These ASX companies could perform ‘better than feared’ this reporting season

News

News

In the wake of such huge market disruption, this year’s August reporting season is one of the most hotly anticipated in recent memory.

Results for the 2020 financial year are beginning to roll in, with investors on the lookout for missed expectations in what’s sometimes referred to as “confession season”.

With all eyes on the market, the UBS equities team has run the ruler over their Emerging Companies portfolio, in a research note called ‘Top Picks for August Reporting Season’.

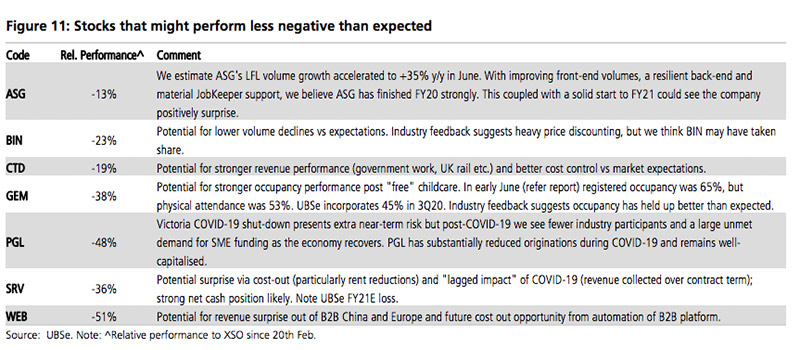

Included in the coverage was a useful summary of ASX companies that could “surprise on the upside, given the low expectations reflected in current trading”.

Here’s the list:

Of the seven stocks selected, UBS said their highest conviction “better than feared” stock is G8 Education (ASX:GEM).

Shares in the childcare centre operator dipped from a pre-crisis level of around $1.70 in February to a low of 50c, but have since only recouped about a quarter of those declines to trade just above 80c.

UBS said GEM’s network of centres has the potential to see stronger occupancy rates as childcare subsidies are wound back.

In addition, “industry feedback suggests occupancy has held up better than expected”, the analysts said.

Morningstar analyst Adam Fleck also flagged G8 as a potential winner back in early June.

UBS also highlighted positive upside for business travel company Corporate Travel Management (ASX:CTD), which has declined by around 50 per cent from its January highs.

The analysts said CTD has the capacity to generate stronger revenues from its pipeline of work with government clients and infrastructure businesses such as the UK’s rail network.