Lunch Wrap: ASX up as Wall Street breaks records

Tetratherix jumps in biotech IPO debut. Picture via Getty Images

- ASX lifts as Wall Street soars to new records

- Tetratherix jumps in biotech IPO debut

- Hardie, DroneShield rise; Execs exit LTR, Inghams

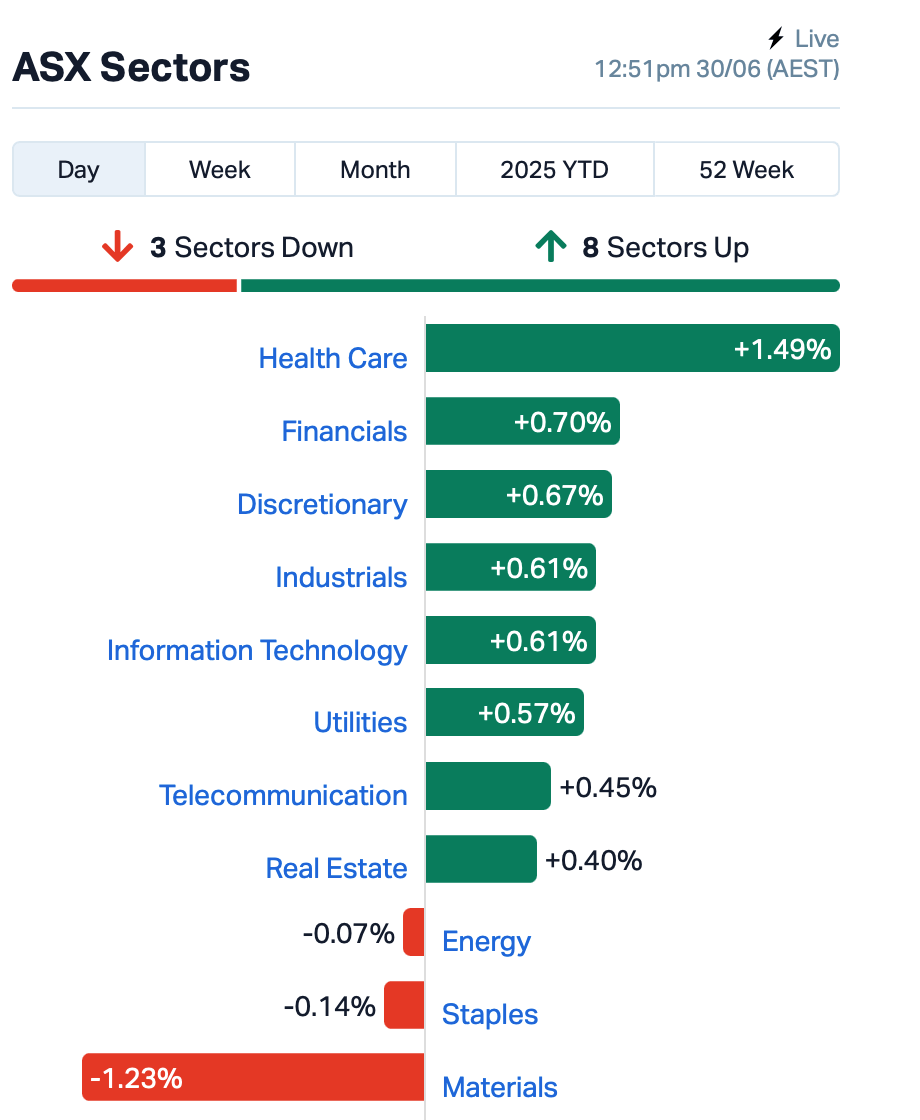

The ASX opened Monday a touch stronger, up 0.3 % by lunchtime in the east as healthcare and bank stocks led the charge.

On Friday, the S&P 500 and Nasdaq both clocked fresh record highs, with Nvidia edging ever closer to the US$4 trillion club.

The big driver was the sense that Trump’s tariff tantrum might not go nuclear.

In an interview with Fox, Trump said he didn’t reckon he’d need to extend the July 9 tariff deadline, implying that he believes countries are moving toward deals.

That has calmed nerves and helped boost market appetite for a bit more risk.

Asia picked up the vibe, too. This morning, the Nikkei jumped over 1.5%.

Elsewhere, oil lost steam, with Brent dipping to below US$67 a barrel. Traders are bracing for another potential OPEC+ supply hike, the fourth in a row, with 411,000 barrels a day possibly hitting the market come Sunday’s meeting.

Over in the gold pits, the precious metal slipped again, on track for its first monthly fall this year. The easing Middle East fears have taken some shine off the haven play.

Back on the ASX, Tetratherix (ASX:TTX) made its ASX debut this morning with a 15% pop in the first few minutes of trading.

Backed by Xero founder Rod Drury, the biotech raised $25 million for its injectable “chewing gum”, designed for tissue, bone and surgical work with FDA approval in its sights.

It’s the first biotech IPO since ReNerve (ASX:RNV) last November and a decent litmus test for investor appetite in the space.

In the large caps space, James Hardie (ASX:JHX) jumped 7% after Azek shareholders greenlit its $14 billion takeover, paving the way for Hardie to shift its primary listing to the NYSE.

Liontown Resources (ASX:LTR) saw its CFO and COO both announce their departures, with successors lined up to take the reins in July and August. LTR shares fell 3.5%.

And, Inghams (ASX:ING) officially waved goodbye to CEO Andrew Reeves on Friday, with Edward Alexander now steering the chook ship forward. Reeves will stick around until August to help with the handover.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for June 30 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| TD1 | Tali Digital Limited | 0.002 | 100% | 13,897,807 | $4,095,156 |

| WEL | Winchester Energy | 0.002 | 100% | 165,600 | $1,363,019 |

| LSR | Lodestar Minerals | 0.009 | 50% | 30,067,490 | $1,910,543 |

| ADD | Adavale Resource Ltd | 0.002 | 50% | 8,325,802 | $2,287,279 |

| ADY | Admiralty Resources. | 0.006 | 50% | 1,690,337 | $10,517,918 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 854,101 | $3,253,779 |

| ALM | Alma Metals Ltd | 0.004 | 33% | 387,947 | $5,261,182 |

| EMT | Emetals Limited | 0.004 | 33% | 50,000 | $2,550,000 |

| FHS | Freehill Mining Ltd. | 0.004 | 33% | 628,446 | $10,241,561 |

| GTR | Gti Energy Ltd | 0.004 | 33% | 2,603,885 | $8,996,849 |

| LCL | LCL Resources Ltd | 0.008 | 33% | 5,356,812 | $7,195,543 |

| M2R | Miramar | 0.004 | 33% | 6,250,614 | $2,990,470 |

| MPR | Mpower Group Limited | 0.009 | 29% | 4,162,897 | $2,405,923 |

| RPG | Raptis Group Limited | 0.066 | 27% | 177,393 | $18,235,612 |

| RCM | Rapid Critical | 0.003 | 25% | 500,000 | $2,831,556 |

| ROG | Red Sky Energy. | 0.005 | 25% | 120,000 | $21,688,909 |

| VR1 | Vection Technologies | 0.036 | 24% | 30,049,768 | $51,255,235 |

| GBZ | GBM Rsources Ltd | 0.016 | 23% | 3,064,593 | $18,406,194 |

| LRK | Lark Distilling Co. | 0.840 | 23% | 485,122 | $72,333,777 |

| PUA | Peak Minerals Ltd | 0.033 | 22% | 42,337,208 | $75,797,675 |

| SDV | Scidev Ltd | 0.365 | 22% | 112,163 | $57,026,459 |

| AS2 | Askarimetalslimited | 0.006 | 20% | 3,057,649 | $2,020,853 |

| BNL | Blue Star Helium Ltd | 0.006 | 20% | 187,807 | $13,474,426 |

| C7A | Clara Resources | 0.003 | 20% | 513,147 | $1,470,677 |

| ICR | Intelicare Holdings | 0.006 | 20% | 198,537 | $2,430,941 |

Lodestar Minerals (ASX:LSR) is raising $2.2 million in a two-tranche placement. The raise includes loyalty options for existing shareholders and is backed by Oakley Capital, which also comes on board as lead manager. The first $475k is locked in, with the rest subject to shareholder approval. The cash will fund new drilling and fieldwork at its Darwin and Three Saints copper-gold projects in Chile and bankroll a hunt for more ground there.

Adavale Resources (ASX:ADD) has locked in approval for a 10-hole, 2,200m RC drilling program at its London Victoria gold project in NSW, aiming to boost its current JORC resource of 107koz at 1.06g/t. It’s the first proper drill campaign at the site in over 30 years, and it’s targeting shallow mineralisation extensions and potential high-grade veins like those found at the nearby Koh-I-Nor mine. Drilling is set to kick off shortly.

GTI Energy (ASX:GTR) has raised $4.5 million from a placement to back its next round of drilling at the Lo Herma uranium project. The raise was done at 0.0035 a share, a 16.7% premium to its last close, with strategic investor Snow Lake Energy leading the charge and set to take a 9.9% stake in GTI, plus a board seat if all goes through. The cash will go toward resource expansion, infill drilling, and fieldwork.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for June 30 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.001 | -50% | 1,560,215 | $11,239,518 |

| IS3 | I Synergy Group Ltd | 0.002 | -50% | 3,892,995 | $2,002,920 |

| VEN | Vintage Energy | 0.003 | -40% | 343,075 | $10,434,568 |

| L1M | Lightning Minerals | 0.040 | -33% | 1,076,495 | $6,199,699 |

| CCO | The Calmer Co Int | 0.002 | -33% | 142,635 | $9,034,060 |

| TKL | Traka Resources | 0.001 | -33% | 135,263 | $3,188,685 |

| TMK | TMK Energy Limited | 0.002 | -33% | 35,626,606 | $30,667,149 |

| FIN | FIN Resources Ltd | 0.003 | -25% | 557,800 | $2,779,554 |

| HLX | Helix Resources | 0.002 | -25% | 248,732 | $6,728,387 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 72,209 | $9,673,198 |

| SRN | Surefire Rescs NL | 0.002 | -25% | 190,144 | $4,972,891 |

| T3D | 333D Limited | 0.007 | -22% | 195 | $1,585,651 |

| SRL | Sunrise | 0.775 | -22% | 490,344 | $109,125,223 |

| UCM | Uscom Limited | 0.015 | -21% | 80,000 | $4,759,063 |

| AUK | Aumake Limited | 0.002 | -20% | 326,886 | $7,558,397 |

| PPG | Pro-Pac Packaging | 0.016 | -20% | 77,661 | $3,633,754 |

| SKK | Stakk Limited | 0.004 | -20% | 1,165,197 | $10,375,398 |

| SRJ | SRJ Technologies | 0.004 | -20% | 528,849 | $3,027,890 |

| EM2 | Eagle Mountain | 0.005 | -17% | 156,132 | $6,810,224 |

| MKL | Mighty Kingdom Ltd | 0.017 | -15% | 480,524 | $10,326,928 |

| OVT | Ovanti Limited | 0.006 | -14% | 21,838,756 | $21,038,605 |

| PLG | Pearlgullironlimited | 0.006 | -14% | 705,981 | $1,431,793 |

| SSH | Sshgroupltd | 0.120 | -14% | 30,823 | $10,407,640 |

| YAR | Yari Minerals Ltd | 0.013 | -13% | 2,283,074 | $8,320,672 |

| EQS | Equitystorygroupltd | 0.020 | -13% | 61,331 | $3,836,869 |

IN CASE YOU MISSED IT

Star Minerals (ASX:SMS) is attempting to grow its Tumblegum South project resource with the goal of bringing the project into production.

Resolution Minerals (ASX:RML) has appointed Perpetua Resources veteran Austin Zinsser as its lead consulting geologist.

Brightstar Resources (ASX:BTR) is shooting for gold with attractive DFS for Menzies and Laverton.

LAST ORDERS

Finder Energy (ASX:FDR) has opened a new office in Dili, Timor-Leste, to support operations at the KTJ project’s Kuda Tasi and Jahal oil fields. Management says the office will be a strategic hub for planning, stakeholder engagement and day-to-day operations management as FDR pursues first oil at KTJ.

West Wits Mining (ASX:WWI) has locked in a loan facility for US$50m to develop the Qala Shallows gold project in South Africa, covering 55% of project funding. The remaining capital expenditure will be supported by equity contributions and early operational revenue.

At Stockhead, we tell it like it is. While Finder Energy and West Wits Mining are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.