Market Highlights and 5 ASX Small Caps to watch on Friday

Picture: Getty Images

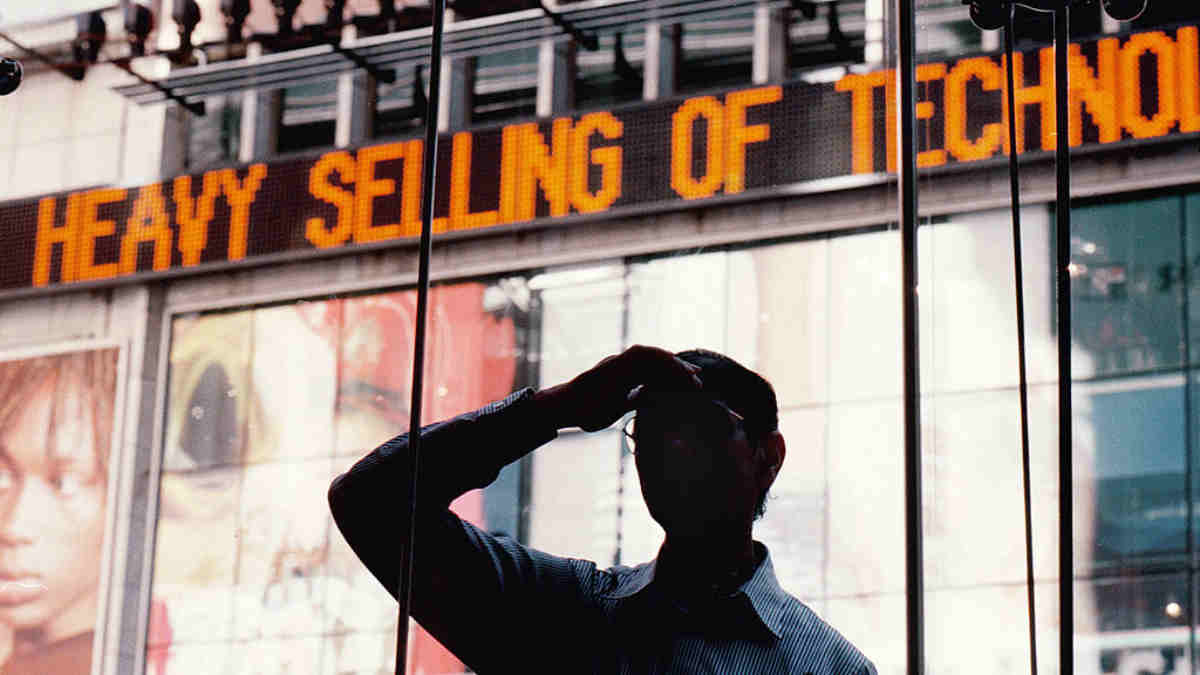

Tech stocks rout on Wall Street

US tech stocks fell hard overnight as investors reassessed the Fed’s decision to hike rates next year.

Tesla and Apple led the rout, down by 5% and 3.5% respectively as markets reassessed their near term prospects. Apple announced recently that three of its stores were hit by cases of COVID.

Buy-now-pay-later (BNPL) stocks also came under huge pressure after the US Consumer Financial Protection Bureau (CFPB) said it was about to open an inquiry into the business of BNPL.

The regulator specifically named five US players including Afterpay, Zip Co, Affirm, , Klarna, and PayPal. The Affirm stock price sank 11% on the news.

All in all, it was a bad day for equities as all three major stock market benchmarks reversed gains made the previous day – the S&P 500 fell by 0.89%, the Dow by 0.09%, and tech heavy Nasdaq by 2.51%.

Commodities however were the bright spot and rallied – with spot iron ore up 4.6%, gold by 1%, and oil prices by 2.5%.

Eurozone shares +1%

US shares -0.9% as Nasdaq -2.5% on concerns about impact of rising rates on tech stocks

US 10 yr yld -3bp to 1.43%

Oil +0.7% to $72

Gold +1.2% to $1798.3

Iron ore +4.6% to $114.7

ASX futures +0.1%$A 0.7181 with $US index -0.5%— Shane Oliver (@ShaneOliverAMP) December 16, 2021

Meanwhile, Bitcoin lost around 2% and at 8am AEDT, was trading at US$47,900.

Hybrid blockchain XDC Network has been the biggest gainer in the top 100, rising 31% to US9.6c, possibly on rumours of a Coinbase listing.

Read the rest of our crypto roundup here on Coinhead.

ASX 200 to open higher on Thursday

With commodity prices higher, the mining heavy ASX 200 looks set to rise at the open this morning, with futures markets (January contracts) pointing up 0.31% at 8:30am AEDT.

Yesterday, the local index finished 0.43% lower, closing at 7,296 points. Healthcare stocks plunged 5% dragged down mainly by CSL’s cap raise, while Energy fell 1.17% and Tech gained 2.07%.

Local BNPL stocks like Afterpay (ASX:APT) and Zip Co (ASX:Z1P) may come under pressure today following what happened in New York.

Meanwhile according to the ASX, four companies will be making their IPO debut later today:

Winton Land (ASX:WTN)

A New Zealand property developer with 28 projects underway throughout NZ and one in Australia. WTN raised $350m at $3.89 per share in its IPO and will have an implied market cap of ~$1.15bn on listing.

AVADA Group (ASX:AVD)

An Aussie traffic management operator, with a focus on NSW and QLD, founded by ex-Wallaby Dan Crowley. It raised $32.5m at $1 per share in its IPO and will have an implied market cap of $73m on listing.

SHAPE Australia (ASX:SHA)

One of Australia’s leading fit-out and refurbishment construction companies, with a national presence across commercial and government, hospitality, healthcare, education, defence, and retail sectors. It raised $2m at $1.96 per share and will have an implied market cap of $163m on listing.

IPD Group (ASX:IPG)

A company servicing Australia’s electrical industry. It raised $40m at $1.20 per share.

On the economics front, RBA governor Phil Lowe said on Thursday the fate of the central bank’s bond buying program will be decided in its next meeting in February, but hinted the program may end by May 2022.

Dr Lowe however reiterated the bank’s stance that the condition for a rate hike will still not be met next year.

5 ASX small caps to watch today

Consolidated Zinc (ASX:CZL)

CZL has signed an offtake deal for 100% of the lead concentrates produced from its Plomosas Project for 2022. The deal was done with Mexican trading company Metco Trading, and will include the sale of lead sulphide and lead oxide concentrates.

ReNu Energy (ASX:RNE)

ReNu says it’s continuing to make progress with the proposed acquisition of Countrywide Renewable Hydrogen (CRH). The company says that several key conditions have now been met, and a shareholder vote is expected to take place on 1 February 2022.

SenSen Networks (ASX:SNS)

An extension contract has been signed with Crown Melbourne to deploy SenSen’s new, patent pending sensor AI solutions. The solution will be retrofitted to existing gaming tables, and helps casinos track players’ activities. Revenue is expected to be $725k over a two and a half-year period.

Way 2 Vat (ASX:W2V)

The tax solutions platform company has signed a major client in NYSE listed Endeavor Group Holdings. Way 2 will help Endavour improve compliance and automation of its VAT/GST claim and returns across US, EMEA and Asia Pacific.

Empire Energy (ASX:EEG)

Empire says it has successfully drilled, cased, and suspended Carpentaria-2H, its first horizontal well located within 100% owned and operated EP187 at Beetaloo. Around 192 metres of liquids-rich shale gas were intersected across the four middle Velkerri pay zones, according to Empire.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.