Scott’s Super Home Buyer fix is not a solution… because the boom ain’t over, it’s just left the city

Picture: Getty Images

So over the weekend, the Coalition government of Prime Minister Scott Morrison played its property card for a second term in power, leveraging the national obsession with home-ownership by announcing two new policies uniting the double-perplexity of housing and superannuation.

With the federal election but a few sleeps away, the first less glamorous move was to lower the age threshold for accessing ‘downsizing contributions’ to superannuation.

The second headline move was a ‘Super Home Buyer Scheme’, which would target younger Australians, allowing them to borrow up to 40% of their superannuation to plonk into a deposit for their first home (capped at up to $50,000).

With housing affordability now a key federal election issue, opinion is cleft in twain about how to do this without making things worse.

As the legendary, oft cantankerous independent economist Saul Eslake has noted time and again, almost every time a politician takes a crack to confronting housing affordability the idea is some daft variation of pumping up demand.

Demand is not the problem, Scott

Both Ken Morrison, CEO of the Property Council of Australia, and Jane Rennie from the CPA Australia welcomed any major housing policies to tackle affordability, but warned regional and city prices could spike if the issue of housing supply is not solved.

Rennie says these kind of ‘demand-based’ policy tweaks just add to the upward pressure already stoking house prices, suggesting that just bloody increasing the supply of housing is probably the best way to tackle high prices.

Dr Rennie, in comments provided to Stockhead, says housing affordability is a high priority issue, but flooding the market with superannuation dollars isn’t a fix.

“We caution against implementing any demand-based solutions which may inflate house prices further, such as the Coalition’s Super Home Buyer Scheme or Labor’s Help to Buy policy.

“We don’t support the use of mandatory superannuation contributions for purposes which are unrelated to retirement savings, like home ownership.”

It’s something fundamental about supply and demand, but either side of the political equation aren’t too adept at hearing a week out from the national ballot.

That said, Rennie’s particularly wary of the Coalition’s Super Home Buyer Scheme, arguing that the fundamental purpose of superannuation is to provide an adequate income in retirement, not to fuel debt.

“The fundamental purpose of the superannuation system is to provide an adequate income in retirement. Early access erodes the value of the member’s super savings, which increases the risk there may not be enough in the ‘pot’ to provide a sufficient income in retirement.”

Ken Morrison, CEO of the Property Council of Australia, welcomed both major housing policies from the Coalition and Labor to tackle affordability concerns. But warned prices of properties around the country could spike and become further out of reach for young Australians if the issue of housing supply is not solved.

And adding ballast to the argument – Aussie rental asking prices are still on the rise according to the latest SQM Research, up another 1.4% across the nation’s capital cities in April and bringing the total rise over the past 12 months to 13.8%

And it’s no longer just an issue for the major urban centres.

Regional prices continue to outpace cities, Scott: CoreLogic

The Regional Australia property boom might be showing signs of slowing, but the pandemic-inspired Seachange still has regional home values outpacing capital cities at something of a canter.

CoreLogic’s latest quarterly Regional Market Update has dwelling values across the combined regions jumped 23.9% in the year to April 2022, smashing the combined capital city growth rate of 14.6%, as sustained and desperate buyers confront chronically short stock.

The equation suggests prices in glamour areas could rise by another 20% this year.

The growth rate across Australia’s 25 largest non-capital city regions eased from a peak of 6.6% in April last year to 4.7% in the three months to April, but the housing boom is far from over especially across the Hunter Valley in NSW, the Gold and Sunshine Coasts and even in dodgy Shepparton in Victoria all of which have jumped by around 10% since Christmas, according to Ray White’s chief economist, Nerida Conisbee.

CoreLogic’s research director Tim Lawless says the regional housing boom is still being driven by accelerated internal migration.

“The high level of demand is supported by estimates of home sales, which were tracking 20.1% above the previous five-year average over the three months ending April 2022.

“It seems many employers across the relevant industries have implemented permanent hybrid working arrangements for staff which is likely to be supporting the stronger demand trend across regional Australia.”

Generally regional prices arwe more affordable than capital city prices and while the comparison doesn’t always hold true there are big, big differentials in popular Sea/Country change hotspots, like in Newcastle and Lake Macquarie where median dwelling values remain $250,000 lower relative to Sydney.

Likewise the Illawarra’s median dwelling value is $143,000 lower relative to Sydney’s and Ballarat’s housing values are $203,000 lower relative to Melbourne’s median.

There’s always Geelong, Scott

Then there’s always Geelong where dwelling values are $5,350 cheaper relative to Melbourne.

According to CoreLogic the Hunter Valley, excluding Newcastle, was the best performing non-capital house market, with an annual growth rate of 34.3%, overtaking the Southern Highlands and the Shoalhaven, which were still up by 33.3%

“Across the Hunter Valley region the median value of a house is still well below $1 million implying less dampening pressures from worsening affordability,” Lawless says.

The largest change in sales volumes was recorded in Central Queensland (Qld) and New England and North West (NSW), which both recorded a 42.9% increase in house sales over the year to February

Houses in Toowoomba sold fastest in the 12 months to April, where the median time on market was 13 days, followed by Queensland’s Sunshine Coast and Gold Coast, where both regions recorded a median time on market of 16 days.

The slowest selling region for houses is the New England and North West region in New South Wales, where the median time on market was recorded at 46 days over the same period. Eek.

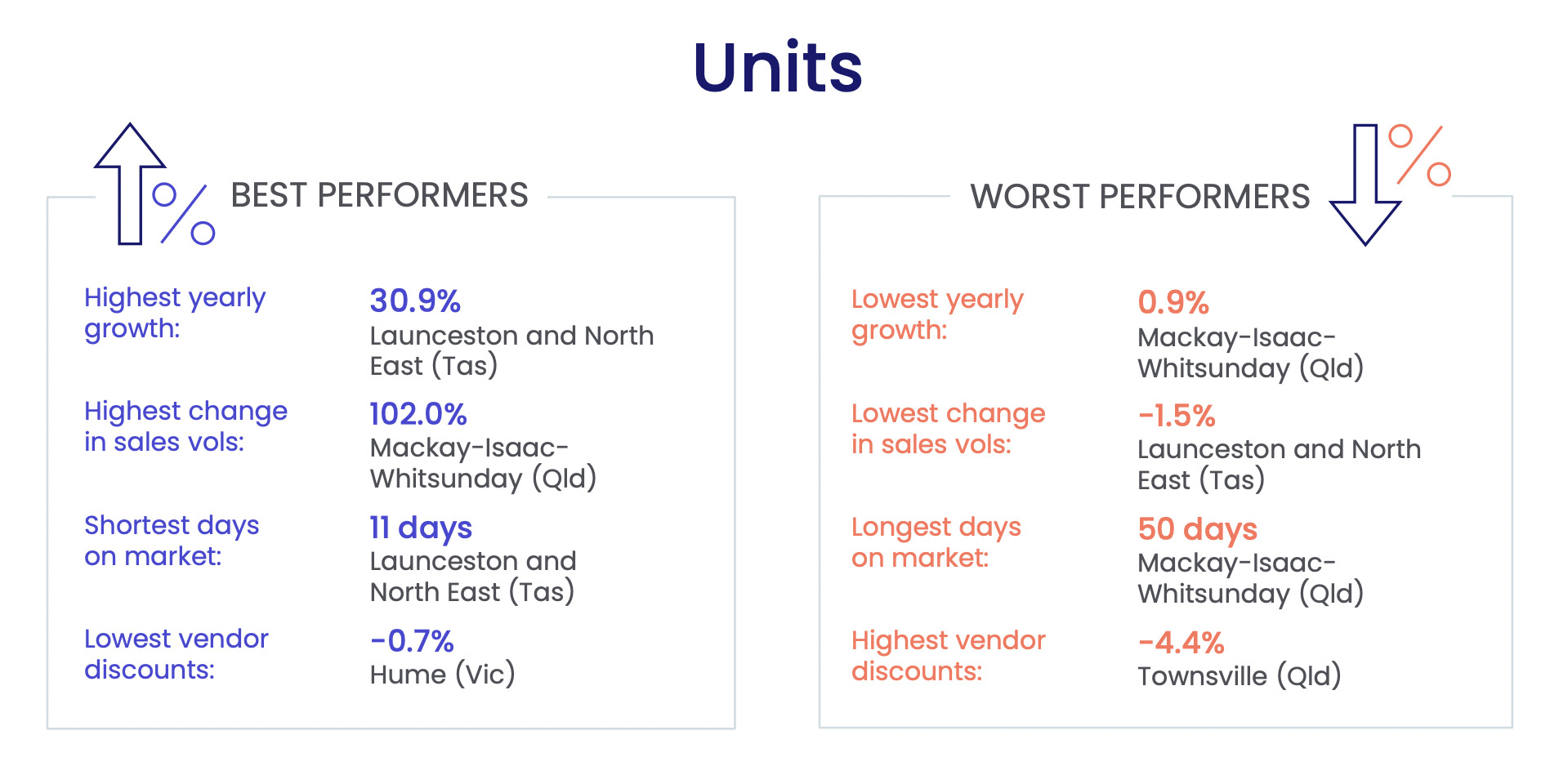

Across Australia’s regional unit market, the Launceston and North East region in Tasmania saw a 30.9% increase in values over the 12 months to April 2022, making it the best performing unit market. This was followed closely by Queensland’s Sunshine Coast (29.3%) and Gold Coast (28.4%) regions.

At the other end of the scale, Queensland’s Mackay – Isaac – Whitsunday (0.9%) and Townsville (2.2%) regions saw minimal growth over the same period.

A demand/supply disconnect, Scott

Although the median days on market and vendor discounting figures remain low, both metrics have softened in recent months, although the number of homes for sale across regional Australia is more than 40% below the five-year average and 20.5% lower than a year ago.

At the same time, regional sales activity is up some 20% above the five-year average, Lawless says.

“Clearly we are still seeing a disconnect between available supply and demonstrated demand,” he added.

“These conditions favour vendors over buyers. Buyers in tightly supplied housing markets are probably feeling a bit rushed in their decision making process and will generally have little opportunity to negotiate on the advertised price.”

As interest rates move higher and affordability pressure mount, CoreLogic suggests the outlook for non-capital regional markets is for “a softening in growth rates to more sustainable levels.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.