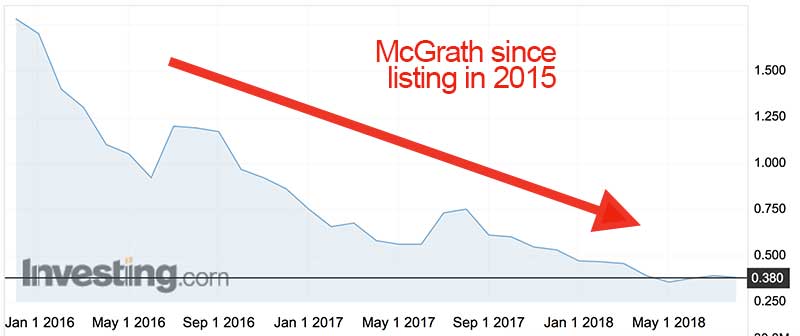

Real estate group McGrath slides to a $63m loss

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

McGrath posted a $63.1 million after-tax loss, hit by difficult market conditions, lower sales and the departure of some of the real estate agency’s sales agents.

Revenue was down 23 per cent to $99.2 million but underlying EBITDA earnings of $5 million hit guidance.

The results include one-off restructuring costs of $4 million and impairment charges of $59.4 million.

The ASX-listed real estate agency (ASX:MEA) earlier this year cleaned out its board of directors and replaced the CEO, following a slide in earnings, a drop in listings and the departure of some high performing agents.

McGrath chief Geoff Lucas says the last quarter of 2018 saw the beginning of a period of stabilisation, a new board of directors and a senior leadership team settled in.

“We are in the midst of a business turnaround,” he says.

“We are already seeing good progress in culture and agent recruitment, and critically we are seeing some strong sales results within our key markets.”

McGrath’s balance sheet had no debt and $10.9 million cash.

In June, the Aqualand Group paid $10.7 million for a 15 per cent stake in McGrath.

Improving the business

Lucas says McGrath is committed to restoring its industry-leading position.

“We intend to introduce a range of strategic initiatives that are designed to improve the business, including initiatives relating to learning and development, data driven technology improvements and assessment of select acquisitions,” he says.

“While the current property market conditions are challenging, we believe this will continue to generate some very real opportunities as more agencies and sales people will be seeking to join larger, well capitalised, quality branded groups like McGrath.

Company owned agent numbers returned to growth over the fourth quarter of FY18, and that trend has continued into FY19.

“Our strategic plan has, as its centerpiece, the goal of growing McGrath’s franchised and company offices across Australia over the next five years.

“We will be concentrating our growth in predominantly franchised offices along the eastern seaboard, with particular focus on Victoria and Queensland.

“We will also be strengthening our presence in our existing company owned offices with an additional focus on the growth precincts around Western Sydney.”

The 2018 results at a glance:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.