Market Highlights: Local markets look rosy after bad jobs means good news on Wall Street

Via Getty

- ASX to open higher after Wall St lifts on fresh jobs data

- US 10-year yields pull back from 5%, so everyone’s less upset

- PEXA buys a British surveyor, DYM says it’s found 2.8km of potential Li2o in WA

Aussie shares are set for a win after an awful Wednesday in Sydney, with the SPI200 ahead by around 0.5$ at 8.45am.

That said, a drag in commodity prices could yet weigh things down.

The benchmark ASX200 tumbled -0.8% on Wednesday, as equity markets across the Asia-Pac region dropped to an 11-month low.

Also ready for a wee victory at last, Wall Street rebooted its approach to October business, traders still blinking but not blustered by the ongoing distraction provided by US lawmakers as Republicans in the Lower House trolled and then removed their own Speaker.

All three key US indices finished comfortably higher overnight in New York, the broad selloffs of the previous session also in the rearview mirror, as the latest ADP jobs data came in with a sigh of relief as a weaker-than-expected read helped pull Treasury yields away from the edge of more multi-year highs.

The Dow Jones Industrial index closed almost 130 points higher, snapping a three-day losing streak.

Next door, the S&P 500 gained 0.8% and the Nasdaq Composite found almost 170 points to lift 1.35%.

The ADP report showed the US private sector added the least amount of jobs since January 2021, challenging the strong JOLTs report which sucked the oxygen out of Tuesday trade.

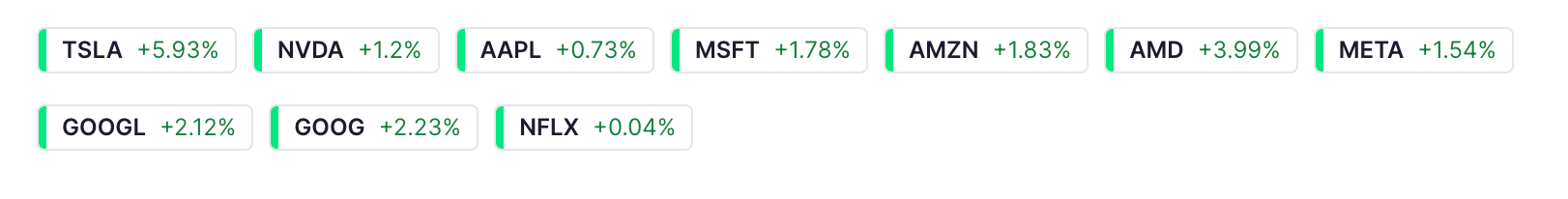

Large-cap tech led the gains in the session, aligned with the breather for US bonds as the yield on the 10-year Treasury retreated from 16-year highs. Megacap stocks booked sharp gains including Tesla (5.9%), Alphabet (2.1%), Microsoft (1.8%), and Amazon (1.8%).

Nasdaq: Most active USD volumes

On the other end of fun – Energy was the worst-performing sector overnight as crude prices had their single largest day of losses back to September 2022. WTI futures tumbled over -5%, with Brent crude now trading at US$84.48 a barrel.

That was bad for familiar old oil plays like SLB and Halliburton which both dropped more than 4%. Exxon Mobil which fell over 3.75%, Chevron dropped 2.3%. Devon Energy and Marathon Oil each fell circa 5%.

Chicken Wars: An Overnight Takeaway

In other critical news, Popeyes has overtaken KFC as the No.2 chicken chain in the US.

According to Barclays research, the Restaurant Brands International chicken upstart – Popeyes – first sounded KFC’s no.2 death knell back in 2019 when it launched a chicken sandwich that CNBC reports “turned into a blockbuster menu item and ushered in the chicken sandwich wars”.

Then the big burger chains watched first with envy and then greed, keen to learn how to feed on the booming chicken game themselves.

McDonald’s and Wendy’s were soon up to their necks in chicken sandwiches, leading to paltry levels of poultry in the US and longish-shortages for consumers..

Yum Brands ’ KFC looks like the loser in the Chicken Wars. Over the past year, its US market share has fallen foul by almost 5%, from 11.3% from 16.1%, according to Barclays.

And that’s a full decade after Chick-fil-A first unseated KFC from top spot. Since then Chick-fil-A has spread like bird flu, shifting from a regional player to a national big gun, with only McDonald’s and Starbucks topping it in yearly sales.

In other markets …

Gold price was down -2.14% to US$1,820 an ounce.

Oil prices tumbled over -5%, with Brent crude now trading at US$84.48 a barrel.

Iron ore down 1.1% at US$115.50 a tonne.

Copper futures fell by -0.9% to US$317

The Aussie dollar gained 0.4% US63.15c.

Bitcoin meanwhile lifted more than +0.8% in the last 24 hours to trade at US$27,655.

ASX small caps to watch today

Westgold has updated preliminary production results for Q1, FY24, saying it produced 63,104 ounces of gold from its Murchison and Bryah Operations in Western Australia, achieving an average gold sale price of $2,888/oz.

Cash, bullion and liquid assets at the end of Q1, FY24 increased by $25M, taking the Group total to $217M (Q4, FY23: $192M) adding it remains ‘on track’ to deliver FY24 production guidance of 245,000 – 265,000 ounces.

Managing Director Wayne Bramwell:

“With $25M of cash build in Q1, FY24, Westgold continues to build balance sheet strength. Corporately, the completion of our fixed forward sales program in July saw us realise the full value of the Australian dollar gold price in August and September for the first time. Our operational performance was pleasing and with positive cash build for a third consecutive quarter, Westgold has set the foundation to deliver its FY24 guidance.

Looking forward, Q2 will mark the first full quarter with cash flows unimpeded by fixed forward contracts.

We can fund our exciting suite of internal growth options from operating cashflows and see opportunities such as Great Fingall as heralding a new stage of Westgold’s transformation into a progressive and more profitable Australian gold miner.”

DYM says it has defined a 2.8km lithium anomaly at Pioneer Dome, on Thursday morning, taking circa 1900 soil samples as part of its reconnaissance exploration program on the recently granted E15/17211 at Pioneer Dome.

Considered ‘highly prospective for Lithium-Caesium-Tantalum pegmatites first pass program tested 12km of strike along the western side of Pioneer Dome next door to Essential Metals’ (ASX: ESS) Dome North lithium project which hosts a Mineral Resource of 11.2Mt @ 1.2% Li2O2

Elevated lithium trend (>40ppm) defined extending over 2.8km through the centre of sampling area.

Dynamic’s team will commence infill auger sampling to further test continuity of the elevated lithium trend in the regolith profile – part of the larger Widgiemooltha Project in the Goldfields Region of Western Australia – expected to start next week.

The ASX-listed digital property exchange platform and property insights business says it’s reached agreement on the proposed acquisition of UK-based conveyancing technology provider, Smoove.

By way of a scheme of arrangement, shareholders of Smoove will be entitled to receive 54 pence in cash for each share in the capital of Smoove that they hold.

PEXA informs us the Smoove Board intends to unanimously recommend that Smoove Shareholders vote in favour of the deal and PXA expects the acquisition will complete in calendar Q4 2023.

The offer values Smoove at £30.8 million (A$58.6 million), on a fully diluted basis, or £20.8 million (AUD $41.5 million) net. The acquisition will be funded through cash currently held by PEXA.

Group CEO and Managing Director Glenn King says the acquisition is ‘aligned with PEXA Group’s strategy of enhancing and leveraging our property exchange know-how to deliver growth from different markets, including in other Torrens title jurisdictions, starting with the UK.’

“Since entering the UK market, the PEXA Group has launched its first re-mortgage product, successfully brought two lenders onto the PEXA platform and acquired and progressed integration of specialist remortgage conveyancer, Optima Legal.

“The acquisition and integration of Smoove into the PEXA UK business will further help us address the many detriments suffered by consumers due to the UK’s fragmented, inefficient conveyancing processes. The acquisition will allow us to build additional scale and depth in the UK market, enabling the PEXA product suite to reach more customers, whilst streamlining and improving the UK property transaction experience.”

S2 says its wholly-owned subsidiary Southern Star Exploration has been granted an exploration licence for ‘the highly sought after’ Block 4 of the Victorian Government’s North Central Victoria Gold (NCVG) ground release, which S2 won sole right to apply for in October 2021.

The Exploration Licence (EL) covers an area of 394 square kilometres, extending 55 kilometres north to south, and abuts and surrounds Agnico Eagle’s Fosterville mine lease.

S2’s Executive Chairman, Mark Bennett says that ‘by virtue of its position, its size, and its inherent prospectivity, EL7795 is a highly strategic asset.’

This is the first of the four NCVG tender blocks to be granted. Based on the proposed work program submitted as part of the tender process, the Company has a minimum expenditure commitment of $10.4 million over the first five year term of the licence, inclusive of a minimum $2.1 million commitment in the first two years.

“The granting of EL7795 is a significant moment for S2. It is the most strategic of the four blocks released around Fosterville, and it is the first to be granted. I would like to thank the Dja Dja Wurrung and Taungurung people, and the staff of the Victorian Earth Resources Regulator for their goodwill, guidance and diligence in this process.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.