Lunch Wrap: Gold glitters again as ASX cools and Woodside lights up

When you realise yesterday’s gold crash was just a buying opportunity. Pic: Getty Images

- ASX eases as Wall Street tech tumble hits local sentiment

- Energy stocks light up on oil surge and Woodside’s US deal

- Gold miners claw back after brutal selloff

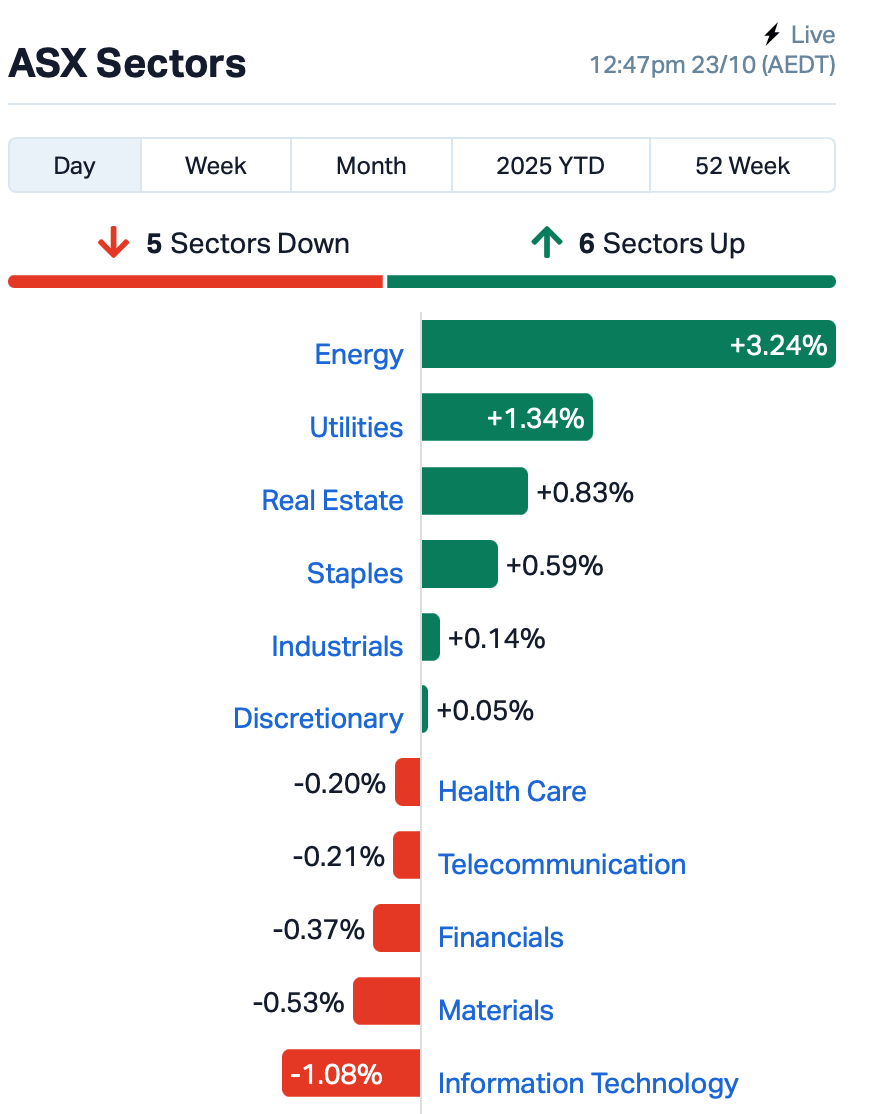

The ASX slumped around 0.3% by Thursday lunchtime in the east, dragged down by another tech wobble from Wall Street.

Overnight, the Nasdaq dropped a further 1% , with Apple and Netflix taking a fall.

Apple lost 2% after reports that iPhone demand is solid but not “record-breaking”. Netflix tanked 10% after missing both revenue and profit estimates.

Tesla fell 4% post-market after reporting record quarterly revenue of US$28.1 billion, which is above forecasts, but with thinner margins.

Back home this morning, the energy sector was the big story.

Woodside Energy Group (ASX:WDS) jumped 5% after locking in a strategic partnership with US gas giant Williams, selling stakes in its Louisiana LNG and Driftwood Pipeline projects for US$378 million all up.

With oil up nearly 3% last night after fresh US sanctions on Russia’s top producer, oil stocks like Santos (ASX:STO) and Karoon Energy (ASX:KAR) rode the wave too.

Gold miners also clawed back ground after yesterday’s trouncing, the metal’s sharpest fall in 12 years.

Northern Star Resources (ASX:NST) and Regis Resources (ASX:RRL) both bounced thanks to solid quarterly numbers.

NST posted a rock-solid September quarter, selling 381,000 ounces of gold at an all-in cost of $2,522 an ounce, keeping costs tight and cash flow strong.

In other large cap news, Fortescue (ASX:FMG) chalked up a record first quarter, shipping 49.7 million tonnes of iron ore, up 4% on last year, with costs steady at US$18.17 a tonne.

South32 (ASX:S32) announced a passing of the baton as chair Karen Wood retires in 2026, to be replaced by Stephen Pearce, a former Anglo American CFO.

And finally, across the ditch, New Zealand’s Genesis Energy (ASX:GNE) was glowing; with its hydro generation rising by 218 gigawatt-hours thanks to rainfall and a shift away from coal.

It’s a nice reminder that sometimes it really does just come down to the weather.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| VBS | Vectus Biosystems | 0.125 | 69% | 41,339 | $3,946,666 |

| THR | Thor Energy PLC | 0.020 | 54% | 57,553,747 | $9,377,044 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 767,718 | $3,253,779 |

| MTL | Mantle Minerals Ltd | 0.002 | 50% | 800,000 | $7,233,115 |

| NYR | Nyrada Inc. | 0.440 | 35% | 2,004,337 | $77,675,120 |

| MEM | Memphasys Ltd | 0.004 | 33% | 130,000 | $6,723,294 |

| TMS | Tennant Minerals Ltd | 0.009 | 29% | 1,038,249 | $7,461,233 |

| AQX | Alice Queen Ltd | 0.005 | 25% | 198,009 | $5,538,785 |

| RKB | Rokeby Resources Ltd | 0.005 | 25% | 3,280,992 | $7,306,245 |

| SRN | Surefire Rescs NL | 0.003 | 25% | 239,116 | $8,051,219 |

| AXI | Axiom Properties | 0.021 | 24% | 49,610,323 | $7,356,132 |

| REM | Remsensetechnologies | 0.048 | 22% | 811,827 | $7,688,553 |

| ATS | Australis Oil & Gas | 0.012 | 20% | 350,801 | $13,231,866 |

| TMK | TMK Energy Limited | 0.003 | 20% | 2,261,628 | $29,743,458 |

| ADC | Acdc Metals Ltd | 0.099 | 19% | 1,514,309 | $6,219,253 |

| C1X | Cosmosexploration | 0.070 | 19% | 528,373 | $6,399,530 |

| TM1 | Terra Metals Limited | 0.180 | 18% | 3,868,221 | $102,544,168 |

| FMR | FMR Resources Ltd | 0.375 | 17% | 320,367 | $15,362,156 |

| PAB | Patrys Limited | 0.035 | 17% | 801,726 | $10,221,859 |

| JAV | Javelin Minerals Ltd | 0.004 | 17% | 133,136 | $22,710,675 |

| NES | Nelson Resources. | 0.007 | 17% | 500,000 | $13,179,566 |

| NWM | Norwest Minerals | 0.014 | 17% | 3,218,029 | $12,361,283 |

| SIS | Simble Solutions | 0.007 | 17% | 583,883 | $6,529,982 |

Thor Energy (ASX:THR) has signed a binding deal with US firm DISA Technologies to process old uranium waste dumps at its Colorado projects using DISA’s patented ablation tech. DISA will fund and operate everything, while Thor’s subsidiary Standard Minerals earns a 2.5–4% share of gross sales from recovered uranium and critical minerals.

With DISA now holding the first-ever US licence to remediate abandoned uranium waste, THR said the partnership could clear the way to turn old mine dumps into new revenue.

RemSense Technologies (ASX:REM) has landed a US$770k (A$1.19m) contract with Chevron USA to deliver advanced photogrammetry and asset-visualisation work across its LNG facilities, extending a long-running global partnership. The project kicks off immediately and wraps before the end of 2025, reinforcing Chevron’s confidence in RemSense’s virtualplant tech and digital-twin expertise.

Coming hot on the heels of its Shell deal, it shows RemSense is quietly turning Tier-1 energy giants into repeat customers, and proof that its 3D visualisation tools are becoming essential kit for big-energy operations.

Axiom Properties (ASX:AXI) has teamed up with Securexchange to launch Settlement Advance, a new product that lets property sellers unlock up to $350,000 (or 80% of their equity) before settlement, with no upfront fees or repayments until maturity.

Powered by Axiom’s lending tech and integrated into Securexchange’s digital transaction platform, it aims to help vendors bridge the gap between selling and buying with speed and security.

The partnership also sets the stage for a future all-in-one property platform combining funding, compliance, and payments, a sign that Axiom is positioning itself at the heart of Australia’s digital real estate shift.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AMN | Agrimin Ltd | 0.072 | -25% | 1,636,091 | $36,953,226 |

| EGY | Energy Tech Ltd | 0.021 | -25% | 51,355 | $13,998,672 |

| BIT | Biotron Limited | 0.004 | -22% | 23,773,438 | $5,972,606 |

| ERA | Energy Resources | 0.002 | -20% | 33,715 | $1,013,490,602 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 126,180 | $7,051,062 |

| RFT | Rectifier Technolog | 0.004 | -20% | 717,157 | $6,909,920 |

| GTE | Great Western Exp. | 0.018 | -18% | 3,988,369 | $12,490,674 |

| MSG | Mcs Services Limited | 0.009 | -18% | 454,902 | $2,179,096 |

| RML | Resolution Minerals | 0.083 | -17% | 70,880,459 | $179,818,188 |

| CLA | Celsius Resource Ltd | 0.010 | -17% | 9,273,369 | $37,625,861 |

| ENT | Enterprise Metals | 0.005 | -17% | 13,900,370 | $8,964,904 |

| OVT | Ovanti Limited | 0.005 | -17% | 4,493,308 | $33,094,738 |

| TYX | Tyranna Res Ltd | 0.005 | -17% | 25,351,655 | $20,052,929 |

| NGY | Nuenergy Gas Ltd | 0.023 | -15% | 10,000 | $48,079,047 |

| LPM | Lithium Plus | 0.120 | -14% | 381,039 | $18,597,600 |

| WSR | Westar Resources | 0.006 | -14% | 50,000 | $2,791,074 |

| D3E | D3 Energy Limited | 0.430 | -14% | 71,687 | $39,737,503 |

| LMS | Litchfield Minerals | 0.600 | -14% | 648,231 | $31,082,874 |

| CAZ | Cazaly Resources | 0.026 | -13% | 329,915 | $14,020,923 |

| YUG | Yugo Metals Ltd | 0.054 | -13% | 2,916,958 | $14,726,171 |

| LCL | LCL Resources Ltd | 0.007 | -13% | 59 | $9,594,057 |

| PET | Phoslock Env Tec Ltd | 0.007 | -13% | 3,974,313 | $4,995,124 |

| SPX | Spenda Limited | 0.004 | -13% | 3,190,896 | $18,910,862 |

IN CASE YOU MISSED IT

The underground story at Kanmantoo mine keeps building with Hillgrove Resources (ASX:HGO) returning more strong copper-gold results from the Kavanagh system.

Weebit Nano (ASX:WBT) has kicked off FY26 with record customer receipts, three product design deals and a major manufacturing milestone at onsemi’s production fab.

A heavily oversubscribed $4.9m share purchase plan has left Nimy Resources (ASX:NIM) fully funded for further gallium and base metals exploration at Mons.

St George Mining’s (ASX:SGQ) latest thick REE and niobium hit confirms potential to drastically boost resources at its already impressive Araxá project.

Airtasker (ASX:ART) secures a further £2.5 million ($5.1m) media capital investment from Channel 4’s venture arm 4Ventures to accelerate its strong growth trajectory in the UK.

LAST ORDERS

ClearVue Technologies (ASX:CPV) has expanded its building-integrated photovoltaic solutions to include modular carparks, carports and canopy structures. CPV’s solar carpark offering is waterproof and fire-resistant, and can deliver 20 watts peak per square metre.

HyTerra (ASX:HYT) has listed to the US OTCQB market, gaining much greater exposure to US investors as well as finance and collaboration opportunities. HYT expects “significant growth” in the US hydrogen industry in the coming years and has positioned itself to be a vital part of that development.

At Stockhead, we tell it like it is. While Brightstar Resources and Locksley Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.