Lunch Wrap: Santos left at the altar, Stakk rockets 300pc on Robinhood deal

Stakk (ASX:SKK) rocketed 400% on Robinhood deal. Picture via Getty Images

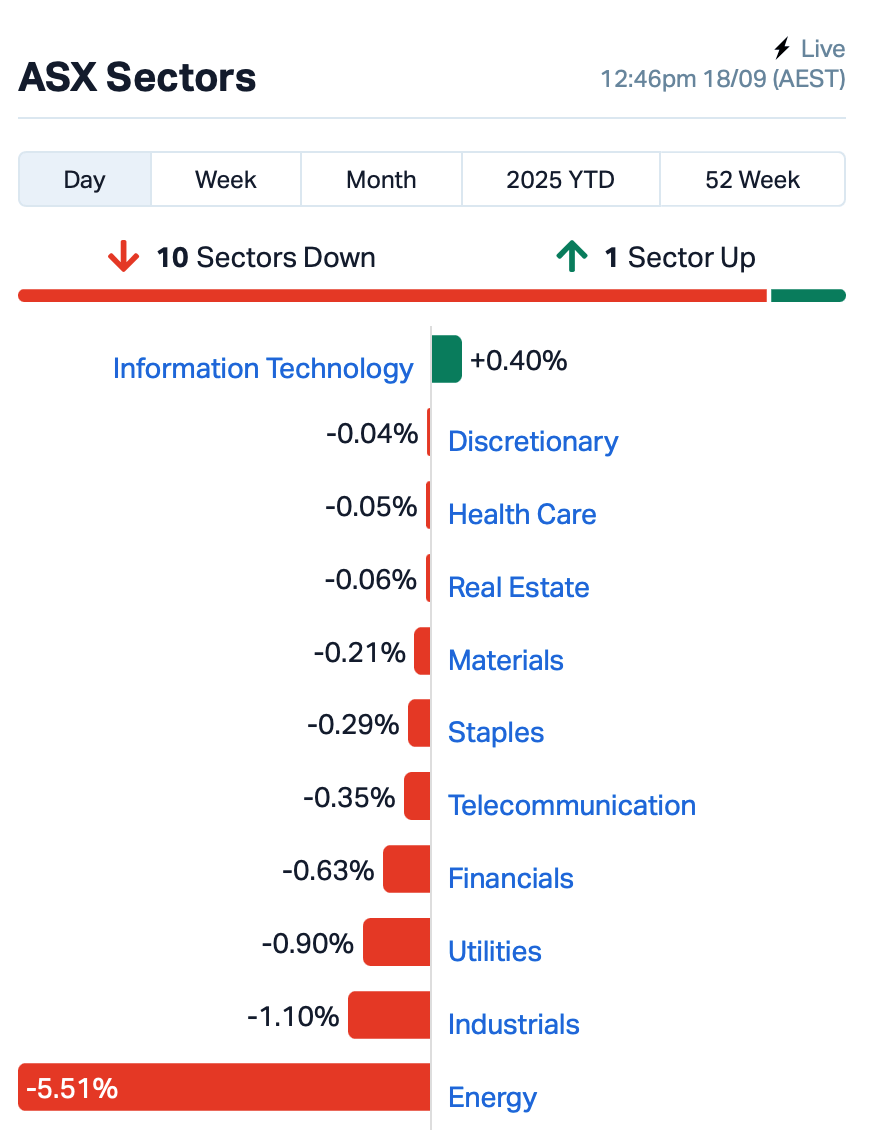

- ASX drops as Fed Reserve cuts 25bp

- Santos deal blows up, stock torched

- Stakk rockets over 300% on Robinhood deal

The ASX was down around 0.4% by Thursday lunchtime in the east.

Overnight, Wall Street closed mixed after the Fed Reserve’s quarter-point trim, its first cut of the year.

Fed Chair Powell called it a “risk management cut”, but investors read the dot plots and realised the so-called easing cycle is more of a drip feed than a flood.

The bond market certainly got the memo, with yields climbing as traders tore up their fantasy playbook of 150 basis points of cuts this year.

Back home on the ASX, energy was where the knives were out.

The sector bled more than 5% after Abu Dhabi’s oil giant walked away from a $36 billion marriage with Santos (ASX:STO), torching STO stock by 12%.

Santos has spent years telling the market it’s undervalued, but every time a deep-pocketed suitor gets under the hood, they end up walking out with their chequebooks still zipped.

The XRG consortium’s decision to walk shows the value gap isn’t just about share price, it’s about baggage.

Regulatory headaches, domestic gas obligations, and capital-heavy projects like Barossa weigh down like anchors.

Broker Jarden wasted no time swinging the axe, slashing its rating on Santos to underweight and trimming its price target from $8.40 to $7.05.

In other large cap news, Endeavour Group (ASX:EDV) named Woolworths exec Jeanette Fenske as the new boss of BWS, a steady hand to keep the liquor tills running. EDV shares were up 0.5%.

Meanwhile, the jobs print released at 11.30am didn’t exactly reassure anyone.

Aussie employment fell by 5400 in August, versus consensus for a gain of 21,000. Full-time jobs fell off a cliff – down 40,900 – with part-time work plugging the gap to the tune of 35,500.

The unemployment rate stayed at 4.2%, but that’s lipstick on a pig when the quality of work is slipping.

If full-time jobs keep collapsing into casual shifts, the RBA board will have to admit the cycle is easing because the economy’s running out of puff.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SKK | Stakk Limited | 0.024 | 300% | 228,366,078 | $12,450,478 |

| BMO | Bastion Minerals | 0.002 | 100% | 3,750,000 | $2,204,953 |

| PAB | Patrys Limited | 0.002 | 100% | 2,416,247 | $4,583,757 |

| CCE | Carnegie Cln Energy | 0.155 | 48% | 4,755,127 | $42,350,923 |

| SRN | Surefire Rescs NL | 0.002 | 33% | 994,500 | $5,860,289 |

| EV1 | Evolutionenergy | 0.013 | 30% | 745,240 | $5,077,107 |

| HTG | Harvest Tech Grp Ltd | 0.025 | 25% | 6,109,534 | $18,180,366 |

| DTM | Dart Mining NL | 0.003 | 25% | 350,000 | $2,749,052 |

| GTE | Great Western Exp. | 0.020 | 25% | 4,182,676 | $9,084,127 |

| MRQ | Mrg Metals Limited | 0.005 | 25% | 21,021,000 | $10,906,075 |

| VFX | Visionflex Group Ltd | 0.003 | 25% | 830,000 | $6,735,721 |

| WBE | Whitebark Energy | 0.005 | 25% | 375,000 | $2,814,051 |

| SMM | Somerset Minerals | 0.013 | 24% | 26,693,816 | $8,466,682 |

| LMS | Litchfield Minerals | 0.185 | 23% | 254,211 | $4,964,409 |

| LTP | Ltr Pharma Limited | 0.740 | 23% | 2,260,257 | $67,177,778 |

| MDX | Mindax Limited | 0.064 | 23% | 1,301,366 | $122,130,989 |

| DMG | Dragon Mountain Gold | 0.011 | 22% | 52,289 | $3,552,045 |

| TZL | TZ Limited | 0.047 | 21% | 368,872 | $10,934,200 |

| LML | Lincoln Minerals | 0.006 | 20% | 2,883,084 | $12,889,684 |

| TEG | Triangle Energy Ltd | 0.003 | 20% | 166,667 | $5,473,085 |

| IBX | Imagion Biosys Ltd | 0.046 | 18% | 21,611,020 | $9,607,315 |

| TG6 | Tgmetalslimited | 0.245 | 17% | 562,146 | $21,493,183 |

| BLU | Blue Energy Limited | 0.007 | 17% | 1,043,000 | $12,771,718 |

| C7A | Clara Resources | 0.004 | 17% | 200,000 | $2,229,885 |

| ENT | Enterprise Metals | 0.007 | 17% | 3,284,408 | $8,647,904 |

Stakk (ASX:SKK) surged over 300% after landing a two-year deal with Robinhood to provide image capture, authentication and transaction processing for the US fintech’s new Robinhood Banking platform. The agreement, which can be extended, makes Stakk a critical vendor as Robinhood pushes into full-service banking with checking and savings accounts. While revenue will depend on how successful the rollout is, Stakk said the partnership is material given Robinhood’s scale and ambition.

Somerset Minerals (ASX:SMM) has hit wide zones of visible copper mineralisation in its first two Jura North holes, extending mineralisation below its earlier 42.7m at 2.69% Cu intercept. JURC006 logged multiple mineralised zones over 85.4m and JURC005 over 56.4m. Assays are due in about two weeks, with recent geophysics set to guide the next phase of exploration across the broader 7km Jura fault zone.

Litchfield Minerals (ASX:LMS) has wrapped up an oversubscribed shortfall offer, adding $527k and bringing its total raise to $1.5m. The strong demand shows growing confidence in the Oonagalabi Project, with a 14-hole drill program set to kick off in late September to test high-priority copper-gold targets.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ERA | Energy Resources | 0.002 | -33% | 1,509,053 | $1,216,188,722 |

| HLX | Helix Resources | 0.001 | -33% | 10,114,594 | $7,569,436 |

| TMX | Terrain Minerals | 0.002 | -33% | 756,640 | $8,045,443 |

| CZN | Corazon Ltd | 0.003 | -25% | 624,900 | $4,938,289 |

| IRX | Inhalerx Limited | 0.028 | -22% | 2,208 | $7,684,136 |

| AQX | Alice Queen Ltd | 0.004 | -20% | 2,498,009 | $6,923,481 |

| IS3 | I Synergy Group Ltd | 0.009 | -18% | 377,716 | $18,930,894 |

| ABX | ABX Group Limited | 0.075 | -17% | 7,210,084 | $22,669,336 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 2,978,518 | $11,143,423 |

| MMR | Mec Resources | 0.005 | -17% | 925,762 | $11,231,939 |

| NWM | Norwest Minerals | 0.010 | -17% | 13,499,854 | $12,361,283 |

| RLC | Reedy Lagoon Corp. | 0.003 | -17% | 20,000 | $2,330,120 |

| SRL | Sunrise | 4.240 | -16% | 779,837 | $619,730,819 |

| KLR | Kaili Resources Ltd | 0.245 | -16% | 1,382,403 | $42,746,105 |

| BRX | Belararoxlimited | 0.094 | -15% | 1,425,321 | $17,819,887 |

| 1AD | Adalta Limited | 0.003 | -14% | 11,136,500 | $5,110,719 |

| AUZ | Australian Mines Ltd | 0.012 | -14% | 20,608,963 | $25,360,492 |

| RML | Resolution Minerals | 0.052 | -14% | 40,833,703 | $75,274,209 |

| XGL | Xamble Group Limited | 0.025 | -14% | 19,500 | $9,831,413 |

| FBM | Future Battery | 0.033 | -13% | 1,224,260 | $25,637,119 |

| EMU | EMU NL | 0.020 | -13% | 38,180 | $4,858,715 |

| AA2 | Ariana Resources PLC | 0.340 | -13% | 221,513 | $15,321,428 |

| LEG | Legend Mining | 0.007 | -13% | 2,980,377 | $23,315,817 |

| MOH | Moho Resources | 0.007 | -13% | 1,613,103 | $5,963,312 |

| RIM | Rimfire Pacific | 0.014 | -13% | 3,319,695 | $43,598,302 |

LAST ORDERS

DY6 Metals (ASX:DY6) has finished off a shareholder-approved placement to its directors and added $245k to the coffers, with another chunk of change brought in by on-market buying and exercised options from executive chairman Dan Smith, CEO Cliff Fitzhenry and non-executive director Myles Campion.

The company recently expanded its collection of highly prospective rutile tenure in Cameroon, and the buying signals the directors’ support for a strategy which has entrenched the company as a dominant regional player for the scarce and highly pure titanium feedstock.

Red Metal (ASX:RDM) has begun the first of a quarter of diamond drill holes over its Pulkarrimarra project in Western Australia’s highly sought after Paterson Province.

The company has a collection of geophysical targets to explore, and drilling will first turn to the on the western end of the project funded by Alliance partner BHP on the trail of sedimentary hosted copper.

Red Metal will also look at bringing in a second rig to wrap up the four holes during the current field season, with it fully owned eastern end of the project sitting along trend from Rio Tinto’s Winu discovery and playing host to its own high-priority gold targets.

IN CASE YOU MISSED IT

With silver’s star on the rise, a host of big-name institutional investors have piled into a $14m placement for explorer Rapid Critical Metals (ASX:RCM) and its emerging silver strategy centred around the super high-grade Webbs Consol project in NSW.

Early results from Greenvale Energy’s (ASX:GRV) second drillhole at Oasis have pointed towards thick, high-grade uranium starting near the surface of and running deeper than expected into the Queensland project.

iTech Minerals (ASX:ITM) has begun a farm-in and lithium joint venture with SQM Australia for Reynolds Range, with the subsidiary of the world’s largest lithium producer managing all exploration and development activities over the Northern Territory project.

Diamond drilling at Argent Minerals’ (ASX:ARD) Kempfield project has returned broad, robust silver zones which highlight its potential for resource growth in the highly polymetallic-prospective Lachlan Fold Belt of NSW.

Hillgrove Resources (ASX:HGO) has reported high-grade copper and gold from the Emily Star prospect as it continues to enhance the prospects of opening up fresh mining fronts for its operating Kanmantoo copper mine near Adelaide.

Ariana Resources (ASX:AA2) sees the Canadian mid-tier Alamos Gold’s US$470 million sale of its Turkish subsidiary to Tumad as a spotlight on the strong valuations being paid for undeveloped gold ounces.

Cardiex (ASX:CDX) has announced that its Pulse device is fully compatible with Apple’s newly announced hypertension detection features.

At Stockhead, we tell it like it is. While DY6 Metals and Red Metal are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.