Lunch Wrap: Bargain hunters step in to stem the bleeding, despite Trump doubling down

Bargain hunters stepped in to stem the flood of losses. Picture via Getty Images

- ASX 200 bounces back after Monday’s big drop

- Wall Street goes wild last night as Trump doubles down on tariffs

- Investors grab bargain buys on the ASX

The ASX 200 managed to claw back some ground today, rising 1.4% at lunch time AEST after a brutal 4% sell-off yesterday.

Overnight on Wall Street, stocks went bananas as investors scrambled in the face of a whirlwind of headlines surrounding President Trump’s tariffs.

US indexes were all over the place, with the S&P 500 swinging a massive 8.5% between its high and low points after a sharp dive of 4% early on, only to rise over 3% before heading south again. The index eventually closed lower by 0.23%.

It was a similar story for the Nasdaq, which managed to scrape together a 0.1% gain, despite entering a bear market.

The Cboe VIX index, Wall Street’s “fear gauge”, shot up to its highest point since the start of the pandemic after Trump came out swinging again.

Trump announced last night that he wasn’t planning to back off from his sweeping tariff plans. In fact, he doubled down, threatening to hit China with an extra 50% tariff if they didn’t remove their 34% levies on US imports.

“There can be permanent tariffs and there can also be negotiations, because there are things that we need beyond tariffs,” Trump said.

Beijing responded and said it would “fight until the end”.

“The US shock is going to lead to a more severe China shock, which may very well lead other major players in the world to put tariffs up against China,” said economist Richard Baldwin.

Trump’s team tried to calm the waters, appearing on TV to insist that the economy would be fine despite the tariffs.

But experts weren’t buying it. Many warned of slower growth and higher inflation, with some suggesting the US economy could already be heading into recession.

“I’d say it’s classic market chaos right now. Unless you’re ahead of the curve on the headline, you’re not going to make any money,” said David Neuhauser at Livermore Partners.

But Larry Fink from BlackRock thinks this might actually be a buying opportunity in the long run.

“I see it more as a buying opportunity than a selling opportunity, but that doesn’t mean we can’t go down further,” Fink said.

Back on the ASX, investors were keen to grab bargains, especially in blue chips like BHP (ASX:BHP) and Commonwealth Bank (ASX:CBA), which pushed the local market higher.

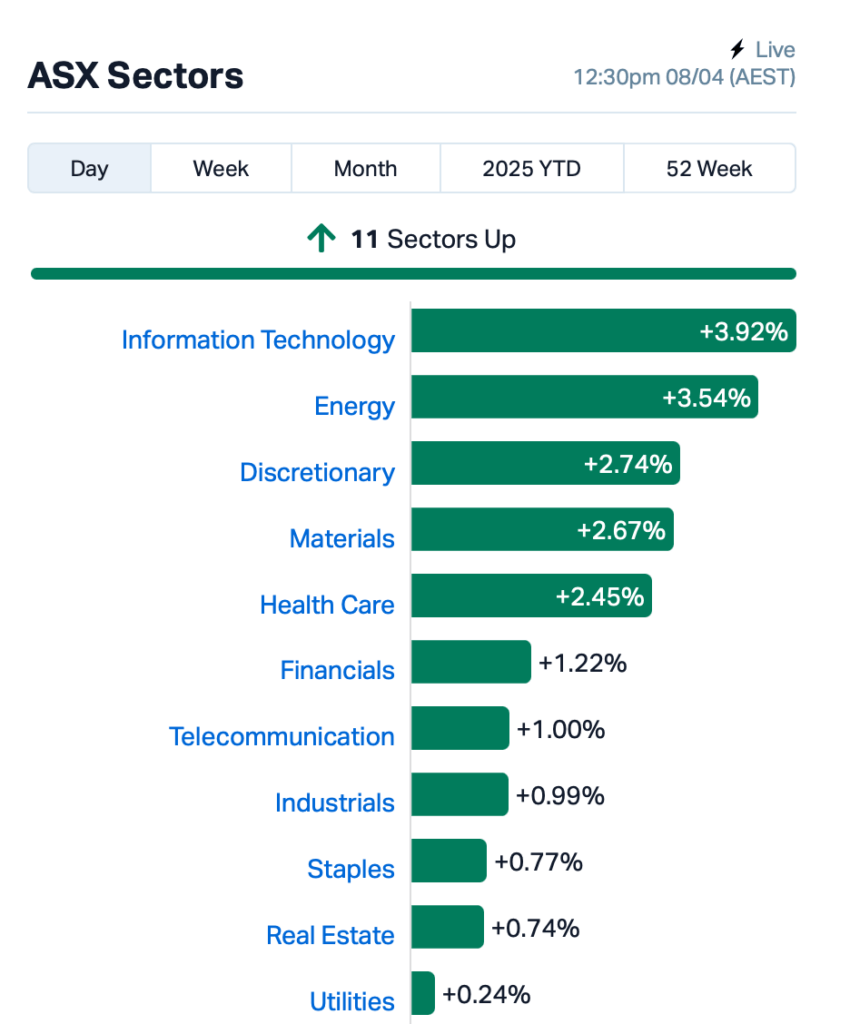

All 11 sectors were in the green, with tech and energy leading the charge.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 8 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| CDT | Castle Minerals | 0.003 | 50% | 4,219,132 | $3,855,646 |

| HFR | Highfield Res Ltd | 0.145 | 45% | 95,233 | $47,407,704 |

| LM1 | Leeuwin Metals Ltd | 0.140 | 40% | 278,222 | $8,429,972 |

| TM1 | Terra Metals Limited | 0.027 | 35% | 4,495,258 | $8,152,701 |

| ADD | Adavale Resource Ltd | 0.002 | 33% | 1,750,000 | $3,430,919 |

| ERL | Empire Resources | 0.004 | 33% | 409,909 | $4,451,740 |

| PAB | Patrys Limited | 0.002 | 33% | 3,400,000 | $3,086,171 |

| RMI | Resource Mining Corp | 0.004 | 33% | 384,556 | $1,996,217 |

| TMK | TMK Energy Limited | 0.004 | 33% | 123,750 | $28,090,995 |

| WOA | Wide Open Agricultur | 0.019 | 27% | 1,630,320 | $8,005,299 |

| AMD | Arrow Minerals | 0.029 | 26% | 1,682,416 | $18,877,471 |

| WC1 | Westcobarmetals | 0.015 | 25% | 1,461,495 | $2,149,878 |

| AJL | AJ Lucas Group | 0.005 | 25% | 5,179,736 | $5,502,919 |

| ALM | Alma Metals Ltd | 0.005 | 25% | 800,000 | $6,345,381 |

| CUL | Cullen Resources | 0.005 | 25% | 250,000 | $2,773,607 |

| REE | Rarex Limited | 0.021 | 24% | 2,409,673 | $13,614,379 |

| T92 | Terrauraniumlimited | 0.036 | 20% | 350,580 | $2,609,128 |

| MTM | MTM Critical Metals | 0.150 | 20% | 5,665,949 | $57,334,741 |

| OSM | Osmondresources | 0.420 | 20% | 143,374 | $31,434,447 |

| POD | Podium Minerals | 0.030 | 20% | 15,000 | $17,035,265 |

| AZL | Arizona Lithium Ltd | 0.006 | 20% | 186,837 | $22,809,073 |

| GTR | Gti Energy Ltd | 0.003 | 20% | 1,059,135 | $7,497,374 |

| KGD | Kula Gold Limited | 0.006 | 20% | 1,735,388 | $4,606,268 |

| TEM | Tempest Minerals | 0.006 | 20% | 18,500 | $3,172,649 |

| WSR | Westar Resources | 0.006 | 20% | 818,947 | $1,993,624 |

Leeuwin Metals (ASX:LM1) has announced some good news on the Marda gold project in WA. A review of old drilling results has uncovered high-grade mineralisation over 3km at Marda Central, outside the pits mined by Ramelius. There’s some juicy drill targets already lined up, with strong intercepts showing up to 14.05g/t gold, and drilling’s already underway to explore further. With this solid data, Leeuwin said it was eyeing up a big exploration push across the Marda, including the Evanston, Golden Orb, and King Brown prospects.

Empire Resources (ASX:ERL)’s Yuinmery copper-gold project in WA is also looking promising after the latest drilling program. The slim line RC drilling confirmed extensions of the YT01 mineralisation, and hit high-grade copper at the YT12 Prospect, including 6m at 8,821ppm Cu and 0.26g/t Au. Other highlights included strong copper intersections, with results showing solid copper and gold grades across multiple drill holes. The project is located around 470km northeast of Perth, near Sandstone.

Arrow Minerals (ASX:AMD)’s Niagara Bauxite Project in Guinea is showing promising results, with high alumina recovery rates of up to 91%, confirming the bauxite will meet market requirements. The project’s high-grade mineralisation is looking solid too, with a maiden resource of 185Mt at 42.3% alumina, including a premium 48Mt at 48.2%. Drilling has revealed the bauxite is suitable for low-temperature refining, and a scoping study is set to wrap up by June.

Terra Uranium (ASX:T92) has called off the proposed acquisition of the Amer Lake project in Canada after failing to get a deal over the line despite multiple attempts. The company will now look to recover any costs spent on the project where possible.

MTM Critical Metals (ASX:MTM) has made a big leap in sustainable metal recovery, pulling ultra-high-grade gold (551 g/t) and other valuable metals like silver and copper from e-waste. Using its Flash Joule Heating (FJH) tech, it achieved over 95% recovery of gold and titanium, and over 90% for silver, tin, and zinc. On top of that, MTM has secured a five-year e-waste supply agreement with top US recycler Dynamic Lifecycle Innovations, ensuring a steady flow of feedstock for its operations. MTM says it’s tapping into the rapidly growing $250 billion e-waste recycling market.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 8 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.001 | -50% | 30,533 | $8,219,762 |

| CRB | Carbine Resources | 0.002 | -33% | 100,000 | $1,655,213 |

| ECT | Env Clean Tech Ltd. | 0.002 | -33% | 13,406,251 | $10,940,431 |

| ERA | Energy Resources | 0.002 | -33% | 1,252,365 | $1,216,188,722 |

| VPR | Voltgroupltd | 0.001 | -33% | 3,288 | $16,074,312 |

| CT1 | Constellation Tech | 0.002 | -25% | 101,636 | $2,949,467 |

| EE1 | Earths Energy Ltd | 0.006 | -25% | 124,549 | $4,239,714 |

| GMN | Gold Mountain Ltd | 0.002 | -25% | 369,650 | $9,158,446 |

| MMR | Mec Resources | 0.003 | -25% | 5,000 | $7,399,063 |

| OSX | Osteopore Limited | 0.015 | -25% | 50,000 | $2,417,371 |

| NPM | Newpeak Metals | 0.009 | -25% | 261,705 | $3,864,861 |

| NYM | Narryermetalslimited | 0.031 | -21% | 83,317 | $6,866,137 |

| CTQ | Careteq Limited | 0.012 | -20% | 25,000 | $3,556,781 |

| AJX | Alexium Int Group | 0.008 | -20% | 115,000 | $15,864,287 |

| BEL | Bentley Capital Ltd | 0.008 | -20% | 105,558 | $761,279 |

| TEK | Thorney Tech Ltd | 0.084 | -20% | 441,300 | $39,672,467 |

| WBE | Whitebark Energy | 0.004 | -20% | 1,200 | $1,541,046 |

| CAN | Cann Group Ltd | 0.022 | -19% | 3,491,101 | $15,140,937 |

| BLZ | Blaze Minerals Ltd | 0.003 | -17% | 57,731 | $4,700,843 |

| ENV | Enova Mining Limited | 0.005 | -17% | 604,999 | $8,481,005 |

| TNC | True North Copper | 0.220 | -14% | 147,698 | $32,088,949 |

| ATV | Activeportgroupltd | 0.013 | -13% | 352,675 | $10,274,656 |

| LMS | Litchfield Minerals | 0.135 | -13% | 20,512 | $4,372,759 |

| EUR | European Lithium Ltd | 0.034 | -13% | 360,759 | $56,362,077 |

IN CASE YOU MISSED IT

Lanthanein Resources (ASX:LNR) is awaiting results from a diamond drilling program targeted at a moving loop electromagnetic conductor plate at the Lady Grey project in Western Australia, having just completed the program over an area with gold-in-soil geochemical results of up to 256 parts per billion gold.

At Stockhead, we tell it like it is. While Lanthanein Resources and MTM Critical Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.