Market Highlights: How the RBA call today would impact mortgages, and 5 ASX small caps to watch

RBA expected to hand down a 25bp rate increase today. Picture Getty

- ASX to fall modestly on Tuesday after a lacklustre session in New York

- RBA expected to hand down a 25bp rate increase today

- Mozo explains what that would mean for mortgage holders

Aussie shares are poised to open lower on Tuesday despite gains on Wall Street. At 8am AEST, the ASX 200 index futures was pointing down by -0.2%.

Overnight, the S&P 500 rose by +0.18%, the blue chips Dow Jones index was up by +0.10%, and the tech-heavy Nasdaq climbed by +0.38%.

Last week, US stock markets had their biggest weekly percentage gain in about a year, but analysts believe that we’re in a state of a bear market rally, rather than the start of a bull market.

To stock news, DISH Network fell -37% on the Nasdaq overnight after disappointing Q3 earnings.

Berkshire Hathaway fell -1.5% after the conglomerate reported its first quarterly loss in a year.

Also read: No, this is a ‘recession play’: Berkshire’s Q3 earnings jump more than 40pc

Disney shares fell -1.23% after naming Hugh Johnston as senior executive vice president and chief financial officer. Johnston is a 34-year career veteran with PepsiCo.

And dating app Bumble fell over -4% after founder and CEO Whitney Wolfe Herd resigned to make way for Slack CEO, Lidiane Jones.

How RBA’s decision today would impact mortgages

Today, the RBA will hand down its interest rates decision at 2.30pm AEDT.

Traders expect a 25bp hike, and if it does happen, it would be the 13th rate hike since May last year, taking the cash rate to its highest level in over a decade at 4.35%.

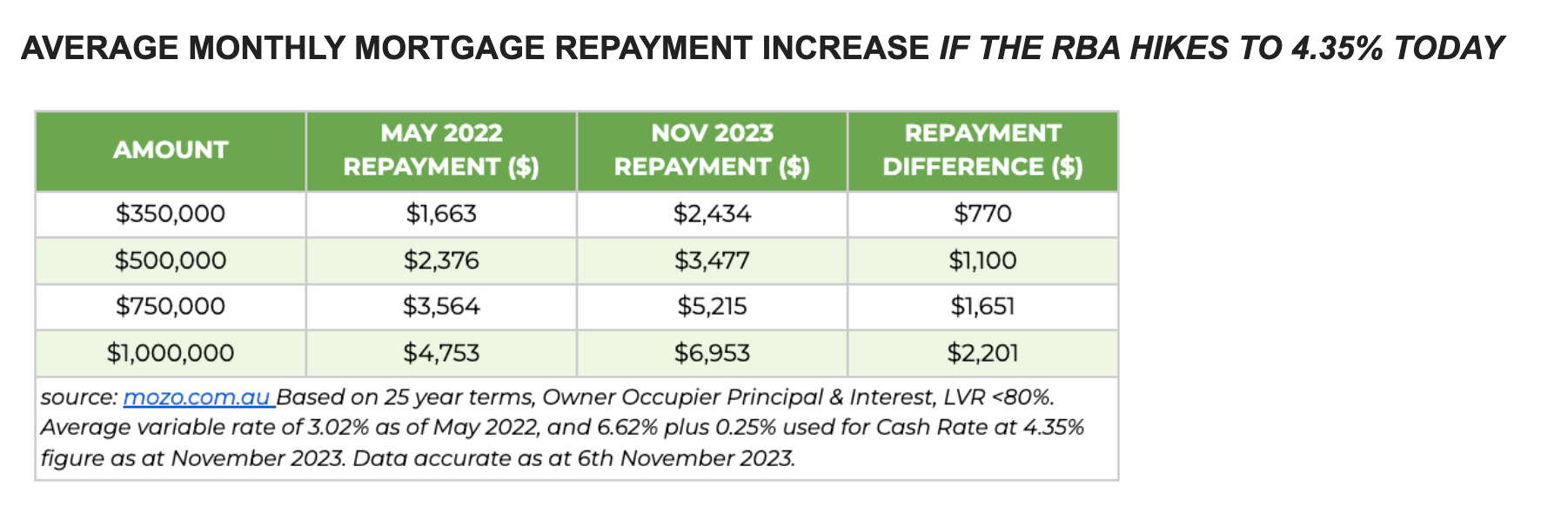

Analysis by Mozo shows that the average mortgage holder with a $500k loan could be paying $1,100 more a month than they were before the rate hiking cycle began.

“For the average mortgage holder with a $500,000 home loan, the impact of those rate hikes could mean they’re paying $1,037 more a month, based on the average variable rate on the Mozo database of 6.62%,” said Rachel Wastell, a Mozo money expert.

Considering 73% of the owner-occupier home loan market is with a Big Four bank, Wastell says there does appear to be an opportunity for borrowers struggling to meet those rising repayments to refinance their home loan and get a little more breathing room.

“Interest rates can be deceptive, as less than 1% difference on a home loan rate can add up to tens of thousands of dollars when you’re looking at 25-year loan terms.

“So, if you’re struggling with rising mortgage repayments, the key is to check your current rate and compare this to what’s on offer in the market, to see if you can get a better rate.”

In other markets …

Gold price fell -0.7% to US$1,978.46 an ounce.

Oil prices climbed +0.5%, with Brent trading at US$85.37 a barrel.

Saudi Arabia and Russia confirmed that they will continue with their voluntary additional production cuts of 1 million bpd for the rest of the year.

Iron ore futures lifted +0.4% to US$126.63 a tonne.

Base metals prices traded strong, with 3-month nickel futures jumping by +1.36%, and copper futures by +0.4%.

The Aussie dollar fell back below the US65c handle to US64.87c.

Meanwhile, Bitcoin was flattish in the last 24 hours at US$34,978.

ARK Invest’s Cathie Wood says BTC can serve as a hedge against deflation, in addition to its potential in an inflationary environment.

She added that Bitcoin would be her choice “hands down” if she had to choose an asset to hold for the next 10 years.

“Gold already has its demand, it’s happened. Bitcoin is new, institutions are barely involved,” she told the Merryn Somerset Webb’s podcast for Bloomberg.

“Young people would much prefer to hold Bitcoin than to hold gold.”

5 ASX small caps to watch today

Mantle Minerals (ASX:MTL)

Mantle announced the granting of the Mt Berghaus exploration licence E45/5899, which covers approximately 84km2 immediately north of De Grey Mining’s Hemi discovery. The company believes the newly granted exploration licence is the most prospective of the three Mt Berghaus exploration licences. The Mantle team has already planned for approximately 15,000m of aircore drilling for Mt Berghaus in the first half of 2024.

Thor Energy (ASX:THR)

Thor announced that the Ambient Noise Tomography (ANT) surveys by Fleet Space Technologies are now complete at the Alford East Copper-REE Project in South Australia. Preliminary ANT models clearly delineate low-velocity, weathered ‘troughs’ that host the oxide copper-gold-REE mineralisation within the Alford Copper Belt. Fleet is currently reviewing the ANT data, integrating the ANT results with Thor’s 3D geological model using artificial intelligence.

Orecorp (ASX:ORR)

OreCorp announced that Silvercorp Metals’ proposed full acquisition of OreCorp has been approved by the Tanzanian government. The takeover price is at $0.15 in cash and 0.0967 of a Silvercorp share for each Orecorp share acquired. The Scheme remains subject to OreCorp shareholder and court approval, as well as other customary conditions.

92 Energy (ASX:92E)

Assays confirmed a new parallel mineralised zone at Gemini. Uranium and high-grade copper mineralisation was discovered along a new parallel zone, 300m east of the GMZ. Best results include: GEM23-075: 1.5m @ 0.2% U3O8 (1,957ppm) and 0.5m @ 3.8% Cu.

Aeris Resources (ASX:AIS)

Aeris provided an update on exploration activities at the Constellation deposit, located within the company’s 100% owned Tritton tenement package in NSW. The current six-hole drill program has been completed, and assays have been received for final three drill holes. All holes intercepted copper sulphide mineralisation, including the following high-grade copper intercept: TAKD099 9.8m @ 2.34% Cu, 0.69g/t Au and 3.1g/t Ag.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.