Lunch Wrap: Global markets panic after China fires retaliatory shot; ASX crashes 4pc

ASX gets hit hard, no sector spared. Picture via Getty Images

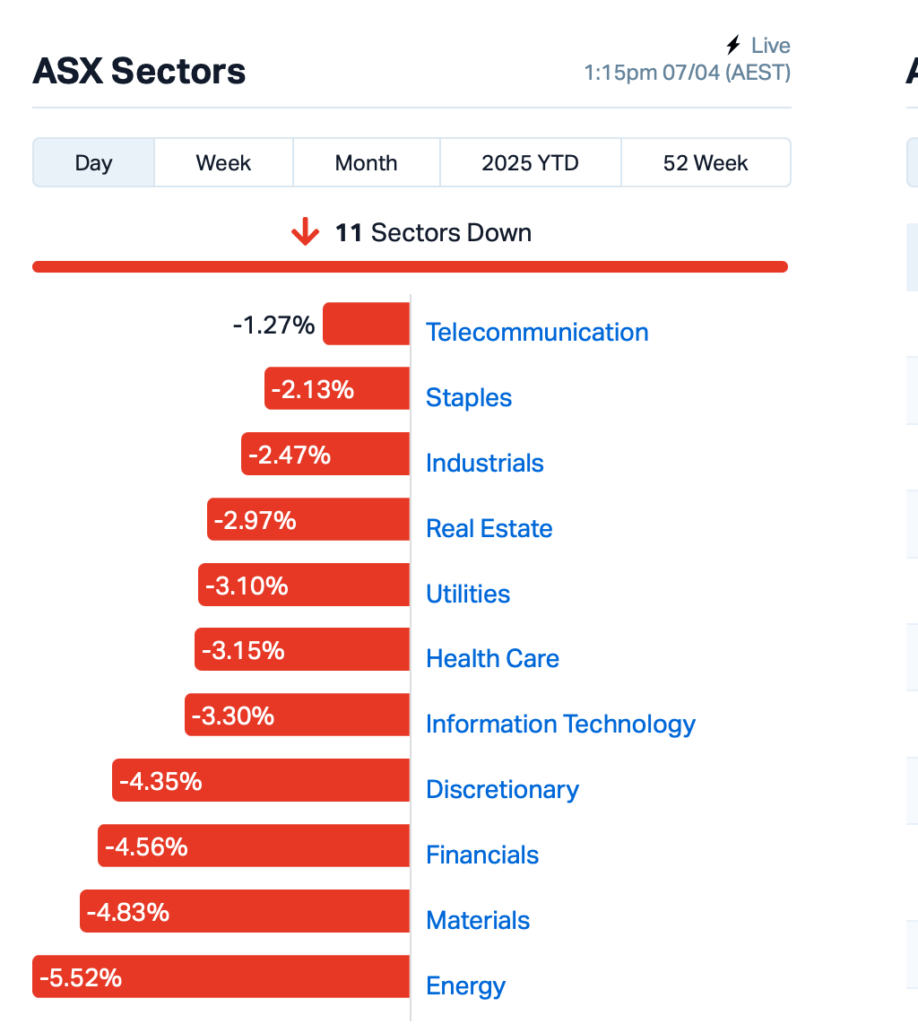

- The ASX has been hit hard on Monday, with no sector spared

- Wall Street’s meltdown deepens, S&P and Nasdaq crash 6pc

- Miners, banks and oil stocks crushed in panic sell-off

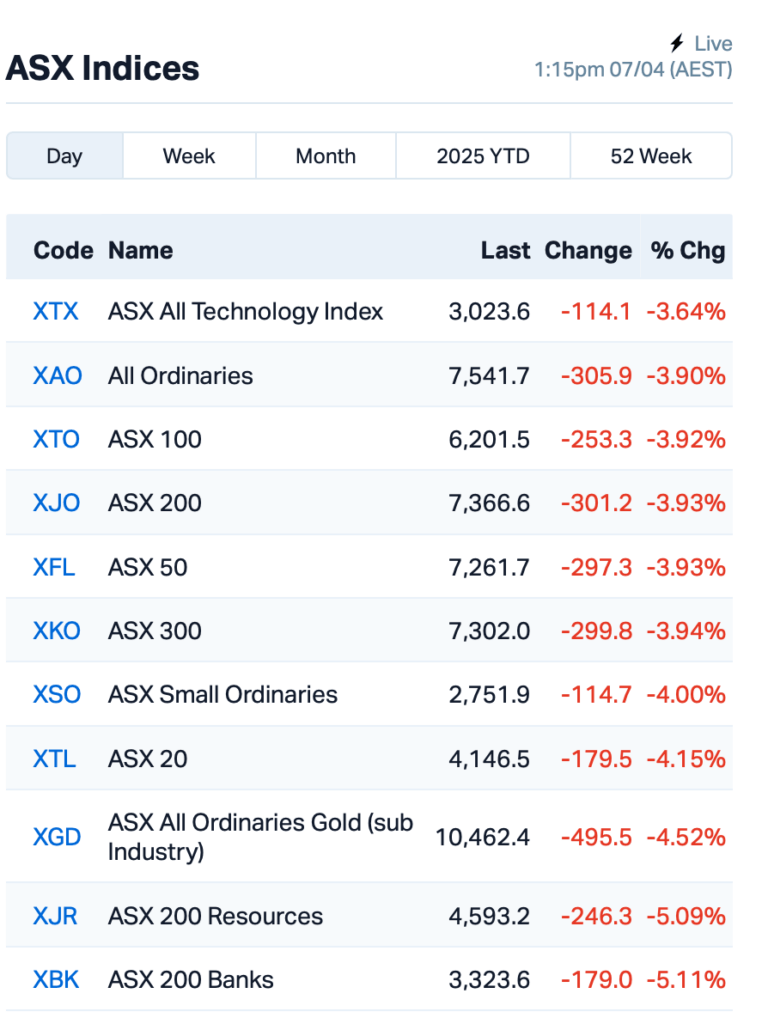

The ASX got a real gut punch at the open this morning, down by 4% at lunch time AEST. A wave of panic has hit global markets, and nothing was left untouched.

For those who didn’t catch the news, the panic was sparked when Beijing decided to retaliate and slap a fresh 34% tariff on all US goods, matching the same rate the US had hit China with just a day earlier.

Wall Street traders reacted instantly.

The S&P 500 closed Friday down by 6%, wrapping up its worst week since the chaos of March 2020. The tech-heavy Nasdaq also crashed by 6%.

Experts warned that things could get a whole lot worse.

“The new trade regime is a mistake,” said billionaire Bill Ackman, the founder of Pershing Square and vocal Trump supporter.

Stuart Kaiser, head of US equity strategy at Citi, argues the market hasn’t even begun to price in the full extent of the damage.

If the worst-case scenario happens, the S&P 500 could sink another 22% in a recession scenario, said Kaiser.

VP Capital’s co founder, John So, added,” We’ve gone into today with no ASX stocks, just shorts.

“Very fast moving situation, but I think we need to watch out for upside risk from Trump doing a deal with someone major and China potentially doing a regional trade deal.”

So, the question on everyone’s mind now is: How much further will this sell-off drag us down?

On the ASX, the sell-off didn’t spare any sector this morning.

Bank stocks crashed. Oil stocks got hammered hard, partly due a surprising move from Saudi Arabia, which slashed its crude prices by the biggest margin in over two years.

Santos (ASX:STO) lost 9.5%, and Woodside Energy Group (ASX:WDS) fell 6%.

The miners were right there in the mix, especially iron ore miners. With the price of iron ore dropping nearly 4% on Friday, stocks like BHP (ASX:BHP) and Fortescue (ASX:FMG) crashed 5%.

Even the gold miners couldn’t escape the bloodbath. Gold, which had been on a roll lately, tumbled from all-time highs and dropped by as much as 2.5%, falling below US$3,000 an ounce.

Meanwhile, copper plunged a big 8%, marking its sharpest fall in five years.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 7 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.002 | 50% | 175,000 | $2,031,723 |

| 88E | 88 Energy Ltd | 0.002 | 50% | 3,733,372 | $28,933,812 |

| OB1 | Orbminco Limited | 0.002 | 50% | 147,500 | $2,166,590 |

| BDT | Birddog | 0.046 | 48% | 1,565,741 | $5,006,067 |

| CRB | Carbine Resources | 0.004 | 33% | 10 | $1,655,213 |

| PRX | Prodigy Gold NL | 0.002 | 33% | 3,277,601 | $4,762,583 |

| ERA | Energy Resources | 0.003 | 25% | 626,050 | $810,792,482 |

| ASK | Abacus Storage King | 1.350 | 16% | 3,968,262 | $1,524,359,436 |

| LCL | LCL Resources Ltd | 0.008 | 14% | 532,590 | $8,363,689 |

| GW1 | Greenwing Resources | 0.045 | 13% | 203,755 | $9,626,059 |

| AT1 | Atomo Diagnostics | 0.018 | 13% | 596,524 | $10,227,237 |

| XAM | Xanadu Mines Ltd | 0.064 | 12% | 7,913,893 | $108,995,261 |

| ATS | Australis Oil & Gas | 0.010 | 11% | 1,865,790 | $11,704,559 |

| TZN | Terramin Australia | 0.076 | 10% | 27,621 | $146,042,828 |

| ROG | Red Sky Energy. | 0.006 | 10% | 1,380,757 | $27,111,136 |

| NTU | Northern Min Ltd | 0.023 | 10% | 11,007,320 | $175,500,272 |

| HCT | Holista CollTech Ltd | 0.035 | 9% | 330,982 | $9,144,535 |

| ABE | Ausbondexchange | 0.036 | 9% | 265,782 | $3,718,048 |

| CGF | Challenger Limited | 6.020 | 9% | 4,515,705 | $3,830,332,128 |

| NNL | Nordicresourcesltd | 0.080 | 8% | 42,703 | $10,906,405 |

| RVT | Richmond Vanadium | 0.140 | 8% | 4,911 | $28,838,333 |

| GAS | State GAS Limited | 0.030 | 7% | 100,000 | $10,992,824 |

| LOM | Lucapa Diamond Ltd | 0.015 | 7% | 775,532 | $6,450,366 |

| CTT | Cettire | 0.665 | 6% | 2,355,640 | $238,273,888 |

| CC9 | Chariot Corporation | 0.090 | 6% | 124,636 | $10,145,070 |

Broadcasting tech firm BirdDog Technology (ASX:BDT) is seeking to voluntarily delist from the ASX, after receiving in-principle approval from the exchange. The company believes this move is in the best interest of both the business and its shareholders, mainly due to poor share price performance, low trading liquidity, and the costs of staying listed. If shareholders approve the delisting at the upcoming meeting on 14 May, BirdDog will also conduct an off-market share buy-back, offering up to 100% of shares back to current investors.

Abacus Storage King (ASX:ASX) said it got an offer after the market closed on 4 April from Ki Corporation and Public Storage to buy all the stapled securities of ASK that aren’t already owned by Ki or its subsidiaries. The offer is for $1.47 per share, minus any dividends or distributions after the proposal date. If the deal goes through, Public Storage would end up owning about 50% of ASK, with the rest controlled by Ki. However, the proposal is still conditional on a successful due diligence, regulatory clearances, and a ruling from the Australian Tax Office.

Atomo Diagnostics (ASX:AT1) is rolling out a national program to distribute free HIV self-tests through vending machines across Australia, funded by the Federal Government’s 2024 budget. Thorne Harbour Health has placed an order worth around $230,000 to help get this off the ground, with plans to expand testing in 2026. Atomo’s HIV self-test is also now available in New Zealand through Chemist Warehouse.

Xanadu Mines (ASX:XAM) has updated shareholders about the Extraordinary General Meeting (EGM) on 11 April. The company’s resolution to approve the exercise of a put option, allowing the sale of a 25% interest in Khuiten Metals, has been withdrawn for now. This is because Xanadu has agreed to extend the put option by 30 days while continuing talks with Zijin Mining on potential transactions. Xanadu’s board has set up a committee to explore these options, but there’s no guarantee any deal will happen.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 7 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -33% | 85,078,217 | $9,862,021 |

| CZN | Corazon Ltd | 0.002 | -33% | 9,750,000 | $3,553,717 |

| DGR | DGR Global Ltd | 0.004 | -33% | 7,178,452 | $6,262,176 |

| FAU | First Au Ltd | 0.002 | -33% | 2,382,051 | $6,215,980 |

| JAV | Javelin Minerals Ltd | 0.002 | -33% | 200,000 | $18,138,447 |

| MRD | Mount Ridley Mines | 0.002 | -33% | 1,998,144 | $2,335,467 |

| VFX | Visionflex Group Ltd | 0.002 | -33% | 31,200 | $10,103,581 |

| VML | Vital Metals Limited | 0.002 | -33% | 2,030,938 | $17,685,201 |

| AUQ | Alara Resources Ltd | 0.019 | -32% | 6,572,880 | $20,106,451 |

| MVL | Marvel Gold Limited | 0.009 | -31% | 795,828 | $14,036,599 |

| CUF | Cufe Ltd | 0.005 | -29% | 4,250,649 | $9,426,024 |

| KPO | Kalina Power Limited | 0.005 | -29% | 1,866,988 | $20,221,206 |

| W2V | Way2Vatltd | 0.005 | -29% | 488,236 | $6,538,001 |

| IRX | Inhalerx Limited | 0.018 | -28% | 405,000 | $5,336,206 |

| 1AE | Auroraenergymetals | 0.034 | -28% | 266,321 | $8,415,996 |

| BMG | BMG Resources Ltd | 0.008 | -27% | 11,734,919 | $9,222,369 |

| DEM | De.Mem Ltd | 0.080 | -27% | 260,175 | $32,219,371 |

| NIM | Nimyresourceslimited | 0.061 | -27% | 1,586,575 | $17,274,612 |

| YOJ | Yojee Limited | 0.115 | -26% | 205,268 | $48,476,847 |

| ANR | Anatara Ls Ltd | 0.006 | -25% | 965,006 | $1,707,070 |

| ANX | Anax Metals Ltd | 0.006 | -25% | 3,553,227 | $7,062,461 |

| AOA | Ausmon Resorces | 0.002 | -25% | 50,000 | $2,622,427 |

| ATH | Alterity Therap Ltd | 0.006 | -25% | 32,074,419 | $53,254,791 |

| BCM | Brazilian Critical | 0.006 | -25% | 1,805,850 | $8,503,669 |

| BP8 | Bph Global Ltd | 0.003 | -25% | 9,903,534 | $2,433,233 |

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.