Cryptos edge higher after Fed Reserve meeting concludes with no major surprises

Getty Images

Cryptos have moved modestly higher after US Federal Reserve officials said they would raise interest rates, but not until next year.

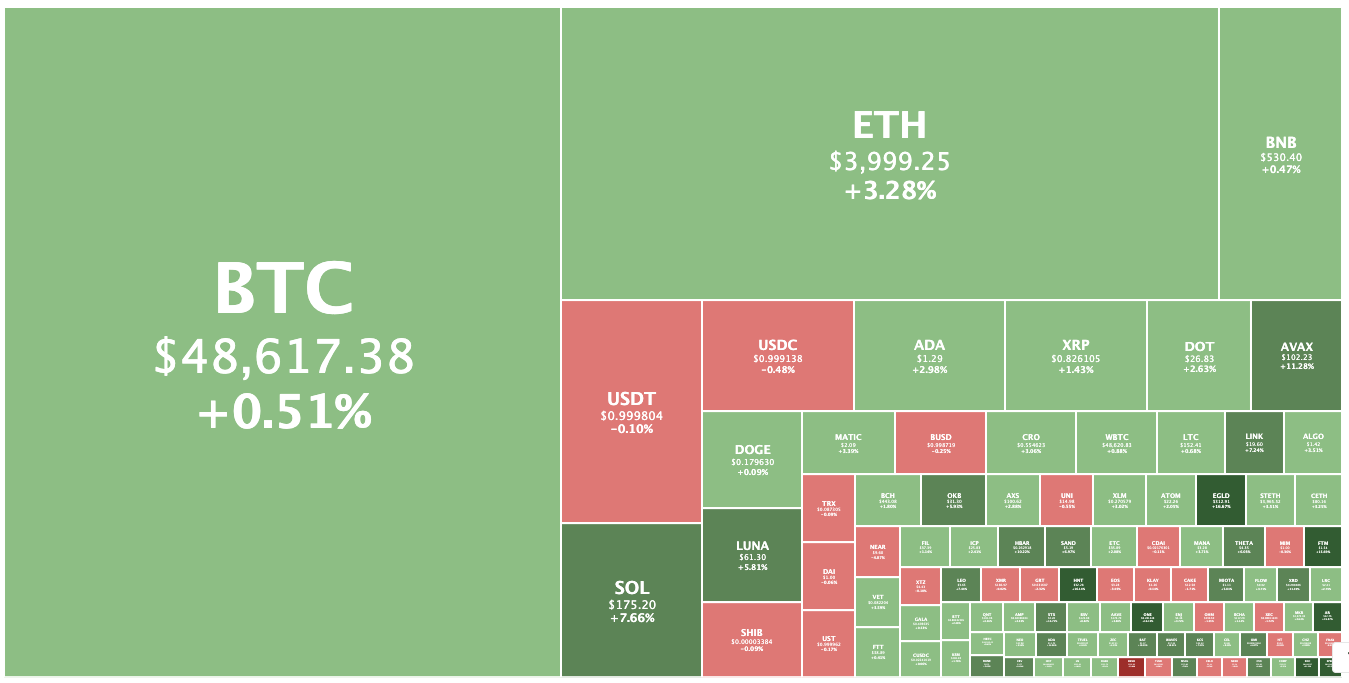

Bitcoin was up just 1.1 per cent to US$48,600 late this afternoon (Sydney time), while Ethereum had gained 4.1 per cent to a three-day high of US$4,011.

That’s up from a low of US$46,600 and US$3,700, respectively, shortly before the Federal Reserve Open Market Committee meeting, which went more or less as expected. The increasingly hawkish Fed officials suggested there’d be three interest rate hikes in 2022 and signalled a speedier end to its bond-buying program.

All three benchmark indices in the US enjoyed their best day in a week following the news. Gold gained 0.29 per cent to US$1,784.

So let me get this straight…

The FED will raise interest rates from 0.25%, 3 times in 2022 up to 1%.

BUT inflation is still over 6%?

Yeah, pump it all! #bitcoin to the moon!

— Lark Davis (@TheCryptoLark) December 15, 2021

Hybrid blockchain XDC Network has been the biggest gainer in the top 100, rising 31.3 per cent to US9.6c, possibly on rumours of a Coinbase listing.

Spell Token was up 24 per cent to US1.48c and Elrond, Helium, Kadena, Harmony and Fantom were all up around 16 per cent.

Decentralised Social, the social network platform formerly known as Bitclout, was the biggest loser in the top 100, falling 17 per cent to $129.75.

Overall the crypto market was up 2.5 per cent to $2.36 trillion.

Anyswap, the No. 220 crypto, was up 12 per cent to $20, and had earlier this afternoon hit an all-time high of $21.46.

The bridge between blockchains in the past seven days has generated US$775,000 in fees after swapping US$1.43 billion in value in 103,886 different transactions, according to its dashboard.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.