Property: Defaults up, renters in ruin and 1 of 3 homeowners in mortgage stress… back in July

Via Getty

- Some 1.5 million Aussies closing in on mortgage stress

- Rising number of homeowner default already emerging

- Renting, office, regional… most markets exhibit signs of significant probs

Australians are defaulting on their home loans at growing rates as the number of borrowers at risk of mortgage stress peaks at levels not seen since 2008.

Just before the global financial crisis hit.

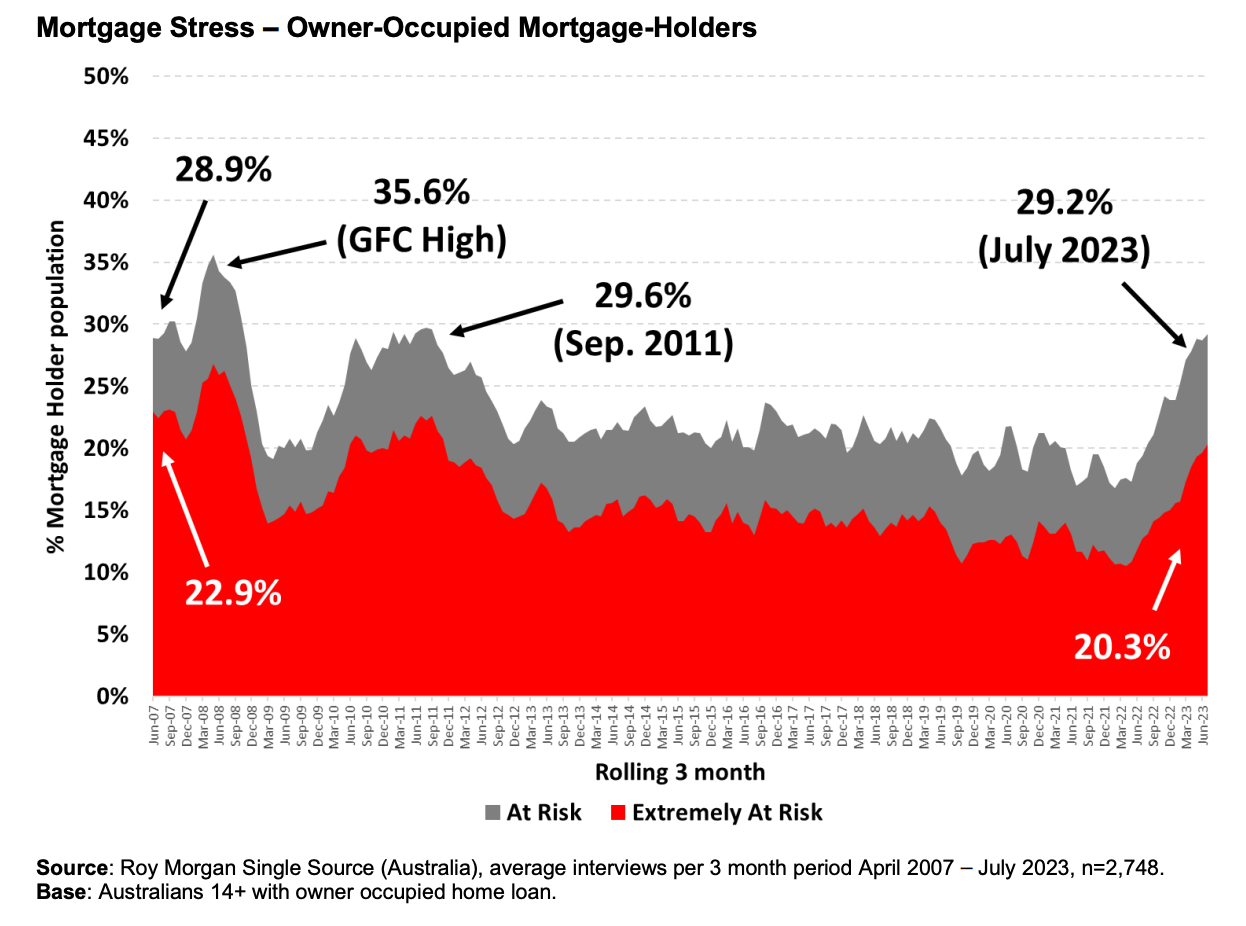

New research out of Roy Morgan suggests 29.2% of homeowners saddled with a mortgage of some kind were at risk of mortgage stress in July.

Roy Morgan says it’s a record high for ‘At Risk’ of ‘Mortgage Stress’ in the three months to July 2023, surpassing the previous record high reached in the three months to May 2008 of 1.46 million.

So that’s worse than the 2008 global financial crisis, which was no picnic.

It’s an increase of more than 640,000 more households at risk of mortgage stress after a year of interest rate rises.

What’s Mortgage Stress?

You’re not defaulting yet, which is good, but you are finding it a right challenge to drum up the money to pay bills and get about your day-to-day while hitting your home loan repayments.

While – according to Loans.com.au – there’s some varied definitions of what mortgage stress is, the garden variety definition is when a household is spending more than 30% of their pre-tax income on their home loan repayments.

Roy Morgan considers the risk of ‘mortgage stress’ among mortgage holders in two ways: Mortgage holders are considered ‘At Risk’ if their mortgage repayments are greater than a certain percentage of household income – depending on income and spending.

“‘At Risk’ is based on those paying more than a certain proportion of their after-tax household income (25% to 45% depending on income and spending) into their home loan, based on the appropriate Standard Variable Rate reported by the RBA and the amount they initially borrowed.

“Mortgage holders are considered ‘Extremely at Risk’ if even the ‘interest only’ is over a certain proportion of household income.

“‘Extremely at Risk’ is also based on those paying more than a certain proportion of their after-tax household income into their home loan, based on the Standard Variable Rate set by the RBA and the amount now outstanding on their home loan.”

The research, released on Monday, adds some kick to our cost-of-living-crisis-cake, with last week’s data on the length and breadth of the national rental crisis showing that having a roof over the head in this country is turning into a nightmare for many of us on both sides of the coin.

Borrowers already feeling the pain of dramatic interest rate rises are also nervously watching what the RBA will do when it meets in the first week of September.

Roy Morgan researchers say that while the percentage of those impacted is a tad lower than when the GFC hit, the actual number of us at risk is higher – because there’s more of us and the number of us going in for house buying’s gotten higher.

Now, all these borrowers are discovering what a cash rate cycle is and that historically low interest rates seemingly locked in around the COVID-19 do not last forever.

The data has 450,000 fixed home loans expiring in the next 12 months.

They’ve been in a pinch for more than 12 months already feeling the pain of dramatic interest rate rises, and are also nervously watching what the RBA will do when it meets in the first week of September.

Calamitous Cash Rates

There’s been 12 interest rate rises out of the RBA since May last year.

That’s hoiked the official cash rate (OCR) from 0.1% in May last year to 4.1% by June this year.

Since then, the RBA has bravely paused at its two most recent meetings in July and August and sat silently listening for signs the record rise is being digested across the economy.

This week, the last speech by deputy but-soon-to-be RBA Governor, Michele Bullock, (Tuesday) will assume new importance other than a passing of the central bank guard, with any clues around her personal take on the direction of interest rates to be hotly anticipated.

And, although the title of Ms Bullock’s speech is a little off topic – “Climate Change and Central Banks” – with CoreLogic’s data for August dropping this week (Friday) the new boss is going to have to talk about the elephants in the room, for sure.

The quandry of revivified house prices – thought to show a further 1% rise in capital city home prices – and rising costs won’t make Ms Bullock’s new gig, or the next decision on Monetary Policy any easier on mortgage holders.

Rotten rent

Ridiculously tight rental markets provide a vivid depiction of how surging demand and insufficient supply is whacking the national housing sector.

Record low vacancy rates and double-digit growth in the prices landlords are asking speak to a ‘intensity of pressures’ and near perfect storm which is still building, because there’s simply not enough affordable building.

According to Westpac’s August Housing Pulse, released on Thursday, most of the indicators suggest the rental squeeze has longer to run with additional supply unlikely to come onto the rental market anytime soon.

Silent cities

Then, dear Gawd, there’s the CBD office market.

A few weeks back, the Property Council of Australia (PCA) released new data on an awfully subdued capital city business district office space demand.

In fact – at 12.8% nationally – capital city CBD office vacancies are at their highest level in almost 30 years (1996). One in eight offices are empty.

Sydney’s office vacancy rate rose from 11.3% to 11.5%. Melbourne’s increased by 90 basis points to 15%.

But, looking on the bright side, the PCA’s NSW executive director Katie Stevenson said numbers, “reflected a resilient Sydney market… with the pipeline of new stock set to hit the market in 2023 and 2024.”

But Katie, that’s not good. New stock is bad, when we already can’t move what we have.

The federal PCA boss Mike Zorbas then suggested demand for office space was down due to corporate downsizing “in anticipation of a global recession.”

The problem, according to the PCA, goes far deeper than just negative demand – anyone that’s set foot in those CBDs over the last decade might note the insanely China-inspired set-to in the office supply growth department. The PCA says it’s been above the normal average since 2020.

But if normal means what’s been going on since before the Sydney Olympics, then the average is already a helluva lot.

“The very big peak in supply additions in 2021 and 2022 – well and truly eclipsing the average – explains a lot of where we are now,” Zorbas said.

Just a passing phase. A mini-glut.

It’s worse than that, he’s got a Mortgage, Jim

It does get worse. Rates take a bit of time to track through the economy, which is part of what will make Bullock’s job such an unthankful task.

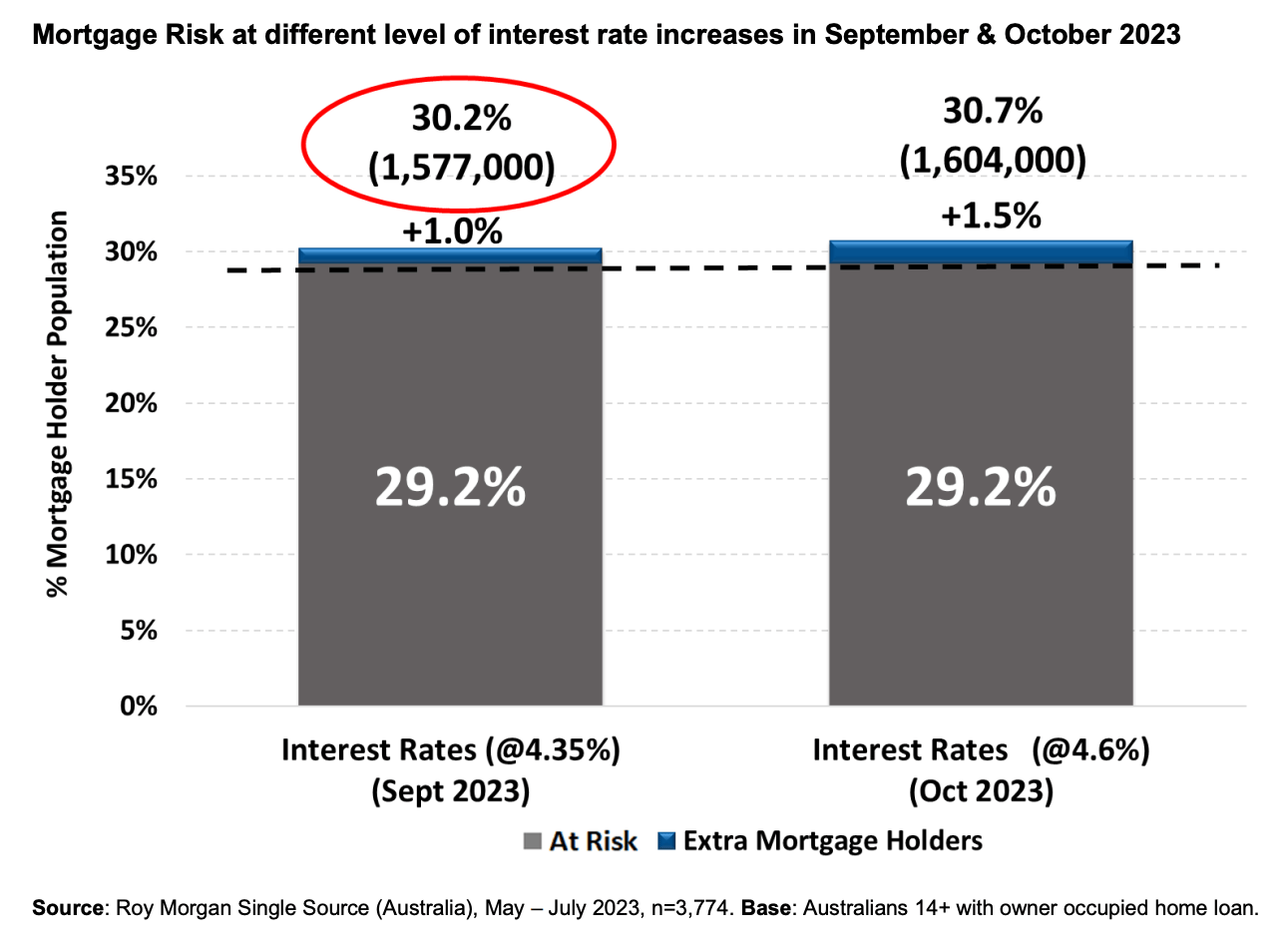

Roy Morgan calculates mortgage risk could increase to over 1.57m of us if the RBA raises rates by +0.25% in September.

Below is the result. The likely impact of x2 more potential RBA interest rate increases of +0.25% in both September (+0.25% to 4.35%) and October (+0.25% to 4.6%)…

In July, RM says 29.2% of mortgage holders (1,496,000,) were considered ‘At Risk’. Should the RBA raise interest rates by +0.25% in September to 4.35% there will be 30.2% (up 1% point) of mortgage holders, 1,577,000, considered ‘At Risk’ in September 2023 – an increase of 81,000.

And if Bullock et al lift rates by a further +0.25% in October to 4.6% there will be 30.7% (up 1.5% points) of mortgage holders, 1,604,000, considered ‘At Risk’ in October 2023 – an increase of 108,000.

Eek.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.