A super first home buyers policy? I wanted to scream, says Saul Eslake

Picture: Getty Images

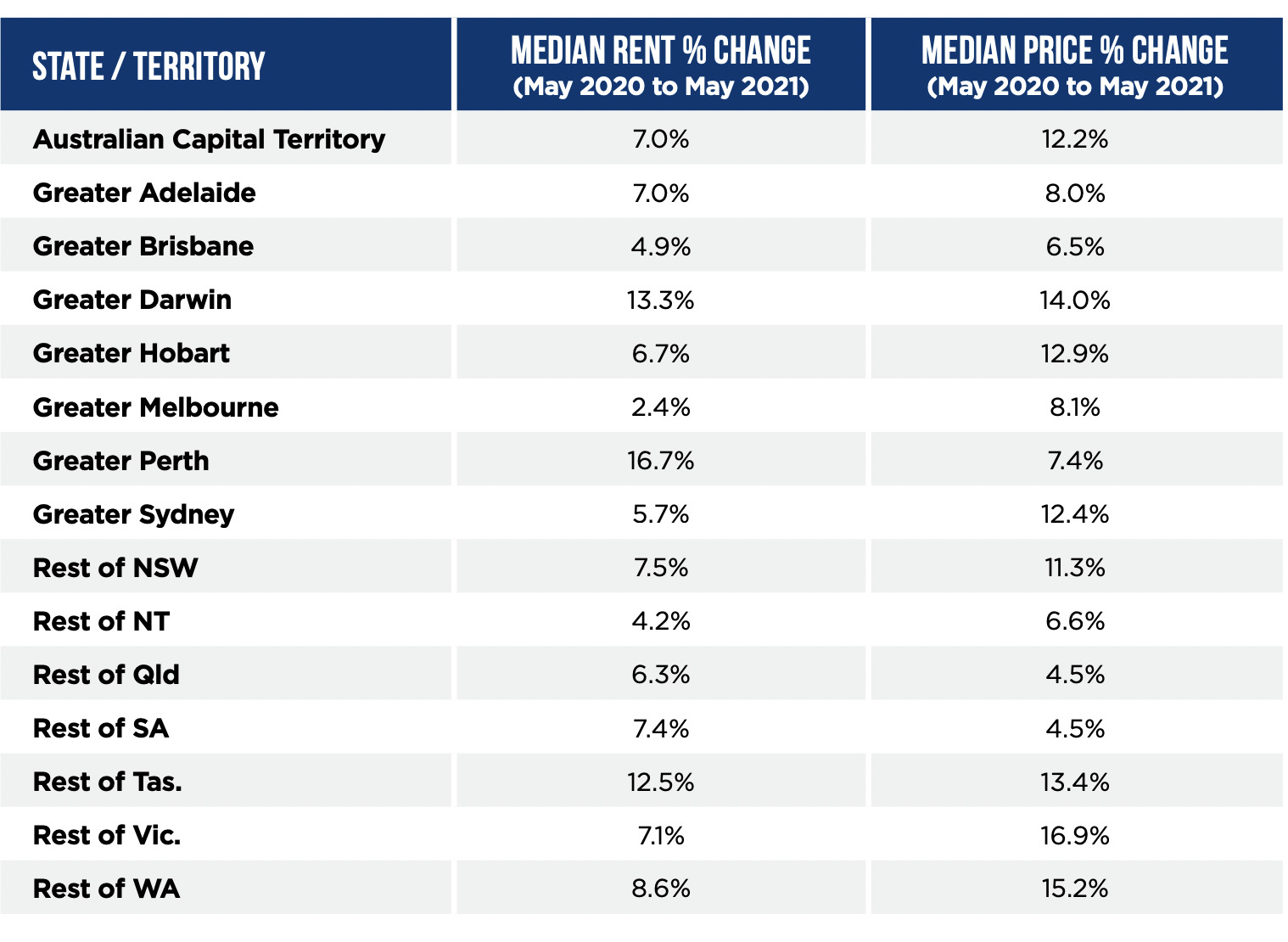

Prime Minister Scott Morrison’s latest-declared plan to allow Australians to dip into their superannuation to spend on a home deposit would set the clock ticking on another national housing price explosion.

This is according to the latest modelling out of the McKell Institute first prepared five months ago and foreshadowing the coalition policy announced on Sunday at its campaign launch.

Under Morrison’s scheme, first home buyers would be able to use up to 40 per cent of their superannuation up to a maximum of $50,000, and should Morrison win the upcoming election the scheme would begin from July next year. When the house is sold, the money would have to be repaid to the super account, plus a cut of any capital gains.

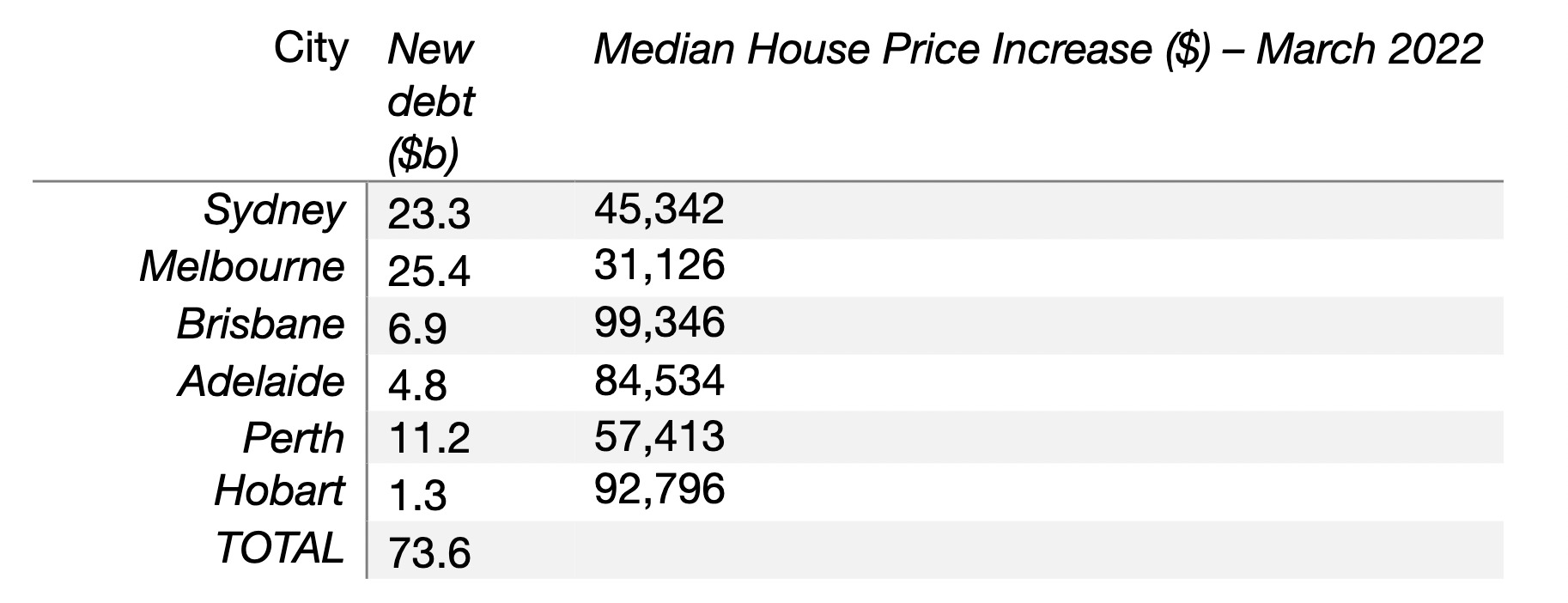

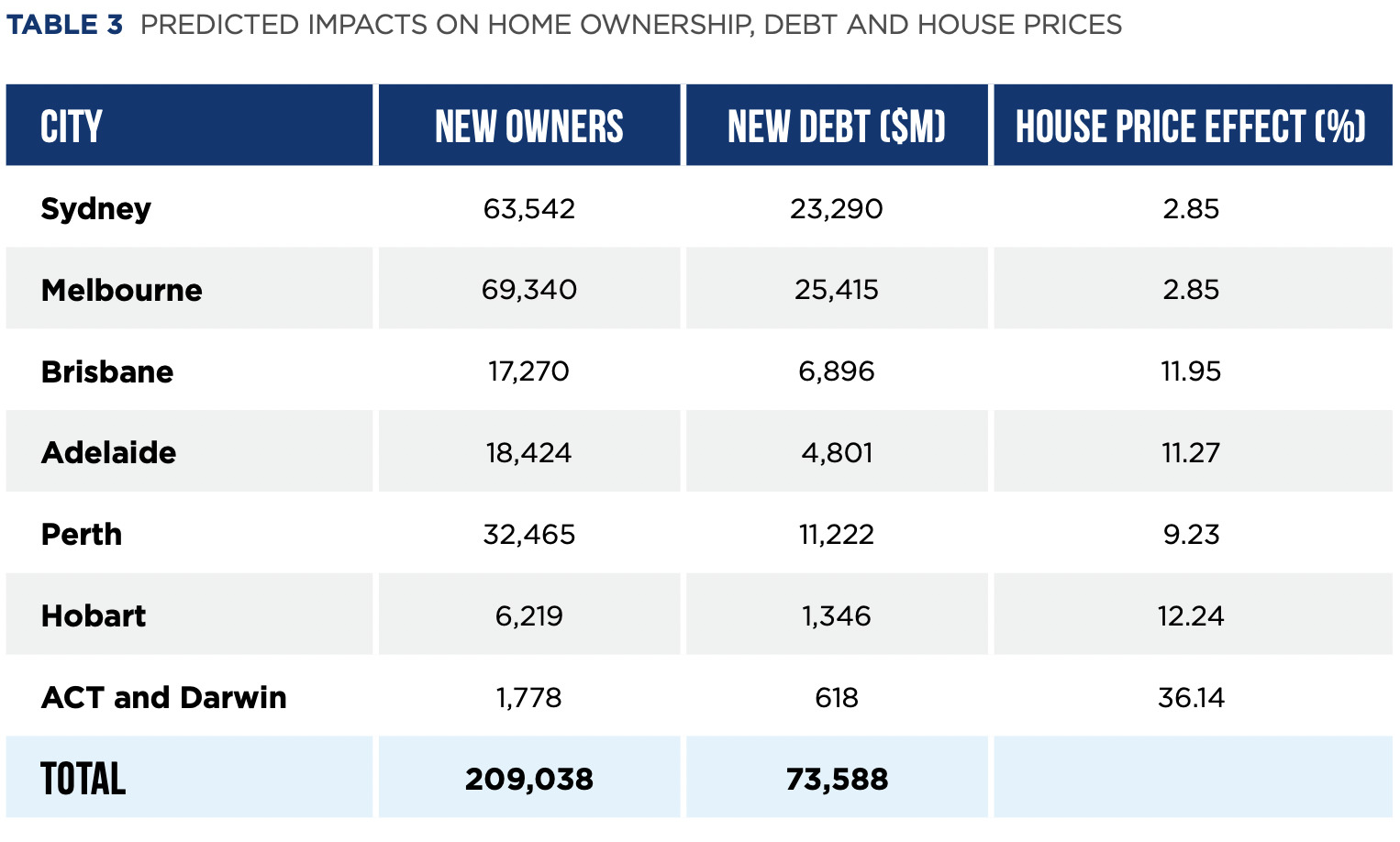

The new modelling done in concert with the Uni of SA shows the median house price in Sydney would increase by more than $40,000.

Up in Brisbane it would increase by almost $100,000.

Mike Rafferty at the Royal Melbourne Institute of Policy says while people have been quick to bag the idea, at least it’s an attempt to address an impossible challenge for so many young Australians.

“Both sides have seemingly acknowledged housing is just unaffordable – and their response has been extraordinarily weak and modest.”

But the McKell Institute suggest Melbourne households would be adding an additional $25 billion of debt. In Sydney, debt would jump by $23 billion.

Not a fan of the idea, independent economist Saul Eslake told the national broadcaster what he thought:

“My initial reaction was that I wanted to scream that this reckless inflation of house prices must stop,” he said.

“Anything which allows Australians to pay more for housing than they otherwise would, which this scheme undoubtedly does, results primarily in more expensive housing, rather than in more people owning that housing.”

“It will be greeted with despair by those would-be first home buyers who will see it rightly as pushing their dreams further out of their reach than they already are.”

The initial architect of Australian super, ex-PM Paul Keating called it a “‘frontal assault’ (on the system) by the Liberal Party”.

It’s not the first time the coalition has floated the notion of cracking open the super-egg to pay for a first-home deposit. Another ex-PM, Malcolm Turnbull, called it the “the craziest idea I’ve heard”.

Housing Minister Michael Sukkar said on Sunday the revamped policy won’t have a material impact on house prices.

“The Australian housing market is $9.9 trillion of value, first time buyers represent on average over the last five years about 100,000 purchases a year, which is less than a third of the market,” he said.

“The way we’ve calibrated the policy by only allowing people to withdraw up to 40 per cent of their superannuation up to $50,000 means that it’s at a level that it won’t have a material impact.”

McKell Institute’s executive director, Michael Buckland, strongly disagrees.

He thinks Australians who chose to invest in a house deposit instead of keeping their money invested in super would retire worse off, because the average returns in a super fund are a beat on the average growth in house prices over the long-term.

Buckland said the data showed the policy amounted to a further intergenerational transfer of wealth from young people to existing, older homeowners.

“Homes are already unaffordable for millions of Australians and Scott Morrison’s proposal would pour fuel on the fire,” Buckland said.

“What first home buyers desperately need is a little calm in the overheated housing market. This proposal would kick-start yet another house price spiral, stripping young people of their super savings and doing virtually nothing to improve real affordability.

“Super-for-housing would basically mean first home buyers handing their hard-earned retirement savings to existing property owners, when they would be much better off investing that money in super.

“Young Australians need their retirement savings quarantined and compounding. Using these savings to fuel yet another house price frenzy would be policy madness.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.