Lunch Wrap: ASX up again, Peak Rare Earths jumps 150pc on Shenghe takeover

Wall Street cruises but Nvidia sprints. Picture via Getty Images

- ASX up again as Wall Street cruises

- Iron ore pops, but China clouds still hanging around

- Jobless rate steady, giving RBA some breathing room

The ASX is eyeing a seventh straight win, nudging up 0.1% by lunch AEST as the rally keeps chugging along.

The local market tracked a quiet Wall Street lead, where the S&P 500 managed a tiny lift of just 0.1% overnight.

Nvidia, however, continued its charge, up another 4% on news it will sell more chips to Saudi Arabia. The stock’s been up nearly 25% in five days now.

As Stockhead’s Phoebe Shields wrote this morning, “Much of this wheeling and dealing has come as a consequence of US President Trump’s visit to Saudi Arabia.”

“He’s been accompanied by more than a dozen of the top CEOs on Wall Street, including Elon Musk and representatives from BlackRock, Blackstone, OpenAI, Nvidia, Palantir Technologies, Halliburton, Google and Amazon.”

But the question now is – how long this bounce can last?

Goldman’s Peter Oppenheimer reckons valuations, especially in the US, are starting to look stretched, and if the R-word (recession) reappears, it could take some air out of the tyres.

In other markets, iron ore price has hit a six-week high, up to US$101.75 this morning.

If you’re riding the miners, the bounce is nice, but it’s not the time to get comfy. The broader signal from China still leans toward cautiousness, says experts.

Back home, the focus was on the Aussie jobless rate this morning.

The unemployment rate came in unchanged at 4.1% in April, bang on expectations, just days out from the RBA’s next call on interest rates on May 20.

Analysts believe this print gives a sign we’re still in that sweet spot: slowing, but not stalling. It will also give the RBA a bit of breathing room.

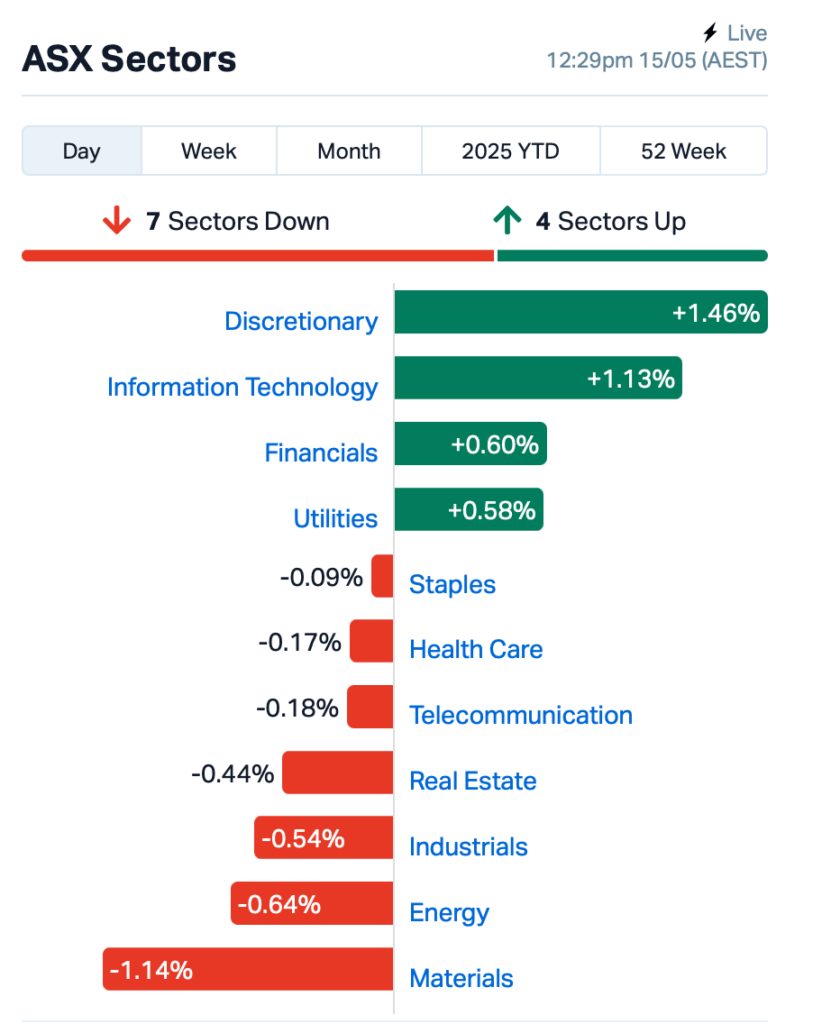

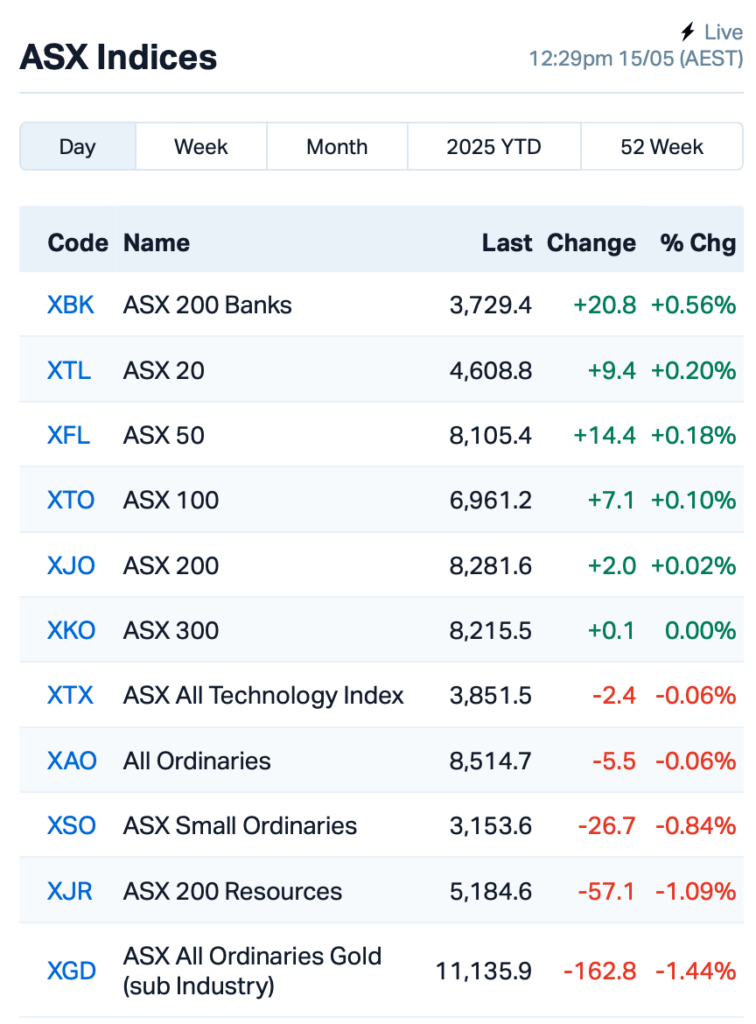

This is where the ASX stood at lunchtime AEST:

In large caps news, Treasury Wine Estates (ASX:TWE) was smashed by 5% after announcing CEO Tim Ford will step down later this year. He’ll be replaced by Sam Fischer, currently running Lion in NZ and sitting on Burberry’s board.

Northern Star Resources (ASX:NST) fell 1.5%, despite lifting its mineral resources and ore reserves.

In a 579-page update to the market, NST essentially said it’s been very busy underground. The gold miner has lifted its total mineral resources to 70.7 million ounces, up 9.4 million ounces over the year. Ore reserves also climbed to 22.3 million ounces, up 1.4 million.

And, Xero’s (ASX:XRO) FY25 numbers hit the sweet spot with 23% revenue growth, strong cash and a Rule of 40 score of 44, showing it’s still running a tight, profitable ship with plenty in the tank. Xero’s shares rallied 3%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 15 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| PEK | Peak Rare Earths Ltd | 0.305 | 154% | 4,495,284 | $42,253,993 |

| ATX | Amplia Therapeutics | 0.077 | 40% | 33,444,073 | $21,337,397 |

| ERA | Energy Resources | 0.002 | 33% | 17,231,078 | $608,094,361 |

| RMI | Resource Mining Corp | 0.014 | 27% | 10,945,034 | $7,319,463 |

| NGS | NGS Ltd | 0.029 | 26% | 332,752 | $3,116,105 |

| MSI | Multistack Internat. | 0.005 | 25% | 65,445 | $545,216 |

| SHP | South Harz Potash | 0.005 | 25% | 1,477,931 | $4,410,915 |

| TEM | Tempest Minerals | 0.005 | 25% | 63,000 | $2,938,119 |

| EDU | EDU Holdings Limited | 0.160 | 23% | 6,160,388 | $19,571,943 |

| NIM | Nimyresourceslimited | 0.120 | 20% | 2,787,351 | $20,812,785 |

| AYT | Austin Metals Ltd | 0.006 | 9% | 616,863 | $8,658,052 |

| IPT | Impact Minerals | 0.006 | 20% | 509,403 | $19,247,483 |

| FZR | Fitzroy River Corp | 0.160 | 19% | 145 | $14,574,364 |

| BCA | Black Canyon Limited | 0.059 | 18% | 12,500 | $6,482,535 |

| C29 | C29Metalslimited | 0.042 | 17% | 153,706 | $6,270,776 |

| AN1 | Anagenics Limited | 0.007 | 17% | 72,536 | $2,977,922 |

| HE8 | Helios Energy Ltd | 0.014 | 17% | 567,964 | $37,426,964 |

| SP8 | Streamplay Studio | 0.007 | 17% | 2,054,747 | $7,688,187 |

| OMX | Orangeminerals | 0.073 | 16% | 565,068 | $7,849,943 |

| CDX | Cardiex Limited | 0.053 | 15% | 95,489 | $18,640,605 |

| BTR | Brightstar Resources | 0.625 | 15% | 2,704,390 | $257,554,722 |

| TMS | Tennant Minerals Ltd | 0.008 | 14% | 300,000 | $6,691,233 |

| 1AE | Auroraenergymetals | 0.073 | 14% | 238,649 | $11,460,079 |

| E79 | E79Goldmineslimited | 0.026 | 13% | 437,252 | $3,643,491 |

Peak Rare Earths (ASX:PEK) came flying out of a trading halt, jumping by over 150% after locking in a takeover deal with its biggest backer, Chinese rare earths giant Shenghe. Through its arm Chenguang, Shenghe’s offering around $150.5 million, plus the proceeds of a $7.5 million cap raise, to buy out the rest of Peak it doesn’t already own.

That values Peak at roughly 36 cents a share, a massive 199% premium to where it last traded. For investors, it’s a big payday if the deal lands, but there are still a few hoops to clear.

Amplia (ASX:ATX) announced a key milestone in its pancreatic cancer trial, with 15 confirmed tumour responses now locked in, enough to show its drug, narmafotinib, works better when paired with chemo than chemo alone. The trial is testing the company’s narmafotinib combined with standard treatments gemcitabine and Abraxane. Top-line results are due mid-Q3.

Read more on this from Tim Boreham: Amplia shares surge on pancreatic cancer trial results; Immutep offers hope

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 15 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LNR | Lanthanein Resources | 0.001 | -50% | 56,074,668 | $4,887,272 |

| BIT | Biotron Limited | 0.002 | -33% | 303,272 | $3,981,738 |

| EAT | Entertainment | 0.004 | -33% | 78,006 | $7,852,716 |

| ZMM | Zimi Ltd | 0.008 | -27% | 51,646 | $4,702,982 |

| JAY | Jayride Group | 0.002 | -25% | 6,009,801 | $2,855,778 |

| ASR | Asra Minerals Ltd | 0.002 | -20% | 1,287,367 | $6,765,117 |

| VML | Vital Metals Limited | 0.002 | -20% | 45,000 | $14,737,667 |

| 8IH | 8I Holdings Ltd | 0.009 | -18% | 24,000 | $3,829,769 |

| NPM | Newpeak Metals | 0.009 | -18% | 2 | $3,542,789 |

| EVR | Ev Resources Ltd | 0.005 | -17% | 834,932 | $11,915,020 |

| IFG | Infocusgroup Hldltd | 0.005 | -17% | 131,116 | $1,574,561 |

| JAV | Javelin Minerals Ltd | 0.003 | -17% | 253,496 | $18,138,447 |

| KPO | Kalina Power Limited | 0.005 | -17% | 1,254,500 | $17,597,818 |

| DTI | DTI Group Ltd | 0.006 | -14% | 130,000 | $3,139,860 |

| 8CO | 8Common Limited | 0.012 | -14% | 2,315,357 | $3,137,329 |

| ARV | Artemis Resources | 0.006 | -14% | 61,476 | $17,699,705 |

| AUR | Auris Minerals Ltd | 0.006 | -14% | 100,000 | $3,336,382 |

| M2R | Miramar | 0.003 | -14% | 7,155,060 | $3,488,881 |

| MSG | Mcs Services Limited | 0.006 | -14% | 287,068 | $1,386,698 |

| SRN | Surefire Rescs NL | 0.003 | -14% | 2,354,298 | $8,457,077 |

| NFL | Norfolkmetalslimited | 0.130 | -13% | 28,351 | $6,137,390 |

| DAL | Dalaroometalsltd | 0.026 | -13% | 149,010 | $7,468,558 |

| AEV | Avenira Limited | 0.007 | -13% | 530,303 | $25,421,152 |

| BNL | Blue Star Helium Ltd | 0.007 | -13% | 3,470,000 | $21,559,082 |

IN CASE YOU MISSED IT

Anson Resources (ASX:ASN) is preparing to re-enter the Mt Fuel-Skyline Geyser after securing the necessary approvals, with the goal of defining a mineral resource for the Green River lithium brine project. ASN will be drilling deeper into limestone layers in this re-entry, looking to increase the size of the lithium-rich reservoir. Read more about it here.

At Stockhead, we tell it like it is. While Anson Resources is a Stockhead advertiser, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.