Lunch Wrap: Goldies, lithium stocks rally; Perenti bags $300m deal

ASX goldies rally again. Pictrure via Getty Images

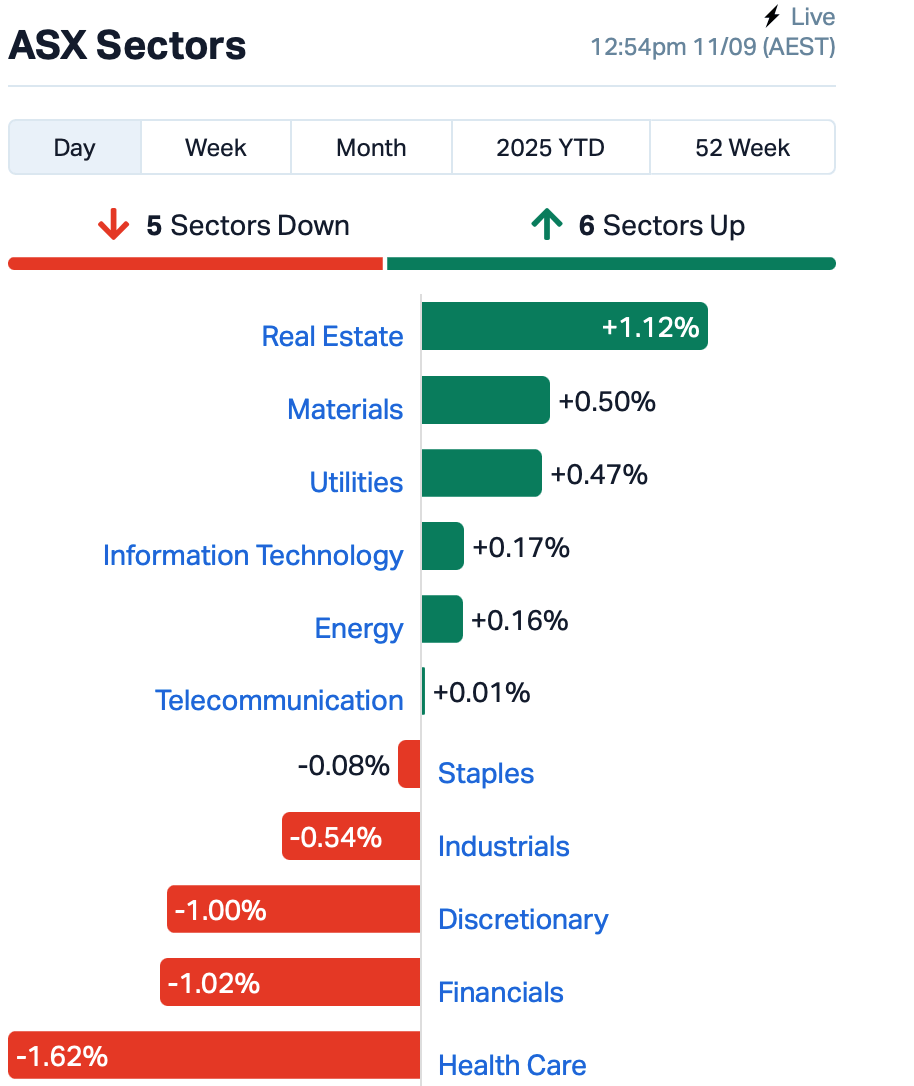

- ASX dips as healthcare slumps

- Goldies rally, lithium stocks claws back after brutal selloff

- Santos keeps talking Narrabri gas

By Wednesday lunchtime, the ASX was sagging about 0.35%.

Overnight, Wall Street didn’t hand us much to work with. The Dow slipped, while the S&P scraped out a record-close by the skin of its teeth.

The only real action was Oracle detonating higher (36%) on the back of its CEO’s spiel about “significant AI contracts” with everyone from OpenAI to Nvidia.

Actually, there was a little bit of action in the land of magic internet money, too, per our latest Mooners and Shakers crypto-market update. At the time of writing, Bitcoin (+2.3%) and Ethereum (+1.5%) have both made half decent moves to the upside over the past 24 hours. Okay, those figures don’t sound like much, but they’re BIG market caps.

Back home on the ASX, it was healthcare that weighed us down this morning.

CSL (ASX:CSL), ProMedicus (ASX:PME), ResMed (ASX:RMD) were all heading south.

Real estate kept the market from looking worse, though it felt more like a sector rotation.

Gold was the real story this morning.

Spot bullion pushed through US$3,700 an ounce for the first time ever, and the gold miners didn’t need a second invitation.

Newmont Corporation (ASX:NEM), Resolute Mining (ASX:RSG) and Regis Resources (ASX:RRL) all spiked higher.

Lithium stocks also found some bounce after yesterday’s bruising, when word of the Chinese CATL mine restart flattened the sector.

In large caps news, Perenti Global (ASX:PRN) added 2% after its Barminco unit secured a $300 million, four-year underground contract with Ramelius Resources (ASX:RMS) at Dalgaranga.

Investors love certainty, and nothing says certainty like someone else’s money locked in for four years.

And Santos (ASX:STO) announced yet another MOU, this time with Orica, for up to 15 petajoules a year of Narrabri gas, if the project ever sees daylight.

CEO Kevin Gallagher is still talking about “overwhelming demand” and “competitive supply,” but after years of talk, investors are treating Narrabri more as background noise than catalyst.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ZNC | Zenith Minerals Ltd | 0.115 | 92% | 13,971,625 | $31,767,330 |

| FUN | Fortuna Metals Ltd | 0.105 | 50% | 6,478,641 | $13,114,086 |

| CXU | Cauldron Energy Ltd | 0.012 | 50% | 38,201,485 | $14,313,288 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 1,617,726 | $7,254,899 |

| ATV | Activeportgroupltd | 0.028 | 33% | 19,794,964 | $19,672,526 |

| AZI | Altamin Limited | 0.028 | 33% | 475,166 | $12,064,561 |

| EPX | EPX Limited | 0.037 | 32% | 3,129,387 | $21,016,413 |

| RMX | Red Mount Min Ltd | 0.013 | 30% | 73,373,081 | $5,952,171 |

| KGD | Kula Gold Limited | 0.011 | 29% | 10,950,509 | $8,811,426 |

| IPB | IPB Petroleum Ltd | 0.009 | 29% | 11,707 | $4,944,821 |

| REM | Remsensetechnologies | 0.050 | 28% | 6,745,405 | $7,566,603 |

| LKY | Locksleyresources | 0.370 | 25% | 26,655,573 | $74,313,636 |

| NTM | Nt Minerals Limited | 0.003 | 25% | 200,000 | $2,421,806 |

| SIS | Simble Solutions | 0.005 | 25% | 16,734,793 | $4,329,321 |

| LPM | Lithium Plus | 0.092 | 24% | 512,524 | $9,830,160 |

| LKO | Lakes Blue Energy | 1.500 | 20% | 169,655 | $85,353,005 |

| MAT | Matsa Resources | 0.120 | 20% | 4,604,627 | $77,722,428 |

| CZN | Corazon Ltd | 0.003 | 20% | 620,000 | $3,086,431 |

| PRX | Prodigy Gold NL | 0.003 | 20% | 429,999 | $16,854,657 |

| SPQ | Superior Resources | 0.006 | 20% | 192,143 | $11,854,914 |

| VEN | Vintage Energy | 0.006 | 20% | 1,192,104 | $10,434,568 |

| OD6 | Od6Metalsltd | 0.060 | 18% | 3,009,799 | $10,145,404 |

| DTZ | Dotz Nano Ltd | 0.063 | 17% | 118,734 | $32,939,421 |

| SRL | Sunrise | 2.600 | 16% | 961,777 | $265,135,842 |

| G11 | G11 Resources Ltd | 0.023 | 15% | 3,372,643 | $19,332,442 |

Zenith Minerals (ASX:ZNC) has kicked off its 2025 drilling at Red Mountain in Queensland with a bang, hitting a broad 139.7m zone grading 1.05g/t gold, including some high-grade intervals topping 37g/t. The company reckons the geology is shaping up to mirror the Mt Wright deposit, with zinc-lead mineralisation suggesting drilling is still skimming the upper levels of the system and higher grades could sit deeper. Assays from the rest of the hole and nearby copper porphyry drilling are due soon.

Fortuna Metals (ASX:FUN) has snapped up the Mkanda and Kampini rutile projects in Malawi, giving it ground right next door to Sovereign’s world-class Kasiya deposit. The 658km2 licences sit in what’s shaping up as a major new rutile province, with strong infrastructure already in place and rising demand for titanium from aerospace to advanced manufacturing. Fortuna has also named Tom Langley as CEO, with the new boss backing the projects as a rare chance to chase big rutile and graphite discoveries on the same geology as Kasiya.

Cauldron Energy (ASX:CXU) has struck a non-binding MOU with Uzbekistan’s uranium giant Navoiyuran, the world’s second-biggest ISR uranium producer, to help advance the Yanrey Uranium Project in WA. The deal could bring in technical expertise, future funding and government advocacy, with Navoiyuran already completing due diligence on Yanrey. CEO Jonathan Fisher called it a transformational step.

And, wound-care biotech PolyNovo (ASX:PNV) drifted higher after chairman David Williams bought $52k worth of shares.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RKB | Rokeby Resources Ltd | 0.006 | -33% | 19,528,581 | $16,432,936 |

| EEL | Enrg Elements Ltd | 0.001 | -33% | 1,699,964 | $4,880,668 |

| 1AD | Adalta Limited | 0.003 | -25% | 2,301,724 | $5,285,266 |

| SRN | Surefire Rescs NL | 0.002 | -25% | 619,000 | $7,813,719 |

| T3D | 333D Limited | 0.083 | -25% | 2,191,383 | $20,773,919 |

| ERA | Energy Resources | 0.002 | -20% | 45,510 | $1,013,490,602 |

| FBR | FBR Ltd | 0.004 | -20% | 1,528,106 | $32,375,888 |

| HFR | Highfield Res Ltd | 0.089 | -19% | 1,888,831 | $52,148,475 |

| OLL | Openlearning | 0.018 | -18% | 1,406,485 | $10,621,775 |

| JAV | Javelin Minerals Ltd | 0.003 | -17% | 12,791,027 | $18,756,675 |

| VAR | Variscan Mines Ltd | 0.005 | -17% | 53,919 | $5,401,718 |

| ALR | Altairminerals | 0.014 | -16% | 10,464,927 | $72,747,907 |

| ORN | Orion Minerals Ltd | 0.011 | -15% | 3,300 | $97,531,224 |

| TNY | Tinybeans Group Ltd | 0.098 | -15% | 99,563 | $17,009,700 |

| AKO | Akora Resources | 0.094 | -15% | 94,117 | $16,213,190 |

| ALY | Alchemy Resource Ltd | 0.006 | -14% | 54,000 | $8,246,534 |

| AZL | Arizona Lithium Ltd | 0.006 | -14% | 81,821 | $37,662,201 |

| TDO | 3D Energi Ltd | 0.130 | -13% | 3,419 | $50,021,033 |

| SRJ | SRJ Technologies | 0.013 | -13% | 4,279,354 | $20,687,176 |

| ATR | Astron Ltd | 0.425 | -13% | 97,275 | $204,995,179 |

| OLH | Oldfields Holdings | 0.020 | -13% | 1,616,788 | $4,900,360 |

| FHS | Freehill Mining Ltd. | 0.004 | -13% | 2,186,445 | $13,655,414 |

| FRX | Flexiroam Limited | 0.007 | -13% | 22,062 | $12,139,189 |

| KRR | King River Resources | 0.014 | -13% | 1,505,364 | $23,417,393 |

| M4M | Macro Metals Limited | 0.007 | -13% | 128,919 | $33,757,603 |

Boss Energy (ASX:BOE) was down 3% after confirming its Honeymoon mine review won’t be wrapped up until December. The company has already admitted its production targets don’t stack up, so this review is basically an exercise in damage control.

IN CASE YOU MISSED IT

Locksley Resources’ (ASX:LKY, OTCQB:LKYRF) expands Mojave footprint to more than 40km2 and increases exploration pipeline for antimony, rare earths and polymetallic minerals.

RareX (ASX:REE) has made a strong start to initial exploration at Mt Mansbridge, identifying several HREO occurrences.

Sovereign Metals (ASX:SVM) has welcomed Japanese investment in key infrastructure to strengthen the Nacala Corridor across southern Africa.

Red Mountain Mining’s (ASX:RMX) new Utah Antimony project could host extensions of neighbouring peers, such as Trigg Minerals.

Pure Hydrogen (ASX:PH2) boosts reach with new partner HDEA to promote and sell its hydrogen fuel cell and battery electric trucks and buses.

New drill results have extended a discovery that has turned Waratah Minerals (ASX:WTM) into one of Australia’s most exciting gold exploration stories.

LAST ORDERS

Argent Minerals (ASX:ARD) has polished off a drilling program over Lodes 100 and 200 at the Kempfield silver-polymetallic project. The company expects to receive the assays later this month.

Brightstar Resources (ASX:BTR) has welcomed a $6m cash injection to advance the Sandstone Gold project after acquisition target Aurumin (ASX:AUN) divested all non-core assets to raise the funding.

At Stockhead, we tell it like it is. While Argent Minerals and Brightstar Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.