How high Lowe goes is the only shock that matters for Aussie property in 2023

Via Getty

A tough run all round for Aussie property in 2022.

Adam Lawrance, Director at Lawrance Private Wealth says you’d be hard-pressed to find a more disliked public figure in 2022 than Reserve Bank of Australia Governor Dr Philip Lowe.

The RBA has hiked interest rates for eight consecutive months, taking the cash rate from 0.10 per cent to 3.10 per cent and that’d be reason enough.

“But this all comes after Lowe assured borrowers as recently as November last year that the conditions for a rate rise weren’t expected until 2024. Compounding the pain, inflation is 6.9 per cent, eroding savings buffers and disposable incomes,” the founder of Lawrance Wealth adds.

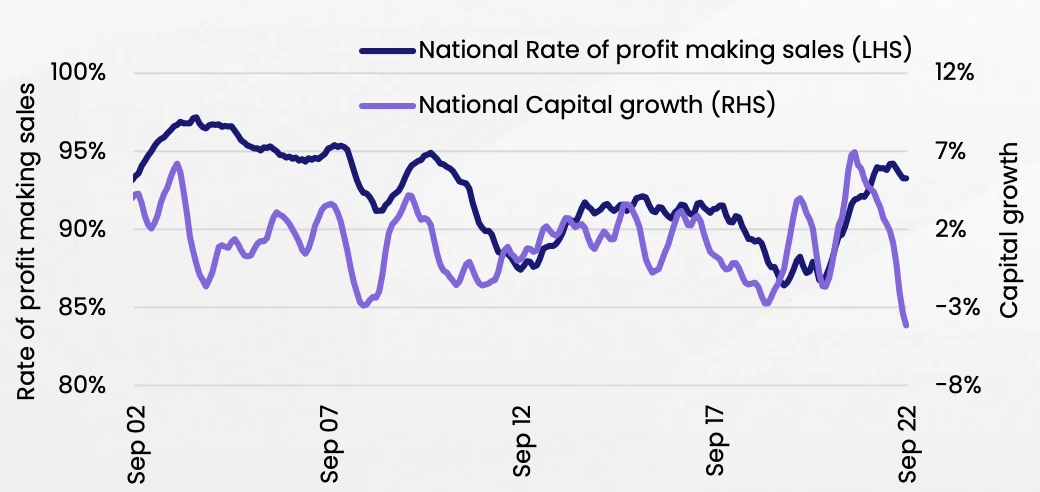

CoreLogic puts the rate of profitability in Australian residential real estate as still in decline through the September quarter, to 93.3%. (This is down from 93.9% in the June quarter, and a recent high of 94.2% in the three months to May 2022).

The slide in the portion of profit-making sales broadly coincides with recent home value falls. Australian dwelling values fell -4.8% between a peak in April 2022 and the end of September, and have since fallen a further -2.2% to the end of November.

“Notably, (at a -4.8% over 5 months), this had already proven the steepest housing market decline on record.

“While the value of homes in Australia declined sharply between April and September, the volume of lossmaking resales actually declined in this period, according to CoreLogic’s Tim Lawless.

“This is likely because of fewer sales and listings amid the housing market downturn, where overall resales nationally fell -17.8% in the three months to September, compared with the three months to April 2022.

Loss making resales had a smaller decline in the period, of -4.9%.”

State of play

Adam Lawrance, of Lawrance Private Wealth notes that coinciding with the first interest rate rise in April, national house prices have fallen 7.0 per cent from their peak.

“Put simply, an increase in interest rates acts as a handbrake on asset prices including property. Existing borrowers incur higher mortgage repayments, estimated to be $1,668 per month for a $1 million home loan. The borrowing capacity of new homebuyers also falls, limiting them to less expensive purchases,” he told Stockhead.

However, Adam adds, what is rarely mentioned is the significant equity buffers most households have built.

“House prices across the country have increased by 28.6 per cent since the onset of the pandemic.

“All cities, except Melbourne and Sydney, could weather a further 15 per cent price fall from here and still be above April 2020 levels. RBA data suggests a fall of 20 per cent in house prices would only increase the share of balances in negative equity to 2.5 per cent.

“The major risk to the housing market is therefore not in terms of home values – but the ability to service debt,” Lawrance says.

Nicola McDougall chair of the Property Investment Professionals of Australia (PIPA) agrees.

She says while it appears the Dr Lowe et al are nearing the end of the current rising interest rate cycle, the damage may already be done.

“It seems impossible to me that the rapid increase in mortgage repayments will not have a significantly negative impact on some households next year.

“Experienced and qualified property investment advisers never expected the cash rate to stay at 0.1 until 2024, however, eight rate rises in as many months seems to be excessive, especially given the lag period before it starts to impact consumer spending,” Nicola says.

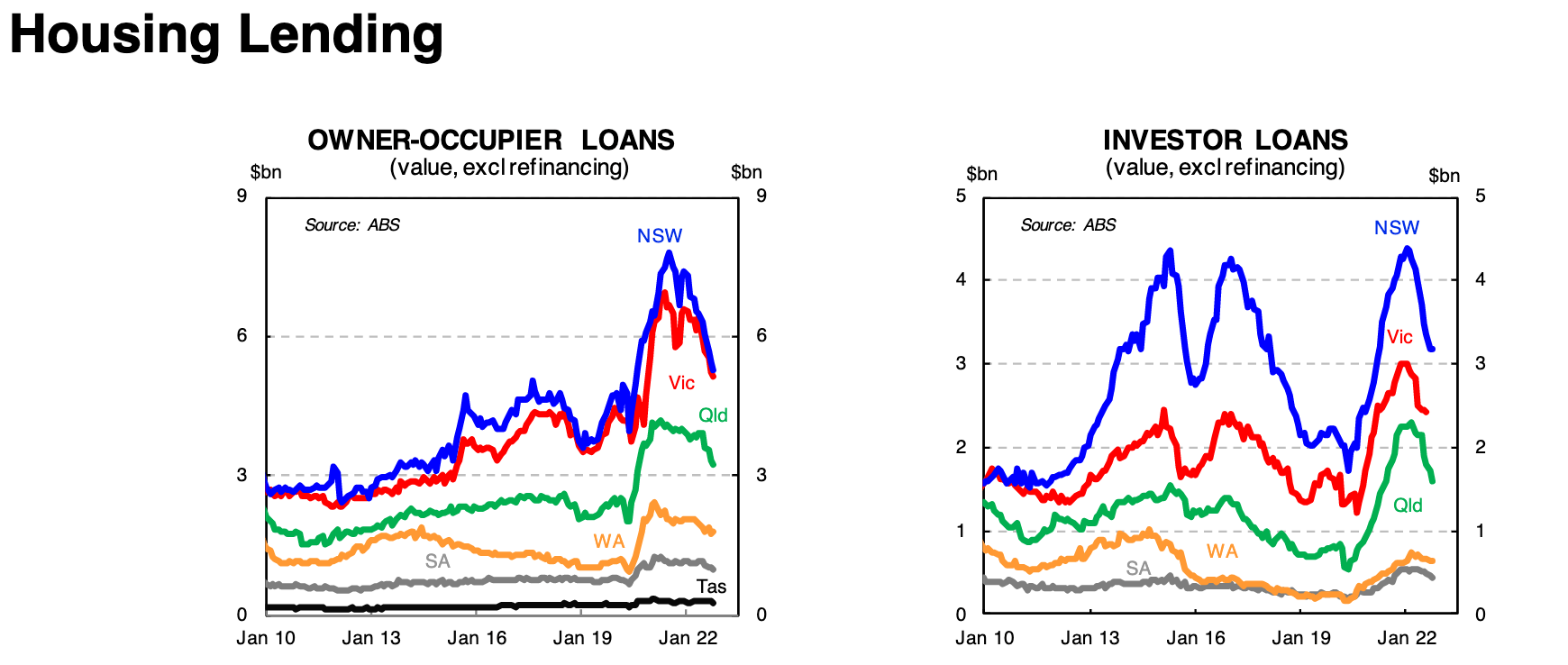

According to McDougall, investor activity is currently at an 18 month low after barely hitting the long-term average earlier this year (before rates started to increase).

“The situation does give me a sense of déjà vu given investors were stuck on the sidelines for a number of years from the mid2010s because of restrictive lending policies.

“Today, many potential investors simply can’t qualify for finance given the three-percentage point servicing buffer that is still in play. I expect investment activity to continue to dwindle next year which will further decimate rental markets.”

Cash flow stress

Watching the loan market, Lawrance believes Aussie households have so far proved resilient to increases in the cash rate – after all – overdue and nonperforming loans anchored to historical lows.

“However, we know monetary policy acts with a lag, meaning the full impact of interest rate hikes won’t be felt for another 12-18 months.

“Furthermore, many households took the opportunity to fix mortgages at 2-3 per cent, which won’t roll off until the second half of 2023,” he adds.

“At the current cash rate, 50 per cent of variable-rate mortgages would incur a monthly repayment increase greater than 30 per cent. For fixed-rate loans, it’s estimated that 60 per cent will incur an increase greater than 40 per cent.

According to Adam, it’s hard to ascertain precisely how households will react.

“But it’s clear this will cut into disposable income. Assuming another two 25 basis point rate hikes, 15 per cent of borrowers will have negative cash flows. To maintain repayments, this cohort will need to dip into savings or risk defaulting.”

Nicola MacDougall says that while higher interest repayments undoubtedly place stress on owner-occupiers, but with the rider that it shouldn’t pose too many headaches for the majority of Aussie homeowners.

She says in the latest BMM Property Market Forecast that selling remains the option of last resort option.

“Most households have significant equity buffers.

“The owner-occupiers most at risk are first home buyers, who typically borrow at the maximum borrowing capacity and buyers over the past year.

MacDougall says where the impact will be harder felt is with investors.

“For the last decade, negatively geared homes have benefitted from tax benefits and capital appreciation. Now, cash outflows are rising and capital values are falling. This is reflected in new lending, which shows a marked drop off in investors compared to owner-occupiers.”

Fundamentals remain solid

Adam Lawrance believes that, notwithstanding the impact of higher interest rates, our property fundamentals “remain strong and will underpin prices over the longer term.”

He says unemployment is at a multi-decade low of 3.4 per cent, supporting the ability of households to service higher repayments.

“Employees are also benefiting from varying degrees of wage growth, with private sector wages increasing 11 per cent annually. The rental market is extremely tight, with vacancy rates and weekly listings at decade-lows.

“There doesn’t appear to be a big supply response, with new dwelling approvals falling and builders struggling to cope with inflationary materials and labour input pressures.”

Increased migration will also underpin rental demand

Richard Crabb founder and MD of Aspire Advisor Network says the Albanese government has sent out an overseas SOS for talent, muscle and tax.

“We need more workers and more tax revenue, and we are looking to import these at record rates.

Over 200,000 migrants per year are expected and budgeted for over the coming years.

“Where are they going to live, given our tight rental markets?”

“So, a tight rental market will get tighter. Rents will rise – providing an inflation-proof investment – making it either harder or more important for home buyers to get their foothold on the ownership side.

Crabb says there are other variables in the mix in a post-COVID world now too.

“The interesting factor for me is the Work from Home trend.”

“With the current shortage of workers for jobs, the flexibility of work places has become a key point of attraction. Will this extend to new arrivals, or will employers wish to have offices restocked and the “old style normal” reinstated?

“The Great Migration”

Record numbers of Australians are relocating around the country in one of the biggest internal mass movements since the second world war. Property is now as much about “lifestyle locations” as it ever was distance to a train station now that so many can take their job with them wherever they go..

“This has created further ability for people to realise their equity in one house and move somewhere cheaper to buy a better property or have a better financial position, Crabb says in the Bricks & Mortar Outlook.

“It does not take a huge number of “pioneers” to stay the course and we will find their family/friends/ colleagues may look to do the same now they have a “social safety net” in a regional centre that was not there a few years ago.”

How far will house prices fall?

According to Adam Lawrance, inflation looks to be easing and will likely peak in the early months of next year. Global commodity prices are off 35 per cent and shipping rates have fallen 70 per cent. This will soon allow the RBA to slow the rate of hikes and reserve the ability to reduce them should the economy require it.

Ultimately, in the short term, house prices will be dictated by how far the RBA needs to increase interest rates. We think the RBA is nearing the end of its hiking cycle and will eventually pause to evaluate its impacts.

“It’s also worth pointing out that lenders historically stress test 250 basis points (recently increased to 300 basis points) above the borrowing rate. With 300 basis points already passed through, the RBA will be reluctant to keep raising because the impact on recent borrowers is now unknown.”

The big four banks largely estimate a fall from the peak of 15-20 per cent. Betashares, using its mortgage repayment ratio, estimates at least a 10 per cent fall to get back to the long-run.

“This range of forecasts is likely where house prices bottom, and depending on the city, above levels seen before the pandemic. Over a longer time horizon, Australian property remains well-placed. Immigration and an already tight rental market will drive demand in addition to the absence of new supply. Households are also entering the interest rate hiking cycle from a position of strength, which should mitigate against any serious downturn,” Adam told us, before heading off on his Honeymoon, I should add.

Congrats mate!!

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.