Lunch Wrap: Coles and Woolies stare down $800m bill, Droneshield lands a spot in ASX200

DroneShield makes the ASX200 list. Picture via Getty Images

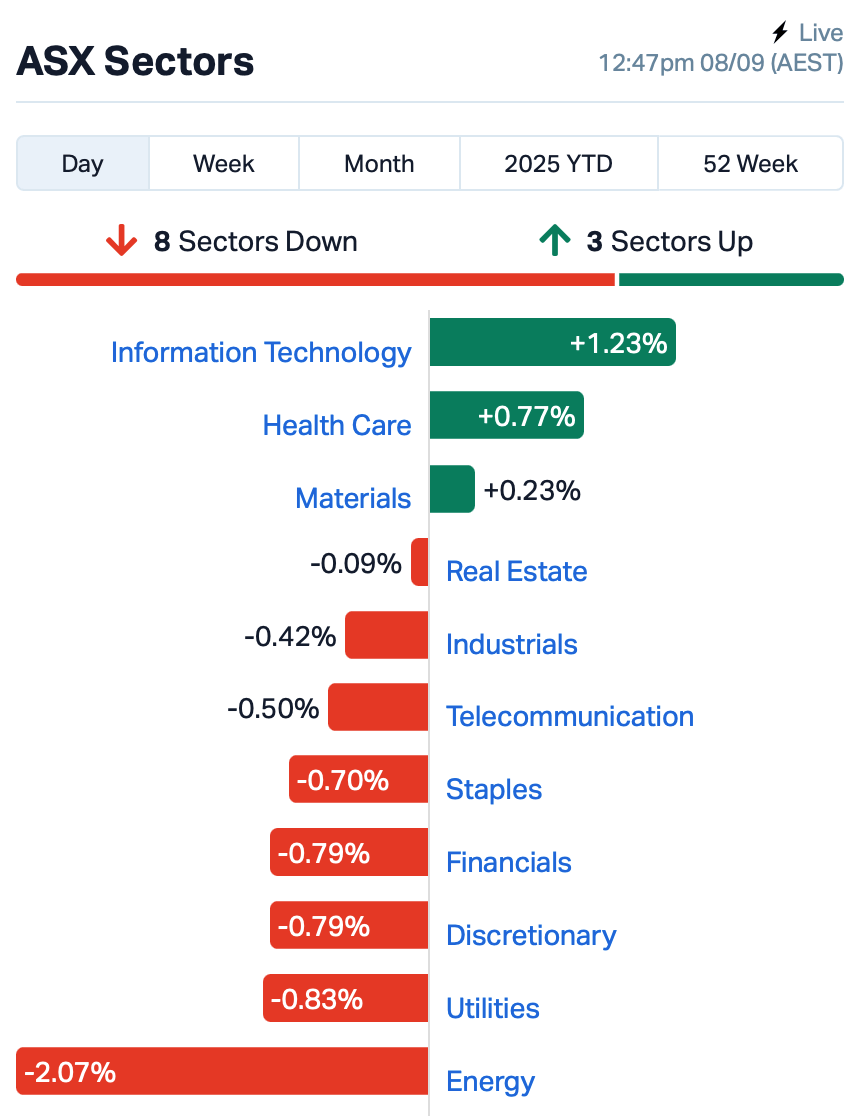

- ASX slips as tech sparks and energy sinks

- Gold keeps rebelling, while supermarkets cop $800m hit

- DroneShield promoted to the ASX 200 as defence demand soars

The ASX slipped 0.35% by Monday lunchtime in the east, carrying the sour mood left over from Wall Street on Friday.

US markets cracked after another weak US jobs print – just 22,000 new roles versus 75,000 expected – which nudged unemployment to 4.3% and pushed the Fed further into a corner.

Rate cuts are no longer the question; the only debate now is whether Powell swings a small axe or a big one in September.

Back in Sydney this morning, the picture was split.

Tech stocks found some spark, with market darling Life360 (ASX:360) up 6%.

The energy sector, meanwhile, sank 2% to a two-month low as Woodside Energy Group (ASX:WDS) dropped 3.5%.

That slump had an obvious culprit – crude oil gave up 2% on Friday – but it also says something darker: the supposed energy supercycle looks more fragile every month.

Gold, on the other hand, is having a full-blown rebellion as gold stocks rallied.

Prices smashed through US$3,650 an ounce last Friday before retreating below US$3,600.

In the large caps space, Woolworths (ASX:WOW) and Coles Group (ASX:COL) both flagged a combined $800 million hit from wage underpayments after a Federal Court ruling.

Woolies could be staring at as much as $530 million in liabilities, Coles up to $250 million.

These are numbers that remind investors that even supermarket cash cows have soft underbellies when the lawyers and regulators come calling.

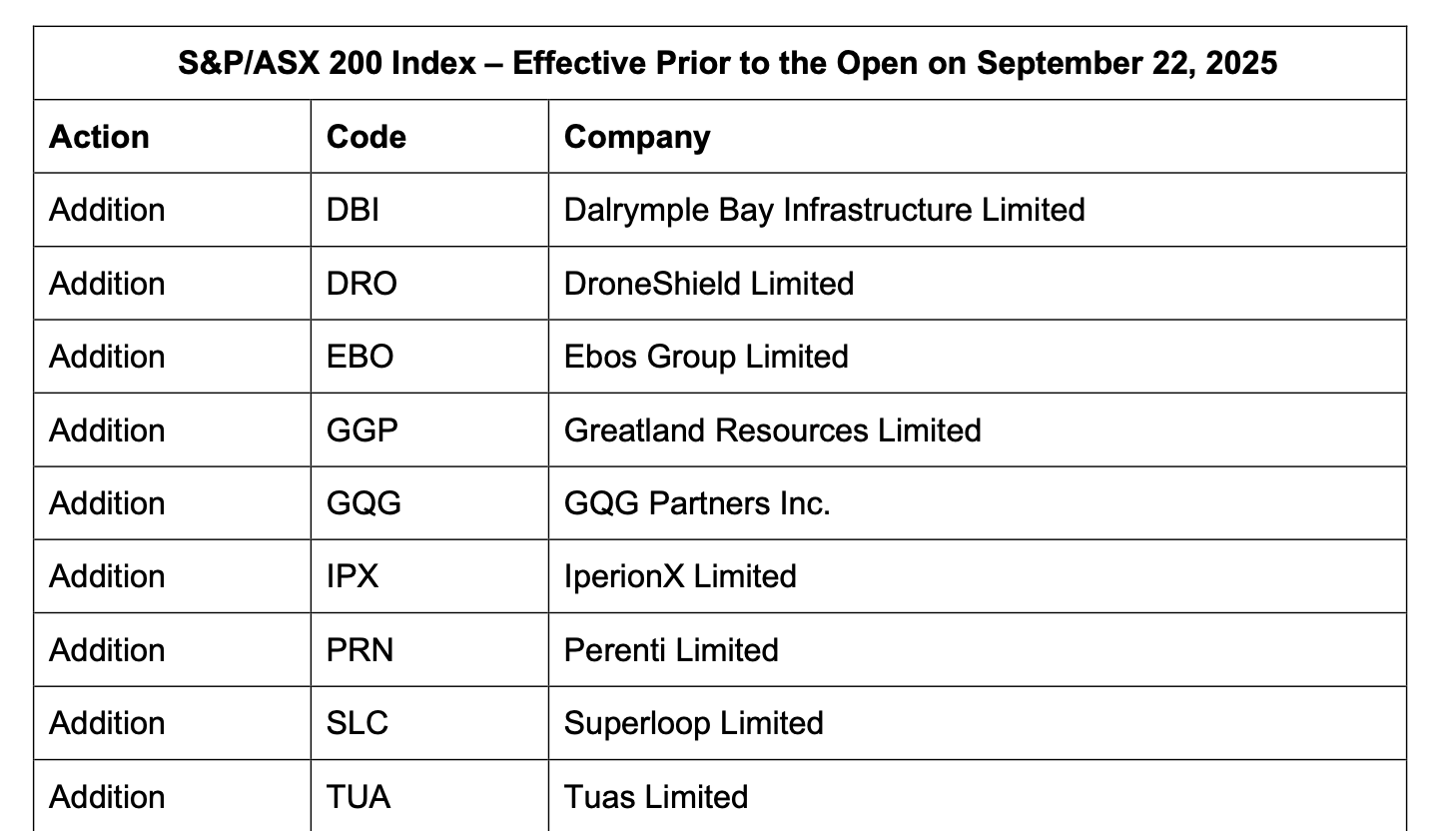

And in defence, DroneShield (ASX:DRO) earned itself a promotion to the ASX 200, confirmation that its once-niche counter-drone tech has become mainstream.

Its timing is impeccable: defence budgets are expanding, while demand is hot due to geopolitics.

For investors, the company is no longer a speculative flyer, but is now part of the benchmark itself.

The other ASX stocks to join the coveted ASX200 club on September 22 are:

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| IBX | Imagion Biosys Ltd | 0.032 | 100% | 70,142,430 | $3,941,463 |

| QFE | Quickfee Limited | 0.095 | 76% | 4,812,778 | $20,114,015 |

| 4DS | 4Ds Memory Limited | 0.016 | 60% | 109,416,781 | $20,608,987 |

| MEM | Memphasys Ltd | 0.006 | 57% | 16,133,644 | $6,942,593 |

| PAB | Patrys Limited | 0.002 | 50% | 4,411,039 | $4,583,757 |

| 4DX | 4Dmedical Limited | 2.310 | 50% | 21,301,501 | $724,399,130 |

| ROG | Red Sky Energy. | 0.004 | 33% | 67,672,674 | $16,266,682 |

| WWG | Wisewaygroupltd | 0.180 | 33% | 255,139 | $23,065,181 |

| GUM | Gumtree Australia | 0.130 | 30% | 50,000 | $32,097,258 |

| SNS | Sensen Networks Ltd | 0.088 | 28% | 7,457,364 | $54,719,586 |

| DRE | Dreadnought Resources | 0.022 | 26% | 41,976,415 | $86,351,500 |

| 1TT | Thrive Tribe Tech | 0.005 | 25% | 51,227 | $866,265 |

| CZN | Corazon Ltd | 0.003 | 25% | 7,660,000 | $2,469,145 |

| ERA | Energy Resources | 0.003 | 25% | 75,701 | $810,792,482 |

| SRJ | SRJ Technologies | 0.010 | 25% | 13,766,126 | $11,033,161 |

| TMK | TMK Energy Limited | 0.003 | 25% | 4,416 | $20,444,766 |

| WWI | West Wits Mining Ltd | 0.044 | 19% | 17,650,435 | $125,312,498 |

| KRR | King River Resources | 0.013 | 18% | 3,934,403 | $16,099,457 |

| A11 | Atlantic Lithium | 0.230 | 18% | 423,719 | $135,163,726 |

| IVZ | Invictus Energy Ltd | 0.240 | 17% | 9,908,075 | $328,713,764 |

| 1AD | Adalta Limited | 0.004 | 17% | 3,000,000 | $3,963,949 |

Imagion Biosystems (ASX:IBX)’s shared doubled after kicking off manufacturing of its MagSense HER2 imaging agent, a key step toward its Phase 2 breast cancer trial slated for late 2025. It’s also begun an AI-driven imaging optimisation program with Wayne State University, with early results due this month. The FDA remains engaged as Imagion prepares its IND filing for Q4, while fresh funding of $3.5m has secured the runway.

Quickfee (ASX:QFE) has sold its US Pay Now payments arm to Aiwyn for US$26.35m, a clean 5x revenue multiple, with most of the US staff moving across. It keeps hold of the US$7.5m loan book and Finance product, now boosted by a reseller deal that will see its Finance offering embedded into Aiwyn’s platform. FY26 EBITDA guidance has been withdrawn until the tax impact of the sale, transaction costs and liquidity position are finalised.

Memphasys (ASX:MEM) has locked in a 5-year exclusive deal with International Technical Legacy (ITL) to roll out its Felix sperm prep system across 15 Middle East and North African countries, covering more than 350 IVF clinics and around 140,000 cycles a year. The agreement includes an initial $325k order that kicks in once CE Mark approval lands, expected within 12 months. ITL also has first rights over future Memphasys tech

4D Medical (ASX:4DX) has signed a trio of deals that sharpen its push into global lung health. In Brazil, it has launched a screening program with a major pharma group covering up to 10,000 scans. At home, Royal Melbourne Hospital will pilot the full 4DMedical portfolio through to the end of 2025, the first public hospital to do so. And in NSW, Spectrum Medical Imaging has inked a multi-year contract to use 4DMedical’s tech in the National Lung Cancer Screening Program, extending to 2027

And, Pointsbet (ASX:PBH) edged higher after Japan’s Mixi finally secured control with a 51.6% stake, leaving Betr stranded.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JAY | Jayride Group | 0.004 | -27% | 5,470,887 | $7,853,390 |

| HLX | Helix Resources | 0.002 | -25% | 1,980,016 | $6,728,387 |

| KCCDA | Kincora Copper | 0.680 | -20% | 24,358 | $20,015,723 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 103,137 | $5,142,663 |

| MRQ | Mrg Metals Limited | 0.004 | -20% | 1,820,230 | $13,632,593 |

| T3D | 333D Limited | 0.041 | -18% | 3,125,381 | $9,442,691 |

| MVL | Marvel Gold Limited | 0.015 | -17% | 1,152,334 | $25,550,263 |

| PKY | Pathkey.Ai Ltd | 0.025 | -17% | 818,808 | $9,082,471 |

| CYQ | Cycliq Group Ltd | 0.005 | -17% | 1,002,515 | $2,763,100 |

| ERL | Empire Resources | 0.005 | -17% | 1,119,974 | $8,903,479 |

| JAV | Javelin Minerals Ltd | 0.003 | -17% | 1,021,433 | $18,756,675 |

| WHK | Whitehawk Limited | 0.010 | -17% | 157,263 | $10,523,820 |

| M3M | M3Mininglimited | 0.027 | -16% | 442,330 | $2,681,772 |

| BLU | Blue Energy Limited | 0.006 | -14% | 9,982,759 | $12,956,815 |

| NGY | Nuenergy Gas Ltd | 0.030 | -14% | 38,024 | $62,324,691 |

| SLZ | Sultan Resources Ltd | 0.006 | -14% | 250,000 | $1,827,585 |

| TSL | Titanium Sands Ltd | 0.006 | -14% | 15,926 | $16,413,230 |

| MYX | Mayne Pharma Ltd | 4.570 | -13% | 974,000 | $428,977,967 |

| LU7 | Lithium Universe Ltd | 0.013 | -13% | 5,234,205 | $21,584,694 |

| PRO | Prophecy Internation | 0.300 | -13% | 134,994 | $25,444,762 |

| ALY | Alchemy Resource Ltd | 0.007 | -13% | 2,176,175 | $9,424,610 |

| ID8 | Identitii Limited | 0.007 | -13% | 53,241 | $6,224,108 |

| RNX | Renegade Exploration | 0.004 | -13% | 500,000 | $8,208,120 |

| SW1 | Swift Networks Group | 0.007 | -13% | 10,000 | $7,292,866 |

| AQX | Alice Queen Ltd | 0.004 | -11% | 344,260 | $6,231,133 |

In Case You Missed It

Caspin Resources (ASX:CPN) has taken a big leap towards demonstrating the commercial viability of its Bygoo flagship with the definition of a 3.94Mt at 0.5% tin resource and a large exploration target which could more than double its maiden tally.

Resolution Minerals’ (ASX:RML) first phase drilling has shown the right early signs for both tungsten and a golden similarity to a major neighbour, surpassing early expectations with the company now keenly awaiting the return of assays from the US state of Idaho.

Anson Resources (ASX:ASN) is preparing for re-entry drilling to go deeper into a historical well and further raise the bar on the JORC lithium resources at its Green River project in Utah.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.