Mo’ cash, no problems for ASX companies as reporting season beats expectations

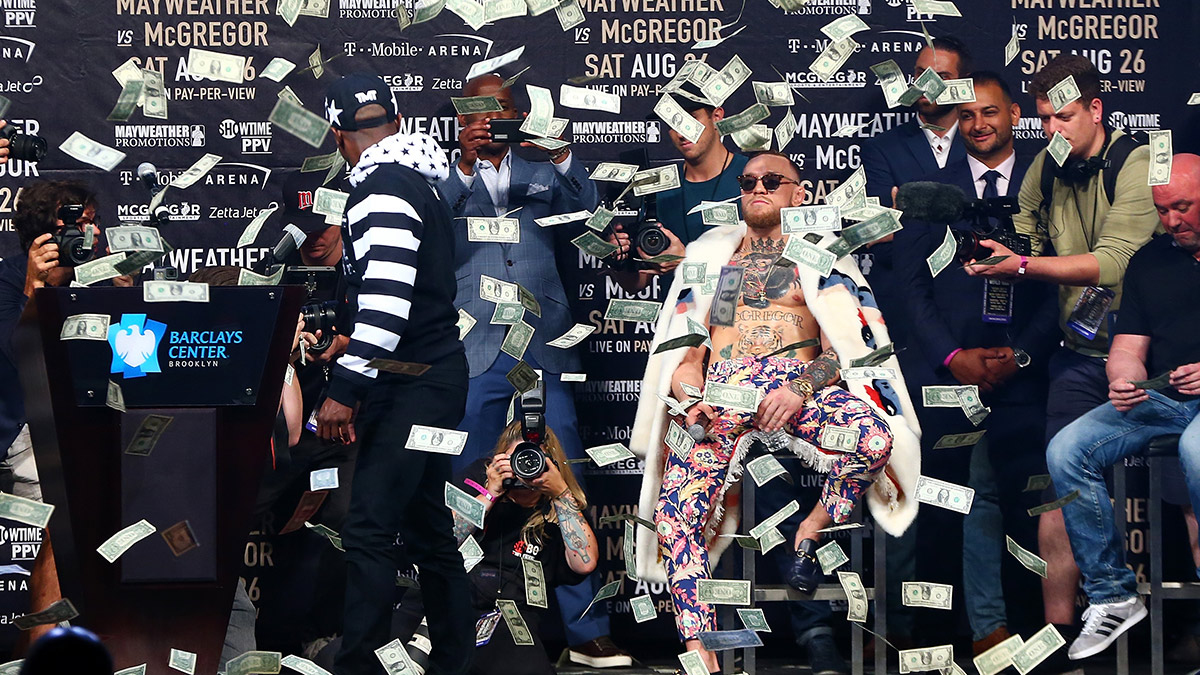

UBS said FY20 reporting season showed a number of ASX companies beat cashflow expectations, despite the disruption from COVID-19. (Pic: Getty)

FY20 ASX reporting season is in the books, and while there was some apprehension coming in the results show most companies emerged unscathed.

The key focus heading into this year’s “confession season” was around how companies will frame forward guidance in the wake of such a huge disruption.

While earnings may have taken a hit (or at least flatlined) through the middle of the year, investors showed a willingness to look past that if company executives could at least point to brighter days ahead.

However, that outlook was clouded somewhat by the fact that many ASX companies withdrew forward guidance completely back in March and April, citing too much uncertainty.

But for Pieter Stoltz and the UBS equities team, the end results were “better than we expected, with a number of stocks showing a surprising resilience to COVID-19”.

While forward guidance was slightly subdued, it remained broadly resilient with the market now expecting earnings per share (EPS) growth of 8.3 per cent in the 2021 financial year (down from previous forecasts of 9 per cent).

Cash is king

In terms of EPS growth in FY21, financial and resources stocks are expected to lead the way, with growth of 13.3 per cent and 8.3 per cent respectively.

But in any kind of crisis, cash flow becomes king — at the very least, companies must prove their business model is generating enough cash to cover short-term liquidity obligations.

And it was cash flow that delivered the key “upside surprise” of this reporting season, UBS said, with around 20 per cent of companies beating expectations.

“We think this reflects a combination of falling inventories and rapid rise in bank deposits,” the analysts said.

For larger companies, that flowed through to higher dividends — at least compared to post-COVID forecasts which were revised lower.

“The one area of weakness observed was on costs, with a number of companies reporting higher than expected COVID-19 costs,” UBS said.

By sector, UBS said stocks in six categories — consumer staples, building materials, discretionary retail, gaming, general industrials and insurance — showed the most reslience to COVID-19 and outperformed on results day.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.