Housing affordability at 30-year low as home prices rise alongside cost of money

News

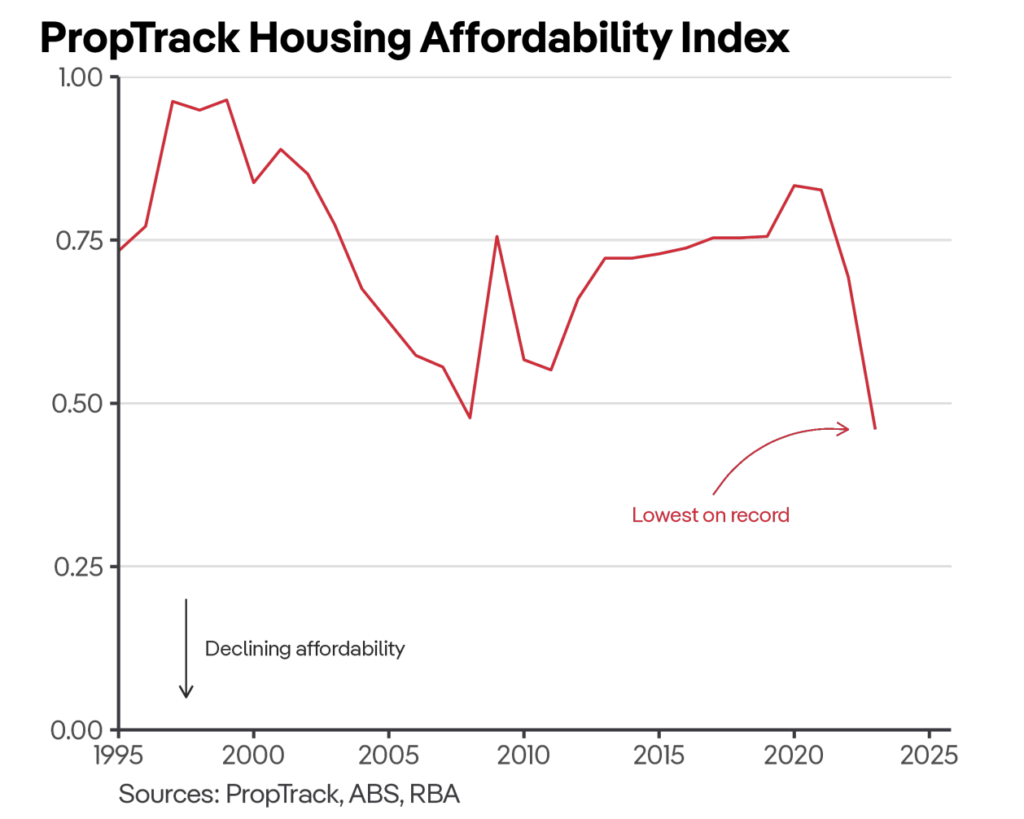

Australian housing affordability just clocked in at its worst level in at least 30 years, according to horrible new data from PropTrack.

The tragedy, three decades in the making, was basically driven by:

A) The 12 straight interest rate hikes

B) The brutal rise in mortgage rates and;

C) The weird way Aussie house prices just keep climbing despite A and B.

Here’s the really key takeouts from the report, in hellish bullies:

“Surging home prices throughout the pandemic and rapidly rising interest rates over the past year have brought housing affordability to its worst level in at least three decades,” PropTrack senior economist and report co-author, Angus Moore said.

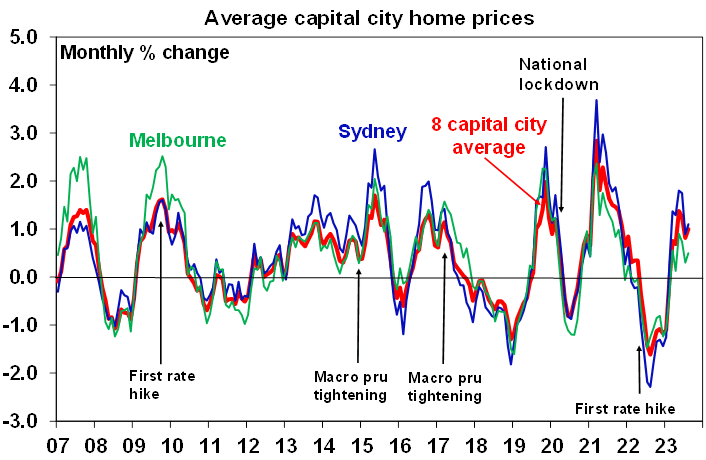

Moore says mortgage interest rates have increased extremely rapidly from the record lows in 2020 and 2021, following the rate hikes that began in May 2022.

“This has caused the sharpest increase in mortgage rates since the mid-1980s and has reduced borrowing capacities by as much as 30% for new borrowers.”

At the same time, existing borrowers, which make up around a third of Australian households, have faced sharp increases in mortgage repayments. According to PropTrack, a typical recent borrower now faces repayments as much as 50% higher than in early 2022.

“In August, home prices rose for the eighth consecutive month. This means there are now far fewer homes for which mortgage repayments are affordable than was the case over the past few years.

“Household incomes have risen since the pandemic and improved labour market conditions have drawn more people into employment and boosted wages growth. However, this has been insufficient to offset higher home prices and, critically, the surge in mortgage rates,” Moore said.

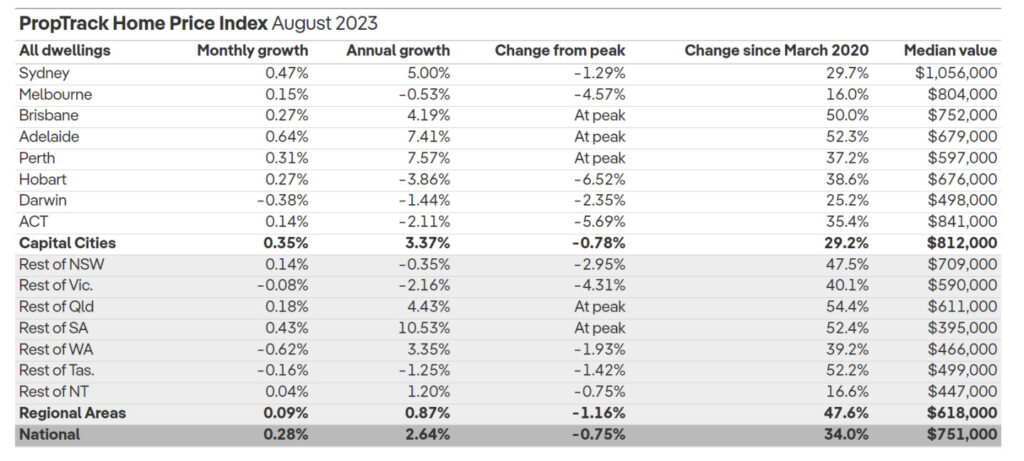

According to PropTrack’s senior economist and oracle Eleanor Creagh, Aussie home prices rose even further in August, jumping a 0.28%.

PropTrack’s, national home prices are now 2.64% higher than a year ago and up 3.51% so far this year.

Sydney continues to lead Australia’s home price recovery, with prices increasing a further 0.47% in August. Sydney prices are now up 6.19% from their trough in November 2022 and are just 1.29% below their peak recorded in February 2022.

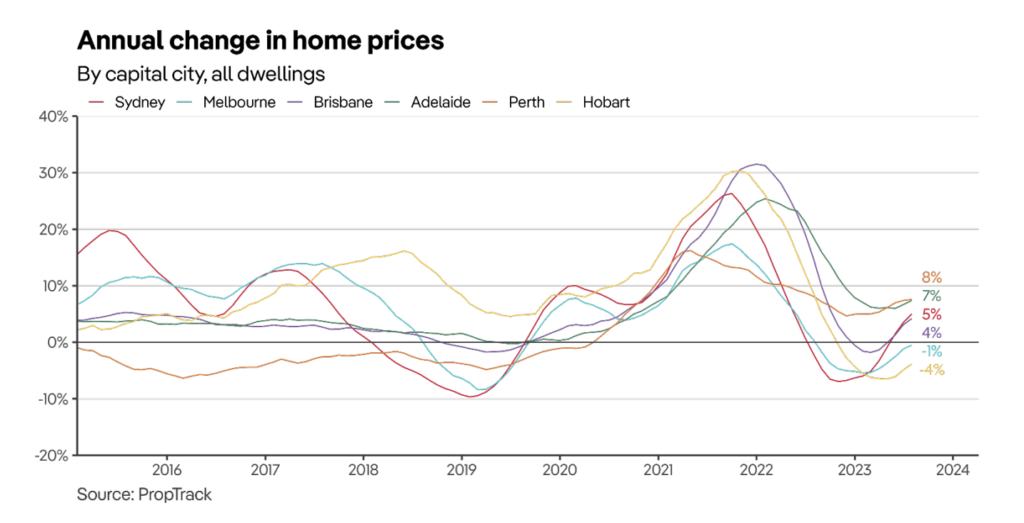

“August marked the eighth consecutive month of national home price growth.

This is the longest period of consecutive monthly growth since the pandemic boom when prices rose for 23 months straight between May 2020 and March 2022.

National home prices have now regained the majority of price falls seen in 2022.

“For much of this year, stronger housing demand and a limited flow of new listings hitting the market have offset the impact of interest rate rises.

“In Sydney and Melbourne, the flow of new listings is increasing as seller confidence improves. However, buyer demand still far outstrips supply, putting upward pressure on prices.

“Limited choice in Brisbane, Adelaide and Perth, has led to strong buyer competition and solid selling conditions, pushing prices to fresh peaks in August.

“As more new listings come to market over spring, we may see the pace of home price growth start to slow. However, with interest rates stabilised and likely near or at their peak, the confidence in the market is likely to sustain, resulting in more of the country returning to positive annual price growth.”

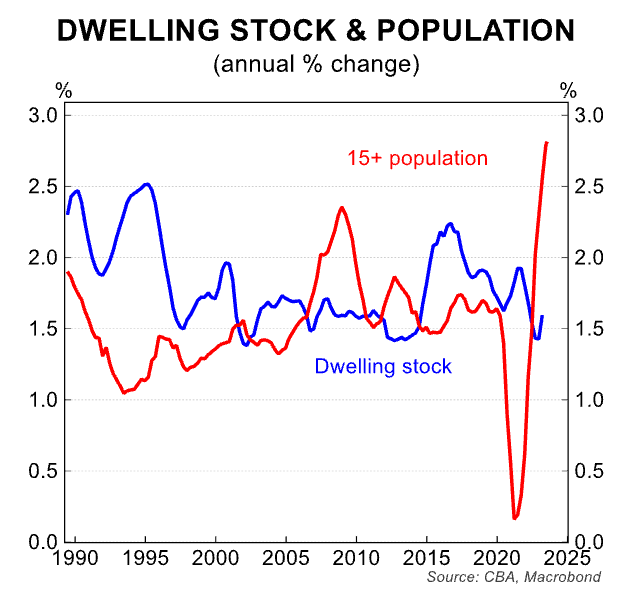

Below average levels of new listings continue to be main cause of home price gains, coupled with strong demand. Demand stock and population are at loggerheads as the CBA chart below suggests. No getting round it.

CoreLogic notes that across the combined capitals, total advertised supply levels are 15.5% lower than a year ago, and 19% below five-year averages.

“While there has been a lift in new listings in recent months, this new stock is being absorbed by the market. As a result, purchasing activity is light. We expect this is impacting on demand for households goods in the broader economy,” CBA says.

CoreLogic data showed national average home prices rose 0.8% in August, up slightly from 0.7% in July, their sixth monthly rise in a row. They are now up 4.9% from their February low.

Monthly gains are down from 1.2% in May, but remain strong, particularly across Sydney, Brisbane, Adelaide and Perth, although prices fell in Hobart and gains were weak in Canberra and Melbourne.

Such dispersion is not unusual. Sydney property prices led on the way down early last year and they led on the way up early this year.

The rebound in Aussie prices since February is the result of a decade of governmental neglect, as the latest surge in demand accelerates on the back of a burst of immigration adding to the underlying dearth of supply.

How strong are these over-riding factors?

Well, even in the face of 12x interest rate hikes, they’ve driven house prices onward and upward – Sydney’s mean home price is now $1.1 million, Brisbane houses are now on average worth as much as Melbourne’s.

AMP Capital on Friday says its base case is that property prices have seen the low for this cycle and will rise around 5% next year as interest rates start to fall.

With a rider:

“Our confidence in this forecast remains low as the risk of another leg down in prices is high as interest rate hikes continue to impact and the economy slows pushing up unemployment. So far though the property market has proven pretty resilient.

“These are the forces at play – chronic housing undersupply shoving home prices higher vs. the still evolving impact of mortgage rate rises and likely rising unemployment.”

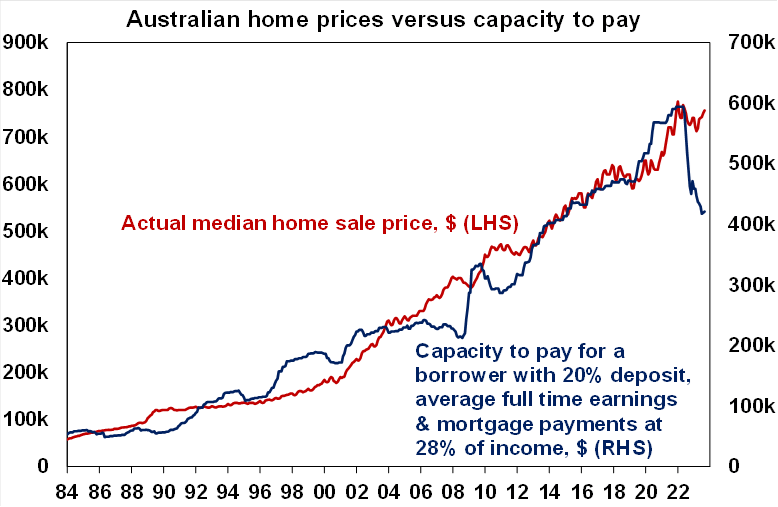

“Even though rates may have peaked, there has been a big hit to home buyer ‘capacity to pay’ which remains in place – we estimate that the capacity to pay for a home for a borrower with a 20% deposit on full time average earnings is around 29% lower than it was in April last year.

“The rapid reversal in the capacity to pay since May last year due to the surge in mortgage rates threatens a downwards adjustment in home prices at some point unless incomes rise dramatically or mortgage rates fall dramatically. This adjustment in prices could come once (or if) housing demand from less interest sensitive buyers is exhausted.

“There is a high risk of increased listings by distressed sellers – this may come from variable rate borrowers and the rollover of fixed rate mortgages which is now underway. On the RBA’s estimates more than 15% of variable rate borrowers (which covers about 1 million people) will have negative cash flow by year end.

“All of which when combined with higher unemployment as the economy slows could lead to an increase in listings by distressed sellers. In fact, we have seen an unseasonal rise in new listings through July which may reflect some combination of homeowners just concluding that now is a good time to sell and/or a pick-up in distressed selling. So far though the rollover of fixed rate borrowers to much higher rates appears to be occurring without major problems, but there is still a way to go yet.

“At the same time, rising rents are likely to reduce some of the tightness in the rental market by encouraging more young people to move into share accommodation or to stay at home longer with their parents thereby pushing household size back up to pre-pandemic levels, which will ease some of the pressure in rental markets.

“Similarly, were the economy to slide into recession it’s likely that the Government would cut the immigration intake, further reducing the underlying demand/supply imbalance.

“In the last three major cyclical upswings in home prices lower interest rates have been required to drive a sustained rise in home prices and this is unlikely until next year. So, the rebound in home prices so far this year looks premature relative to the normal cyclical relationship with interest rates.”