Not a total loss: Kogan is an utter bargain, albeit built on utter hubris

Via Getty

Shares in Kogan.com fell 7% on Tuesday, closing at circa $3.50 – about 60% off recent highs – after the Aussie version of Bezos.com finally delivered the maiden full year loss it’s been talking about since around Easter.

Never mind that says Morningstar. Even at $11.70, this stock is Fair Value.

The inference being: if you owned Kogan (ASX:KGN) and its $35.5 million deficit came as a surprise and you added your bit to the 7% drop, then frankly, you’re a bit of a goose.

I for one credit management for madly flagging its inventory-related mismanagement well ahead of schedule, so that even we were talking up the company’s not unenjoyable and, yes, possibly therapeutic looming slow-motion CAGR crash.

At the time I may’ve fingered hubris as the real culprit behind KGN’s unnessecary downfall.

After all, on one level Kogan.com is about being a really successful e-commerce businesses, selling everything from TVs, credit cards, clothes, Matt Blatt furniture and even insurance.

But, on another level, when you name something after your name it can really only all be about you.

In 2008, when CEO and founder of Kogan – Ruslan Kogan – launched his Ruslan-centric online marketplace, its mission statement was to delight customers. Whether that’s been achieved or not will be something executives are currently debating (the company says right now they’re actually obsessing over it). Whereas, on the other hand Kogan’s unspoken mission – to delight Ruslan – is not up for debate.

The whole Visionary as Founder thing put Ruslan and his handpicked Praetorian Guard in everyone’s crosshairs when the company made – in hindsight – an ill-advised inventory overreach.

It was peak-COVID…

…We all made mistakes:

The former US President for instance wanted to inject the world with UV light. Our former PM tried to take over everything. I failed to murder and bury several offspring in the backyard while I had the chance.

Ruslan Kogan thought the whole e-commerce thing had finally clicked.

“At last,” Kogan may’ve self-dialogued, “as I suspected – it was only a matter of time until everyone bought everything online.”

Thus vindicated, Kogan the Man stacked endless Kogan the Company warehouses full of endless crap. He overpaid for non-existent shipping and he didn’t see just how jack the customer base was of living online and being locked in.

Worst of all, on a net profit of barely $3.5 million, (a near 90% fall on the previous year), Kogan the Company gave Kogan the Man and his Men some $53m worth of sweet, sweet in-the-money options – materially screwing the NPAT and the accounts, with the non-cash equity-based payments totally needing to be booked, no matter how much the company shares your name.

So much for the damning aspect of The CEO as Star.

Now for the retraction

When your name is on the label there can be no hesitation.

As a working adult, endowed with free will, open access to information and a Volkswagen (VW) Tiguan, I know better than most the temptation to lie, cheat, conflate and fabulate my way out of a mistake.

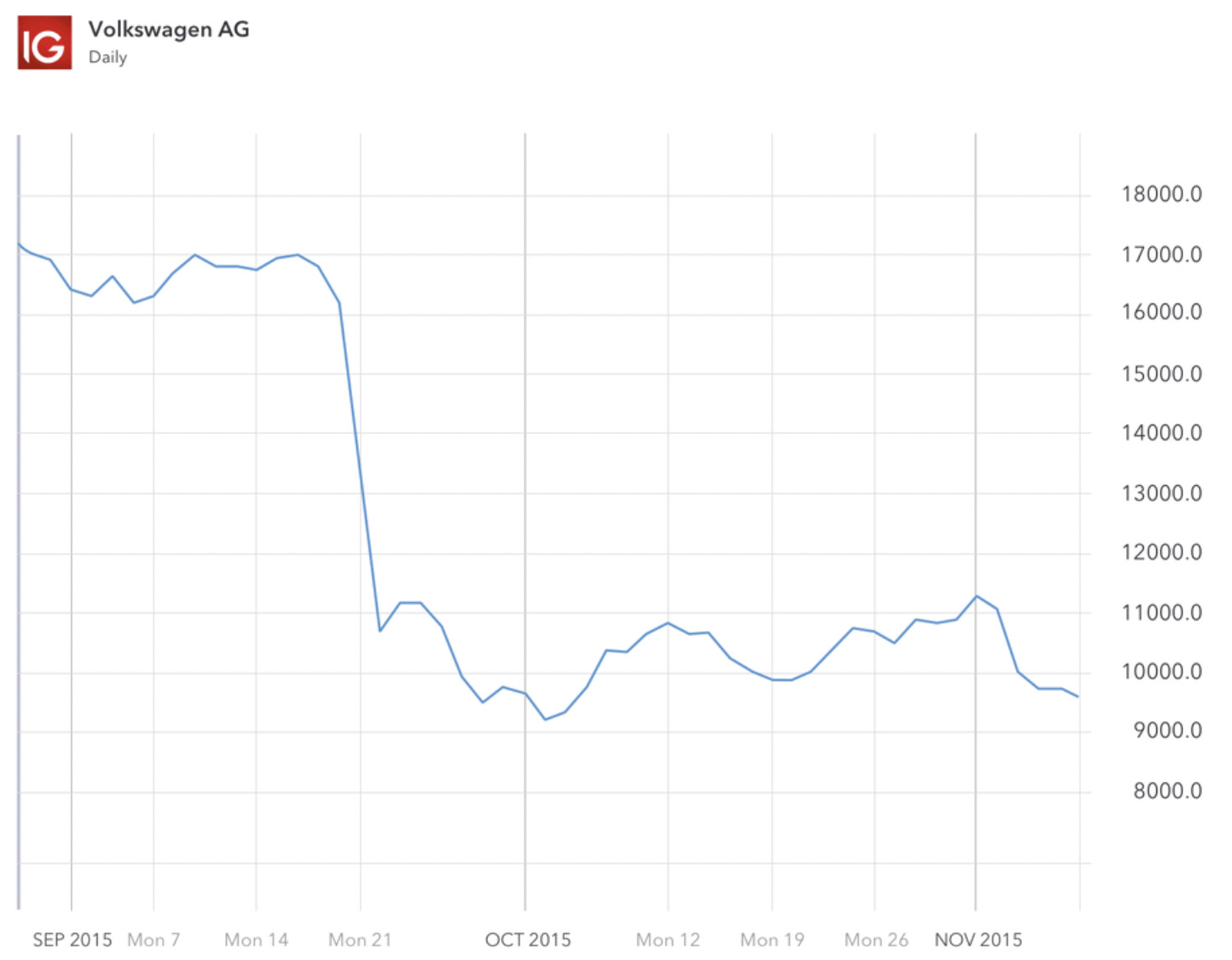

Volkswagen did just that when the US Environmental Protection Agency (EPA) said it thought VW had been cheating its emissions tests.

VW said something like, that’s crazy talk man, and went about its way.

It wasn’t. It turned out to be uncrazy talk about some very crazy behaviour like fitting ‘defeat devices’ to VW cars – or more accurately my VW car – such that would detect when the cars were undergoing laboratory testing and turn on controls to reduce nitrogen emissions, while actually emitting circa 40x nitrogen dioxide limit.

This is what happened when VW fessed up:

Idiots. I mention it because not only am I idiotically currently trying to sell my (Black 2008, 160,000km) Tiguan, but because maybe if the company had been run by Wolfgang Volkswagen it might’ve been different. There might’ve been a sense of … ownership.

In any case, Ruslan Kogan and the recently enriched executive got out front of their faux pas. They owned it. The share price fell. But the essential offering has not.

Worst is behind

As I write, Credit Suisse tells me its rating for KGN is being Upgraded to Neutral from Underperform.

The brokers note selling costs did indeed moderate in the second half and reckons the price increases for Kogan First should provide additional support in FY23.

A small profit is now expected in FY23, with estimates for FY24 and FY25 upgraded by 38% and 30%, respectively.

Credit Suisse has been watching the bloodletting of late on the bourse and says the KGN cash position is improved.

The Price Target also increases a smidge to $3.66 from $3.44.

And now I turn over to the person who even when using bullet points knows the business best of all the people I know. Presenting:

Mr Johannes Faul of Morningstar:

-

We maintain our AUD 11.70 per share fair value estimate for ‘no-moat’ Kogan.

-

Kogan’s underlying loss per share of AUD 0.03 for fiscal 2022 missed our estimate of a loss of AUD 0.01 per share, mainly due to lesser than expected income tax benefit.

-

Gross sales of $1.2 billion, gross profit of close to $184 million, and underlying EBITDA of $19 million were released in July 2022.

-

We expect Kogan to improve its EBITDA margins in fiscal 2023 as its focus remains on cost efficiency.

-

In the June quarter 2022, Kogan posted underlying EBITDA of $3 million after suffering a slight loss in the March quarter 2022.

-

KGN has continued to sequentially reduce its marketing and warehousing expenses with decreasing inventory levels.

-

We expect EBITDA margins were relatively steady, despite significant operating deleverage.

-

We estimate gross sales declined by more than 20% in July 2022 versus July 2021 — a period marked by elevated sales due to COVID restrictions.

-

Nevertheless, we continue to expect Kogan’s top-line growth to reignite in fiscal 2023 after exceptionally strong COVID-19-induced prior period sales growth passes.

-

We estimate group gross sales to increase by 5% in fiscal 2023 and average 6% per year over the next decade.

-

Kogan First, Kogan’s loyalty program, remained a bright spot in Kogan’s results.

-

Subscriptions jumped to 372,000 by June 2022, up 8% from March 2022, and up 36% from 274,000 in December 2021.

-

The activity around Kogan First is likely both dampening near-term profitability for the business, while enhancing long-term shareholder value.

-

Kogan First subscriber acquisition costs are captured upfront as a marketing expense but we expect membership to generate long-lasting revenue stream if members are retained.

-

Renewal rates for Kogan First have improved to 85% in fiscal 2022 from 78% in fiscal 2021 and 70% in fiscal 2020.

-

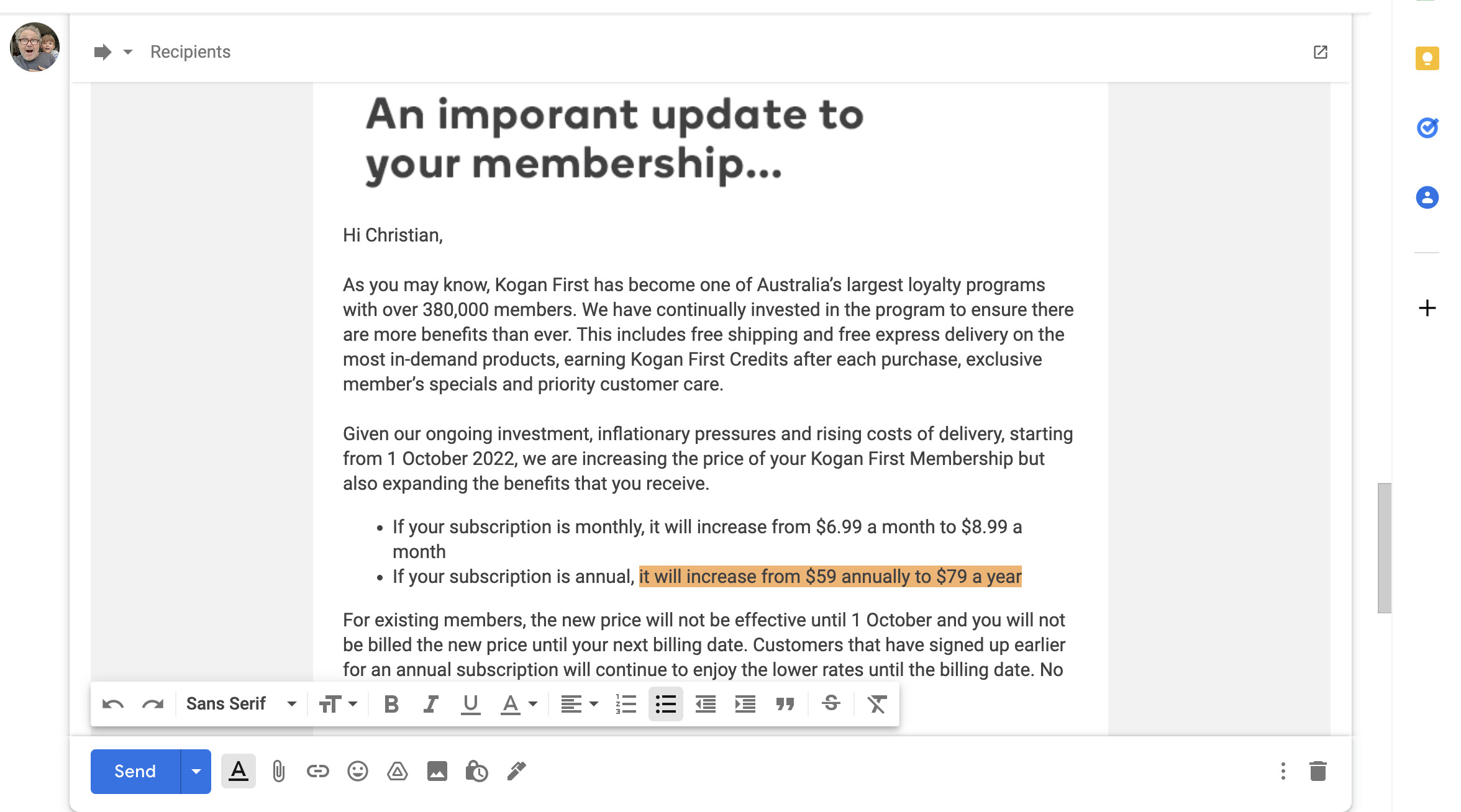

The October 2022 increase in annual subscription fees may affect renewals. (Fees will rise to $79 from $59 per year previously, due to cost inflation.)

I know this, because about 2 mins after I was sent the KGN FY22 results, I also received this:

Worth noting: Bezos.com.au (Amazon Australia) currently charges $59 for an annual Prime membership — much lower than the US$139 standard annual fee it charges in the States.

-

We forecast subscribers to grow to around 760,000 in fiscal 2026, below managements medium-term goal of 1,000,000 subscribers by fiscal 2026.

-

As expected, Kogan’s dividend remains suspended.

-

We consider it prudent to preserve its cash given still elevated marketing costs to grow Kogan First and consolidate gross sales.

-

As of June 2022, Kogan held net cash of $31 million.

-

With the unwinding of high inventories, operating cash flow improved to $62 million versus negative operating cash flow of $63 in fiscal 2022

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.