Lunchtime ASX small cap wrap: Who’s hunting for value today?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

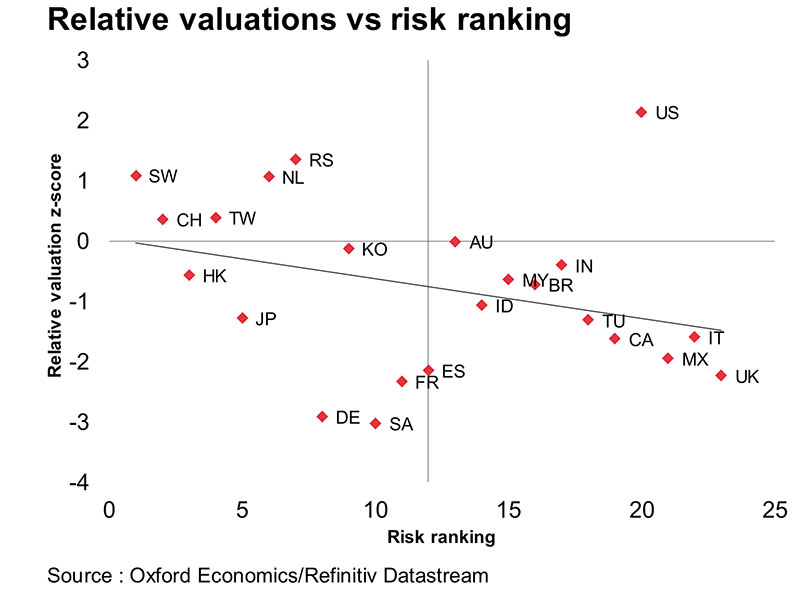

The sharp sell-off in global equities has been ‘indiscriminate’, says Oxford Economics. While downside risks still abound, this could present some interesting relative value opportunities.

Parts of Europe — particularly Germany and France — look to be oversold.

“Indeed, multiples for the Eurozone are now within touching distance of Eurozone-crisis averages, suggesting that a lot of bad news is in the price,” Oxford’s director of equity strategy Daniel Grosvenor says.

“Japan also appears well placed from a relative perspective – valuations are cheap versus history and Japan’s exposure to some of the key risks (particularly balance-sheet and oil) is relatively modest.

The most vulnerable market going forward is the US, Grosvenor says.

“Our analysis suggests it has rerated relative to the wider universe, despite heavy exposure to the underlying risks,” he says.

“Specifically, it is the epicentre of our concerns on corporate debt, could see significant downward revisions to earnings estimates in the worst-case pandemic scenario, and is relatively vulnerable to the underlying virus risk.”

WINNERS

Here are the best performing ASX small cap stocks at 12pm Thursday March 19:

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Chg | Market Cap | Volume |

|---|---|---|---|---|---|

| ADJ | Adslot Ltd | 0.014 | +40.00% | $25.8M | 1.9M |

| MEY | Marenica Energy Ltd | 0.04 | +29.41% | $5.0M | 65.0k |

| CT1 | CCP Technologies Ltd | 0.02 | +26.67% | $21.6M | 1.6M |

| DCC | DigitalX Ltd | 0.01 | +25.00% | $9.1M | 1.2M |

| BUD | Buddy Technologies Ltd | 0.01 | +25.00% | $23.8M | 3.2M |

| GBZ | GBM Resources Ltd | 0.06 | +24.00% | $12.0M | 48.2k |

| TER | Terracom Ltd | 0.19 | +23.33% | $113.5M | 225.9k |

| OLL | OpenLearning Ltd | 0.25 | +22.50% | $35.6M | 2.9M |

| MNF | MNF Group Ltd | 3.61 | +21.96% | $297.4M | 562.8k |

| EQE | Equus Mining Ltd | 0.01 | +20.00% | $8.5M | 4.8M |

| MEB | Medibio Ltd | 0.01 | +20.00% | $6.0M | 100.0k |

| MRG | Murray River Organics Group Lt | 0.01 | +20.00% | $26.5M | 150.0k |

| TOE | Toro Energy Ltd | 0.01 | +20.00% | $15.7M | 83.5k |

| FRM | Farm Pride Foods Ltd | 0.27 | +17.39% | $14.9M | 108.8k |

| LNY | Laneway Resources Ltd | 0.0035 | +16.67% | $13.0M | 150.0k |

| RBR | RBR Group Ltd | 0.01 | +16.67% | $5.5M | 59.0k |

| BDA | Bod Australia Ltd | 0.15 | +15.38% | $13.7M | 83.9k |

| NOR | Norwood Systems Ltd | 0.03 | +15.38% | $6.9M | 1.5M |

| HCT | Holista CollTech Ltd | 0.1 | +15.12% | $26.9M | 8.0M |

Adslot (ASX:ADJ) founder and chairman Andrew Barlow has bought about $30,000 worth of shares in the ad-tech company on-market, sending the stock up 40 per cent in morning trade.

Earlier this week, Adslot told investors that while impacts to the business of COVID-19 were modest at present, there was “material uncertainty” over the short and medium term.

The company said it had taken pre-emptive steps to reduce cash outflows for the remainder of FY20, which included cutting director fees and contractor costs.

Holista Colltech (ASX:HCT) announced it had appointed a distributor for its NatShield hand sanitiser in the US, sending the stock up 15 per cent.

Also among the gainers was OpenLearning (ASX:OLL), which has unveiled a partnership with Alibaba Cloud to offer online courses to students in China.

LOSERS

Here are the worst performing ASX small cap stocks at 12pm Thursday March 19:

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Chg | Market Cap | Volume |

|---|---|---|---|---|---|

| TMZ | Thomson Resources Ltd | 0.003 | -80.00% | $356K | 410 |

| VAL | Valor Resources Ltd | 0.001 | -50.00% | $1.9M | 250.0k |

| DXN | DXN Ltd | 0.02 | -40.74% | $6.8M | 988.5k |

| LOV | Lovisa Holdings Ltd | 2.73 | -37.39% | $291.2M | 1.0M |

| DRX | Diatreme Resources Ltd | 0.01 | -33.33% | $11.1M | 25.0k |

| LVH | LiveHire Ltd | 0.1 | -28.57% | $30.2M | 152.7k |

| DYL | Deep Yellow Ltd | 0.12 | -28.12% | $28.2M | 327.7k |

| PKO | Peako Ltd | 0.01 | -27.27% | $1.0M | 61.0k |

| CCP | Credit Corp Group Ltd | 9.05 | -26.48% | $481.1M | 523.6k |

| RVS | Revasum Inc | 0.34 | -24.44% | $26.5M | 5.5k |

| MNY | Money3 Corp Ltd | 0.92 | -23.97% | $171.2M | 1.3M |

| OBM | Ora Banda Mining Ltd | 0.1 | -23.08% | $58.6M | 682.2k |

| HIL | Hills Ltd | 0.16 | -22.50% | $37.1M | 296.7k |

| CXX | Cradle Resources Ltd | 0.03 | -21.05% | $5.7M | 139.1k |

| ATS | Australis Oil & Gas Ltd | 0.01 | -21.05% | $14.8M | 13.7M |

| MYR | Myer Holdings Ltd | 0.14 | -20.59% | $115.0M | 6.5M |

| LSH | Lifespot Health Ltd | 0.02 | -20.00% | $1.8M | 703.3k |

| EXR | Elixir Energy Ltd | 0.02 | -20.00% | $11.0M | 1.2M |

| AU1 | Agency Group Australia Ltd/The | 0.04 | -20.00% | $12.0M | 117.6k |

| BBX | BBX Minerals Ltd | 0.1 | -20.00% | $41.3M | 110.0k |

Mass consumer jewellery retailer Lovisa (ASX:LOV) says production capacity in China has begun to return to normal levels. However, traffic at its 449 global stores is falling due to COV-19 concerns, causing a “significant deterioration in sales”.

All stores in France, Spain, and Malaysia are currently closed, it says; another 25 stores in the US are closed or closing “as a result of local government directives for shopping malls”.

“All other markets are currently still open and trading, however, have seen a declining sales trend with large decreases in store traffic in recent days,” Lovisa says.

At Stockhead, we tell it like it is. While OpenLearning is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.