Market Highlights: Friday has US non-farm payrolls on the mind and 5 ASX small caps to watch

Via Getty

- ASX to track Wall Street and open flat

- Wall St awaits tonight’s blockbuster, rate-defining NFP drop

- Something else to worry about for the weekend: a new European conflict

Australian shares are looking flat on Friday an hour ahead of the opening bell.

The SPI200 has ASX benchmark futures ahead by 2 meagre points, tracking Wall Street after all three indices closed slightly lower on timid trade as US investors went home early to worry about tonight’s suddenly blockbuster non-farm payrolls report.

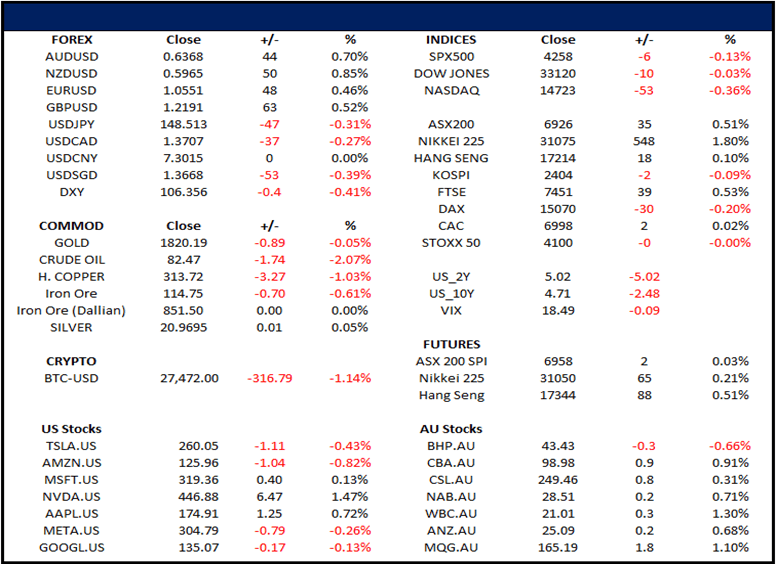

On Wall Street, the S&P 500, Dow Jones and Nasdaq indexes are closed slightly in the red.

The Dow Jones Industrial Average closed 10 points or -0.03% lower, while the S&P 500 gave up more than -0.10% at 4,258.19, and the Nasdaq Composite, -0.12%.

In the States, the remarkable bond sell-off appeared to have eased although Treasury yields remain elevated. Benchmark US 10-year bond yields settled at 4.71 per cent, while the two-year bond yield slid to 5.02 per cent.

Sector-by-sector, it was Materials, Utilities and Consumer Staples which attracted the most selling. Consumer staples companies led the broad market.

Company-by-company, the beer and beverage businesses copped a lot of stick – Coca-Cola and Pepsi Co lost circa 5% each, while Molson Coors crashed 6.3%.

Former Kraft owner, Mondelez and the cleaning product maker Clorox also slid circa 5% – the latter’s recent cyberattack adding texture to roundly poor quarterlies and a plain old dismal outlook.

Clorox stock is at 1-year lows.

NextEra Energy was down -2.3% and American Electric Power short -2.7%, among the losses in US utilities.

Oil prices fell sharply overnight. Brent crude oil is around $US84 barrel, well down from the recent highs of near $US97b a week ago.

Consensus expectations for September NFP:

• Jobs growth of 170k down from 187k in August

• Unemployment rate to fall to 3.7% from 3.8%

• Wage growth to increase +0.3% MoM from +0.2%

In other markets …

US bond yields have edged lower but remain toppy and volatile.

Gold price traded flat US$1,820 an ounce.

Crude prices fell another -2.0%%, with Brent closing at US$82.47 a barrel.

Base metals prices were mixed, with nickel futures and copper futures down -1.0%.

Iron ore futures fell -0.6% to US$114.75 a tonne.

The Aussie dollar was up around +0.4% to US63.68c.

Bitcoin meanwhile rallied +1.15% in the last 24 hours to jump back over US$27k at US$27,129.

A new Fear for Friday

Not quite a Black Swan event yet, but a dark situation that’s been been quietly simmering in another part of Europe is edging closer to boiling point.

Serbia’s recent military deployment along the border with Kosovo might not presage an all-out invasion, but the latest flare-up in century-old tensions leads down a familiar path of further violence which last erupted into a more recent complex and bloody conflict during the break up of Yugoslavia in the 1990s.

Lately analysts have been ringing alarms that relations between Serbia and Kosovo — tense at the best of times — are deteriorating again.

Fresh violence erupted in northern Kosovo late in September, and since then Belgrade has responded with a military buildup on the Kosovo border raising fears of an armed conflict while the world is distracted by the Russia’s actions in Ukraine.

Last week, the White House National Security spokesperson John Kirby confirmed an ‘unprecedented’ build-up of Serbian forces along the border and announced that NATO would be deploying more peacekeepers in northern Kosovo to deter a possible invasion. In the intervening days, following US and EU pressure, Serbian officials stated that they had withdrawn some of the troops their country had stationed near the border, taking the overall number from 8,350 down to 4,500 forces.

5 ASX small caps to watch today

HAR just dropped an update on its regional exploration program over the Saraya Uranium permit in Senegal including some ‘infill termite mound sampling’ and assaying over the anomalous Saraya South and Mandankoli prospects.

Were the termites glowing?

Haranga managing director Peter Batten doesn’t say, but did add that Saraya’s Mineral Resource Estimate at 16Mlbs Inferred and at a grade of 587ppm eU3O8 is ‘a significant result’, in itself.

“But (it) is only the first of, at least, seven anomalies we will be testing within the Saraya Project and whilst the Saraya Prospect is the better defined anomaly, with over 65,000m of drilling, it is also the smallest of the seven anomalies identified, so far.”

Shares in HAR are up 25% in the last month, with ASX uranium stocks the standouts over a stretch of uncertain trade.

Zeus Resources says it’s got the assay results for the Phase 2 Drill Program and reconnaissance soil sampling program at its Mortimer Hills Project, in Western Australia.

“No significant lithium were found from the drilling samples.”

The assay results for the whole of the reconnaissance soil sampling program collected from E09/2147 totalling 174 samples have been received.

“Interpretation of these results and field mapping by the Company has identified multiple anomalies at the Alpha, Beta and Pegmatite Creek prospects warranting further detailed geochemical sampling in anticipation of further drilling.”

The company notes that the presence of pegmatite rock does not necessarily indicate the presence of lithium, cesium, tantalum (LCT) mineralisation.

Greentech says it’s wrapping up a successful five-month field exploration over the Eastern Hub that has led to the confirmation of additional LCT pegmatite outcrops across the now 100% owned Junior Lithium Project.

The company’s also announced the renewal of its Exploration Agreement with Whitesand First Nation, showing support for Seymour, Falcon, and Junior projects, allowing GT1 to continue to work in Traditional Territory.

GT1 is a North American focussed lithium exploration and development business. The company’s 100% owned Ontario lithium projects comprise high-grade, hard rock spodumene assets (Seymour, Root and Wisa) and lithium exploration claims (Allison and Solstice) located on highly prospective Archean Greenstone tenure in northwest Ontario, Canada.

Seymour has an existing Mineral Resource estimate of 9.9Mt @ 1.04% Li2O (comprised of 5.2Mt at 1.29% Li2O Indicated and 4.7Mt at 0.76% Li2O Inferred). Accelerated targeted exploration across all three projects “delivers outstanding potential to grow resources rapidly and substantially”.

GT1 CEO, Luke Cox:

“This has been a big exploration season for GT1 with field teams covering a large amount of ground over the Eastern Hub, with proven success at Tape Lake, part of the Junior Project, as a highlight, showcasing immense regional potential. Proven grades and multiple occurrences hint at stacked pegmatites or a fertile intrusive system, promising significant expansion of GT1’s eastern-hub resource base.”

Over the coming months attention now shifts back to drilling at the flagship Seymour project.

Talga says it’s ‘successfully intercepted wide zones of graphite’ in the first drilling of a 6km long zone of strong EM conductors up to 300m wide, with no surface expression (beneath soil and till cover), on its Vittangi nr 6 exploration permit (~8km northeast of the world-class Nunasvaara and Niska deposits).

The updated Vittangi Graphite Mineral Resource estimate revises Talga’s Swedish graphite resources to an estimated total of 70.8Mt averaging 18.8%Cg, containing 13.3Mt of graphite, which TLG understands is ‘the largest resource of natural graphite in Europe.’

This includes Indicated Resources estimated to total 30.1Mt averaging 22.4%Cg and Inferred Resources estimated to total 40.7Mt averaging 16.2%Cg.

Over the year to date, Talga shares are down about one-third, after losing circa 15% over the last month.

The group has completed a deal to acquire 100% of ISU Group, ‘one of the largest privately owned independent insurance agency networks in the United States of America.’

Bullies:

▪ Acquisition price of US $55 million

▪ The acquisition will be funded from Steadfast’s existing corporate debt facilities and free cashflow

▪ Expected to be EPS accretive from date of acquisition

▪ The ISU purchase is consistent with our successful acquisition strategy

Managing director & CEO Robert Kelly:

“Following numerous discussions and presentations to US intermediaries and insurance carriers, Steadfast has identified significant opportunities to deliver its unique business model to the US insurance market. We are excited to do this through our acquisition of ISU, given their cultural alignment with Steadfast, established and trusted brand and experienced management team.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.