Lunch Wrap: ASX steadies as DroneShield pops; GENIUS vote puts crypto in spotlight

Bitcoin in the spotlight as Genius Act heads to a vote. Pic: Getty Images

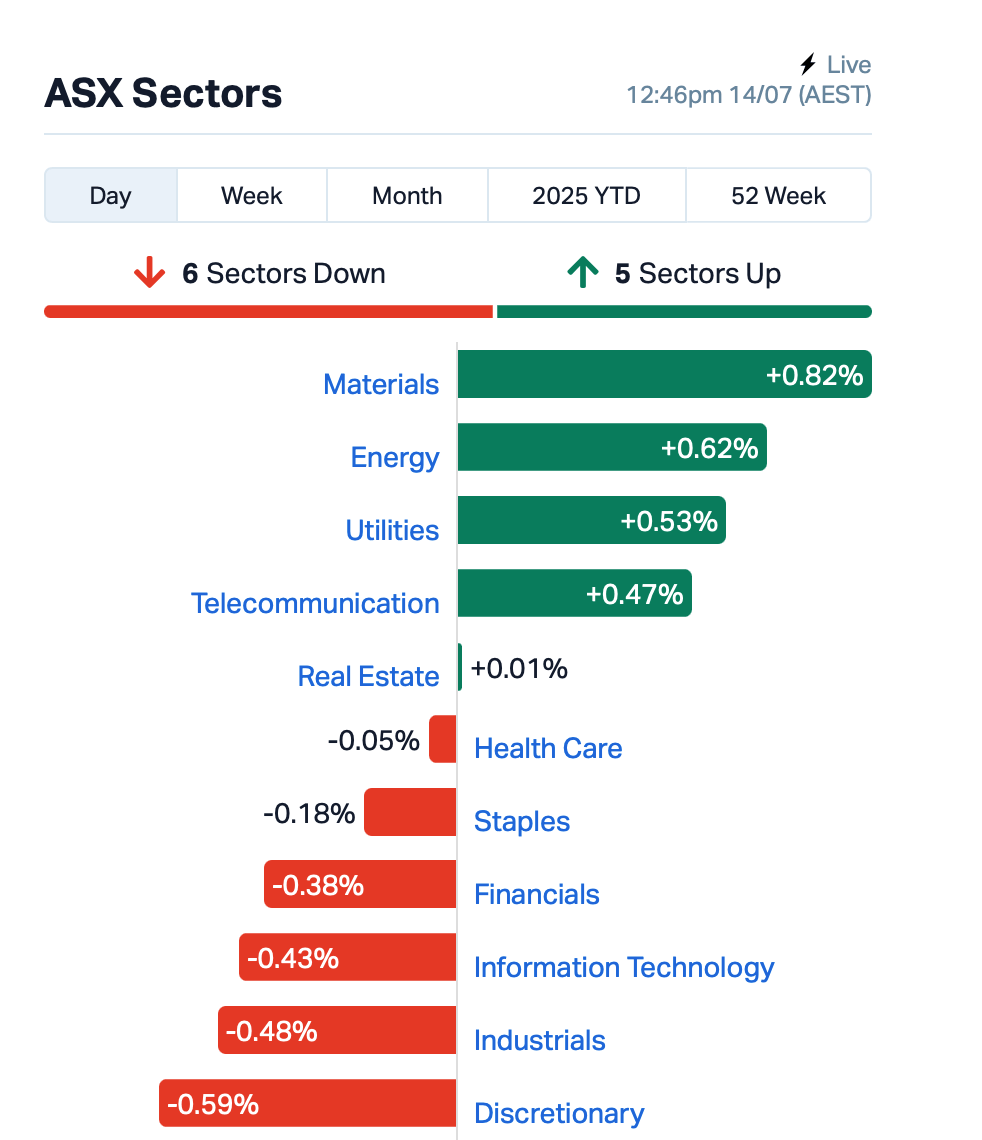

- ASX claws back as mining and energy lift

- DroneShield soars as it plans to triple Aussie manufacturing

- Bitcoin in the spotlight as GENIUS Act heads to a vote

The ASX opened 0.15% down but by lunch time in the east, the local bourse had pulled off a quiet comeback, inching up toward the flatline.

The early wobble came off the back of a soft Wall Street lead, after the Dow dropped 250 points on Friday and the S&P and Nasdaq followed suit.

US traders were rattled after Donald Trump slapped a fresh 30% tariff on goods from the EU and Mexico, starting August 1.

Not content with rattling Brussels, Trump also lobbed letters at Canada – planning 35% tariffs and calling out PM Mark Carney – and Brazil while promising 15–20% blanket duties.

But despite the noise, one stock on Wall Street refused to sit still – Nvidia, which has now hit a US$4 trillion market cap.

Over in crypto land, Bitcoin teased a new all-time high, flirting with US$119,000 at time of writing.

And with “Crypto Week” now underway in Washington, attention is turning to the GENIUS Act, set for a vote later tonight.

The proposed legislation could mark a major turning point for stablecoins, introducing strict requirements for full cash or equivalent backing and a dual oversight model – federal for the big players, state for the smaller ones.

Back home on the ASX, the mining and energy sectors were the best performers this morning.

Among the large cap movers was DroneShield (ASX:DRO), which surged 7.5% after announcing a $13 million investment to triple its Aussie manufacturing footprint, with a new $2.6 billion capacity facility planned by the end of 2026.

Utility billing software company Hansen Technologies (ASX:HSN) popped 12% after upgrading its FY25 earnings guidance by around 15%.

Abacus Storage King (ASX:ASK) added 6% after confirming a juicier $1.65 per share bid from billionaire Nathan Kirsh’s Ki Group and Public Storage, up 14.7% on their first offer.

And, metals miner South32 (ASX:S32) was under pressure, falling 5% after warning that its FY26 production guidance for the Mozal smelter in Mozambique is under review.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 14 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ICU | Investor Centre Ltd | 0.002 | 100% | 186,508 | $304,511 |

| OSX | Osteopore Limited | 0.018 | 80% | 27,665,415 | $1,830,431 |

| BM1 | Ballardmininglimited | 0.350 | 40% | 3,911,512 | $45,922,302 |

| ALR | Altairminerals | 0.004 | 33% | 2,440,000 | $12,890,233 |

| CRR | Critical Resources | 0.004 | 33% | 8,425,500 | $8,310,256 |

| SHP | South Harz Potash | 0.004 | 33% | 1,444,157 | $3,849,186 |

| NVQ | Noviqtech Limited | 0.034 | 31% | 742,795 | $6,539,950 |

| SVY | Stavely Minerals Ltd | 0.018 | 29% | 8,323,856 | $7,616,589 |

| AMS | Atomos | 0.005 | 25% | 532,090 | $4,860,074 |

| MRD | Mount Ridley Mines | 0.003 | 25% | 20,343 | $1,556,978 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 1,019,762 | $6,350,111 |

| TMK | TMK Energy Limited | 0.003 | 25% | 11,732,049 | $20,444,766 |

| LOC | Locatetechnologies | 0.160 | 23% | 1,234,708 | $30,440,054 |

| USL | Unico Silver Limited | 0.405 | 23% | 5,318,142 | $144,521,439 |

| PRS | Prospech Limited | 0.022 | 22% | 107,509 | $6,818,866 |

| CMP | Compumedics Limited | 0.305 | 22% | 88,535 | $48,054,474 |

| KNG | Kingsland Minerals | 0.095 | 22% | 11,354 | $5,659,751 |

| IPB | IPB Petroleum Ltd | 0.006 | 20% | 86,037 | $3,532,015 |

| TFL | Tasfoods Ltd | 0.006 | 20% | 100,021 | $2,185,478 |

| TSL | Titanium Sands Ltd | 0.006 | 20% | 23,739 | $11,723,736 |

| ATV | Activeportgroupltd | 0.013 | 18% | 1,549,687 | $7,556,748 |

| LSR | Lodestar Minerals | 0.013 | 18% | 1,390,378 | $4,373,495 |

| CC5 | Clever Culture | 0.020 | 18% | 2,996,804 | $30,032,035 |

| SVL | Silver Mines Limited | 0.140 | 17% | 9,139,551 | $221,353,847 |

Osteopore (ASX:OSX) has secured market approval in Switzerland for its full range of 3D-printed cranial implants, covering both off-the-shelf and custom-made products. This clears the way for Zimmer to roll out Osteopore’s full product suite in Switzerland and more broadly across Europe.

Stavely Minerals (ASX:SVY) has struck a thick, high-grade gold hit at Fairview South in western Victoria, with its first RC drill hole (SFSRC001) pulling up 40m at 1.96g/t gold, including a hot 1m at 49.2g/t from just 10 metres down. The discovery looks to sit on a large 10km-plus structure, with soil sampling now underway to guide follow-up drilling in August. The prospect is part of the Stavely project, where SVY has already outlined the copper rich Cayley Lode resource.

Unico Silver (ASX:USL) has hit what looks like a game-changer at La Negra, with drill hole JDD017-25 returning a standout 90m at 144g/t silver equivalent from just 10 metres down. The result expands the mineralised footprint more than a kilometre southeast of the old resource and confirms broad, shallow, high-grade oxide mineralisation that’s still open in all directions.

Clever Culture Systems (ASX:CC5) has landed a fresh order from Novo Nordisk in Europe for its APAS Independence instrument. The deal will allow Novo to run a formal evaluation of the tech across its global manufacturing network, comparing APAS to manual plate-reading methods for environmental monitoring. This marks another win in CCS’s push to work with top-tier pharma giants.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for July 14 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AOA | Ausmon Resorces | 0.001 | -50% | 575,000 | $2,622,427 |

| EDE | Eden Inv Ltd | 0.001 | -50% | 65,000 | $8,219,762 |

| GGE | Grand Gulf Energy | 0.002 | -33% | 1,200,109 | $8,461,275 |

| BUY | Bounty Oil & Gas NL | 0.002 | -20% | 71,211 | $3,903,680 |

| ECT | Env Clean Tech Ltd. | 0.002 | -20% | 652,256 | $10,038,589 |

| TON | Triton Min Ltd | 0.004 | -20% | 25,000 | $7,841,944 |

| OLY | Olympio Metals Ltd | 0.097 | -19% | 174,269 | $12,368,076 |

| AUK | Aumake Limited | 0.003 | -17% | 50,000 | $9,070,076 |

| FBR | FBR Ltd | 0.005 | -17% | 1,164,487 | $34,136,713 |

| MSG | Mcs Services Limited | 0.005 | -17% | 600,000 | $1,188,598 |

| PRM | Prominence Energy | 0.003 | -17% | 24,999 | $1,459,411 |

| IFG | Infocusgroup Hldltd | 0.016 | -16% | 2,597,353 | $5,546,844 |

| PGY | Pilot Energy Ltd | 0.011 | -15% | 12,689,783 | $28,062,580 |

| ADY | Admiralty Resources. | 0.006 | -14% | 22,640 | $18,406,356 |

| BYH | Bryah Resources Ltd | 0.006 | -14% | 111,719 | $6,789,675 |

| IPT | Impact Minerals | 0.006 | -14% | 4,126,321 | $27,953,310 |

| TMS | Tennant Minerals Ltd | 0.006 | -14% | 561,287 | $7,461,233 |

| HWK | Hawk Resources. | 0.019 | -14% | 464,694 | $5,960,448 |

| PH2 | Pure Hydrogen Corp | 0.091 | -13% | 159,898 | $39,215,486 |

| ATH | Alterity Therap Ltd | 0.013 | -13% | 37,697,177 | $136,910,560 |

| AM5 | Antares Metals | 0.007 | -13% | 461,088 | $4,118,823 |

| IBX | Imagion Biosys Ltd | 0.014 | -13% | 5,612,769 | $3,221,463 |

LAST ORDERS

Indiana Resources (ASX:IDA) has tapped ex-Alto Metals boss Matthew Bowles as its managing director to lead the charge at its high-grade Minos gold play in the Gawler Craton. With ~$69.35m in the bank and first drill assays due end-July, Indiana says it’s well-positioned to deliver on its near-term exploration and growth objectives.

Anson Resources (ASX:ASN) has shipped two tonnes of lithium-rich Green River brine to POSCO in South Korea as part of due diligence for a planned demonstration plant. The brine, iron-free and processed using a non-chemical method, will be tested for lithium extraction efficiency to help shape initial engineering and cost estimates.

Uvre (ASX:UVA) has completed its acquisition of high-grade NZ gold assets and also welcomed experienced mining execs Norman Seckold and Peter Nightingale to the board. With rock chip hits up to 18.4g/t gold at Waitekauri and $4m fresh in the bank, drilling’s about to fire up just 8km from OceanaGold’s Waihi mine.

West Wits Mining (ASX:WWI) has appointed CEO Rudi Deysel as managing director, following his lead role in advancing Qala Shallows from a gold asset to a producing mine. Keith Middleton also joins the board as the company shifts gear into production.

ClearVue Technologies (ASX:CPV) has launched a full-scale expenditure review as it sharpens focus on long-term growth and product innovation. The move follows board reshuffles, including the resignation of executive director Chuck Mowrey, as the solar façade disruptor works to streamline operations and ramp up global momentum.

IN CASE YOU MISSED IT

Nordic Resources (ASX:NNL) has expanded its total gold inventory in Finland by 34% with a 264,000oz maiden Hirsikangas resource, taking its gold bounty beyond 1Moz.

Break it Down: DY6 Metals (ASX:DY6) has appointed a new CEO and secured $4.625 million in funding to fast-track the Central Rutile and Douala Basin Projects.

StockTake: Verity Resources (ASX:VRL) is preparing to RC drill and grow its Monument gold project in Western Australia.

At Stockhead, we tell it like it is. While Indiana Resources, Anson Resources, Clever Culture Systems, Uvre, West Wits Mining, ClearVue Technologies, Nordic Resources, DY6 Metals and Verity Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.