Market Highlights: Wall Street’s late selloff, home prices rebound, and 5 ASX small caps to watch today

Aussie home prices are staging a recovery - Corelogic report. Picture Getty

- ASX to open lower today after a late selloff on Wall Street

- The US Fed’s preferred inflation posted another increase

- Aussie home prices are staging a recovery – Corelogic report

Australian shares are set to open lower on Friday after a late selloff in New York overnight. At 8am AEST, the ASX 200 index futures was pointing down by -0.5%.

On Wall Street, the S&P 500 finished -01.6% lower, blue chips Dow Jones by -0.48%, while tech heavy Nasdaq climbed +0.11% to end the month.

The market reacted after the Fed Reserve’s preferred measure of inflation, the core PCE or personal consumption expenditures index, posted another modest back-to-back increase from last month.

Some analysts, like Barclays Capital, still reckons the Fed will hike its rate in September.

“We remain skeptical that inflation is on track to return to the Fed’s 2% target without a significant easing of labor market conditions,” Barclays said in a research note.

To stock news, Salesforce jumped 3% after an earnings beat and an optimistic forecast, while cybersecurity company CrowdStrike gained 9% on bullish forecast.

Dollar General shares slumped 12% after cutting its forecasts, blaming a spending slump and theft.

Most megactechs rose as US bond yields eased.

Aussie home prices bouncing back, says Corelogic

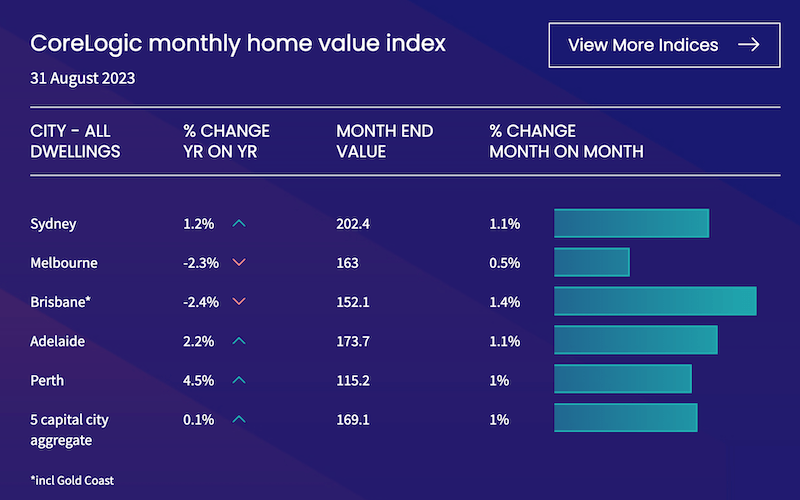

Aussie home prices are staging a recovery with the CoreLogic’s Home Value Index (HVI) rising by 0.8% in August, the sixth-straight monthly increase, said CoreLogic.

Within the capital cities, it was house values rather than unit values that have showed a sharper recovery trend. Since bottoming out in February, every capital city except Hobart has recorded a rise in home values.

Brisbane has posted a strong recovery with values up 6.2% since bottoming out in February.

According to the report released last night, Sydney has led the recovery trend with a gain of 8.8% since January. Sydney also claimed the highest median house price at more than $1.3 million.

Conditions across regional housing markets meanwhile were mixed, with values down over the month across the non-capital city regions – NSW (-0.2%) and Victoria (-0.6%), rising firmly across regional Queensland (0.8%) and SA (0.9%), and holding relatively flat in regional WA (0.1%) and Tasmania (0.0%).

In other markets …

Gold price fell modestly by -0.10% overnight to US$1,940 an ounce.

Oil prices lifted around 2%, with WTI trading now at US$83.58 a barrel.

Crude prices notched their third monthly gains, boosted by expectation that OPEC+ leaders, who will meet on October 4, could extend supply cuts.

Iron Ore 62% fe climbed +0.4% at US$109.40/tonne.

The Aussie dollar was flat at US64.86c.

Bitcoin meanwhile tumbled almost 5% in the last 24 hours to US$25,996.

This comes as the US SEC said decisions on spot Bitcoin ETF applications will be delayed until at least October.

“I continue to expect a gradual sell-off in BTC for the next one to two months,” John Glover of Ledn, said.

5 ASX small caps to watch today

Belararox (ASX:BRX)

BRX says two of the nine recently submitted Environmental Impact Assessments for the Toro-Malambo-Tambo Project have been approved. The Tambo South target is a high-priority target, for which the approved EIA will permit on-the-ground exploration activities, planned for the start of the field season during September.

Living Cell Technologies (ASX:LCT)

LCT announced that it has executed a research agreement with La Trobe University (LTU) to undertake an array of pre-clinical studies to assess the company’s cannabinoid-based combination drug, known as AI116. The pre-clinical studies to be undertaken at LTU will employ a suite of state-of-the-art experimental techniques, which are expected to provide valuable insights into the mechanism of action of AI-116.

Talga Group (ASX:TLG)

A Swedish Court of Appeal has determined that there are no grounds to grant leave to appeal to any of the parties. Talga says the Land and Environment Court’s decision to grant the environmental and Natura 2000 permit for Talga’s s Nunasvaara South mine therefore stands.

MMA Offshore (ASX:MRM)

MMA announced that it has been awarded two contracts to provide LNG field support duties in Australia’s North West. The combined revenue from the firm contract periods is expected to be approximately $12.4m and up, to an additional $4.9m should the options be exercised.

Restaurant Brands NZ (ASX:RBD)

The KFC and Pizza Hut operator announced the permanent appointment of Arif Khan to the role of CEO, effective today. Khan has been acting group CEO since April, and brings extensive working knowledge of RBD’s operations and strategy to the role, having spent several years at RBD in his early career in a management role.

At Stockhead we tell it like it is. While Belararox is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.