Lunch Wrap: Goldies crack, Deep Yellow dips after sudden uranium boss exit

Gold stocks were smashed this morning. Picture via Getty Images

- Gold loses its shine as miners tank

- Bapcor blows a gasket after $12m hit

- Zip zips higher while DroneShield soars

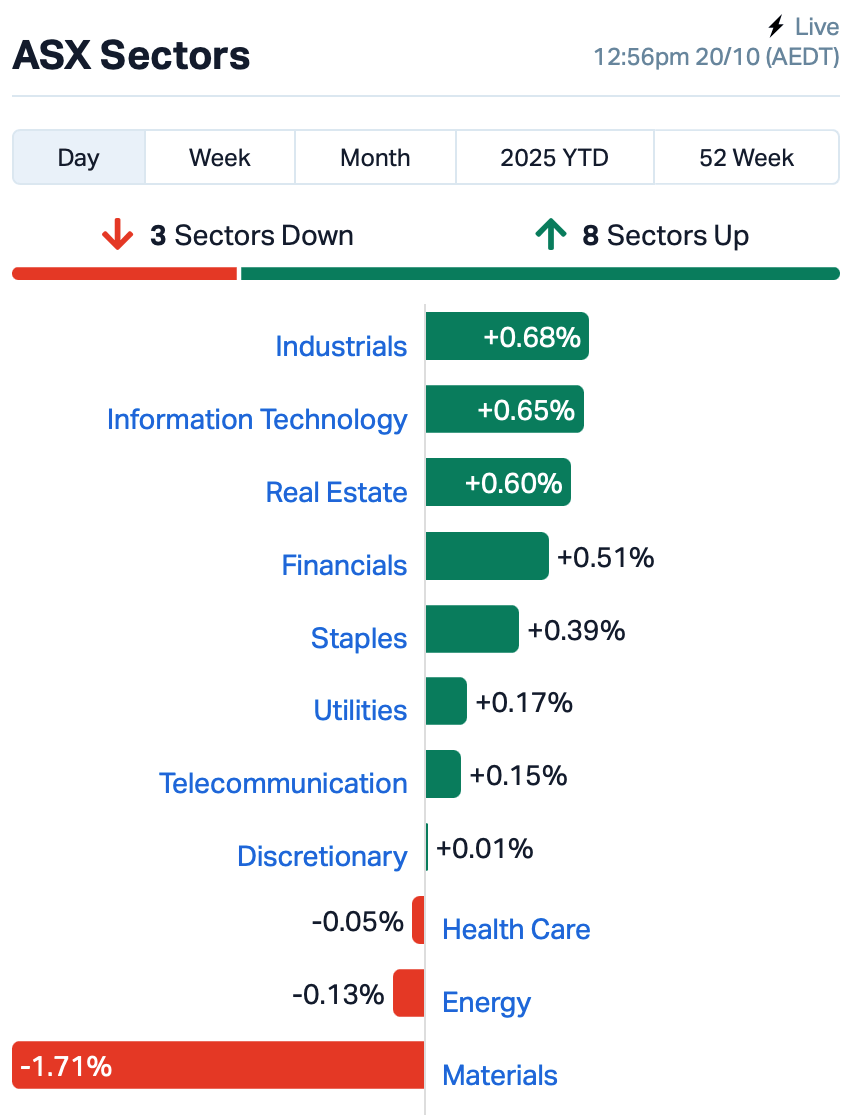

The ASX was slightly lower by Monday lunchtime in the east, off about 0.1% as traders gave little weight to Wall Street’s Friday rally.

US indices ended the week on a high after Trump decided tariffs weren’t “sustainable”, and hinted that his chats with China were going “well”.

But back in Sydney, that optimism barely lasted through the opening bell.

Mining was the mood killer this morning. Gold stocks were smashed after a record-breaking run finally met the brick wall of profit-taking.

Bullion had soared to an absurd US$4,380 an ounce on Friday before dropping by around 1.8%, the biggest fall in months. By this morning, it was just sitting there at US$4,258.

Newmont Corporation (ASX:NEM) and Evolution Mining (ASX:EVN) sank more than 5%. Critical minerals joined the nosedive with Iluka Resources (ASX:ILU) falling 6%, too.

In other large cap news, uranium miner Deep Yellow (ASX:DYL) plunged 16% after CEO John Borshoff quit on the spot.

CFO Craig Barnes will fill in, but investors don’t love sudden exits in the nuclear business. Borshoff’s staying on as an adviser, though.

On the brighter side, Zip Co (ASX:ZIP) shares jumped as high as 6% after the buy-now-pay-later (BNPL) outfit lifted its US growth forecast again. Transaction volumes are up 51% to almost $3 billion for the quarter, and management now expects full-year growth of 40%.

DroneShield (ASX:DRO) continued its hot streak, climbing 2% after revealing revenue was up more than 1,000% year-on-year to $92.9 million.

Last year’s $7.8 million now looks like a rounding error. Operating cash flow swung from negative $19 million to positive $20 million.

And finally…. across the pond, New Zealand inflation came in hot at 3%, right at the top of the RBNZ’s target band.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| 1AD | Adalta Limited | 0.005 | 67% | 67,515,560 | $4,610,616 |

| RAN | Range International | 0.004 | 33% | 1,003,926 | $3,237,871 |

| AUR | Auris Minerals Ltd | 0.013 | 30% | 9,111,720 | $5,481,199 |

| AR3 | Austrare | 0.285 | 30% | 2,846,738 | $47,694,722 |

| BEZ | Besragoldinc | 0.081 | 29% | 2,982,856 | $26,176,751 |

| ERA | Energy Resources | 0.003 | 25% | 1,685,338 | $810,792,482 |

| VFX | Visionflex Group Ltd | 0.003 | 25% | 1,360,000 | $6,758,296 |

| HAS | Hastings Tech Met | 0.885 | 24% | 1,638,469 | $149,493,483 |

| SER | Strategic Energy | 0.011 | 22% | 29,795,444 | $9,890,400 |

| RML | Resolution Minerals | 0.105 | 22% | 70,314,072 | $154,643,642 |

| BPM | BPM Minerals | 0.145 | 21% | 1,118,554 | $10,476,039 |

| AOK | Australian Oil. | 0.003 | 20% | 4,783,377 | $2,653,207 |

| QXR | Qx Resources Limited | 0.006 | 20% | 1,093,160 | $9,213,247 |

| ARU | Arafura Rare Earths | 0.480 | 19% | 36,799,779 | $1,189,535,711 |

| CR9 | Corellares | 0.007 | 17% | 415,792 | $6,045,419 |

| ERL | Empire Resources | 0.007 | 17% | 410,500 | $8,903,479 |

| PGY | Pilot Energy Ltd | 0.007 | 17% | 781,955 | $12,951,960 |

| TEG | Triangle Energy Ltd | 0.004 | 17% | 276,015 | $6,603,702 |

| SRJ | SRJ Technologies | 0.022 | 16% | 4,994,173 | $26,203,756 |

| CUF | Cufe Ltd | 0.046 | 15% | 16,604,374 | $57,437,542 |

| RAU | Resouro Strategic | 0.355 | 15% | 152,014 | $15,073,623 |

| 5EA | 5Eadvanced | 0.950 | 14% | 35,284 | $12,705,989 |

| CYQ | Cycliq Group Ltd | 0.008 | 14% | 348,131 | $3,223,617 |

| PET | Phoslock Env Tec Ltd | 0.008 | 14% | 190,945 | $4,370,734 |

AdAlta (ASX:1AD) shares jumped after the biotech revealed a fresh $1.1 million placement to sophisticated investors, taking its October funding total to $1.6 million. The raise, done at-market at 0.3 cents a share, gives it more balance sheet firepower as it pushes ahead with its “East to West” cellular immunotherapy strategy – licensing CAR-T assets from Asia for global development. CEO Tim Oldham said the investment validated the potential of that approach and strengthened AdAlta’s hand.

Resolution Minerals (ASX:RML) has secured a $2 million strategic placement from global fund manager Tribeca Investment Partners at 8 cents a share. The deal, coming hot on the heels of its $25 million raise earlier this month, strengthens its position to accelerate drilling at the Horse Heaven Project in the US, and push ahead with downstream processing plans. The company said Tribeca’s backing, given its deep focus on critical minerals and US supply chain investment, is a strong endorsement for Resolution.

BPM Minerals (ASX:BPM) is gearing up for its maiden RC drilling program at the Forelands Gold Project in WA, with heritage clearance scheduled for October 31 and drilling set to kick off in mid-November. The approved 3,000-metre, 25-hole campaign will target the high-grade Beachcomber Prospect, where past hits include 3 m at 65.8 g/t gold and 9.7 m at 4.5 g/t.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JLL | Jindalee Lithium Ltd | 0.575 | -37% | 979,595 | $75,733,997 |

| BMO | Bastion Minerals | 0.001 | -33% | 173,470 | $3,333,892 |

| SRH | Saferoads Holdings | 0.090 | -33% | 416,165 | $5,900,230 |

| BMG | BMG Resources Ltd | 0.017 | -26% | 18,018,478 | $21,238,135 |

| LIB | Liberty Metals | 0.003 | -25% | 66,590,760 | $23,931,732 |

| VKA | Viking Mines Ltd | 0.008 | -25% | 16,708,334 | $13,597,545 |

| EUR | European Lithium Ltd | 0.350 | -25% | 31,391,375 | $701,010,819 |

| RAD | Radiopharm | 0.028 | -24% | 12,185,723 | $87,503,132 |

| AVW | Avira Resources Ltd | 0.014 | -22% | 9,500,434 | $4,140,000 |

| CUL | Cullen Resources | 0.007 | -22% | 435,038 | $6,240,617 |

| RDN | Raiden Resources Ltd | 0.007 | -22% | 12,280,141 | $31,058,023 |

| FME | Future Metals NL | 0.025 | -22% | 13,872,397 | $30,668,826 |

| ADG | Adelong Gold Limited | 0.012 | -20% | 17,600,794 | $38,502,545 |

| AGD | Austral Gold | 0.092 | -20% | 2,998,645 | $70,415,806 |

| BIT | Biotron Limited | 0.004 | -20% | 1,620,213 | $6,636,229 |

| OLH | Oldfields Holdings | 0.016 | -20% | 498,969 | $4,261,183 |

| WNX | Wellnex Life Ltd | 0.195 | -19% | 251,730 | $16,789,314 |

| AUA | Audeara | 0.028 | -18% | 55,635 | $6,117,769 |

| ASM | Ausstratmaterials | 1.330 | -17% | 3,839,982 | $363,444,403 |

| POD | Podium Minerals | 0.072 | -17% | 6,023,391 | $76,348,777 |

| CAV | Carnavale Resources | 0.005 | -17% | 18,696,763 | $24,541,310 |

| MMR | Mec Resources | 0.005 | -17% | 3,984,888 | $11,231,939 |

| FDR | Finder | 0.463 | -16% | 1,551,471 | $211,943,740 |

| DYL | Deep Yellow Limited | 1.960 | -16% | 9,049,767 | $2,257,647,770 |

Autoparts seller Bapcor (ASX:BAP) plunged 17% after confessing to a $12 million earnings hit and some “unsatisfactory operational practices” in its trade division. That’s usually corporate code for “we found stuff we probably shouldn’t have”.

Bapcor now expects half-year profit to slump to between $3 and $7 million, with full-year guidance chopped to $40–50 million.

IN CASE YOU MISSED IT

Indiana Resources (ASX:IDA) has kicked off a new drilling program at Minos to test several prospective gold targets eyed for resource growth.

Auravelle Metals’ (ASX:AUV) review of historical soil sampling at the Nuckulla Hill project has identified priority gold and silver targets within the Yalbrinda Shear Zone.

Lode Resources (ASX:LDR) has struck ultra-high-grade antimony in its maiden drilling at Magwood project.

Koonenberry Gold’s (ASX:KNB) soil sampling at the Enmore project has outlined its district-scale potential with the definition of a large anomaly along the Borah Fault.

Bayan Mining (ASX:BMM) is quietly transforming Desert Star into a strategic rare earths story in California, with milestone after milestone landing on a high-profile stage.

LAST ORDERS

Anson Resources’ (ASX:ASN) subsidiary A1 Lithium Inc has entered into an MoU with Utah State University to establish specialised training, internships and apprenticeships for careers in lithium production, sustainable mining practices and industrial operations.

ASN will seek funding from the State of Utah for the courses, with the first students to start on September 2027.

Godolphin Resources (ASX:GRL) has achieved promising metal recovery rates from stage 1 metallurgical testing, recovering 76% of gold, 86% of silver and 85% of lead as well as 89% of zinc from samples.

The company has begun the second stage of cleaner flotation, looking to increase the concentrate grade of both its lead and zinc floatation circuits.

At Stockhead, we tell it like it is. While Anson Resources and Godolphin Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.