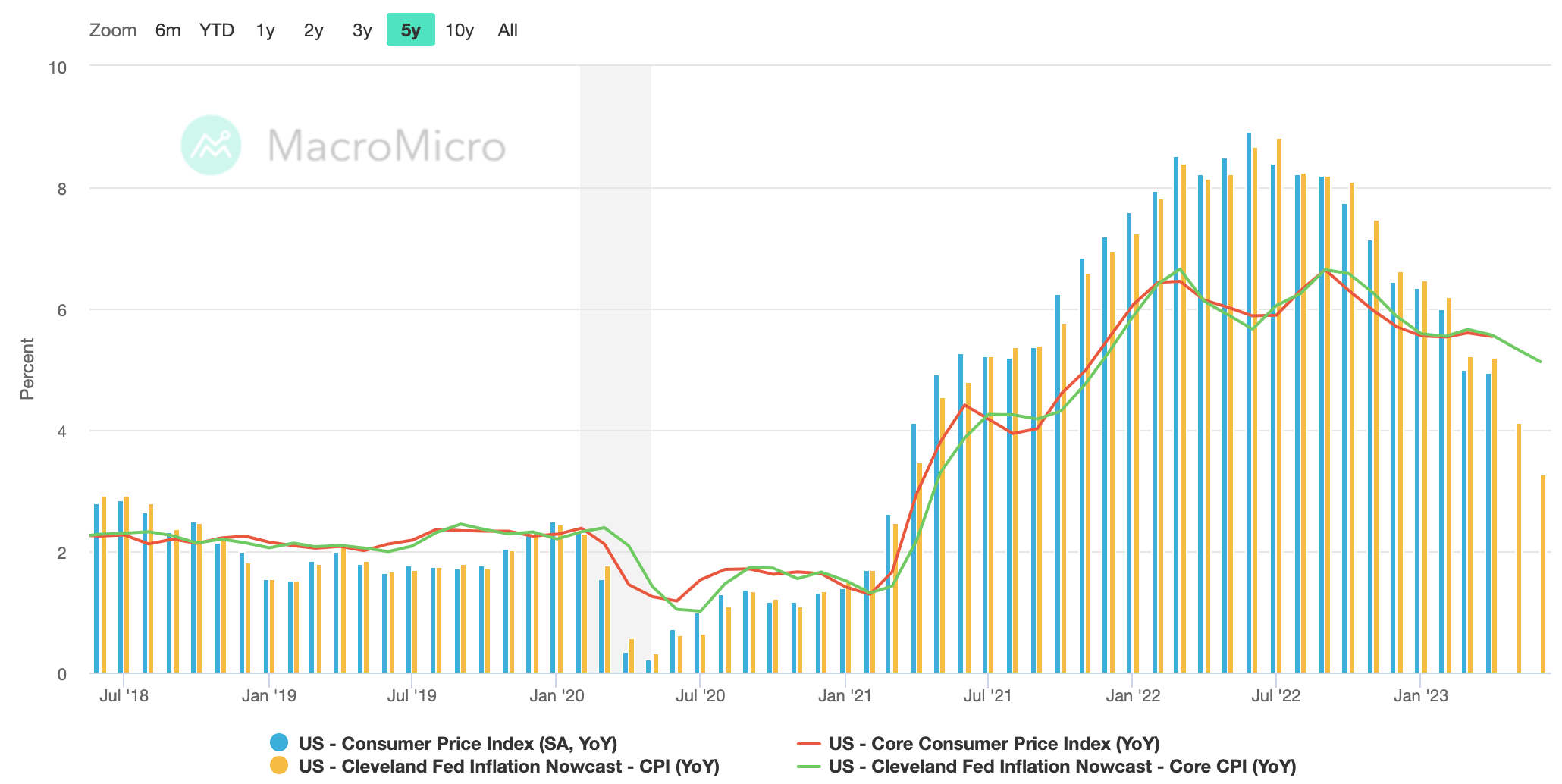

US markets are looking – practically already seeing – another fall in US inflation next week, with expectations of a headline reading of 4.1%.

For the Fed, Josh says, a cooling headline print would be welcomed, “but their attention will be on core prices that are likely to remain sticky and cause a further headache for (Fed Chair) Jerome Powell.”

Cleveland Fed Inflation Nowcast: CPI (5 years)

The Cleveland Fed’s Nowcast of inflation suggests that the core inflation reading will come in at 5.3%.

“If these readings align with estimates, it would show that the headline continues to move in the right direction, thanks to falling energy costs, but underlying inflation, excluding energy, is still well above where the Fed would like it to be,” Josh adds.

A fair few FOMC Fed speakers. J Powell incl, have been foreshadowing they could be persuaded to leave the Funds rate on-hold in June.

However, according to CBA’s Harry Otley, the risk of a 25bp “is material.”

“Our judgement gives a 30% chance of a hike,” he said on Friday.

According to S&P the current consensus points to the Fed pausing in June amid slowing inflation, whereby expectations are for further easing of CPI growth in May.

“Projections and Fed Chair Jerome Powell’s views will therefore be key, with additional interest on the Fed’s take towards stubborn looking service sector inflation and a resilient job market, juggled against an already-fragile manufacturing sector,” S&P GMI said.

What’s good for the US Geese is good for the European Geese, S&P says. Well. In a roundabout manner.

Another hike in June appears to be on the cards at the Domocile de Douleur we call the European Central Bank (ECB), but whether the ECB will continue hiking beyond June is less certain given recent indications of a slowdown in growth and cooling price pressures.

“Divergences in global inflationary trends persisted in May with global manufacturers seeing average prices charged falling for the first time in three years.”

The S&P Intelligence unit says this split in price trends was also evident in the EU, with recent comments by ECB boss Christine Lagarde just about losing her ice cool over the ongoing upward trend of services costs in Europe.

Far from the EU, across the channel in the United Kingdom, April GDP growth figures and labor market data will be watched for inflation smoke signals. Like us, Brit policymakers will be very keen to get a look at wage growth data.

The Economic Calendar

Monday June 12 – Friday June 16

All sources from Commsec, Trading Economics, S&P Global Research

MONDAY

Australia, Philippines Market Holiday.

Yay.

TUESDAY

CommBank Household Spending Indentions (May)

WBC-MI Consumer Sentiment (June)

NAB Business Survey (May)

WEDNESDAY

Nope

THURSDAY

Aussie GDP growth, Production Basis (Q1)

Australia Employment Change (May)

FRIDAY

Nope

&

Everyone else

MONDAY

Japan PPI (May)

Indonesia Consumer Confidence (May)

Malaysia Retail Sales (Apr)

India Industrial Production (Apr)

India Inflation (May)

China (Mainland) New RMB Loans, Loan Growth (May)

TUESDAY

South Korea Market Holiday

Indonesia Retail Sales (Apr)

United Kingdom Labour Market Report (Apr)

Germany Inflation (May)

Germany ZEW Economic Sentiment (Jun)

United States CPI (May)

S&P Global Investment Manager Index*

WEDNESDAY

South Korea Import and Export Prices (May)

New Zealand Current Account (Q1)

South Korea Unemployment Rate (May)

China (Mainland) FDI (May)

United Kingdom monthly GDP, incl. Manufacturing, Services

and Construction Output (Apr)

UK Balance of Trade (Apr)

India WPI Inflation (May)

EU Industrial Production (Apr)

US PPI (May)

US Fed FOMC Meeting

THURSDAY

New Zealand GDP (Q1)

Japan Balance of Trade (May)

Japan Machinery Orders (Apr)

China House Prices (May)

China Industrial Production, Retail Sales (May)

China Unemployment Rate, Urban FAI (May)

Hong Kong HKMA Interest Rate Decision

Indonesia Trade (May)

Germany Wholesale Prices (May)

Taiwan CBC Interest Rate Decision

EU ECB Interest Rate Decision

EU Balance of Trade (Apr)

ECB President Christine Lagarde Holds Fabulous Press Conference

Canada Existing Home Sales Mom May

US Industrial Production MoM

US Retail Sales (May)

FRIDAY

Singapore NODX (May)

Japan BOJ Interest Rate Decision

EU Inflation (May, final)

US UoM Sentiment (Jun, prelim)

The ASX IPO calendar for this week

Nope.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.