Rise and Shine: What you need to know before the ASX opens

(Getty Images)

On Stockhead today: September’s top 10 oil and gas small caps, Robin Hood trading app to steal from the rich brokers, a preview of the Biotech Lunch in Perth and fortnight’s biggest tech winners were fintechs.

But first:

The day ahead

Australia will get a key domestic data update with the release of August retail sales.

Markets are forecasting growth of 0.5 per cent after July’s 0.1 per cent fall, with the federal government tax cuts to provide a “temporary boost”, Westpac said.

The RBA will also be in focus, with the central bank set to release its half-yearly Financial Stability Review at 11:30am (eastern time).

Then once Asian markets close, all eyes will be on US employment data in September. The median forecast is for 140,000 jobs to be added, with unemployment to remain unchanged at 3.7 per cent.

Global stocks slumped mid-week after US private payrolls — a lead indicator for Friday’s jobs data — came in weaker than expected.

The following companies are in trading halts or suspensions and are expected to exit within the next 48 hours:

Today:

Otto Energy (ASX: OEL) – well update

Monday:

Big Star Energy (ASX: BNL) – capital raising

Veriluma (ASX: VRI) – acquisition

MedAdvisor (ASX: MDR) – capital raising

Force Commodities (ASX: 4CE) – trading compliance

BidEnergy (ASX: BID) – capital raising

Markets

Gold: $US1,476.18 (-0.18%)

Silver: $US17.20 (-0.01%)

Oil (WTI): $US54.29 (+1.25%)

Oil (Brent): $US59.43 (-0.78%)

Coal: $US69.62 (-2.87%)

Iron 62pc Fe: $US92.16 (-0.81%)

AUD/USD: US67.07c (+0.04%)

Bitcoin: $US8,206.59 (-2.28%)

What got you talking yesterday

Yesterday’s top story was our latest review of the semiconductor industry. Stockhead’s Nick Sundich took a closer look at the sector, and whether or not the market is due for a rebound.

Join our small cap Facebook group for a daily recap of our best stories and plenty of small cap discussion.

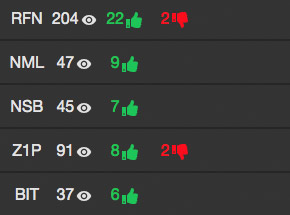

These were the five most-tipped stocks (weekly) on Stocks in Play:

Yesterday’s winners

Scroll or swipe to reveal table. Click headings to sort.

| Code | Name | Price | % Chg | Market Cap | Volume |

|---|---|---|---|---|---|

| NSE | New Standard Energy Ltd | 0.005 | +66.67% | $4.1M | 400.0k |

| ACP | Audalia Resources Ltd | 0.008 | +60.00% | $5.1M | 63.0k |

| WBA | Webster Ltd | 1.94 | +52.76% | $702.8M | 3.4M |

| ENX | Enegex Ltd | 0.012 | +33.33% | $966K | 80.0k |

| ADV | Ardiden Ltd | 0.004 | +33.33% | $6.8M | 7.0M |

| ALT | Analytica Ltd | 0.004 | +33.33% | $14.1M | 2.5M |

| BPH | BPH Energy Ltd | 0.004 | +33.33% | $6.0M | 475.3k |

| KEY | Key Petroleum Ltd | 0.008 | +33.33% | $13.5M | 38.2M |

| FSG | Field Solutions Holdings Ltd | 0.03 | +25.00% | $10.8M | 746.3k |

| PBX | Pacific Bauxite Ltd | 0.005 | +25.00% | $2.0M | 500.0k |

| ACW | Actinogen Medical Ltd | 0.05 | +23.68% | $52.6M | 105.8M |

| MJC | Mejority Capital Ltd | 0.02 | +23.53% | $2.6M | 660.4k |

| CZN | Corazon Mining Ltd | 0.003 | +20.00% | $6.1M | 500.0k |

| SHH | Shree Minerals Ltd | 0.006 | +20.00% | $3.6M | 3.1M |

| TMK | Tamaska Oil & Gas Ltd | 0.006 | +20.00% | $2.9M | 83.7k |

| TPD | Talon Petroleum Ltd | 0.003 | +20.00% | $5.3M | 500.0k |

| TRL | Tanga Resources Ltd | 0.003 | +20.00% | $4.7M | 520.0k |

| BSR | Bassari Resources Ltd | 0.02 | +20.00% | $41.5M | 10.3M |

Yesterday’s losers

Scroll or swipe to reveal table. Click headings to sort.

| Code | Name | Price | % Chg | Market Cap | Volume |

|---|---|---|---|---|---|

| VIC | Victory Mines Ltd | 0.001 | -50.00% | $3.0M | 57.5k |

| SRO | Shareroot Ltd | 0.002 | -33.33% | $2.9M | 32.8M |

| TMG | Trigg Mining Ltd | 0.14 | -30.00% | $8.1M | 1.0M |

| LHB | LionHub Group Ltd | 0.003 | -25.00% | $2.5M | 1.0k |

| IVO | Invigor Group Ltd | 0.003 | -25.00% | $4.6M | 52.0k |

| AWV | Anova Metals Ltd | 0.01 | -23.08% | $6.4M | 300.4k |

| IMC | Immuron Ltd | 0.14 | -20.00% | $24.7M | 4.5M |

| IP1 | Integrated Payment Technologies | 0.02 | -19.05% | $5.3M | 6.4M |

| 8CO | 8common Ltd | 0.08 | -17.53% | $12.5M | 200k |

| AZS | Azure Minerals Ltd | 0.19 | -17.39% | $26.3M | 1.1M |

| RMX | Red Mountain Mining Ltd | 0.005 | -16.67% | $4.2M | 794.7k |

| PWN | Parkway Minerals NL | 0.005 | -16.67% | $6.1M | 19.8k |

| NCL | Netccentric Ltd | 0.005 | -16.67% | $1.3M | 10.0k |

| GLV | Global Vanadium Ltd | 0.0025 | -16.67% | $7.8M | 6.5M |

| LER | Leaf Resources Ltd | 0.03 | -16.67% | $9.8M | 524.4k |

| BUG | Buderim Group Ltd | 0.19 | -15.91% | $15.9M | 255k |

| LMG | Latrobe Magnesium Ltd | 0.02 | -15.79% | $20.7M | 2.0M |

| MGU | Magnum Mining and Exploration | 0.05 | -15.38% | $16.7M | 541.2k |

| AER | Aeeris Ltd | 0.11 | -15.38% | $6.6M | 300.0k |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.