CLOSING BELL: Remember to say thanks to the techies, without whom we’d be deep in the red for the day

Alice's new invention has opened the door for investors to pick stocks using only the power of their mind, instead of just guessing like the rest of us. Pic via Getty Images.

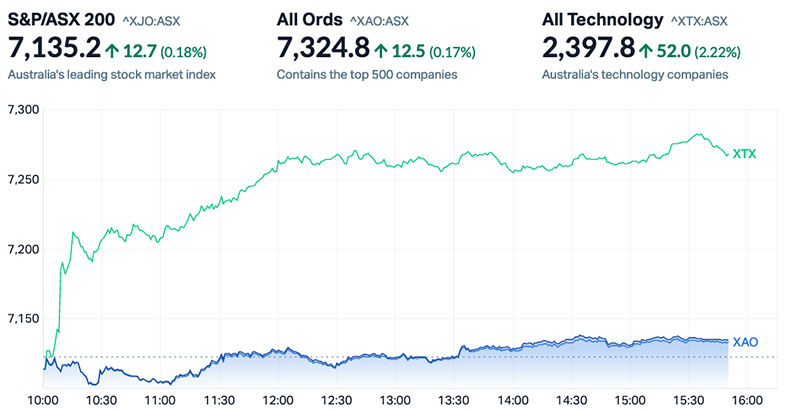

- Local markets shook off a post-long-weekend wobble to end the day higher, up 0.23%

- It’s been another red-hot day for the techies, with that sector up by 3.7%.

- Health techie AHI went flying 370% this morning, and it’s anyone’s guess as to why.

After spending the morning trying to get on top of the usual “flu-like symptoms” that turn any Tuesday morning after a long weekend into a chore, the ASX has rallied to end the day higher by 0.23%.

By “the ASX has rallied”, I mean “Tech stocks have once again defied the pull of the broader market’s gravity”, with that sector flying high while everyone else stood round with their hands in their pockets, or – as was the case with Materials and Energy sectors – called in sick and stayed in bed.

InfoTech was way, way waaay out in front for most of the session, rocketing out to the lead on +3.67%, with Telcos next best on +1.10% and Health Care right there with it on +1.09%.

For those who prefer their stories delivered visually, here’s the ASX’s own index chart showing just how dominant the Tech sector has been all day.

However, proving to be a dust-ridden, battle-scarred counterpoint to those results were Materials (-0.73%) and Energy (-1.72%), with the latter hit pretty hard by slippery oil prices being dealt a double blow.

Firstly, the recent OPEC+ gambit of “cutting output” was deemed to be “transparent horseshit” by the market, which seems to have taken a shining to the idea of not believing a word the cartel is saying these days.

And second, Russia (who is about as trustworthy as our Middle Eastern friends) says that its oil production has recovered somewhat, easing pressure on European energy supplies despite the ongoing “it’ll be over in a matter of weeks” war with Ukraine that is now well into its 16th month.

Oil prices fell 4% overnight, Goldman Sachs cut its price forecast by fully 10%… and the slide looks to be anything but over for now.

Similarly, Goldman Sachs has also taken a bit of a hatchet to local mainstay iron ore, which I will leave to Stockhead’s very own Josh Chiat to explain – but, the short version is that Goldman’s being very Goldman about it, and it’s making Australia’s iron ore community a bit sad.

In Large Cap news, Qantas (ASX:QAN) did pretty well today, up 3% while the company conducts a buy-back, and Resolute Mining (ASX:RSG) rose 4% after disclosing that fund manager Vanguard Group has bought a 5.015% stake in the company.

On the wrong end of the day, however, was Domino’s Pizza (ASX:DMP) which tumbled 7% on news that things aren’t going super-great and the company will be home-delivering some hot, cheesy slabs of cost-cuts over the coming weeks.

To whit: the company is ditching its Danish market and will be completely outta there by end of FY23, and is reducing its overall corporate store network by around 15% to 20%, while also closing its construction and supply subsidiary in Australia.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Today | Volume | Market Cap |

|---|---|---|---|---|---|

| AHI | Advanced Health | 0.4 | 371% | 1,711,239 | $16,762,337 |

| TNT | Tesserent Limited | 0.12 | 145% | 133,433,557 | $66,354,924 |

| CLE | Cyclone Metals | 0.0015 | 50% | 1,355,644 | $10,264,505 |

| SNX | Sierra Nevada Gold | 0.145 | 45% | 10,010 | $4,162,787 |

| ALO | Alloggio Group | 0.23 | 44% | 8,072,264 | $18,939,241 |

| PRMDG | Deferred Settlement | 0.02 | 43% | 196,071 | $1,697,226 |

| AD1 | AD1 Holdings Limited | 0.007 | 40% | 650,000 | $4,112,845 |

| AW1 | Americanwestmetals | 0.074 | 32% | 13,807,422 | $14,905,051 |

| AZS | Azure Minerals | 0.825 | 32% | 20,699,075 | $243,897,545 |

| EMC | Everest Metals Corp | 0.13 | 30% | 5,900,231 | $12,943,311 |

| EGN | Engenco Limited | 0.44 | 29% | 135,284 | $107,321,087 |

| MQR | Marquee Resource Ltd | 0.049 | 29% | 50,630,909 | $12,433,885 |

| DVL | Dorsavi Ltd | 0.014 | 27% | 2,020,808 | $6,085,320 |

| ERW | Errawarra Resources | 0.11 | 26% | 546,059 | $5,263,848 |

| AUH | Austchina Holdings | 0.005 | 25% | 619,925 | $8,311,535 |

| AVW | Avira Resources Ltd | 0.0025 | 25% | 2,680,000 | $4,267,580 |

| EDE | Eden Inv Ltd | 0.005 | 25% | 2,510,432 | $11,987,778 |

| OAU | Ora Gold Limited | 0.0025 | 25% | 574,996 | $7,873,850 |

| RBR | RBR Group Ltd | 0.0025 | 25% | 8,249,021 | $3,236,809 |

| THR | Thor Energy PLC | 0.005 | 25% | 6,096 | $5,840,051 |

| YPB | YPB Group Ltd | 0.0025 | 25% | 1,838,217 | $1,238,498 |

| REM | Remsensetechnologies | 0.069 | 23% | 878,597 | $2,546,070 |

| CY5 | Cygnus Metals Ltd | 0.295 | 23% | 969,658 | $51,393,771 |

| OPA | Optima Technology | 0.017 | 21% | 563,068 | $3,518,788 |

| CAN | Cann Group Ltd | 0.17 | 21% | 614,756 | $54,340,281 |

The clear winner for the day is Advanced Health Intelligence (ASX:AHI), which went zooming off the charts to the tune of +370% this morning in the split-second that it wasn’t in an ASX-induced trading pause, or an outright halt requested by the company.

There’s a bit to unpack around that particular mystery bag of magnificent performance – which I’ve covered off in Last Orders below, where there’s more scope for wild hypothesising than in this section of Closing Bell.

So… moving on, in second place (and with 100% more actual reasons for being there) is Tesserent (ASX:TNT), up 150% on news that it’s entered into a Scheme Implementation Deed (SID) with Thales Australia that will see the latter acquire 100% of TNT for $0.13 per share in cash.

The price is a massive premium of 165.3% to the last closing price of $0.049 per share and 157.4% to the 1-month volume weighted average price (VWAP) of $0.0505 per share – a solid indication of just how badly Thales wanted to scoop up TNT.

Thales has advised the TNT business will continue to be known as Tesserent, while its visual identity will incorporate the “Cyber Solutions by Thales” tagline, and the deal will position TNT as the lead cybersecurity offering of Thales Australia and New Zealand.

The TNT board unanimously recommends shareholders vote in favour of the deal at an anticipated meeting in September, to the surprise of absolutely nobody at all, because premiums like that don’t come along all that often.

Third place has been a tight race throughout the day, with late-bloomer Marquee Resources (ASX:MQR) putting in a strong showing that left it around 44% higher, trading on a big spike in volume against Friday’s news that the company has reached an agreement with Mineral Resources (ASX:MIN) to fast-track a farm-in solution.

And another takeover has been making waves throughout the session, which has seen Allogio (ASX:ALO) jump around 44% on news that it has finally reached an agreement with Next Capital over the price it’s prepared to accept for 100% of the company.

Negotiations between ALO and Next have been trundling along for quite some time now, and today was the deadline for the Consultation Notice that had allowed the pair to haggle.

The deal has apparently been struck, and Next is now set to buy up 100% of ALO at $0.24 per share in cash.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the least best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Today | Volume | Market Cap |

|---|---|---|---|---|---|

| WNR | Wingara Ag Ltd | 0.023 | -36% | 316,552 | $6,319,530 |

| BOA | Boadicea Resources | 0.05 | -35% | 1,943,678 | $6,158,315 |

| VPR | Volt Power Group | 0.001 | -33% | 927,224 | $16,074,312 |

| CT1 | Constellation Tech | 0.003 | -25% | 1,883,333 | $5,884,801 |

| EMU | EMU NL | 0.0015 | -25% | 2,647,063 | $2,900,043 |

| MTB | Mount Burgess Mining | 0.0015 | -25% | 5,052,617 | $1,766,342 |

| PYR | Payright Limited | 0.003 | -25% | 322,584 | $3,523,541 |

| FNX | Finexia Financialgrp | 0.22 | -21% | 181,106 | $13,430,362 |

| MBX | Myfoodieboxlimited | 0.011 | -21% | 91,500 | $519,791 |

| DCX | Discovex Res Ltd | 0.002 | -20% | 114,999 | $8,256,420 |

| FGL | Frugl Group Limited | 0.008 | -20% | 1,102,284 | $9,560,620 |

| AQC | Auspaccoal Ltd | 0.105 | -19% | 772,015 | $45,150,424 |

| C6C | Copper Mountain | 2.11 | -19% | 544,473 | $43,760,946 |

| RGS | Regeneus Ltd | 0.009 | -18% | 785,294 | $3,370,806 |

| SCT | Scout Security Ltd | 0.018 | -18% | 2,594,756 | $5,074,696 |

| GBE | Globe Metals &Mining | 0.054 | -17% | 1,085,491 | $32,939,965 |

| S3N | Sensore Ltd | 0.25 | -17% | 12,527 | $8,449,120 |

| CAV | Carnavale Resources | 0.0025 | -17% | 3,260,019 | $8,200,655 |

| TZL | TZ Limited | 0.02 | -17% | 116,986 | $6,064,995 |

| TNY | Tinybeans Group Ltd | 0.26 | -16% | 57,549 | $19,029,491 |

| HFY | Hubify Ltd | 0.021 | -16% | 597,882 | $12,403,407 |

| GIB | Gibb River Diamonds | 0.038 | -16% | 70,593 | $9,517,925 |

| TTM | Titan Minerals | 0.039 | -15% | 7,431,972 | $64,918,567 |

| ADX | ADX Energy Ltd | 0.006 | -14% | 7,798,898 | $25,271,497 |

| CPT | Cipherpoint Limited | 0.006 | -14% | 2,900,000 | $8,114,692 |

LAST ORDERS

It’s probably best that we mention the elephant in the room, and that is the mystery of how and why Advanced Health Intelligence (ASX:AHI) managed to hit warp speed and jump 370%, despite trading being paused right as the market opened this morning and the trading halt being formalised (at the request of AHI) a few minutes before lunch.

The short answer is “I don’t know” – but there are a few theories kicking around including a possible takeover… which are this month’s hot ticket fashion item for every Small Capper on the go.

AHI was in the news overseas on Friday June 9, when its US-listed shares also went completely berserk and “blasted nearly six-fold higher on massive volume in midday trading Friday”, per marktwatch.com – which also noted that it’s all happening despite no news.

For what it’s worth, the wording of AHI’s trading halt request is a little vague – the company is citing an upcoming “capital raising transaction”, which could mean any of a number of things.

AHI is also prepping a response to the ASX’s speeding ticket that it got today – to absolutely nobody’s shock or surprise – because the price chart went vertical this morning:

And that’s the sort of thing that those eagle-eyed ASX Safety Patrol Officers spend month after painstaking month learning how to spot, at the Academy just outside Goulburn, New South Wales.

It’s both a fascinating and infuriating story – like when the biggest present you’ve ever seen lands under the tree about a week out from Christmas, gift-wrapped and labelled as yours, and you have to wait for what feels like an eternity until you’re allowed to find out what’s inside.

Elsewhere, Leaf Resources (ASX:LER) has revealed that it’s signed a term sheet Ground Base Solutions, which will see the latter provide “100,000 tonnes of stumps” per annum for Leaf’s proposed manufacturing facility to be constructed in Rotorua, New Zealand.

For background: Leaf Resources describes itself as “a leading natural and renewable pine chemical and biomass pellet manufacturing company”, and the deal represents supply of about 50% of the required feedstock for its proposed new NZ facility.

“100,000 tonnes of stumps” is Russell Crowe’s new musical project, after his previous band 30 Odd Foot of Grunts was ordered by the UN Human Rights Commission to stop performing live over persistent allegations of “egregious aural assault” and other war crimes.

From the list of Trading Halts today is one from Ryder Capital, which has hit the pause button to give the company time to sort out its May 2023 Net Tangible Asset (NTA) release, in relation to an investment the company is holding in Updater Inc.

Spoiler alert: it’s not going to be good news for Ryder.

Ryder has been holding onto its investment in Updater since the company delisted in September 2018, and at 31 December 2022 its carrying value for the investment was $10.0 million, equivalent to ~$0.12 per share or 8.8% of the last published monthly net tangible assets (NTA) being $1.3571 per share.

Ryder says its been in contact with Updater regarding a potential financing transaction, but the talks appear to have been fruitless and the terms of any transaction “remain incomplete” – and, as such, Ryder is saying that it is “likely” the result will be a material negative revaluation of the investment’s carrying value, and Ryder’s NTA.

The results should be known fairly soon, so stay tuned.

And lastly, a snippet of happy news from Golden Mile Resources (ASX:G88), which has announced that current Chief Executive Officer Damon Dormer has been appointed to the role of managing director.

“We are delighted to welcome Damon as managing director to the G88 Board. Damon joined the company in March 2023 in the role of CEO, and we have been impressed with his performance and closed out his probationary period early while in this role,” non-executive chairman Grant Button said.

“His experience in project development is invaluable for leading our flagship Quicksilver nickel-cobalt project through the technical workflows and, results pending, into formal studies. He has been instrumental in setting the direction, strategy and work programmes for the portfolio.”

A Mining Engineer with more than 26 years of experience inclusive of 15 years of mine management and executive roles, Dormer has worked in studies, projects, operations and innovation across Australia, USA, Papua New Guinea and Africa.

TRADING HALTS

Macquarie Technology Group (ASX:MAQ) – Equity raising.

Intelligent Monitoring Group (ASX:IMB) – Strategic acquisition and debt refinance.

GreenTech Metals (ASX:GRE) – Exploration update from the Ruth Well project.

Cosmo Metals (ASX:CMO) – Capital raising.

Locksley Resources (ASX:LKY) – Material acquisition and capital raising.

Challenger Gold (ASX:CEL) – Mineral Resource Estimate from the El Guayabo Project in Ecuador.

Ryder Capital (ASX:RYD) – Halt requested to allow time to complete the company’s May 2023 Net Tangible Asset (NTA) release (See above).

Advanced Health Intelligence (ASX:AHI) – Capital raising transaction and response to an ASX price query.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.