Market Highlights and 5 ASX Small Caps to watch on Wednesday

Picture: Getty Images

- ASX rises a tad after Wall Street wins

- US Fed decision weighs on May the Fourth

ASX rises in timid trade ahead of US Fed rates call

The news in briefs.

Aussie shares are up 0.2% at 11.30am on Wednesday after US markets nabbed a second straight positive close. However, there’s a certain electricty in the air Stateside ahead of tonight’s blockbuster US Federal Reserve’s interest rate decision.

Sensible, rational market consensus points at a 50 basis point rate increase, and while that’d be the hunkiest injection of steaming basis points in well over 20 years, let’s not discount the Fed’s potential to do something stupid on the way to the pulpit. Let’s all take a moment on May the Fourth to remember this was also something carefully considered:

At the close of business, the tech-heavy Nasdaq and the Dow Jones index were up 0.2%. The S&P 500, 0.5%.

Oil shed circa 2.5% with worries out of China offsetting the prospect of a broader European embargo on Russian crude.

Gold futures rebounded overnight, a turnaround which may provide a tailwind to local goldies. Iron ore lost 2% a tonne on the Singapore Futures Exchange.

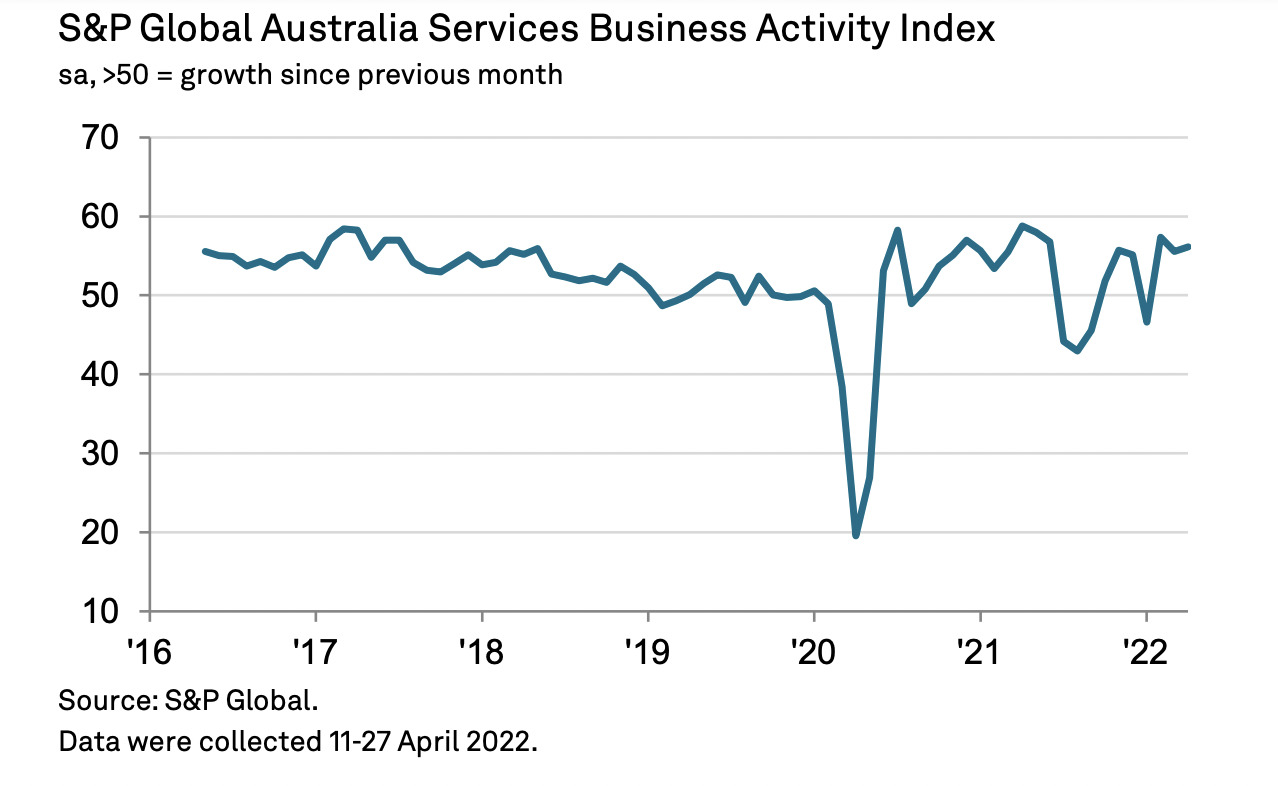

Back home, Australia’s service sector expanded in April according to the latest S&P Global PMI data. Easing COVID-19 disruptions spurred faster business activity and sales growth.

S&P Global also says new export orders rose at a record rate during April.

5 ASX small caps to watch today

It’s not a sport, but watching East33 flail about since mid last week has been an Olympic experience.

The oyster-catcher’s run has been of dizzying highs and lows.

The share price peaked at over 120% on Monday, it lost about 40% yesterday and this morning it’s already gaining at a fast clip – up 25%.

This all began with a note to the ASX last week suggesting rain had ruined a bunch of yummy Sydney Rock oysters.

The company says the ‘inclement weather’ – that’s the insane rain that’s been falling since like, forever – just vindicated its geographic diversification strategy, meaning the lads got in a decent oyster harvest.

But when E33 shared the news last week the share price fell for two days straight. Sank, stone-like.

As I said last week, Monday, yesterday and now today: the people must have their oysters.

The advanced zinc play is telling twitchy shareholders to take no action on an unsolicited takeover offer from its largest shareholder – a generous $37 million and change unsolicited bid from VBS Exchange.

The 9.5c per share offer is an 8.7% discount to AZI’s 52-week high of 10.4c per share. VBS wants to snap up all the rest of Altamin’s stock which it doesn’t already own via an off-market takeover deal.

Altamin, up about 37% and obviously enjoying the attention, says it will need time to bask – I mean, to consider – the offer before it makes a formal call to its shareholders.

The former straggler, now toast of the bauxite clique, is back trading on the ASX.

PBX has been out for a bit dredging through the black book for a recapitalisation.

The new and improved balance sheet now features a handy $4m in cash to get back on the ground and explore its PGE projects out west.

NZ King Salmon(ASX:NZK)

Down 20% at 11.30am, just thought it would be fun to stick with the seafood theme. Over in Kiwiville, NZK is really struggling after dropping a tough annual report late monday. CEO and chair John Ryder saying unusually early elevated seawater temperatures were a major factor behind high mortality rates, with the marine heatwave during summer associated with a La Niña event, resulting in a $20.8m negative impact on profitability.

I would also add, La Niña has been a total bitch this year.

Peppermint Innovation (ASX:PIL)

In a trading halt yesterday ahead of an important licence for the company in the Phillipines, Peppermint Innovation has come storning out of the blocks, after being granted said licence to operate as an electronic money issuer (EMI) by the Central Bank of the Philippines.

Now it can get about offering e-wallet services through its “bizmoto” app allowing any cashed-up Filipino to use the platform, opening up the hard-to-reach micro-entrepreneurs and and lucrative digital payments segment.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.