Lunch Wrap: Cooled Aussie inflation data helps ASX makes strides

How quick can Anthony Albanese run those election papers up to Government House? Pic: Getty Images

- ASX grabs some more green as local inflation data cools

- Budget muddies the waters for healthcare sector and small businesses

- Resources sector and financials lead the gainers at lunch

As the mixed reactions and consternation washes about after Australia’s latest federal budget reveal, the ASX moved up quite nicely in early morning trading.

At the time of writing, the ASX 200 index has pushed into green territory by 0.77% as it tries to maintain the momentum into the afternoon session.

Australia’s February CPI (Consumer Price Index) data has risen less than expected, so this has given the local market something to smile about, even if it’s bit of a downer for the Aussie dollar and bond yields.

The annual headline CPI has has risen 2.4 per cent, which flies in the face of wide expectations it would again rise by 2.5 per cent. Meanwhile, the annual trimmed mean CPI rose 2.7 per cent from 2.8 per cent.

All that being said, according to The Australian’s Jack Quail, the Reserve Bank still remains “unlikely to deliver a second consecutive rate cut when its new specialist rate-setting board convenes for the first time next week, even as fresh figures showed inflation eased last month”.

On Wall Street overnight, the S&P 500 and Dow Jones indexes closed 0.2 per cent higher and 0.1 per cent lower, respectively, while the tech-heavy Nasdaq rose 0.5 per cent.

Adding context there, hopes for a moderate outcome on Trump’s tariffs obsession is tipping the balance slightly more than another drop in consumer-sentiment data.

According to Reuters, US consumer confidence has plunged to the lowest level in more than four years in March, with households fearing a recession in the future and higher inflation because of the tariffs effect.

Meanwhile, the bull goose crypto (and the one that really matters most right now and always) – that’d be Bitcoin – is inching back towards US$88k, as the Trump family venture has announced the launch of a new stablecoin. What a time to be alive, and so forth.

World Liberty’s USD1 will reportedly be pegged to the US dollar and backed by both US Treasuries and dollars.

Per Reuters: USD1 will be “fully backed by a reserve portfolio audited regularly by a third-party accounting firm,” World Liberty said, without giving details of the accounting firm, or the date of its launch.

Regarding the budget, according to reports on The Australian (and from Stockhead’s Tim Boreham with regards to the healthcare sector), it generally underwhelmed.

The Australian Chamber of Commerce and Industry wasn’t a fan…

“There appears to be no coherent strategy to take the pressure off small business, just an almost random list of largely unrelated announcements,” ACCI chief executive Andrew McKellar said.

“In particular it seems the government has not announced an extension of the instant asset write-off for small business.”

Miners are angry about the discontinuation of the Junior Minerals Exploration Incentive, a scheme that gives tax breaks to investors in early stage explorers.

BDO, which did modelling for the policy’s biggest flag waver the Association of Mining and Exploration Companies, has come out swinging.

“The omission of the JMEI from the Federal Budget is a setback for the mining and exploration sector,” BDO global head of natural resources Sherif Andrawes said.

BDO’s latest report recommended topping up the JMEI to the value of $200m over four years, with the accounting firm claiming every dollar the government spent generated $6 in capital market raisings and $2 on exploration.

Based off the modelling AMEC claims the $182.2m in tax credits generated $769m in GDP value.

“This is a critical investment in Australia’s future and supports mineral exploration – a long-term, high-risk activity,” AMEC CEO Warren Pearce said.

“And by doubling the investment, you’re doubling the benefits.”

This fight could well be carried into the election.

ASX market news

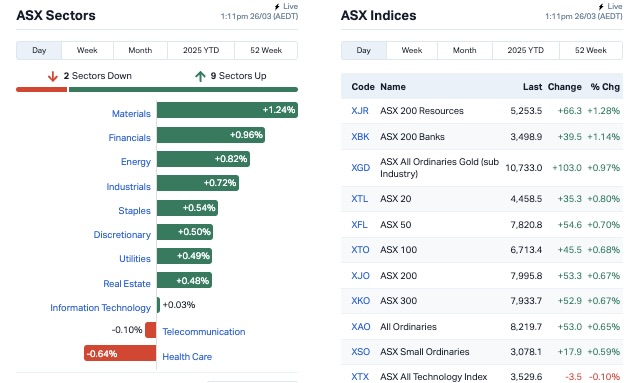

Nine of 11 ASX sectors are all in positive territory as we close on 1pm AEDT today, with ressies (materials) and financials having a much better day so far on the whole than yesterday.

Healthcare’s lagging a bit, perhaps partly due to the federal budget not giving it a whole lot new to go on.

Making news of note in the big caps, Paladin Energy (ASX:PDN) shares have taken a near double-digit dive today on guidance withdrawal.

This is in relation to the uranium producer’s African mining operations, which has been hammered and hampered by Namibia’s one-in-50-year rainfall.

The group did note that it had resumed partial operations at the Langer Heinrich Mine in Namibia, but it has withdrawn full-year production guidance as it deals with the impact of the unseasonal rain on its operations.

Meanwhile, Australia’s third-largest telco, TPG Telecom (ASX:TPM) has been slapped on the wrist by consumer regulator the ACCC, copping a $75,120 fine for allegedly failing to implement measures to separate its wholesale and retail staff – which contravenes carrier separation rules, apparently.

Here’s what the ASX sectors look like at about 1.10pm.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 26 [intraday]:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EMH | European Metals | 0.34 | 100% | 2,796,280 | $35,265,600 |

| LNU | Linius Tech Limited | 0.0015 | 50% | 4,365 | $6,151,216 |

| WYX | Western Yilgarn NL | 0.052 | 44% | 1,673,893 | $4,472,144 |

| EEL | Enrg Elements Ltd | 0.002 | 33% | 100,000 | $4,880,668 |

| GGE | Grand Gulf Energy | 0.002 | 33% | 250,000 | $3,675,581 |

| EMN | Euro Manganese | 0.059 | 31% | 3,172,426 | $9,353,885 |

| ADD | Adavale Resource Ltd | 0.0025 | 25% | 6,968,769 | $4,574,558 |

| ERA | Energy Resources | 0.0025 | 25% | 158,537 | $810,792,482 |

| EV1 | Evolution Energy | 0.02 | 25% | 354,566 | $5,802,408 |

| HPC | The Hydration Company | 0.01 | 25% | 50,000 | $2,439,305 |

| MTB | Mount Burgess Mining | 0.005 | 25% | 593,961 | $1,358,150 |

| LSR | Lodestar Minerals | 0.016 | 23% | 6,258,510 | $3,358,328 |

| KGD | Kula Gold Limited | 0.006 | 20% | 533,332 | $4,606,268 |

| RWD | Reward Minerals Ltd | 0.061 | 20% | 26,974 | $13,577,198 |

| RGT | Argent Biopharma Ltd | 0.155 | 19% | 20,850 | $7,705,395 |

| ENV | Enova Mining Limited | 0.007 | 17% | 355,000 | $8,481,005 |

| PIL | Peppermint Inv Ltd | 0.0035 | 17% | 286,262 | $6,634,438 |

| NSX | NSX Limited | 0.022 | 16% | 205,001 | $8,705,978 |

| HAW | Hawthorn Resources | 0.053 | 15% | 20,000 | $15,410,718 |

| BM8 | Battery Age Minerals | 0.069 | 15% | 505,171 | $7,147,851 |

| GBZ | GBM Rsources Ltd | 0.008 | 14% | 375,000 | $8,197,490 |

| VAR | Variscan Mines Ltd | 0.008 | 14% | 250,000 | $5,480,004 |

| DM1 | Desert Metals | 0.024 | 14% | 1,056,013 | $6,842,232 |

| LRV | Larvotto Resources | 1.005 | 14% | 5,643,076 | $360,807,048 |

| AQD | Ausquest Limited | 0.0625 | 14% | 4,874,445 | $74,064,733 |

European Metals (ASX:EMH) is up 100% in morning trade after the European Commission declared Cinovec,~100 km from Prague on the border with Germany, to be a strategic project under its recently implemented Critical Raw Materials Act.

EMH said the declaration confirms the importance of Cinovec in supplying battery grade lithium chemicals to the European battery supply chain and will bring explicit support from regional institutions, along with simplified and accelerated permitting.

Euro Manganese (ASX:EMN) has risen 31% after announcing that its Chvaletice Manganese project in the Czech Republic has also been designated a strategic project under the European Union’s Critical Raw Materials Act.

EMN said the designation was a “milestone achievement”, representing significant endorsement of the importance of the Chvaletice manganese project to European strategic and critical raw material supply independence.

Linius Technologies(ASX:LNU) has risen 50% after announcing establishment of a $750,000 convertible note facility and binding commitments for $300,000 in notes from professional and sophisticated investors.

LNU says the funding provides additional runway for unlocking growth, delivering on a growing pipeline and scale from new and existing partnerships with industry leaders Prime Focus, Fujitsu, Magnifi, and Avid along with its goal of achieving cashflow breakeven.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 26 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BYH | Bryah Resources Ltd | 0.003 | -25% | 20,000 | 2,507,203 |

| MMR | Mec Resources | 0.003 | -25% | 3,732,838 | 7,399,063 |

| REC | Recharge Metals | 0.01 | -23% | 1,697,755 | 3,334,370 |

| YAR | Yari Minerals Ltd | 0.004 | -20% | 26,666 | 2,411,789 |

| VN8 | Vonex Limited | 0.024 | -17% | 107 | 21,825,502 |

| HLX | Helix Resources | 0.0025 | -17% | 768,356 | 10,092,581 |

| LNR | Lanthanein Resources | 0.0025 | -17% | 260,000 | 7,330,908 |

| RMI | Resource Mining Corp | 0.005 | -17% | 407,930 | 3,914,087 |

| TUA | Tuas Limited | 5.27 | -16% | 1,851,543 | 2,933,556,631 |

| OPL | Opyl Limited | 0.028 | -15% | 9,119 | 6,367,955 |

| KPO | Kalina Power Limited | 0.006 | -14% | 27,469 | 20,221,206 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 851,666 | 11,196,728 |

| ROG | Red Sky Energy | 0.006 | -14% | 50,000 | 37,955,590 |

| REE | Rarex Limited | 0.019 | -14% | 30,954,725 | 17,618,608 |

| RWL | Rubicon Water | 0.255 | -14% | 60,000 | 71,005,054 |

| SVM | Sovereign Metals | 0.845 | -13% | 1,665,640 | 584,882,882 |

| INF | Infinity Lithium | 0.02 | -13% | 255,590 | 10,639,618 |

| MRQ | Mrg Metals Limited | 0.0035 | -13% | 42,857 | 10,906,075 |

| PCL | Pancontinental Energy | 0.007 | -13% | 45,265,038 | 65,092,687 |

| SP8 | Streamplay Studio | 0.007 | -13% | 100 | 10,250,916 |

| ASQ | Australian Silica | 0.022 | -12% | 34,782 | 7,046,509 |

| BKY | Berkeley Energia Ltd | 0.52 | -11% | 177,772 | 260,791,078 |

| KRR | King River Resources | 0.008 | -11% | 21,739 | 13,753,987 |

| NHE | Noble Helium | 0.016 | -11% | 220,782 | 10,465,908 |

| EXR | Elixir Energy Ltd | 0.026 | -10% | 8,138,020 | 40,492,099 |

IN CASE YOU MISSED IT

Challenger Gold (ASX:CEL) has drawn down the first US$2 million from its US$20 million project finance facility to fund early mining work for toll milling. The tranche 1 proceeds will also cover corporate overheads and working capital

At Stockhead, we tell it like it is. While Challenger Gold is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.